The Gold Standard and Investing

With the uptick in fear and market volatility, inquiries this year in unorthodox niche investments have risen incrementally. There has been a recent increase in online search results for property, rare coins and even Lego toys. Across the pond, Scots are mulling over premium collectible scotch, while the Brits the same on fine wine investments.

Right on cue, from Wall Street to main street, there has been an increase in gold prices and curiosity on ways to hold it. We remind investors to always take caution before loading up on gold stocks, bullion, coins or jewelry as a diversification hedge or fashion statement.

The Gold Standard

When gold was discovered at Sutter’s Ranch in 1848, it inspired the Gold Rush to California. In 1861, The U.S. Treasury printed the first U.S. paper currency. The “Gold Standard” Act established gold as the only metal for redeeming paper currency. Most countries then adopted the gold standard to standardize transactions and trade.

To this day, the U.S. dollar is the benchmark pricing mechanism for the price of gold globally. Strength or weakness in the dollar can affect the price of gold as well as other direct and indirect factors. Still if you consider that less than 5% of the 7.1 billion world’s population resides in a country where the dollar is not the national currency, it’s helpful to understand the financial factors that affect golds pricing and movements outside our boarders.

To say that the past six months have been a rollercoaster ride for investors since the onset of COVID-19 would be an understatement. With the pandemic resulting in the first global recession since 2008, the stock market crashing then swiftly recovering, and the impact of the nationwide shutdown on our everyday lives, it’s understandable that many investors would prefer stability and safety. Thus, it’s no surprise that the price of gold has risen to its highest level since 2011. (see chart below)

Two Investment Purposes of Gold

Demand due to Fear: As a precious metal with consumer and industrial uses, the value of gold can rise over time due to limited supply but steadily increasing demand. As a result, it can serve as a store of value when the world is uncertain and can also help protect against inflation as the economy heats up or as central banks increase stimulus.

Indeed, much of the rise in gold prices over the past two decades occurred during the global financial crisis as the Fed grew its balance sheet and amid the ensuing global challenges. Not only did the price of gold increase immediately after 2008, but it rose during the Eurozone crisis and peaked in 2011 when the U.S. debt was downgraded.

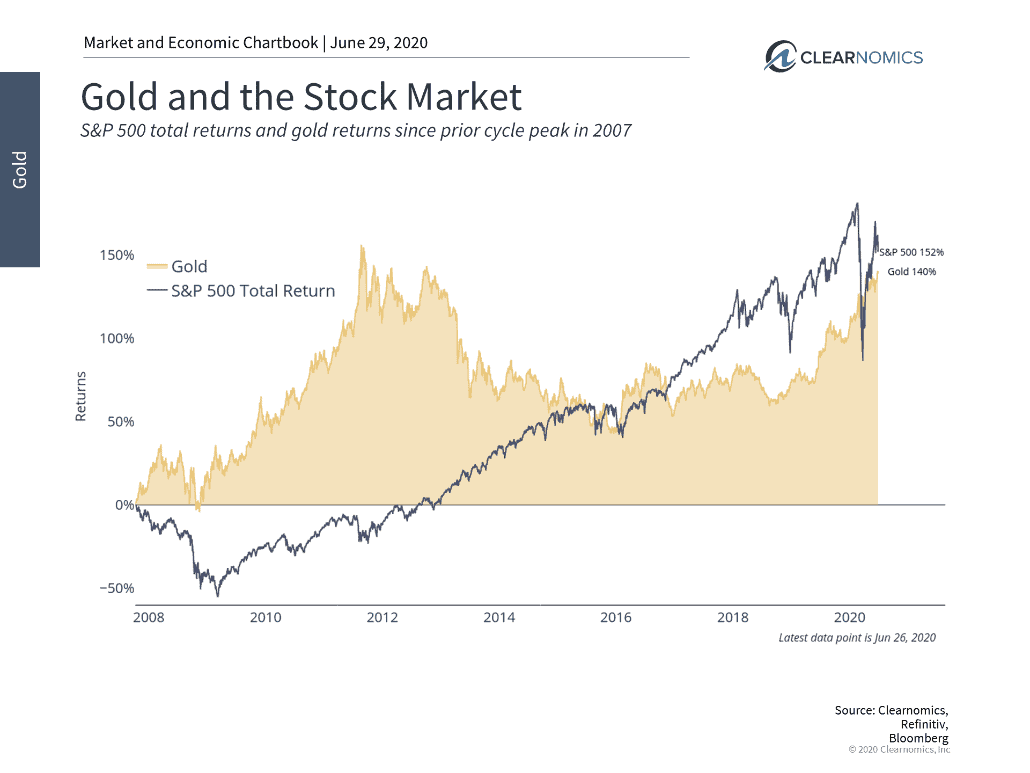

Demand due to portfolio diversification: The relationship between gold and the stock market since 2008 makes this fairly clear. (see chart below) Although gold outperformed stocks during the global financial crisis as expected, it fell in value and flat-lined for years while the stock market was climbing to new record highs. More recently, gold prices have increased due to the pandemic and ensuing economic shutdown. But while stock prices have been volatile, they have staged a recovery as well.

This means that while stocks are slightly ahead of gold when tracing their performance back to their 2007 peaks, they have taken very different routes. (see chart below.) To experienced investors, this is a tell-tale sign that holding these assets with the right proportions in a portfolio can help create a smoother ride across market cycles.

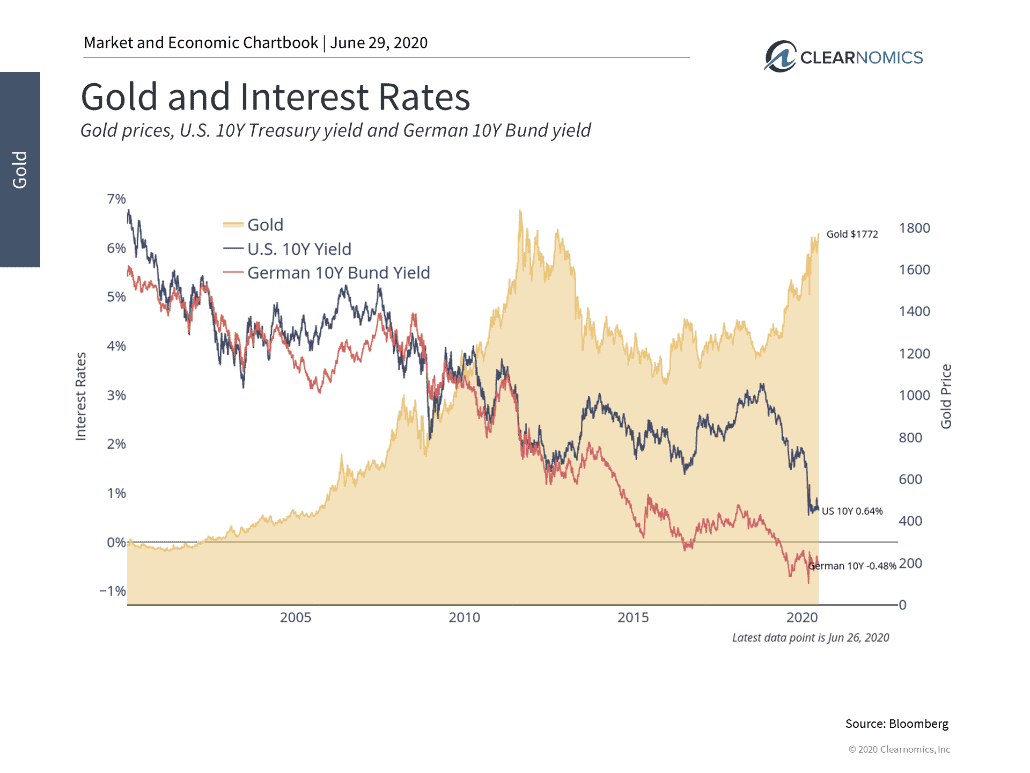

The relationship between interest rates and gold show a familiar pattern as well – gold prices have tended to rise as interest rates fall. (see chart below) Thus, gold prices have behaved similarly to bond prices – yet more reason to believe that gold is better suited as a portfolio diversifier than as a standalone investment.

Gold Dilemmas

Although gold can play an important role, why are stocks and bonds still the primary asset classes for most investors? For those investors that need income, gold does not generate yield or pay interest. So, while it can protect investors from short-term uncertainty, especially when the Fed is involved, it may not help with other income needs. For those investors who need growth, the stock market simply has a much longer track record of creating long-term wealth. Gold might protect wealth in times of uncertainty, but it will do little to create it.

One last important note is that gold itself can be extremely volatile. In particular, for those investors worried about stock market volatility, short-term movements in gold can be as bad or worse. For instance, gold prices began to plummet down about 50% in late 2012 when the global economy began to heat up. (see chart below) The Fed was still expanding its balance sheet and interest rates would still be at zero percent for 3 more years. Just as with the stock market, movements in gold may run counter to expectations.

Ultimately, the choice to invest in gold – or any individual asset – should be viewed in the context of a diversified portfolio and long-term financial goals. Holding too much of any one traditional or unorthodox niche investments from gold to bitcoin or even wine, could cause problems for your net worth and savings. Consider the following two charts:

- Gold can serve as a stock market diversifier

Gold and the stock market have performed quite differently since 2007. Gold, like many types of bonds, did offset much of the market volatility experienced during the financial crisis in 2008. However, stocks have risen steadily since then, even in 2020 as the COVID-19 crisis rages on.

Also, unlike gold, stocks pay dividends which provide income over time. Reinvesting those dividends has resulted in stocks outpacing gold over the past ten years. Thus, both can serve as important components of a diversified portfolio.

- Gold can serve as a store of value when interest rates fall

Gold and interest rates are intimately connected. Gold can be less attractive when real interest rates are high and it’s possible to generate significant investment income. The opposite is also true – gold can be attractive when inflation is rising, real interest rates are falling, or when there is significant market uncertainty. This has been true over the past several months as global interest rates have plummeted, and bond prices have risen.

The bottom line? Gold can serve as an important component of a diversified portfolio. However, it should be held alongside other major asset classes to create a smoother ride toward long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.