These Gravitational Forces Are Keeping Interest Rates Down

To paraphrase Einstein, “Compound interest is “the eighth wonder of the world”. He who understands it, earns it; he who doesn’t, pays it.”

No matter whether you are 18 years old and signing up for your first college loan, a millennial shopping for your first home mortgage, or a recent retiree attempting to “squeeze” investment income out of your nest-egg, most of us at any age are not immune from the gravitational forces of interest rates and their repercussions on our personal finances.

Interests rates have been a puzzle for investors, borrowers, economists and policymakers over the past decade. Despite steady U.S. economic growth and an unemployment rate near historic lows, long-term interest rates have remained anchored. Traditional economic models would have predicted rising inflation and interest rates. That this hasn’t occurred is a result of slower global growth and a reversal in Fed policy, among other reasons.

Rates have been declining since the 80’s

Long-term rates have faced many false-starts after decades in tailspin and, despite the recent market recovery, rates have declined further. The yield on the 10-year Treasury had risen above 3.2% as recently as last November. It’s now hovering around 2.6%, about the same level that was seen at the start of both 2017 and 2018.

Fortunately, most investors don’t appear to be over-reacting to these dynamics, unlike last year when a “flattening yield curve” was seen as a sign of an immediately recession and immanent market crash. The long-term context of these interest rates moves is that they have been declining for almost four decades, resulting in an unprecedented bull market in Treasuries and other bonds. This trend continued over the course of this economic expansion, with the 10-year yield not bottoming until 2016 when it reached around 1.35%.

Two major factors are impacting rates today.

First, economic uncertainty and a deceleration in global growth from an aging population and an acceleration in technology and innovation has put downward pressure on long-term interest rates. Factors such as trade uncertainty between the U.S. and China have also played a role.

Second, many investors believe that the Fed is likely to pause or even reverse its policy of monetary tightening. The market, via fed funds futures, is expecting less than a 1% chance of a rate hike when the Fed meets this week. It’s expected that the Fed will pause its policy of shrinking its balance sheet in the coming months as well.

This is a double-edged sword for investors. Lower rates mean portfolio income is still difficult to come by – the defining challenge of this economic cycle since 2008. Investors still need to turn to other sources, such as riskier assets including stocks and high yield debt to generate sufficient income.

But on the other hand, declining interest rates have supported fixed income prices somewhat, resulting in even greater portfolio stability. Ultimately, for most investors, this diversification benefit is what will continue to be important in the eleventh year of the market cycle.

This week, we review three charts that highlight these trends.

Long-term rates have pulled back

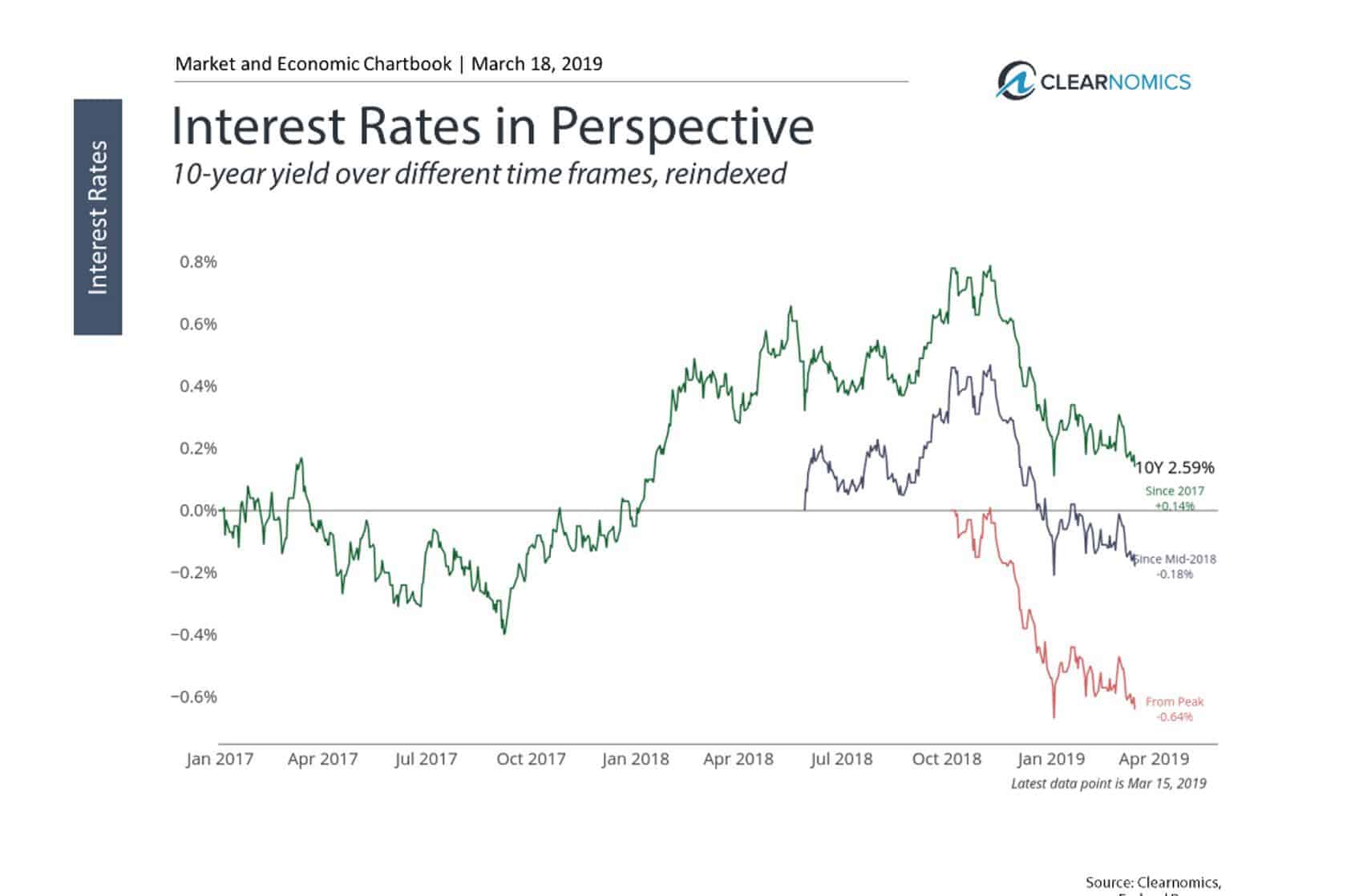

Interest Rates in Perspective

Interest rates fell to historic lows following the financial crisis due to slow global growth and easy central bank policy. Ten years later, long-term rates are still quite low, with the 10-year Treasury yield stuck around 2.6%.

The chart above shows how rates have moved over the past several months, the past year and past two years. Interest rates have fallen from their peaks last year, and are still near levels from the beginning of 2017. There have been many false-starts for rising rates, including the 2013 “taper tantrum” and in late 2016 following the presidential election. Dynamics such as slower global growth and the Fed suggest there could be downward pressure on rates for some time.

Other international rates are still low

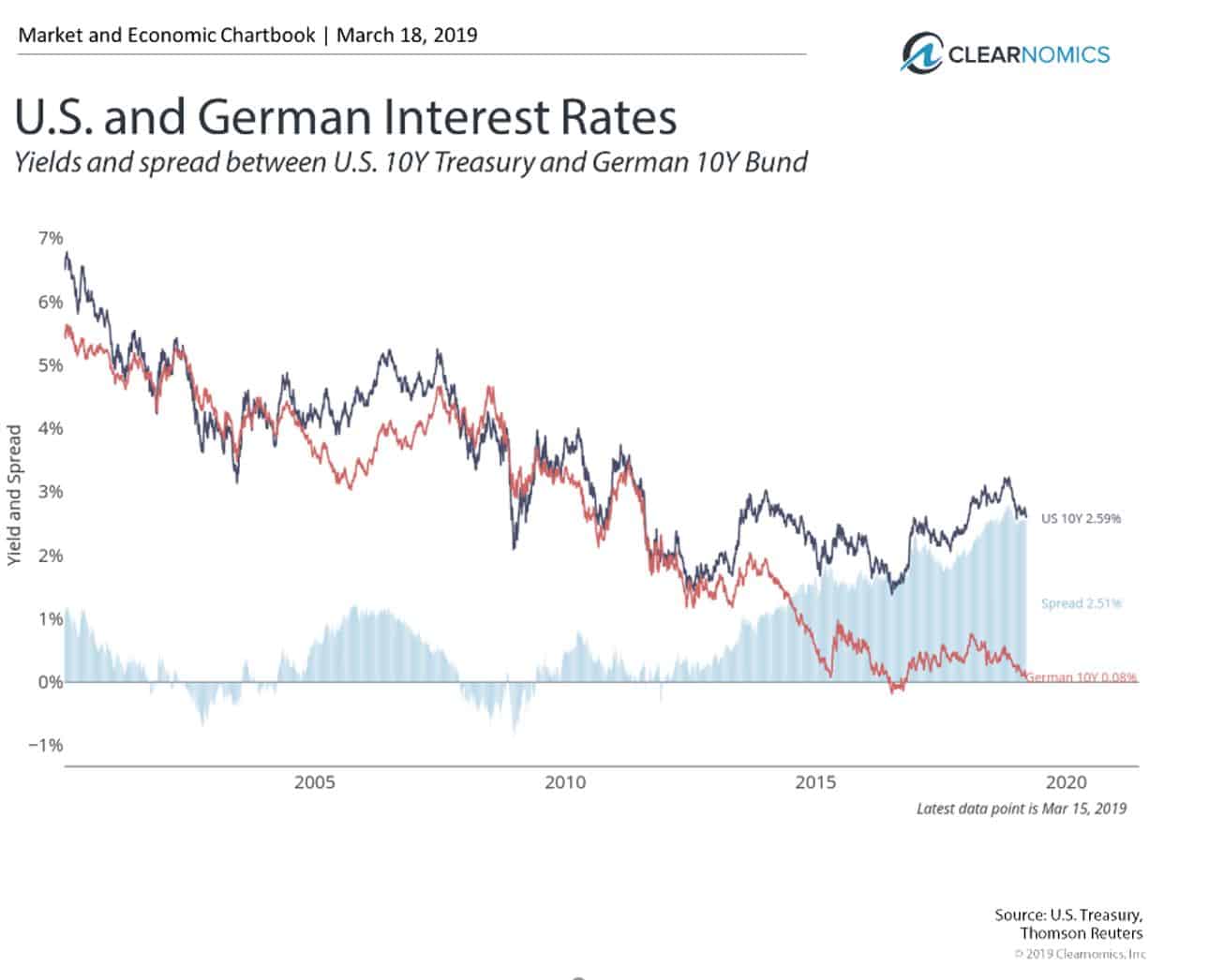

U.S. vs German 10YR Yields

This chart compares the U.S. 10-year Treasury yield to the 10-year yield on German bunds. The spread between the two has continued to widen due to differences in growth trends, monetary policy and events such as Brexit. It’s easy to see from the chart that this spread has moved in both directions in the past.

This is one reason U.S. rates have been low over the past several years. While U.S. interest rates are low by historical standards, they are still much more attractive than most other high-quality sovereign debt. This increases demand for U.S. Treasuries, and since prices and rates move in opposite directions, interest rates have remained low as a result. Unless global growth, and European growth in particular, begins to take off, this pressure on U.S. long-term rates could remain for some time.

Short-term rates have risen, but income is still hard to find

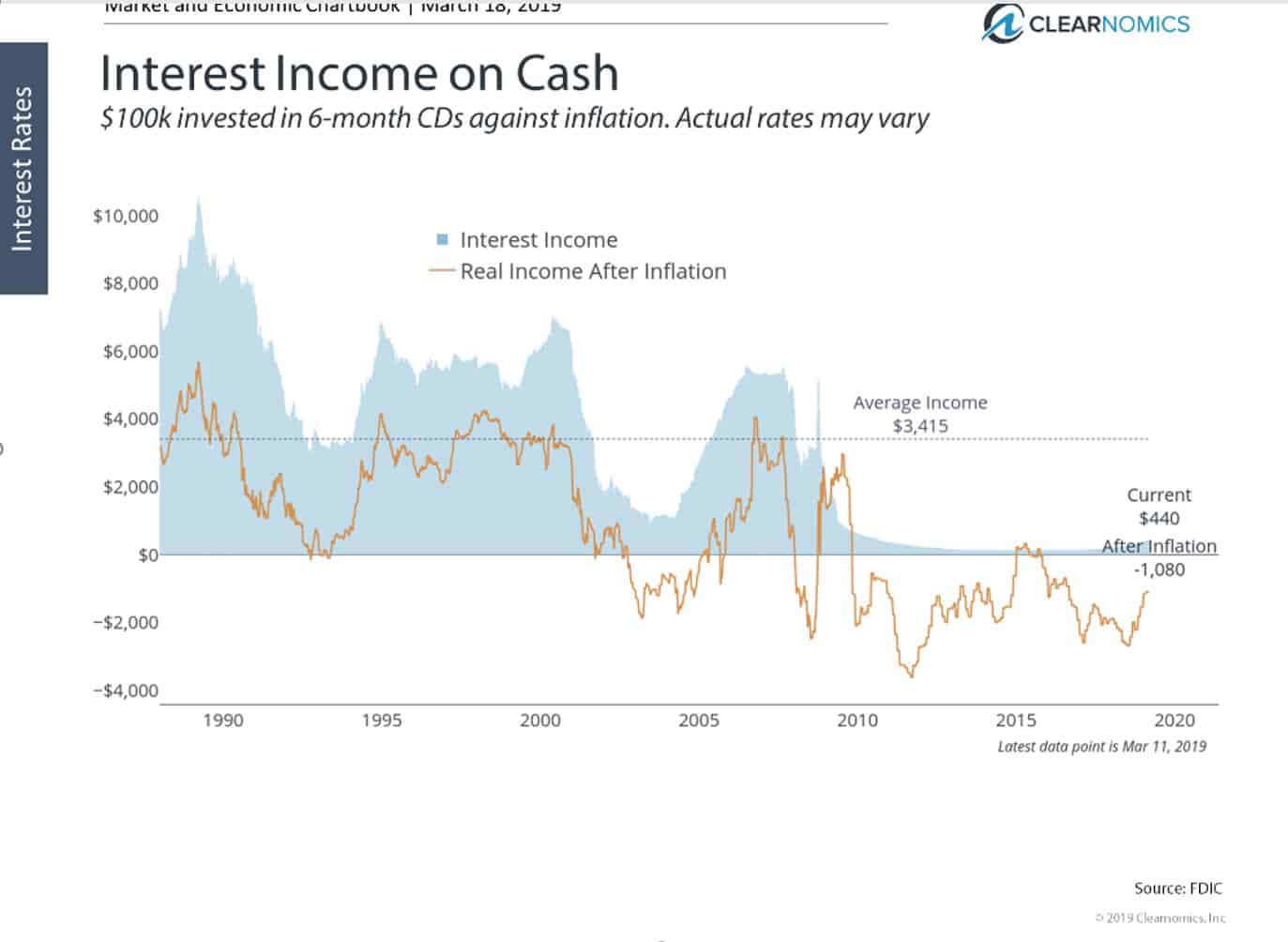

Interest Income on Cash

The good news for many investors is that short-term rates have risen faster than long-term ones, primarily due to Fed rate hikes and balance sheet tightening. As a result, the income generated from cash in savings accounts, certificates of deposit, and other short-term savings vehicles has increased.

The bad news is that these rates haven’t kept pace with inflation. The average national rate on 6-month CD’s with $100,000 or greater is still only 0.44%. Of course, there are individual vehicles with much higher rates, but this suggests that the average American is still earning little at a time when most consumer prices are rising 2% annually.

Of course, cash serves an important purpose in portfolios, both as a source of income and potentially as a way to reduce volatility. After last year, when it “outperformed” many assets, some investors may have been tempted to move to cash. Over the long run, however, it’s clear that holding cash alone is unsustainable. Not only do markets recover from volatile periods, the yields on cash are still low by historical standards.

The bottom line? With interest rates still low, it’s important for investors to stay balanced across asset classes and within fixed income while balancing liquidity, credit quality, country, sector and duration capacities.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.