That Dog will Hunt: Why the Bull Market Trots Forward

“That dog will hunt” is an affirmative adage indicating that something or some action may lead to a gain or positive outcome.

Many investors are fearful and a bit paralyzed from negative headlines that a bear may soon come knocking on their door and take a bite out of their life savings. Yet the longest, most hated and misunderstood bull market is poised to “hunt” nimbly forward and through its 11th anniversary on March 9th.

Perhaps many investors suffer from acrophobia, or a fear of heights.

While The U.S. markets (as benchmarked by the S&P 500 index) may be a bit “long in the tooth” and frothy with a PE ratio near 25 (15.78 historical mean), there is no indication or “magical” indicator that the current bull market, despite many geopolitical, political and epidemic health risks and headwinds, will not continue to rise to new heights and levels over time.

The average bull market and economic expansion before 1999 lasted four to five years. While entering the 12th year of the current bull market may feel dizzying, consider that unlike humans, bull markets do not die because of old age.

As an example, Australia took the record for the longest run of uninterrupted GDP growth in the developed world through March of 2017, marking 26 years since the country had a technical recession.

While this old bull is poised to continue forward, staying on the sidelines or being too conservative in cash, CD’s, money markets and fixed income can throw off your retirement goals for the long run.

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” (Peter Lynch)

Just remember that bear markets and recessions travel together. For a bear market to arise (a 20% decline in stock prices) there must be a substantial and long-lasting decline in earnings, further fueled by widespread pessimism and negative investor sentiment. Bear markets (like Bull Markets) can be cyclical or secular. The former lasts for several weeks or a couple of months and the latter can last for several decades.

Jobs, Earnings and Unemployment, oh my!

The stock market continues to react to coronavirus headlines on a daily basis – with both negative and positive market swings. As the death toll rises (primarily in China at the moment), the fact that this is a human tragedy and not just an economic or financial one should not be diminished.

However, from an investment perspective, it’s important to not over-react to daily headlines, especially ones that are extremely uncertain. While the impact on the Chinese and global economies won’t be known for a long time, recent data suggest that the U.S. economy is still quite healthy. For diversified investors, a stable and growing economy is the foundation of long-term portfolio returns.

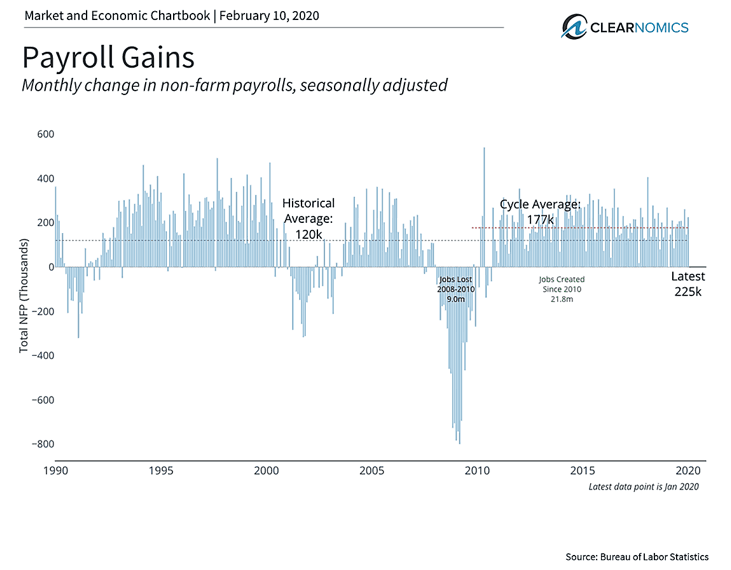

Last Friday’s jobs report (see below) provided further evidence that this is the case. 225,000 non-farm jobs were added in January which significantly exceeded economists’ expectations. In total, about 22 million new jobs have been created since 2010 and, even after a decade of growth, new jobs are still being added at a pace of over 2 million per year.

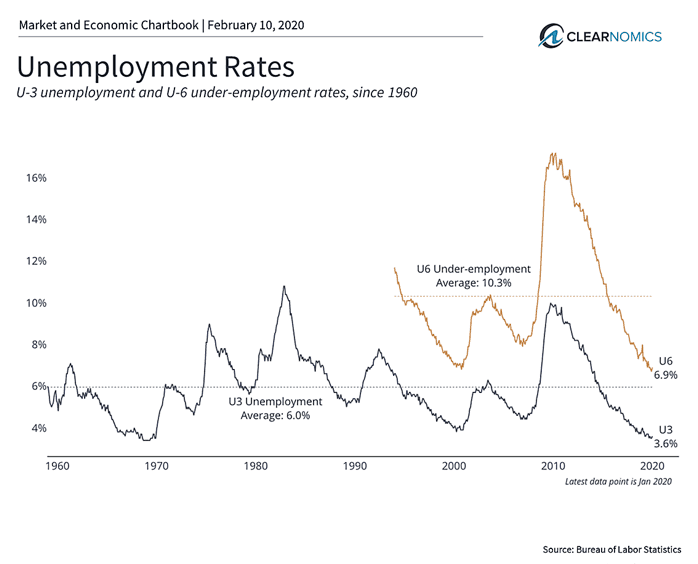

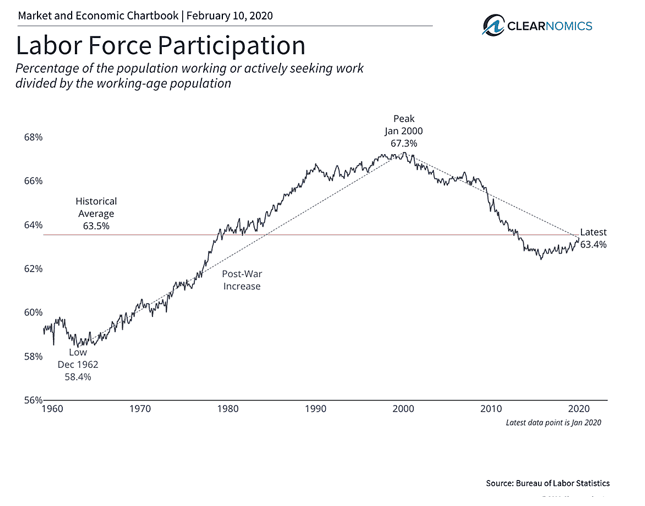

The unemployment rate (see below) did increase slightly to 3.6% – still nearly the lowest in half a century – but only did so because more Americans re-entered the labor force after being on the sidelines. The evidence of this is a rising “labor force participation rate” (see below) which measures the proportion of Americans working or looking for work. This percentage plummeted after the financial crisis and has until recently been flat since 2013.

For many investors and economists, the labor force participation rate is a key metric for determining how long this cycle might last. This is because an economy that runs out of workers would eventually overheat – either growth would slow, wages and inflation would rise, or both. The fact that Americans who have been on the sidelines are re-entering the workforce is a sign that perhaps we are not at “full employment” just yet.

What this mean for investors, amid global public health concerns, is that the underlying foundation of diversified portfolios – a stable economy – is still intact. While we might debate the specific rate at which the economy can grow, the ultimate toll of the coronavirus, and how these factors might impact corporate profits in 2020, it’s clear that there are still few signs of a recession. Given the circumstances, it’s important for investors to stay disciplined in their portfolios in order to achieve their financial goals.

Below are three charts that put these economic trends in perspective:

1. 225,000 jobs were created last month, well above expectations

Last Friday’s jobs report showed that 225,000 non-farm payroll jobs were added in January, well above consensus expectations of only 165,000. About 22 million new jobs have been created over the course of this economic expansion, compared to the 9 million that were lost during the recession.

2. Unemployment continues to be extremely low

At 3.6%, the unemployment rate continues to hover around the lowest levels in five decades. The under-employment rate (U6 unemployment) is also quite low, having fallen significantly from its 2010 peak. This is an indication that even those who struggled to find jobs in the wake of the financial crisis are now doing so.

3. More Americans are re-entering the labor force

One reason the unemployment rate ticked up slightly last month is that more Americans are re-joining the labor force. This is measured by the labor force participation rate, shown above.

The labor force participation rate began to decline starting in the year 2000 due to the impacts of globalization and technology. Companies were able to do more with less via cheaper labor and automation. This trend then accelerated during the financial crisis but has now begun to reverse.

The bottom line? If you suffer from acrophobia, or a fear of heights from the current almost 11-year bull ascension, consider the underlying economy is still healthy despite global uncertainty. It’s important for long-term investors to stay disciplined in their portfolios during this period

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.