The Gold Standard and Investing

With the uptick in fear and market volatility over the past year fueled by trade wars, impeachment inquiries and a decelerating global economy, take caution before loading up on gold bullion, coins and jewelry as a diversification hedge or fashion statement.

When gold was discovered at Sutter’s Ranch in 1848, it inspired the Gold Rush to California. In 1861, The U.S. Treasury printed the first U.S. paper currency. The “Gold Standard” Act established gold as the only metal for redeeming paper currency. Most countries then adopted the gold standard to standardize transactions and trade.

To this day, the U.S. dollar is the benchmark pricing mechanism for the price of gold globally. Strength or weakness in the dollar can affect the price of gold as well as other direct and indirect factors. Still if you consider that less than 5% of the 7.1 billion world’s population resides in a country where the dollar is not the national currency, it’s helpful to understand the financial factors that affect golds pricing and movements outside our boarders.

In many cases, the main role of gold is that, as a precious metal with consumer and industrial uses, its value can rise over time due to limited supply but steadily increasing demand. As a result, it can protect against inflation as the economy heats up or as central banks increase stimulus, i.e. “print money,” which devalues existing dollars. Much of the rise in gold prices over the past two decades occurred after the financial crisis as the Fed grew its balance sheet.

However, it’s important to distinguish between gold as an investment and gold as a part of a diversified portfolio. This is because, for many investors, the value of gold is that it acts as a safe haven when markets get choppy. In many ways, this is no different from how some investors view cash – as a market timing tool to help protect them from short-term stock market gyrations.

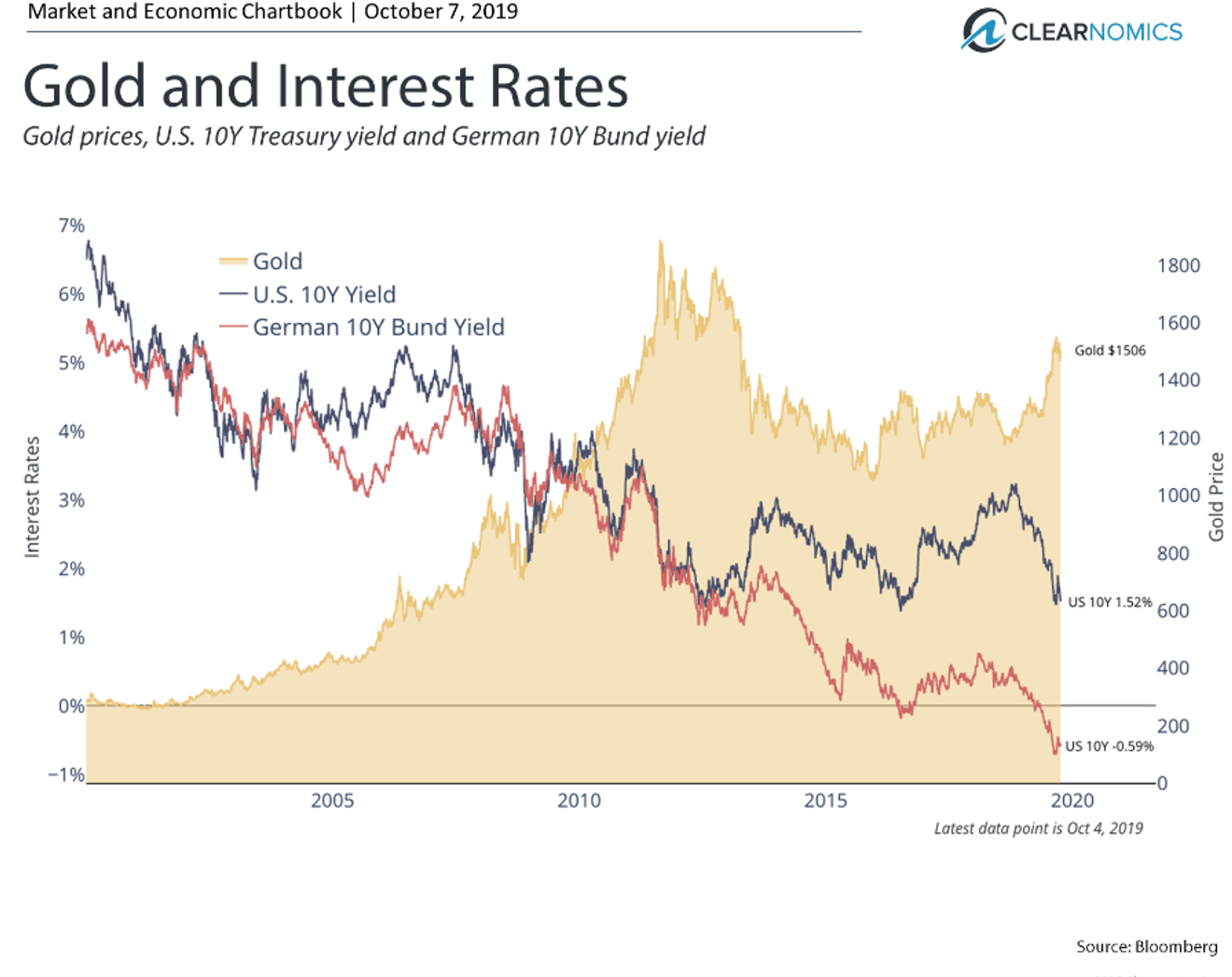

While the value of gold is still down about -20% for the past eight years (shown below), it can serve several purposes in a diversified portfolio. Consider the following key issues:

First, gold does not generate yield (dividends) or income. So, while it can help protect investors from short-term uncertainty, especially when the Fed is involved, it may not help with retirement income needs or financial goals.

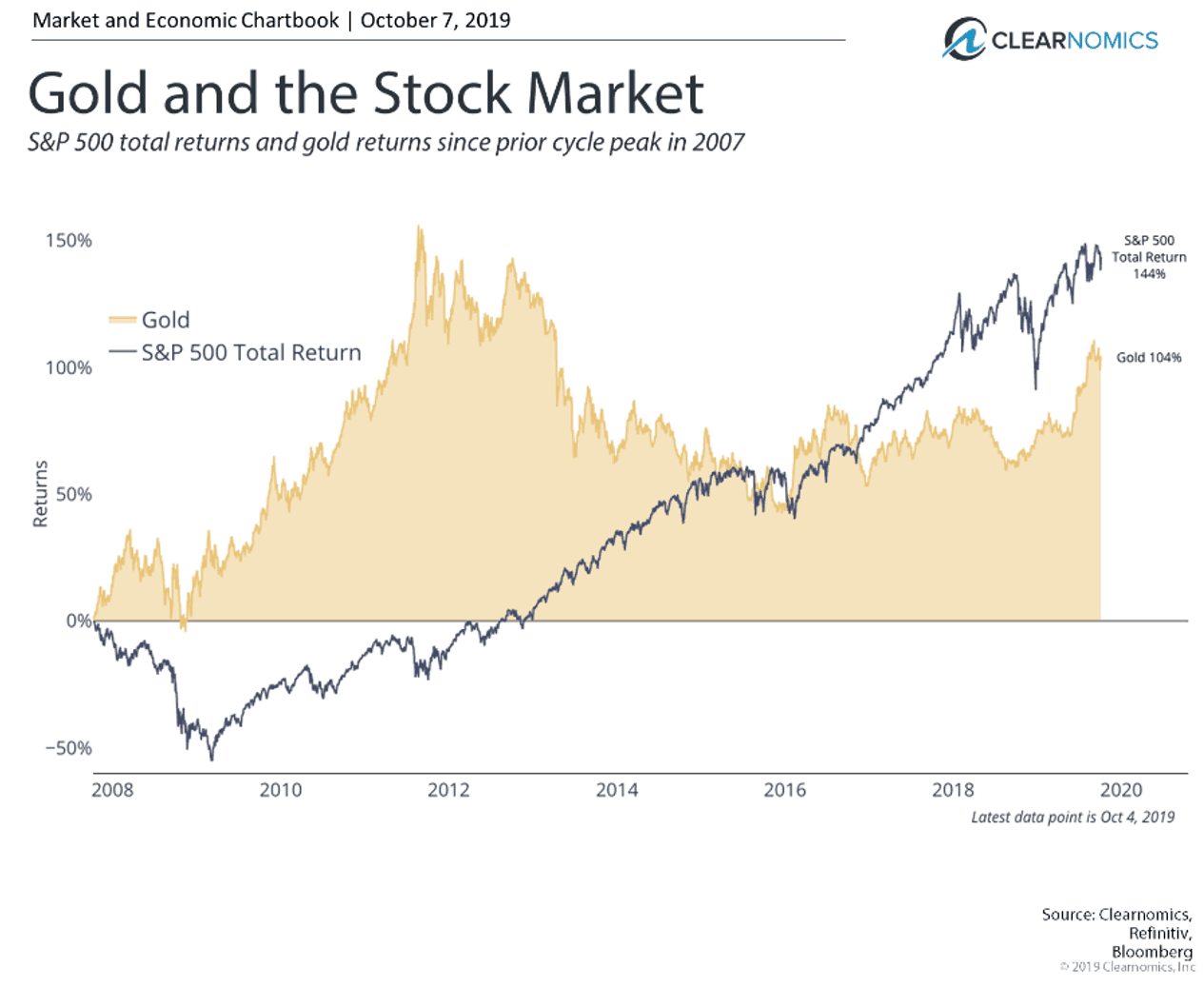

This is readily apparent in a chart of the stock market since the pre-2008 peak (shown below). Gold not only held its value but rose significantly after 2008. Since then, however, the stock market – with dividends reinvested – has far outpaced gold. Thus, it’s not about holding one or the other – it’s about how different assets can complement one another in a portfolio.

Second, gold itself can be extremely volatile. In particular, for those investors worried about stock market volatility, short-term movements in gold can be as bad or worse. For instance, gold prices began to plummet in late 2012 (shown below) when the global economy began to heat up. At this point, gold has yet to return to its record high.

Finally, choosing how to invest in gold can be tricky as well. Holding physical bars of gold or coins is unrealistic and inconvenient for most people. For most disciplined investors, choosing a professionally managed passive or active investment strategy from a well-known provider would be the most common approach to incorporate gold as part of their diversified portfolio.

Ultimately, the choice to invest in any individual asset class – should be viewed in the context of one’s overall portfolio and long-term financial goals, more so than as a stand-alone holding.

Gold and stocks have complemented one another since 2007

Gold and the stock market have performed quite differently since 2007. Gold, like many types of bonds, did offset much of the market volatility experienced during the financial crisis in 2008. However, stocks have risen steadily since then.

Unlikely gold, stocks pay dividends which provide income over time. Reinvesting those dividends has resulted in stocks far outpacing gold over the past ten years. Thus, both can serve as important components of a diversified portfolio.

Gold can protect against inflation and during volatile periods

Gold and interest rates are intimately connected. Gold can be less attractive when real interest rates are high and it’s possible to generate significant investment income. The opposite is also true – gold can be attractive when inflation is rising, real interest rates are falling, or when there is significant market uncertainty. This has been true over the past several months as global interest rates plummeted.

There are many types of gold investments that can provide investors quite different results at the same time. Picking the one that fits one’s portfolio most appropriately, while also maintaining balance across other asset classes, is the primary objective of long-term investors.

What’s the bottom line? Gold can serve an important purpose in a diversified portfolio. However, like cash, gold should not be used as a market timing tool. Investors should stay patient and balanced to best achieve their long-term goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.