R.I.P. 60/40? Balanced Portfolios are Alive and Well

Nostradamus like headlines have been advocating ominous warning signs that the “60/40 portfolio is dead” and “R.I.P. 60/40.” They furthermore mention that interest rates and bond returns will remain low while the overpriced stock market will suffer headwinds and underperformance for the coming decade. Whether these forecasts will evolve is unknown.

The series of equity bear markets and crashes starting in 2000 coupled with decreasing rates, high equity valuations and periodic bond bear markets have eroded the popularity of this basic, balanced, time-tested approach to investing in stocks and bonds, with some pundits suggesting that more asset classes and alternative products to stocks are aptly needed to help better accomplish one’s financial goals and not suffer from potential underperformance this coming decade.

There are further references and comparisons to the ever famous endowment fund of Yale University as a prime example of how traditional stocks and bonds are “no longer relevant” or needed to produce material growth with manageable risk. This fund currently has only 5% of its portfolio allocated to stocks and 6% in mainstream bonds of any kind, and the other 89% is allocated in other alternative sectors and asset classes.

Should you invest like Buffet, Dalio, Soros, Harvard or Yale fund gurus, or follow fearmongering advisors into unique insurance and or alternative illiquid based vehicles as an “alternative hedge” to stocks before the world ends, remains to be seen. Like a good doctor diagnosing a problem, consider the truism of Occam’s razor. This theory is the “problem-solving principle” that implies that in the mist of many possible options, “the simplest explanation” is usually the right one.

Most investors do not have a billion dollar plus portfolios nor can their retirement afford the different types of risks inherent with unique strategies like major hedge and pension funds. Therefore, our investment philosophy is grounded in the Markowitz Nobel Prize winning study of Modern Portfolio Theory while developing liquid, low cost, diversified portfolios while focusing on variations of the four major assets classes of cash, bonds, stocks and alternatives.

Jon here. Perhaps a bit of a throwback to my father, Dr. Alexander Ulin, my three simple rules to working with clients are (1) “diagnose before prescription” (2) follow the “KISS principle” (keep it simple) for an investment process and (3) help investors to avoid “paralysis by analysis,” where no solution or course of action is decided upon, potentially leading to a worse outcome whether money or health. Investing is truly an art and a science, like medicine, between the science of the data and the art of interpreting information to make an informed, disciplined decision.

Rocky Start for 2021

While the first quarter of 2021 brought sobering results for treasuries and most bond sectors ending up in the red followed by minor pullbacks at the top of this quarter on news of potential changes by President Biden to raise income, investment, estate and corporate tax rates, the remainder of this year could be a repeat of 2013 with stocks advancing and bonds declining, and not a return to the “high-flying” interest rates and inflation numbers of the early 80’s.

Rather than discarding your investment process and strategy onto the wayside while pivoting from bonds to cash, stocks, annuities and or alternative investments, there are other options to tactically diversify your liquid, fee-based portfolio whether you are seeking income and or growth. The 60/40 portfolio does not appear to be dead by any factors and has helped investors weather bond and stock volatility for decades. Is this time truly any different?

Returns may be low, and you may experience some temporary paper losses to the bond side of your portfolio in 2021 as rates may continue to advance as we boomerang out of quarantine, but you may not be able to financially handle or mentally stomach major losses of a high stock weighted portfolio (see below) if there were another stock market crash or correction.

At the same time, being too conservative and “cash heavy” with rates near zero may not help to meet your goals to keep up with income, inflation, growth and taxes over the long run.

The Case for 60/40

60/40 is often portrayed as a “cookie-cutter portfolio when it’s really not – there is freedom to tailor it to specific investor needs while adjusting styles, sectors, industries, market caps, duration and country exposure (to name a few) each quarter for ongoing macroeconomic and market conditions and outlook. A balanced portfolio simply provides a time-tested guideline on allocating to equity-like and bond-like assets. Greatly deviating from one’s portfolio risk tolerance based on current headlines or what “may” happen later this year can end up being as harmful to your savings and retirement as consulting yourself with “Dr.” Google” on health-related matters.

Economic and stock market forecasts are all over the place, just like projections and numbers on the of COVID-19 pandemic. While most people will recover from the Coronavirus or the flu on their own, the symptoms can be undeniably terrible. Cold and flu medications can help you to feel better while treating your symptoms, but do not provide a cure.

The 2020 quarantine-led market crash and ongoing volatility is much like the flu. We know it will eventually subside, but we feel compelled to take brisk, unnecessary action with our money in the short term to make ourselves feel more financially and emotionally secure.

Thus, investors face a balancing act between taking advantage of the business cycle (one year out from the market bottom of the COVID19 crash) while staying disciplined and diversified through unknown potential future events (Tax hikes, Fed policy, geopolitical risks, Black Swan events and more). While this is a difficult balance to strike amid constant distractions, history has shown that those who are able to do so have a better chance at achieving their financial goals and financial independence over time.

Below are four charts that help to put recent market highs in perspective while providing perspective on staying diversified with a balanced, 60/40 portfolio.

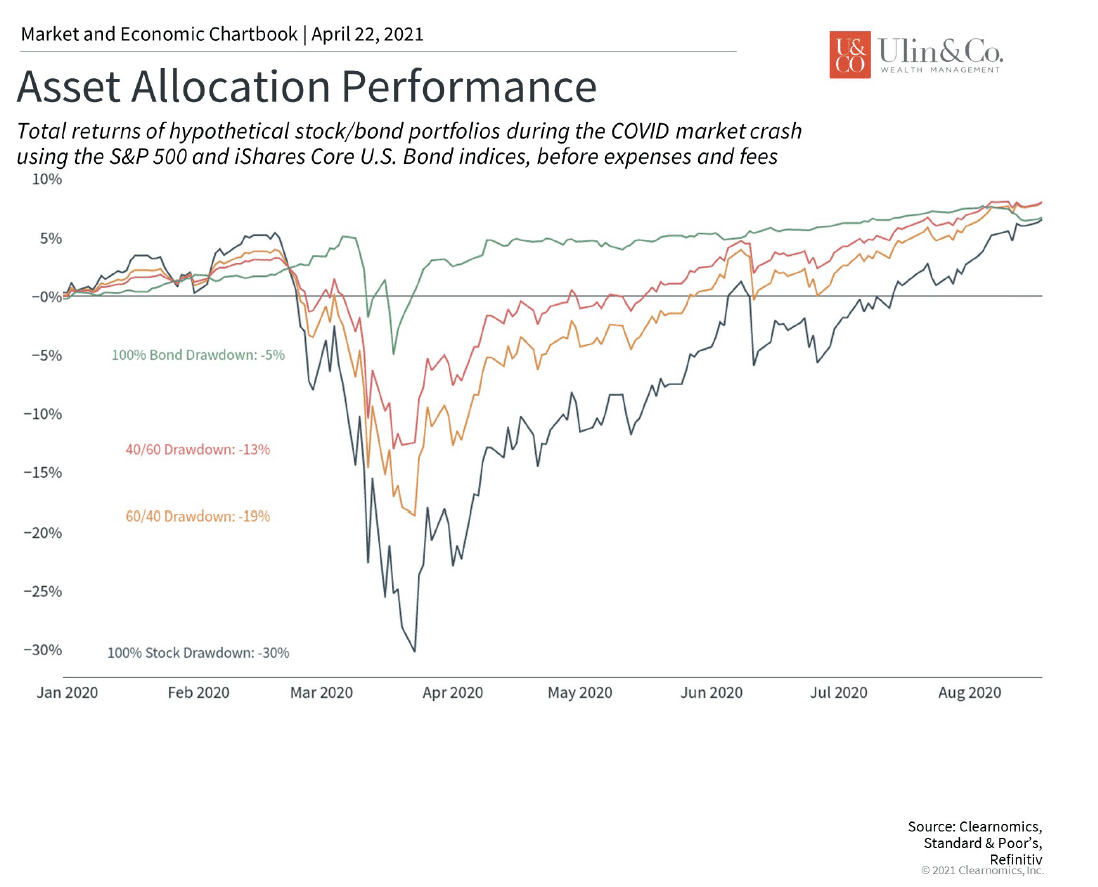

1 Asset allocation provides a valuable hedge on the downside

This chart shows how different asset allocation portfolios performed during the crash last year. 60/40 fell much less than an all-stock (of course) and recovered nearly two months before an all-stock portfolio. This indicates that the “40” in bonds still provides ballast and helps protects you on the downside despite low interest rates. You may not have a love relationship with bonds this year, but you will thank yourself again the next time volatility hits.

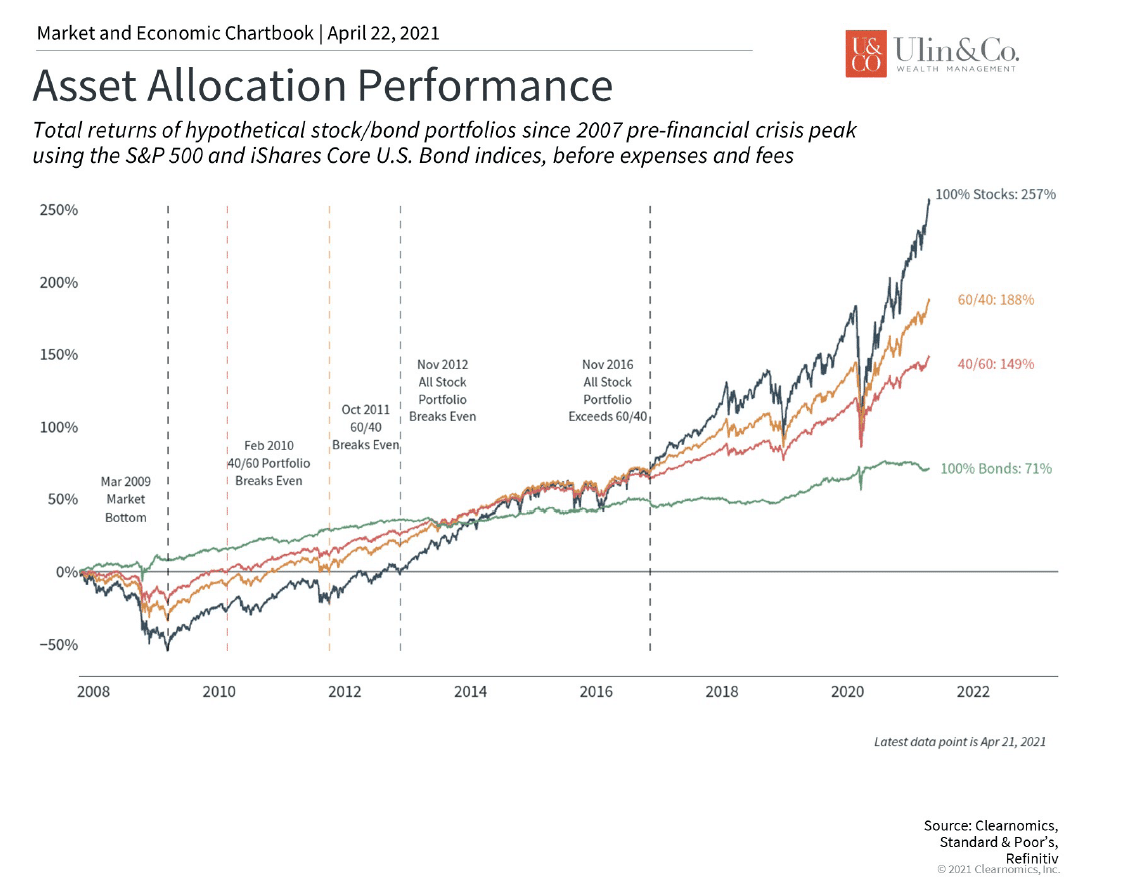

2 Balanced 60/40 portfolios have performed appropriately over time

The following chart show us that the “60/40” has done very well going back to 2007, through a dozen ups and downs. Yes, the “all-stock” index has spiked over the past year (providing some investors remorse they were not more aggressive), but we all know this can’t last forever. For most investors, the “smoother ride” over this period is probably preferred.

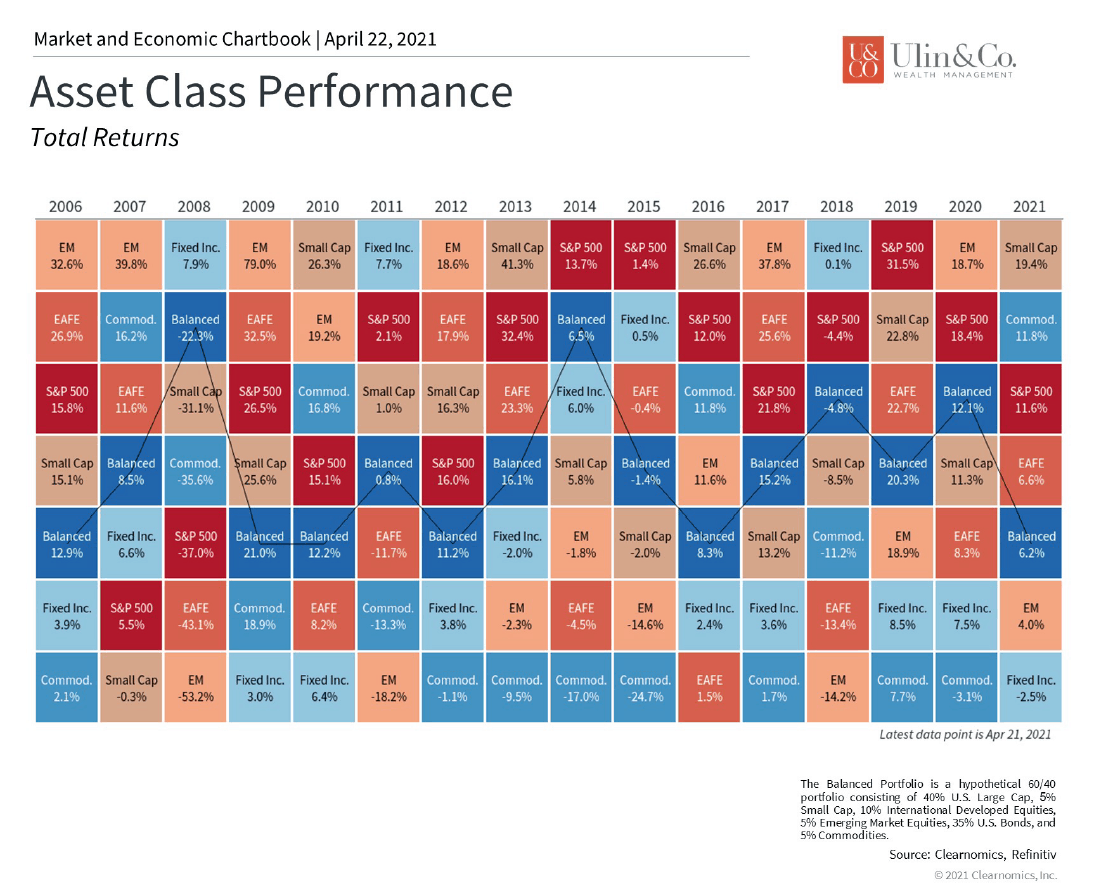

3 The Quilt Chart of asset performance by year illustrates the smoother ride of 60/40

In the following chart, the balanced 60/40 portfolio (see caption) surgically “cuts through the middle” of all other provided major individual asset class returns and risk measure for the past 15 years. It’s done very well over the through very different environments and changes in market leadership and black-swan events. The noted 6-7% per year Target return goals (on most client risk analysis) of the 60/40 portfolio do seem to be met, but not in a straight line.

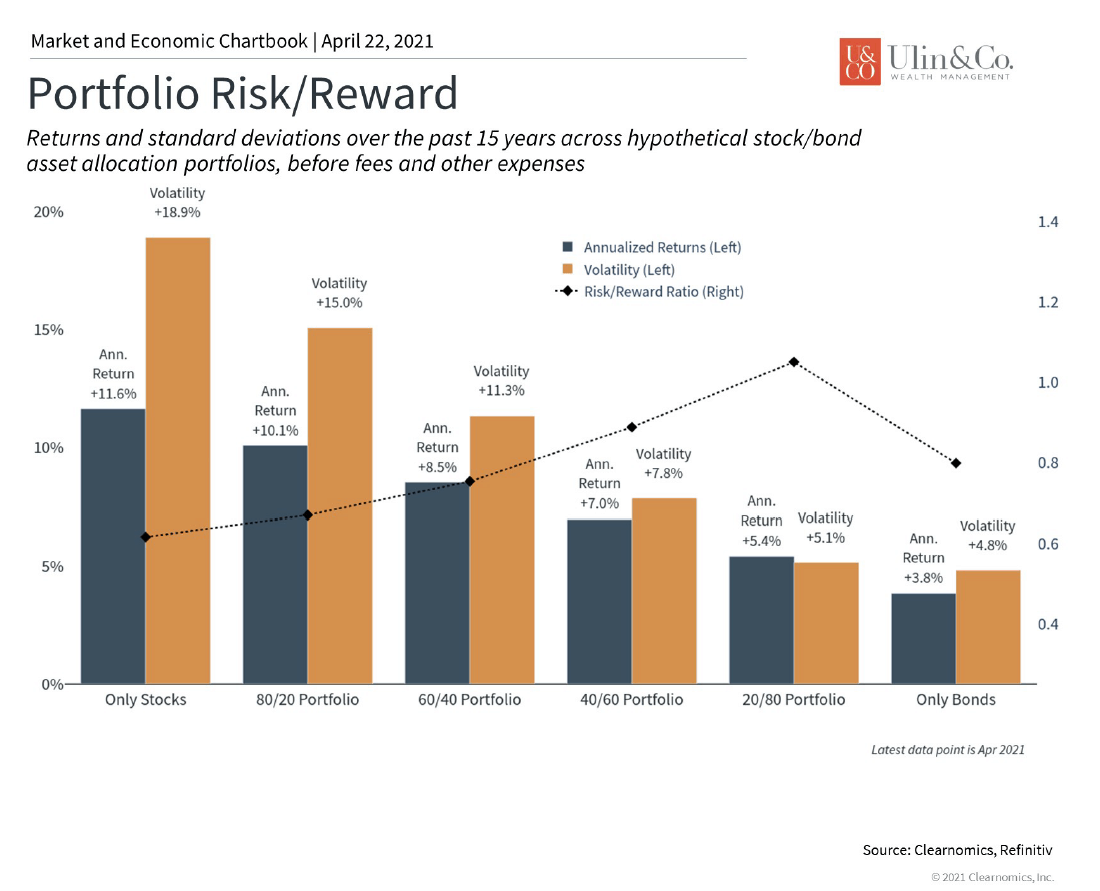

4 The risk and reward metrics of various asset allocation mixes – and all bond or all stock portfolios over time puts this all into perspective.

This is the most theoretical chart. Over the past 15 years, the risk/reward on 60/40 has been very attractive, especially given the absolute level of return it can achieve.

The bottom line? The economic recovery coming out of the COVID19 shutdown is strong, but this has pushed the stock market toward historic valuation levels while elevating interest rates and lowering bond values as the Fed continues its ‘zero rate’ policy goal. Investors should stay invested and remain disciplined as the cycle evolves. Whether the ominous market forecasts will evolve remain to be seen.

The 60/40 portfolio, or other variations of it depending on your risk level, do not appear to be “dead” by any measures while providing a time-tested approach and process to investing that is turnkey enough to provide a smoother ride over time to help reach your financial independence.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.