Taper Tantrum Headlines Drive Investor Concerns

When Fed Chairman Jerry Powell speaks at the periodic Fed meetings, everyone is glued to every word that comes out of his mouth.

In trying to balance concerns between recognizing renewed economic risks from the pandemic and satisfying hawks’ concerns about hot, persistent inflation, Powell runs the risk of disappointing one side. After a quite low volatility year on the Street, an eventual 5-10% pullback in stocks given the headwinds from the Delta variant and inflation to the geopolitical events unwinding in Afghanistan would not be shocking over the next eight weeks.

Driving Rates

When driving a car, you may only have a vague idea of how the underlying engine mechanism works. Internal combustion engines can contain any number of combustion chambers (cylinders), typically between four and twelve. Yet you should know that the accelerator speeds you up and the breaks slow you down.

When driving a portfolio construction strategy, you may only have a vague understanding of five underlying factors (cylinders) of bonds including interest rate risk, reinvestment risk, call risk, default risk and inflation risk. Similar to basic concepts of automobile acceleration and braking, investors should develop fundamental knowledge of the mechanics of interest rates and how the Fed can affect the economy, lending rates and the markets.

Shifting Gears

A bit opposite of the effects of the accelerator and brakes on your car, when the economy is decelerating, the Fed downshifts short term rates (the Fed funds rate) into lower gears (near zero) while adding a mountain of cash (billions!) into the banking system through bond purchases (quantitative easing) to help “speed up” the economy while encouraging lending, spending and investing.

When the economy is accelerating back up along with inflation, the Fed up-shifts short term rates into higher gears while decreasing cash in the banking system to help slow down the economy (tapering). This week’s virtual Jackson Hole Economic Symposium with Fed Chair Powell could provide more clarity around upcoming tapering and future rate hikes.

While the Fed’s monetary toolkit controls short term interest rates, long term rates as benchmarked by the 10 Year Treasury are market driven. The 10-year T-note index is the most widely tracked government debt instrument in finance, and its yield is often used as the “holy grail” of benchmarks for other interest rates, such as U.S. mortgage rates.

Taper Tantrum Déjà vu?

Back in August of 2013 when then Fed Chairman Bernanke made an announcement during a congressional hearing (eight years ago this month) for the Fed to reduce its bond buying program, the notorious “Taper Tantum” evolved before the Fed even had a chance to take any action.

The benchmark 10-year Treasury yield spiked a full percentage point over the next few months (fueled by a bond selling frenzy) to almost 3% causing many bond values to decrease into the red for the year. At the same time, the S&P 500 index relinquished -5% before suddenly turning around, and ended 2013 up with significant gains.

While the financial system has calmed down a bit this year since the pandemic led shutdown and stock market rollercoaster, many argue that it is overextended in many areas. In our opinion, there may be little the Fed can do to prevent another taper tantrum. The best it can do is be prepared and communicate clearly and consistently.

Simply put, Powell will need to first work on reducing (not stopping) the $120 billion in monthly Treasury and mortgage-backed securities purchases before then engaging to systematically raise the short term Fed-Funds rate.

Why Fed Tapering Shouldn’t Be Distressing

We have seen this movie before from the Fed with varying degrees of success, across the 15 boom-bust cycles since the Great Depression. There were a variety of causes for each recession, from asset bubbles to debt crises, which resulted in different recoveries and subsequent expansions.

The nature of the pandemic and the speed of the recovery have made economic forecasting challenging to say the least this time around. Many measures of inflation are at their highest levels since the early 1990s. Unemployment has fallen sharply. Manufacturing activity is red hot, and while retail spending has slowed, car and home prices remain elevated. It’s difficult to say with accuracy how much of this economic boom will continue.

What is certain is that we are still early in the business cycle and market prices are factoring in a strong expansion. With the economy above pre-pandemic levels and the stock market grinding higher, it’s natural for the Fed to consider returning to its own pre-pandemic policies. At the end of 2019, the Fed was shrinking its balance sheet and the federal funds rate was at 1.5%.

Given this backdrop, there are many reasons for investors to be optimistic and stay invested. However, it’s also prudent to be prepared for greater uncertainty. This can occur in a few ways.

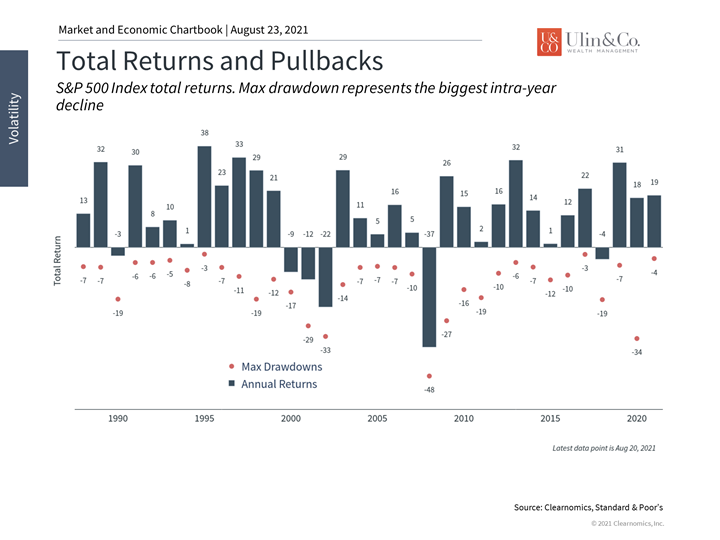

First, there may be larger swings across the stock market on a day-to-day and week-to-week basis. For instance, the most recent market pullback of 1.7% was concerning to some investors, but this proved to be shallow and short-lived. As always, it’s important for investors to remember that short-term pullbacks are both normal and completely expected. What is unusual is that the largest peak-to-trough decline in the S&P 500 this year has only been 4%. (see below) Managing larger swings with a diversified portfolio, especially with valuations at multi-decade highs, is more important than ever.

Second, it is likely (very logical) that interest rates will continue to rise over the coming quarters and years. While the first half of the year showed that rates almost never move in a straight line, the ongoing economic expansion and tighter monetary conditions should push rates higher over time. In general, this is good news for savers who depend on portfolio income. And while it may create tighter conditions for borrowers and mortgage-holders, economic data suggest that the average consumer is in a strong position.

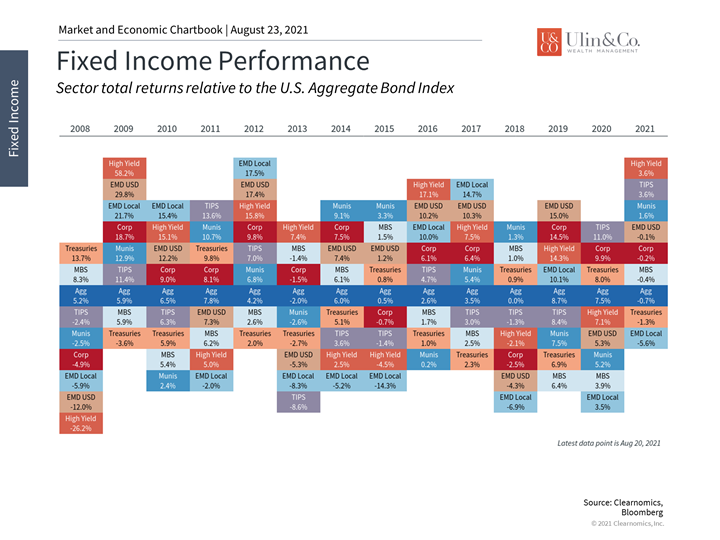

Third, fixed income continues to be an important diversifier when managing portfolios. Although many bond sectors were shaken by the rapid rise in interest rates at the start of the year and were in the red, some parts of the market have since recovered. (see below) Bonds will likely still help to stabilize portfolios in uncertain times, regardless of the interest rate backdrop or if we have a repeat of the 2013 “taper tantrum.”

It’s more important than ever for long-term investors to have a solid financial plan and well-considered portfolio. Below are three charts that help provide perspective on Fed policy and economic uncertainty.

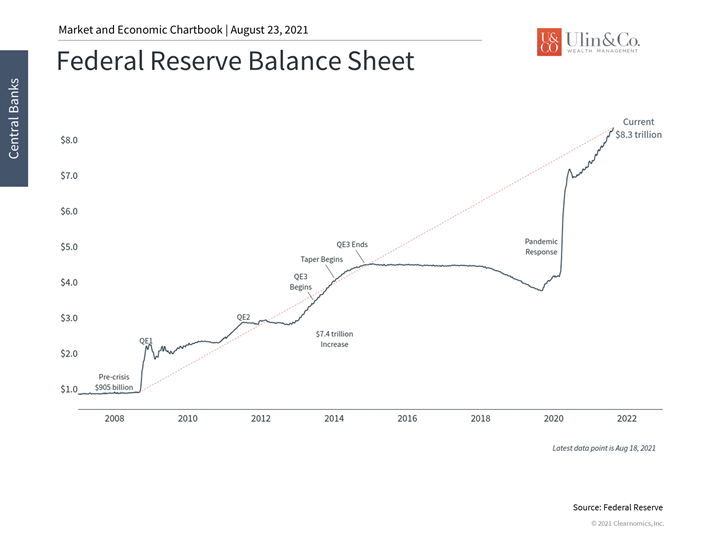

1 The Fed will likely begin reducing its asset purchases soon

The Fed’s balance sheet has expanded dramatically over the past 18 months – nearly doubling from its post-2008 level. With the economy back to pre-pandemic levels, it’s likely that the Fed will begin slowing its asset purchases soon.

2 Investors should always be ready for market volatility

Despite daily swings, the largest intra-year decline has only been 4% in 2021. This is far below average. With valuations and Fed uncertainty both elevated, investors should stay balanced in order to navigate markets in the months to come.

3 Fixed income still plays an important role in portfolios

Although rising rates rattled many parts of the bond market earlier this year, the asset class still plays a substantial role in stabilizing portfolios.

The bottom line? Rather than focusing on daily Fed headlines, investors ought to focus on the underlying economic trends and maintain balance in their portfolios.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.