Should Bitcoin be Part of Your Portfolio? The Billion Dollar Ride

Speculative assets that are gaining momentum among investors today involve hot alternatives such as collector watches, jewelry, precious metals, numismatic coins, fine art, rare wine, aging scotch barrels, music rights and insect farms. Many of these unorthodox moves not only bestow the pleasures of tangible ownership but also aren’t tied to the ups and downs of capital markets or real estate.

The topic of cryptocurrencies can be more complex to understand than most speculative assets combined and is well beyond of the scope today of whether it can serve a role in portfolios. To paraphrase Morpheus from The Matrix movies, “there is a difference between knowing the path, and partaking on the path.”

A proper explanation would involve the blockchain, hashing/mining algorithms, energy consumption, financial theories of currencies and asset classes, and more. Bitcoin is just one popular (and newsworthy) investment on the blockchain that could become a viable investment over time but appears more like a Vegas speculative bet today. Before jumping in and buying 1 coin for $40K consider the following.

Those implying bitcoin is like a “digital gold, safe-haven asset or investment hedge to the stock market should look no further than the 1636 Tulip Bulb mania, 1993 Beanie Baby fad, 1999 dotcoms and 2007 real estate craze that all were all driven up by speculative crowd-mania and a lack of transparency before going down in flames.

Bitcoin’s wild rise has led some commentators to warn it could be the next market bubble likely to burst. The world’s most-valuable cryptocurrency has skyrocketed over 300% in the last 12 months surpassing $40,000 a few weeks ago. Bank of America in a recent note called it the “mother-of-all-bubbles.” Then again, perhaps Bitcoin may have even more of a dire ending, as the U.K.’s Financial Conduct Authority (FCA) warned this week, “thinking of investing in a cryptocurrency? Be prepared to lose all your money.”

A lot of theories have emerged on why Bitcoin has skyrocketed with most heralding widespread adoption by institutions and individuals. The fact remains that there’s nothing widespread to transparent about Bitcoin ownership which is worrisome in the short term as it’s limited supply. Your coins or the whole lot on the web could potentially disappear in thin air.

A few large holders commonly referred to as “whales” continue to own most of Bitcoin. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset, according to researcher Flipside Crypto. As worrisome, the study found Ninety-five percent of spot bitcoin trading volume is faked and manipulated by unregulated exchanges.

Speculating vs Investing

Benjamin Graham, often considered to be the father of value investing, drew a stark distinction between speculating and investing. He considered speculation to be the buying/selling of securities that is based on price movement alone. Investing, on the other hand, is based on the skilled analysis of factors such as company performance, sector trends, macroeconomic data, etc. He even went a step further by arguing that “an investment operation is one which, on thorough analysis, promises some protection of principal and a satisfactory return.”

In short, a cryptocurrency, of which Bitcoin is the most famous, can be thought of as a “digital asset” that is de-centralized in nature. It is digital in that a bitcoin exists only within computers. It is de-centralized in that no person, corporation or government controls the network.

It relies on an anonymous peer-to-peer distribution network called the blockchain, a Matrix typed system within itself, which initially raised eyebrows because it was a favorite of criminals on the dark web looking to make untraceable payments. Unlike most databases, the blockchain is distributed across the Internet, making it practically impossible to shut down. But since its most recent accession, major companies such as Square and PayPal are looking into blockchain usage.

From a long-term investor’s standpoint – whether this turns out to be true, and whether or not one believes the arguments for or against – Bitcoin is simply another asset with certain characteristics. The question of whether and how much to invest in this asset should be no different than deciding on any individual stock, bond, currency, commodity, investment theme or idea.

Three Challenges

It is from this perspective that there are a number of challenges. First, cryptocurrencies are still not a reliable store of value, medium of exchange, or means of account. In other words, they do not yet fit the practical requirements of currencies such as the dollar. While this may change in the future, today it is still difficult for everyday individuals to purchase and store digital currencies. And even when that day comes, it’s hard to know which cryptocurrency will prevail – just as it was difficult to know in 1995 which dot-com stocks would survive and change the world.

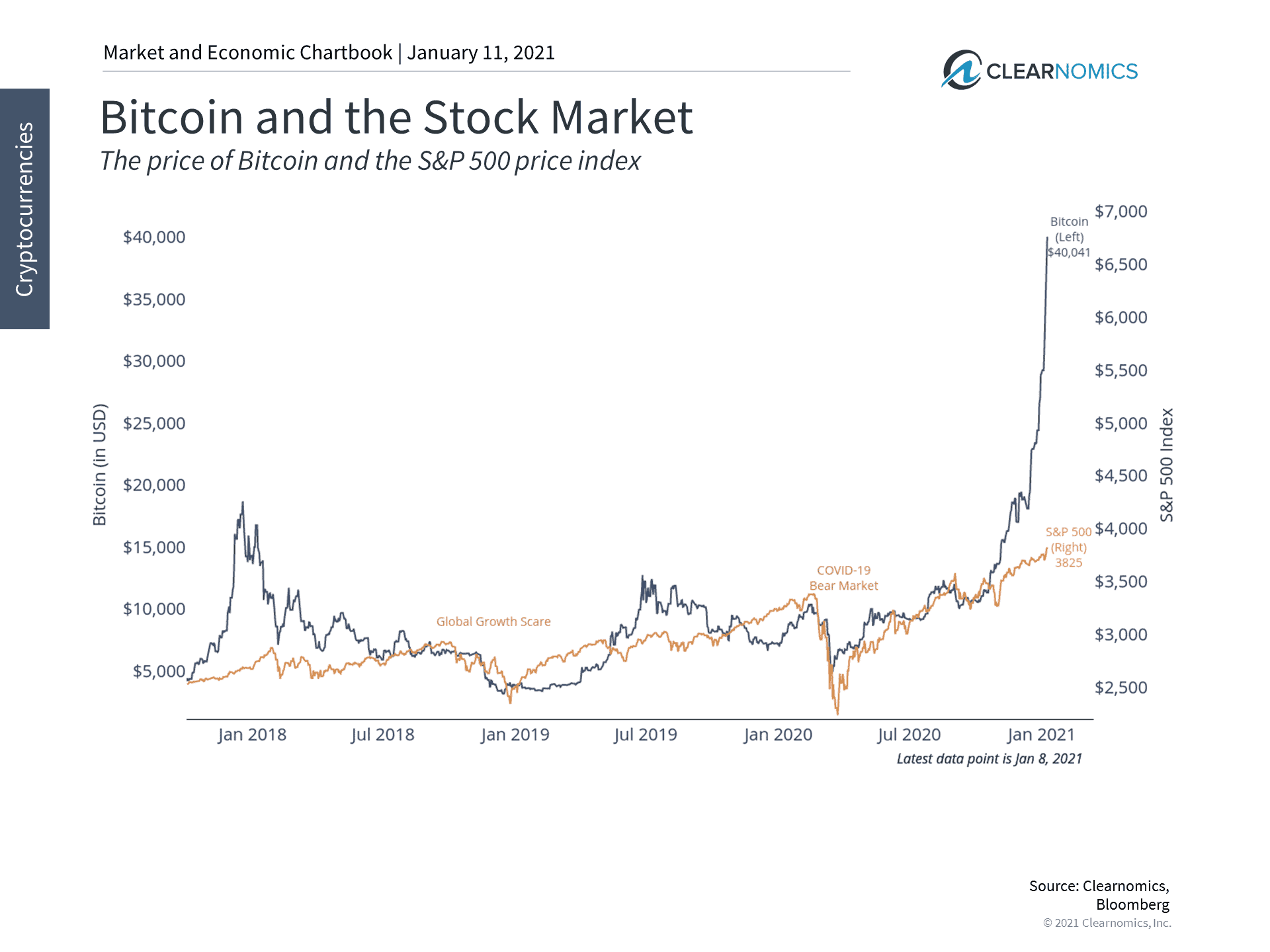

Second, cryptocurrencies have not yet proven to be reliable portfolio diversifiers. In fact, they have often been positively correlated with the stock market and other risk assets. From its peak last February to the bottom in March, the price of Bitcoin declined 53%. Since then, it has gained alongside the S&P 500 – although to a much larger scale due to its significantly greater volatility. (see below) For those seeking safety when stocks are down, especially from an asset with no central control, unfortunately this hasn’t yet been proven to work.

Third, Bitcoin and other digital currencies are extremely volatile. Depending on the period, they can be 5 to 10 times as volatile as the overall stock market which is itself is considered to be risky. This is one reason they are still poor stores of value and thus dissimilar from Treasuries and some commodities – and also how they may be more similar to traditional speculative assets. Its previous run-up in late 2017 and early 2018 saw Bitcoin rise by over 20x before plummeting nearly 80%. Thus, it’s important to focus on both rising and falling periods.

What does this mean for long-term investors? Just like speculative tech stocks during the dot-com boom, none of this is to say that cryptocurrencies may not be important in the future. It’s also not to dismiss that some investors have captured eye-popping returns in the latest run-up.

However, this is where speculation needs to be strongly distinguished from investing. The purpose of long-term investing is to construct sound portfolios that can help investors to achieve financial goals. It’s possible that cryptocurrencies can play some role in these portfolios, especially as Bitcoin and other assets develop and become more institutionalized over time.

Jon here. In the short term, I agree with the UK authority’s viewpoint to only invest in Bitcoin what you can afford to 100% lose. As we noted in our recent blog, 45 Financial Hacks; do not invest more than 5% to 10% of your liquid capital in any one individual stock or product. If you made some good money in Bitcoin, perhaps consider to cash out some of your profits and pay income taxes on your gains.

Ultimately, the choice to invest in cryptocurrencies – or any individual asset for that matter – should be viewed in the context of a diversified portfolio and long-term financial goals. Below are three charts that provide perspective on the role of cryptocurrencies in portfolios.

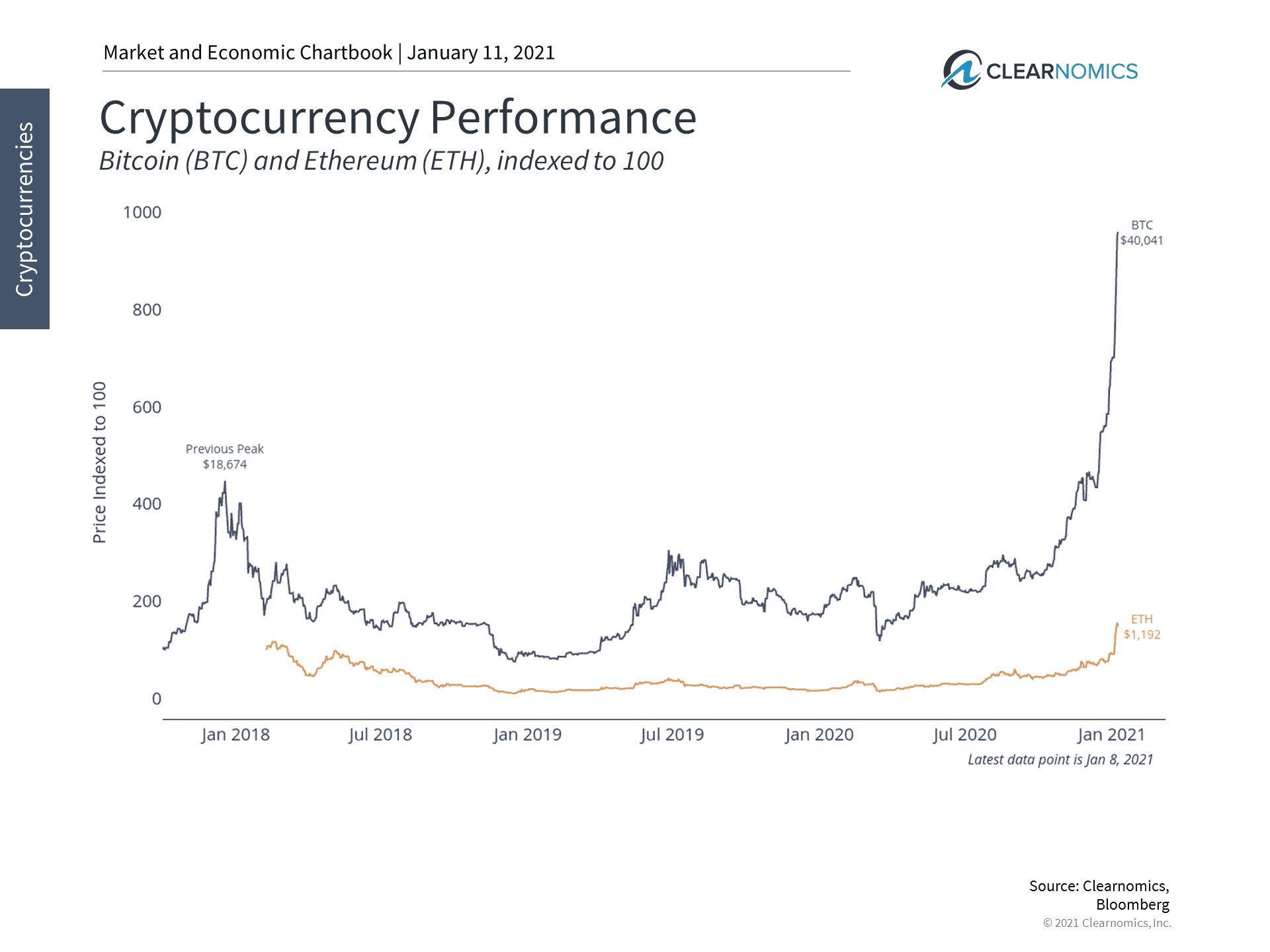

1 Cryptocurrencies such as Bitcoin have risen significantly this year

The prices of Bitcoin, Ethereum and other cryptocurrencies have risen dramatically in the past several months. However, Bitcoin has experienced other run-ups including in late 2017 when it breached $10,000 for the first time on its way to $18,000, before plummeting. These digital assets are extremely volatile and should be handled with care in portfolios.

2 Bitcoin has often been correlated with the stock market

Bitcoin has not proven itself to be a portfolio diversifier. Instead, it can magnify risk since it is positively correlated to assets such as stocks. This can be seen most clearly in 2020 when it declined alongside the stock market before recovering at the same time.

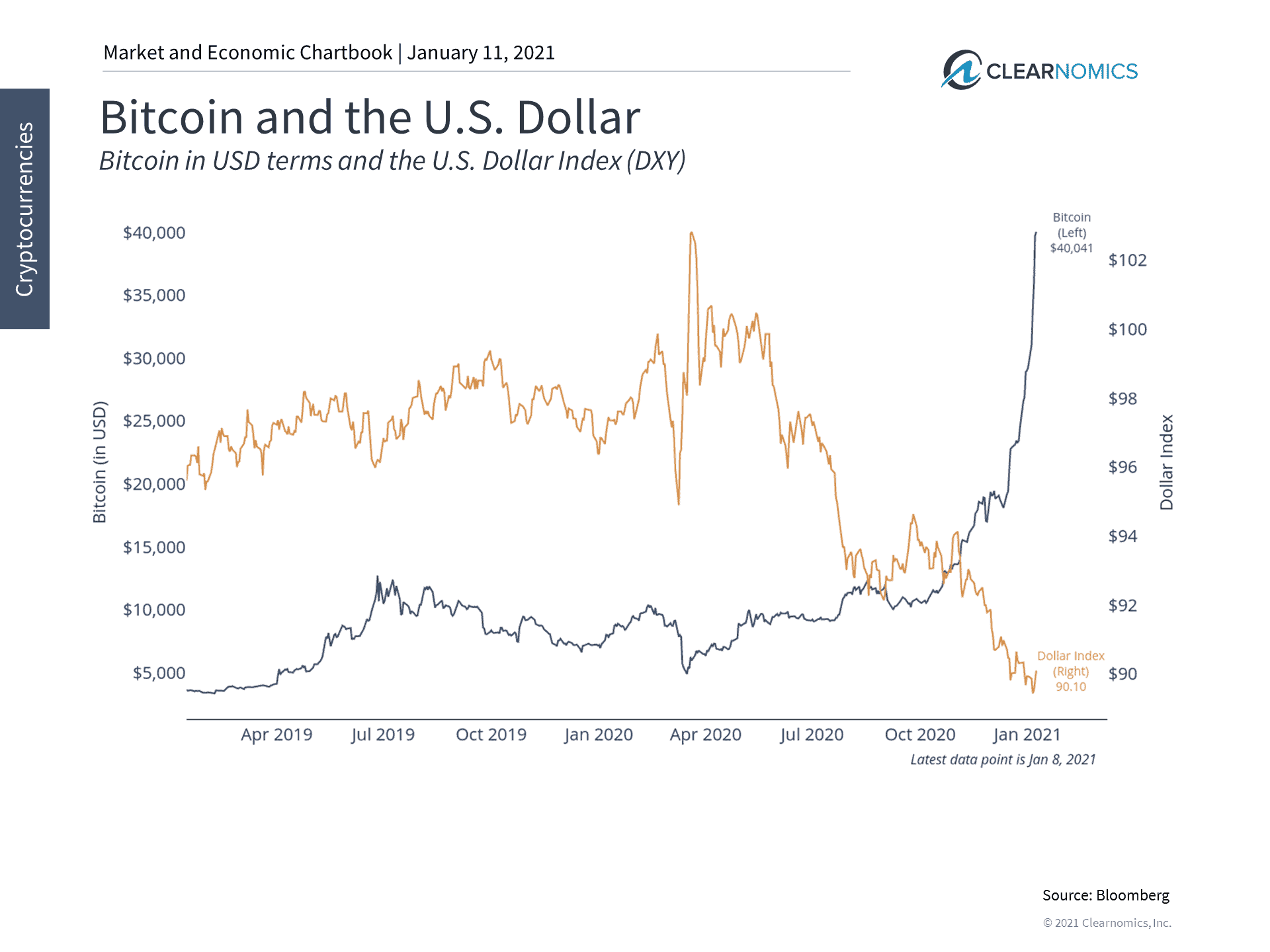

3 The dollar’s decline has likely boosted Bitcoin as well

Since the price of Bitcoin is often denominated in U.S. dollars, the falling dollar has likely helped to propel Bitcoin higher as well. In this way it is no different from other major currencies which have risen over the past several months as the dollar has devalued.

The bottom line? From a technical perspective, cryptocurrencies are extremely complex and interesting. From a portfolio perspective, however, investors ought to consider whether these assets can contribute to achieving their long-term goals or are simply like a Vegas-typed bet on the roulette wheel.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.