Real Estate Slowdown Impacts

The repercussions of elevated inflation, ongoing Fed rate hikes and the evolving banking crisis are now being felt throughout the financial system like getting severe flu symptoms that are unpleasant, but not terminal. Perhaps the ominous reports of Home Depot cutting its profits outlook for the year is the canary in the coal mine on real estate, construction and the economic slowdown in general.

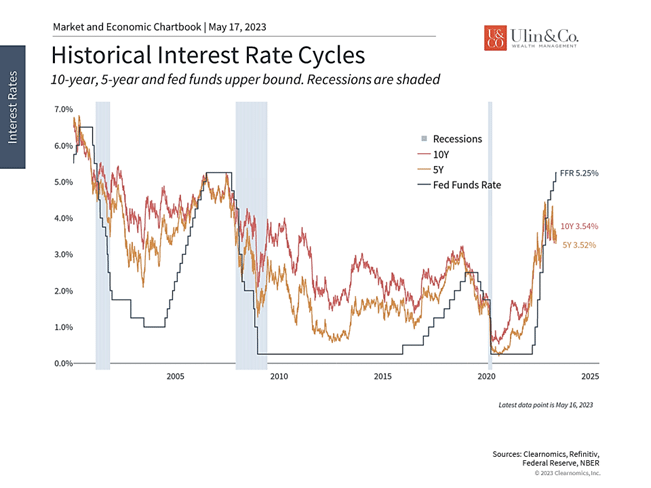

While the Fed hikes rates “until something breaks,” Fed Chair Jay Powell’s aggressive rate hike medicine is starting to cause issues beyond the recent bank failures. One area directly impacted by these financial shocks is real estate and lending across both the residential and commercial sectors. The quick jump over the past year with the Fed Funds rate to 5.25%, mortgage rates above 7%, and the Prime Rate to 8.25%, combined with banks tightening up on lending, is causing slowdowns and implications for businesses and consumers alike.

Brakes not Bubbles

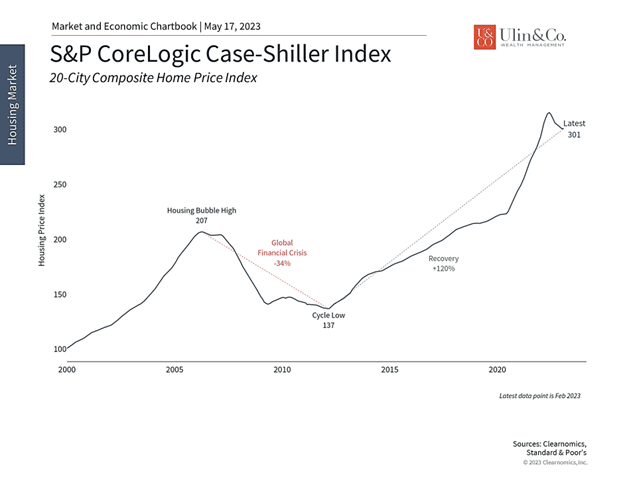

The most significant sector headline story and trends on google involve residential real estate prices and whether we are heading into a new housing bubble and eventual crash. Contrarian investors antennas are up with over 100 million search results on Google this week for “when is the housing market going to crash.” Let’s address the elephant in the room. Are we due for a repeat of the 2008 housing bubble? Most likely not.

The past few years post- pandemic real estate boom and housing price surges that are now slowing down are not a “house of cards” built on high-risk, adjustable rate, rubber-stamped NINJA loans with little cash down that led to a “flipping-frenzy,” magnified by derivatives in the financial markets as we witnessed leading up to the 2008 crash. Today’s elevated rates and tightening effects are more like tapping the brakes on real estate sales, lending and construction, than a bubble popping.

Residential Real Estate Slowdown

Many of the 72 million millennials are getting older and focused more now on home ownership, while simultaneously more of the 76 million baby boomers are winding down into retirement while downsizing their homes. As a result, home prices reached all new all-time highs by the end of last year that have eclipsed the mid-2000’s housing boom driven in part by a supply and demand imbalance along with previously low rates. All that has changed.

As noted this week by a Fortune Headline by Alicia Adamczyk, “Americans have had a sudden change of heart about buying a house, and only 1 in 5 think it’s a good idea.” High interest rates and soaring prices are killing Americans’ faith in the U.S. housing market. Just 21% of U.S. adults say now is a good time to buy a house, according to a new poll from Gallup. That’s the lowest homebuyer sentiment has ever been in data going back to 1978.

With residential real estate, many older buyers may be on the fence to downsize and list their primary residence if still holding a mortgage at a rate below 3-4% (along with today’s housing sticker-shock), and many younger, new buyers may be priced out of the market a bit with today’s 30-year mortgage rates hovering near 7.5% on now how much house they can realistically afford.

Commercial Real Estate Impacts

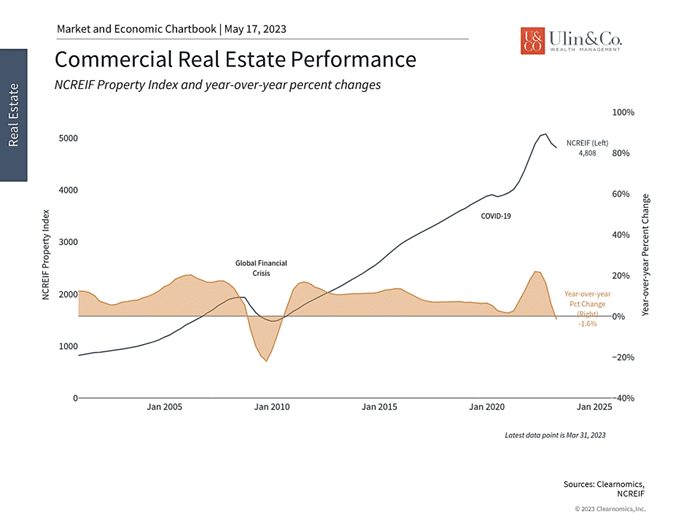

Commercial real estate (CRE) is feeling the aftershocks of the historic Fed rate hike program in a slightly different manner. CRE is highly dependent on regional and smaller banks, including those that have struggled or failed since early March. Some investors and economists are concerned about what this might mean for the broader economy in the months to come. In this article we’ll discuss how investors should view these changes along with potential effects to the stock market and economy

Commercial real estate is struggling

Commercial real estate is a broad asset class that includes many types of investments including office space, retail, industrial, and multifamily residential projects. Different factors impact each class of CRE including the pace of economic growth, industrial and manufacturing activity, retail spending, consumer confidence, and more.

Over the past few years, office vacancy rates have been a primary focus in the news due to the pandemic and the rise of hybrid work models. According to the National Association of Realtors, U.S. office vacancy rates rose from 9.4% prior to the pandemic to 12.5% at the end of 2022, and these rates are undoubtedly worse in many major cities. Overall CRE prices have declined 1.6% over the past year, driven primarily by office space. In contrast, hotel and industrial properties have risen over this period as demand has recovered.

Since CRE projects are often capital-intensive and have heavy financing needs, rising interest rates and instability in the banking sector hurt new projects and existing ones that require refinancing. Due to the size of the CRE loan market and importance of smaller regional banks for CRE credit, the two are tightly linked. Smaller banks are a critical source of credit for CRE capital expenditures and CRE loans are an important source of business for small banks.

According to the recently released Financial Stability Report by the Federal Reserve, smaller banks (those with $100 billion in assets or less) hold more than two-thirds of CRE loans by dollar value, totaling nearly $1.6 trillion. When midsize and regional banks are included, this proportion jumps to 87%. Similarly, the Fed’s latest Senior Loan Officer Opinion Survey suggests that both the demand and credit conditions for CRE and industrial loans have tightened. From a microeconomic perspective, these data show that the CRE industry may continue to face challenging times ahead, and projects will depend heavily on the ability to secure financing and on the quality of banking relationships.

These trends are a symptom of slower growth and higher rates, and not a cause. Thus, it’s not yet clear that these factors will have a large impact on the broader economy beyond what is already occurring. This is because most regional and smaller banks do appear to be healthy despite the ongoing banking crisis.

Housing prices have fallen from their recent peaks

Of course, the effect of rising rates has been affecting residential real estate for over a year as we chewed over above. The housing market had already experienced an unsustainable run-up during the pandemic as buyers sought more space. Thus, it’s no surprise that both residential housing activity and prices have decelerated as rates have risen and economic growth has stalled.

Specifically, the average rate on a 30-year fixed mortgage currently sits near 7% and is well above the average of 4.2% since 2008. Mortgage refinancing activity has plummeted ten-fold and many homeowners are reluctant to give up their locked-in rates. This has led to a sharp deceleration in the Case-Shiller index, a gauge of home prices across the country.

The housing market affects the economy and financial markets in important ways. As individuals, primary residences are usually the most important assets on household balance sheets, and monthly mortgage payments are the largest expenses. As diversified investors, the housing market can represent an income-generating asset class as well as a macro-economic indicator. Rising home prices can bolster financial confidence and spur consumer spending, and vice versa, a fact often referred to as a “wealth effect.”

Fed policy rates are far above market rates

Despite these historic challenges across commercial and residential real estate slowdown, few investors expect a repeat of the 2008 crisis driven by a bubble in residential housing and significant financial leverage. In this context, it’s important to maintain perspective around the current economic and market environment.

As the accompanying chart shows, the Fed has tightened conditions rapidly to combat inflation, and policy rates are now far above long-term market rates. Thus, it’s not surprising that this would create instability in some parts of the economy, especially in areas that are rate-sensitive such as real estate. After all, the Fed’s goal is to slow economic growth in order to rein in inflation. So, while there may be industry-specific concerns within real estate, and CRE in particular, long-term investors ought to maintain a broader view of the economy to position for the years ahead.

The bottom line? While there are challenges with real estate slowdown impacts to commercial and residential markets, investors ought to stay diversified and balanced in order to navigate this period of financial and economic instability.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us Below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.