The Bear Market has Arrived: Markets Reaction to Public Inoculation

Headlines are ominously conveying that “it’s the end of a bullish era for stocks” for the first time since 2009 and the beginning of a new phase of bearishness, after the Dow “blue-chip” index plummeted over 20% from a record high to bear market territory in a record 19 days.

Financial pundits are comparing this surprising and swift market spectacle driven by the Corona Virus (COVID-19) to the depth of the Black Monday crash of 1987 (DJIA lost 22% in one day) and to the speed of the Great Depression crash of 1929.

Many corporations are pushing meetings online while schools and colleges across Florida are now closed to ward off the Corona virus. If you have a Genius Bar appointment, consider that Tim Cook recently tweeted an unprecedented retail move – that all Apple stores are now closed thru month end.

Toilet Paper

In between fear and panic, while stocking up on emergency supplies including hand sanitizer, water, canned goods and a year’s supply of toilet paper (why you need a roomful of toilet paper, I am not sure), we suggest taking a break from all the traumatic news predictions and insanity- and take a look at the world, markets and information a bit more scientifically.

The average bear market historically wipes about 36% off the S&P 500 and lasts for about six to seven months according to data compiled by Dow Jones Market Data. If that held this time, it would put the S&P at about 2200 sometime around September. The S&P closed Wednesday at 2741, down near 26% off its all-time high.

If this is the case, we may already be over 72% near the bottom of a crash. If you hear the headline news in the morning on your way to work or to your hot-yoga class, and your portfolio is down by 26% (about equal to the S&P 500) and think “maybe I should sell everything and buy a bigger mattress,” just recognize it’s either too late or a bad decision.

As we discussed in past newsletters, in many instances, an investor’s portfolio “ailment” leading to financial (and retirement) demise (and losing sleep) may be due more to being “over-weight” in stocks and under-diversified based on their risk tolerance and investment goals- than the COVID-19 virus headlines causing the extreme selloff.

Crash but No Recession

Many people we have talked to (including our local Publix Pharmacist) thinks the bear market, along with the Corona Virus ailment will not be here for long as the weather heats up and the virus peaks- viewing the scare as likely having only a transitory impact on our health and the economy. As swiftly as we arrived into this bear market, we could come out of it as quickly.

Jon here. This is one of a handful of times in history we have experienced an event driven crash without being in a recession, indicating that the underlying factors and fundamentals of the economy are slowing down, but still intact. Even if production and consumption is off-line for a while, it may not completely derail the economy like the 2008 credit crisis and real estate crash.

When the worst of the (COVID-19) virus subsides, we may see a quick “V” shaped “bounce back” recovery like we saw in the beginning of 2016 and 2018, fueled by today’s historically low interest rates, inflation and oil prices. By the time you hear the headline news to invest your cash, it will be too late. Market timing is always a fool’s errand.

Recession and Crash

But others think the stock market’s outlook will be determined mainly by yet another unknown regardless of the depth of the crash: whether or not the economy heads into recession this year after a 11-year economic expansion. If the shut-down of America is sustained for a few months or more- there could be a recession around the corner by year end.

Recessions are typically accompanied by steep share-price declines and are defined as a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

Uncharted Territory

For many investors, it may feel as if we’ve entered uncharted territory. However, while the specific circumstances may differ, we have been here before. For long-term investors, especially those who receive guidance from experienced financial advisors, times like these are the reason so much care goes into portfolio construction, asset allocation, risk assessment, retirement income strategy and financial planning.

It’s easy to stay invested when markets are going up, as they have been for the better part of the past 11 years. It’s when the world seems the most uncertain that investors need to be disciplined and trust in their preparation and execution with their advisor.

In the short run, markets can swing wildly in any direction and can often do so for longer than investors expect. However, having a solid economy and sound fundamentals can form a foundation on which the stock market can stabilize. This is often the key difference between a market correction and a true bear market.

How does this apply to today’s environment? In many ways, the market is having a bad reaction to governments and the public health sector inoculating society against the coronavirus (COVID-19). Quarantining cities, instituting work-from-home policies, canceling conferences, social distancing and other responses to the coronavirus are an attempt to keep contagion at bay. Whether this will work is still unclear.

What we do know, however, is that the economic slowdown that has already begun is most likely not a result of weakness inherent to the economy. Last week’s jobs report showed that 273,000 jobs were created in February, well above economist expectations and recent trends.

In many ways, the coronavirus resembles a classic “exogenous shock” – i.e. an economic shock that comes from outside the financial and economic system. This is not 2008 when the financial system came to a grinding halt due to its own excess. This is not 2001 when tech valuations were sky high. This is not due to the misallocation of resources, runaway inflation or significant trade, fiscal or monetary imbalances.

In fact, it’s highly unusual that we can pinpoint the exact cause of economic weakness. Typically, we rarely know the direct reason for poor economic readings and are forced to make educated guesses or wait for more data. In this case, we know with a high degree of certainty why manufacturing activity in China came to a halt and why service sector activity will likely slow in Europe and possibly the U.S.

Still, with recent market swings, this knowledge may provide little comfort to some investors. This is when it’s more important than ever to focus on holding appropriately diversified portfolios rather than attempting to trade in and out of markets as we discussed above.

Investors should take comfort in the fact that balanced portfolios have done what they were designed to do this year: create a steadier ride amid market uncertainty while helping to provide better downside performance than the S&P 500 ‘news’ index and indicator. Government bonds and other high-quality fixed income investments have helped to stabilize investor portfolios this year and actually provide gains (fueled by falling interest rates) and helping many to not overreact.

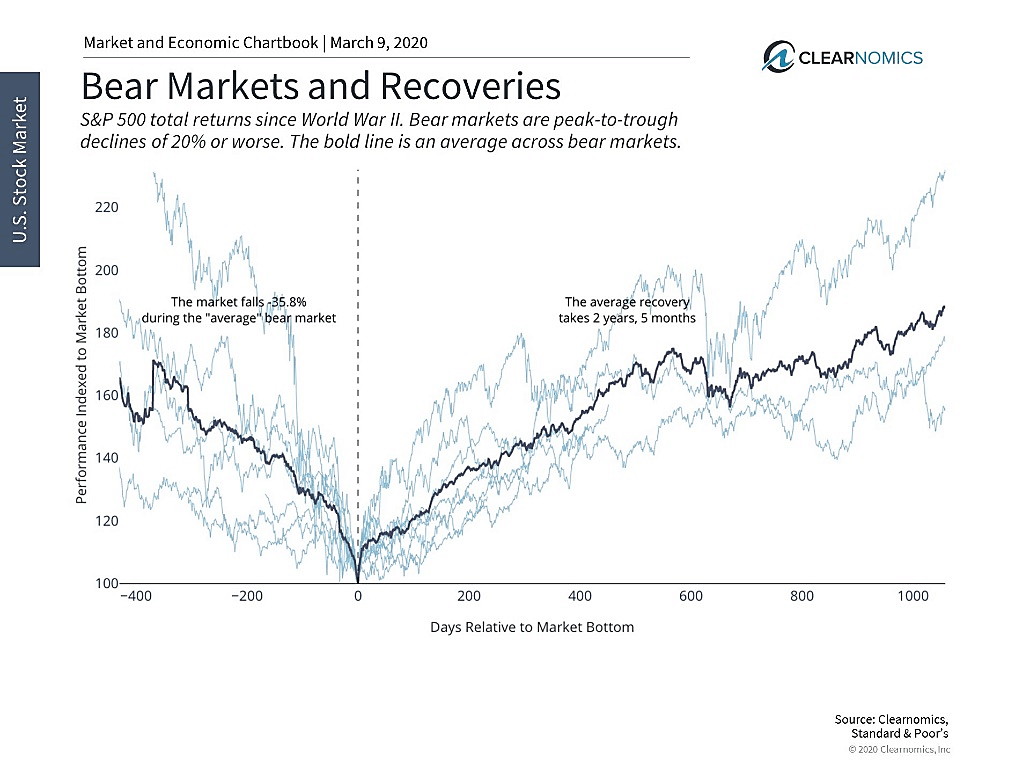

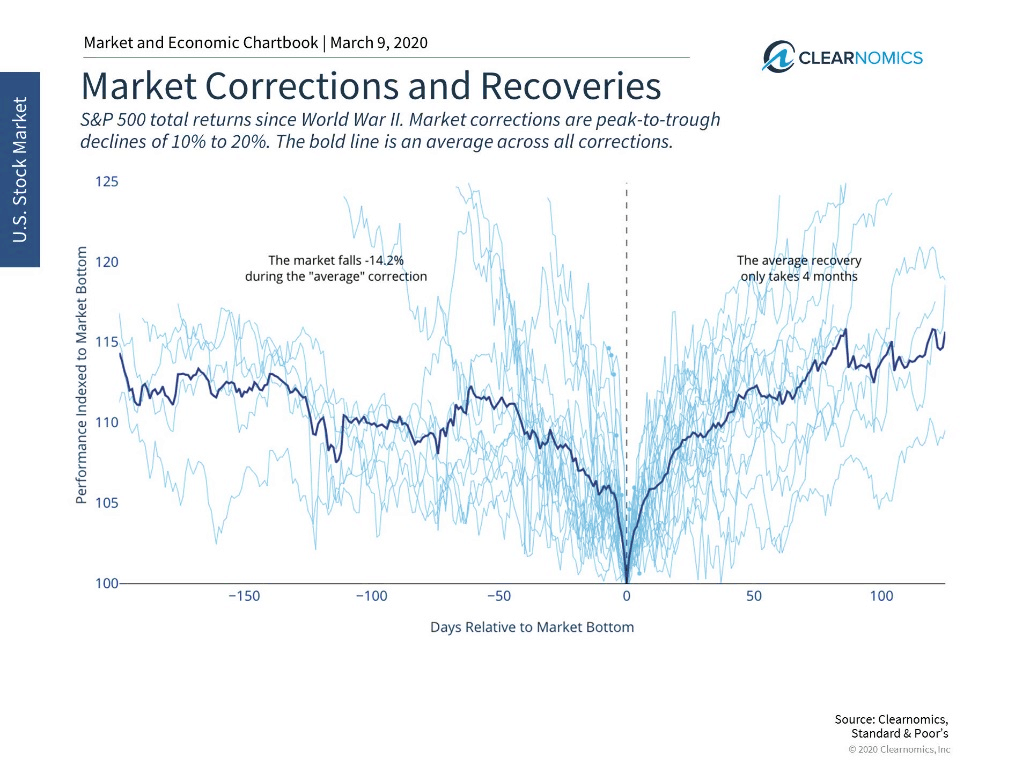

Below are three charts that help to put recent market movements in perspective.

- Bear markets occur during recessions and recover steadily over a couple of years

Bear markets, which occur during recessions, are typically much worse than 20% – they fall over 35% on average. Despite these deep, swift declines, they often recover steadily over the course of the following two and a half years.

- However, if the economy is healthy, the market often recovers much sooner

In situations where the economy is still healthy, or is able to recover from weakness quickly, stock market declines are more shallow. Market corrections typically see the stock market fall 14% and recover within several months. While each scenario is different, and it’s unclear how widely the coronavirus will spread, markets often recover if the economy is fundamentally healthy.

- Diversified portfolios have helped to stabilize investor returns this year

The best course of action for long-term investors is to trust in their diversified portfolios. A balanced portfolio has helped to stabilize investment returns this year, in large part because government and other high-grade bond prices have risen as interest rates have fallen dramatically. In other words, diversified portfolios are behaving exactly as they were designed to do.

It’s important to keep this bear market pullback in perspective. Historical bear markets have been much worse because of economic weakness. Still, even with the tech bubble and 2008 financial crisis, markets tend to recover once there is clarity and growth resumes. Long-term investors seeking to achieve financial goals over years and decades should keep recent market swings in context, shown in the chart above.

The bottom line? Investors are facing significant uncertainty due to the nature of the coronavirus. However, staying balanced and disciplined has been the best course of action across all types of bear markets.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.