Gimme Shelter: Protect Your Portfolio Through a Tariff Storm

Ooh, a storm is threatening, my very life today- Rolling Stones

Market turbulence is rattling investors as economic uncertainty, a tech sell-off, and tariff risks push stocks and major indices into a tailspin. Both the S&P 500 and Nasdaq slipped into correction territory, down more than 10%, with tech stocks steadily leading the downturn. The once-magnificent ‘Mag 7’ have lost their shine, and even Bitcoin wasn’t spared, tumbling nearly 25%. To paraphrase Mick Jagger, a storm may be threatening your portfolio today.

As the “everything rally” recently turned the corner, recession fears are rising. Prediction markets – where traders bet on economic outcomes have doubled the odds of a 2025 recession to 40% in the past month, according to Polymarket. Meanwhile, CNN’s Fear & Greed Index sits firmly in “fear” territory. Are these signals contrarian buying indicators and a repeat of the incorrect recession forecasts from 2022 and 2023 – or warning signs of deeper trouble?

Our short answer: the former. This drop seems like a healthy correction after two years of over-performance – partly fueled by nearly $12 trillion of government spending and stimulus – along with some of the top tech companies CapEx spending of over $200 billion per year on ai and infrastructure. With one of the worst starts to a year for U.S. stocks since President Obama was elected in 2008, it’s easy to feel like the sky is falling – especially in the era of 24/7 financial news and social media doomscrolling.

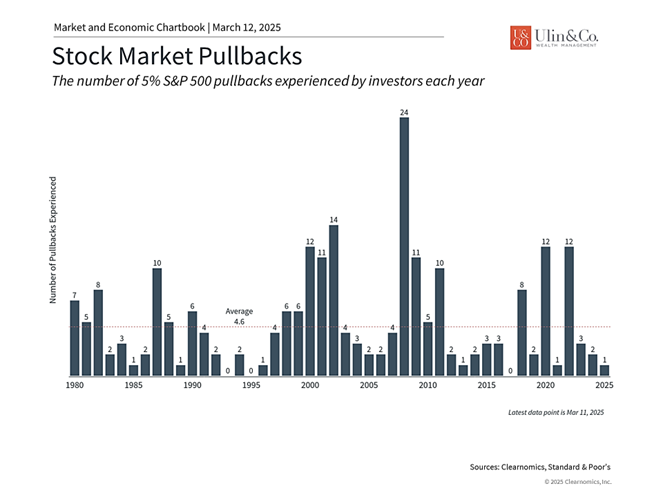

Of course, like a stopped clock that’s right twice a day, a recession will eventually occur. But timing downturns are notoriously difficult. Investing based on recession fears often leads to suboptimal decisions. we’ll chart out below, there has been, on average, a 14% pullback or correction every year since 1990. In essence almost every year there has been some sort of nefarious stock market implosion causing panic – right before the market continues on.

Jon here. For long-term, diversified investors, the best move is often no move at all. If market headlines have you jittery, consider a media detox – it might do more for your financial health than any short-term portfolio adjustment (or worse, panic-selling). While this year does not appear to have a doomsday recession in the cards, selectively adjusting your flight course allocations, checking key financial indicators, and strategically buying on dips could present real opportunities.

What’s Driving Investor Anxiety?

If I don’t get some shelter- Ooh yeah, ‘m gonna fade away-

Our outlook for 2025 isn’t all sunshine with this year leading potentially to a 2018 tariff-war Deja vu and even more market chop. Increased volatility could cap U.S. stock returns at only the mid-to-high single digits for this year, particularly if stagflation emerges as a side effect of potential trade-wars. This aligns with Fed Chair Jay Powell’s latest meeting comments, where he discussed the strength of the current economy while raising inflation and unemployment forecasts and also warning of weaker economic data – essentially describing stagflation without saying the word. In other words, don’t expect more than one or two rate cuts (if any) this year. Right now we may be in the eye of a storm.

At the heart of investor concerns is whether tariffs and inflation will weaken consumer spending – the backbone of the U.S. economy, accounting for nearly 70% of GDP. When confidence is high, consumers fuel corporate profits and growth. But when uncertainty creeps in, they pull back, sending ripple effects through both Wall Street and Main Street with consumers cutting back on both their stock exposure – and their spending. Beyond sentiment-driven swings and algorithmic quant trading, a more hawkish Fed and persistent inflation could weigh further on the economy.

The real wildcard? April 2nd – the looming tariff war deadline, when Trump plans to impose reciprocal tariffs on China, Canada, and Mexico. China tariffs will jump from 10% to 30%. Canada and Mexico will face a new 25% tariff (most goods are currently tariff-free under the USMCA.) Canada energy imports will remain at 10%. While this may be a Trump – negotiation tactic like flying a plane down on a temporary dive, it may or may not pull back up fast enough into a soft landing.

If history is any guide, 2025 could resemble the Trump 1.0 trade war, when U.S markets saw a -19.8% drop in 2018 and ended the year down -6.2%before the U.S. and China renegotiated trade terms pushed the market up quickly in 2019 (over 25%), fueled also by strong economic data.

Diversification is Providing Stabilization

It’s just a shot away

Diversification is your portfolio’s seatbelt – essential for weathering market turbulence. Spreading risk across asset classes, sectors, and regions reduces vulnerability to economic shocks. A balanced 60/40 portfolio may be up 1-2% year to date and holding up effectively through the storm – while the Nasdaq and S&P 500 were down nearly 10%, and stocks like Tesla and NVIDIA have plunged nearly 50% and 25%, respectively.

The recent volatility is a wake-up call- to check your 401(k) and or brokerage accounts through the recent market correction, assess your performance, and make adjustments if and when required. A hard rule of thumb: don’t have more than 5-10% of your portfolio in any single stock or illiquid alternative investment.

Tariff-Proof Your Portfolio

Mad bull lost your way

Geopolitical tensions and trade disputes can wreak havoc on certain investments. Tariff-proofing means diversifying into less trade-sensitive sectors like healthcare, utilities, gold and consumer staples, or adding international stocks and bonds up about 10% and 2% respectively year to date. Alternative assets, such as structured notes, can also help buffer against volatility risks by offering downside protection and enhanced yield opportunities more so than the traditional balanced portfolio.

Why Recession Concerns are Peaking

Historically, recessions occur when the business cycle enters its later stages or when external shocks—such as a pandemic or financial crisis—disrupt economic growth. While the current business cycle has shown signs of slowing, it has not yet contracted. Instead, a possible trade war presents an external shock to consumers, businesses, and global supply chains. Additionally, slower growth—or even two consecutive quarters of negative GDP—differs significantly from crises like 2008 or the 2020 pandemic shutdown.

Even if tariffs do not directly harm growth, they have created an environment of uncertainty. Trump’s swift, broad tariffs compared to his first term, are making any outcomes harder to predict. Only time will tell if tariffs reach levels not seen since the 1930s or if agreements with major trading partners will be reached through negotiation.

As we keep pointing out, it’s important to remember that tariffs are often a negotiating tool for broader policy objectives. In the past, market reactions to tariff announcements were more dramatic than their actual economic impact. In 2018, the market fell as tariffs were implemented, but earnings growth remained strong and GDP grew nearly 3% that year. While uncertainty is unsettling and has led to market swings, economic strength can help absorb policy shifts

The economy has grown steadily despite investor fears

Beyond tariffs, the economic data is causing concern, including hotter-than-expected inflation and mixed jobs numbers. For example, the Consumer Price Index reversed course recently and rose above 3.0% for the first time since last summer.

Adding to this uncertainty, federal government jobs fell by 10,000 in February according to the Bureau of Labor Statistics, and more are expected. While federal workers account for less than 2% of the workforce, there is concern of ripple effects on the private sector and job growth overall. Despite this, the economy still added a healthy number of jobs in the latest report.

The price sensitivity of the consumer and their outlook on the job market have also worsened. Consumers now expect inflation of 3.5% over the next five years, the highest level since 1995, according to a University of Michigan survey. This has translated into feelings of deep pessimism about their financial situation in the next 5 years.

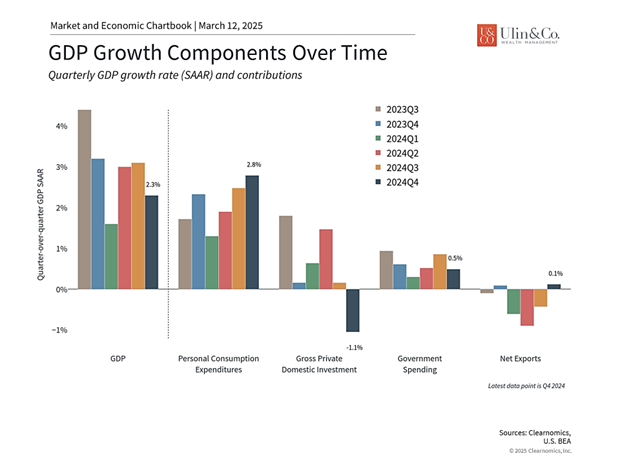

The irony is that markets have forgotten about the reasons for their post-election optimism: the possibility of pro-growth policies around manufacturing, energy, taxes, and regulation. As the chart above shows, consumer spending has driven the economy in recent years. Some economists hope that policy changes could boost business spending as well. An extension of the Tax Cuts and Jobs Act (TCJA) is currently being considered by Congress, and regulatory changes are in progress as well.

The S&P 500 experiences pullbacks on a regular basis

While the thought of a recession can be unpleasant, it’s important to remember that periods of slower economic growth are a natural part of the business cycle. Forecasts are not always correct, and even when they are, markets do not always behave in expected ways. While the past is no guarantee of the future, the market declines and subsequent sharp recoveries in 2020 and 2022 are recent examples of situations where markets can quickly change their tune.

Similarly, short-term market pullbacks are a natural part of investing. As the accompanying chart shows, the S&P 500 experiences pullbacks on a regular basis, even as it has risen in the long run. It’s important to maintain a broader perspective amid heightened economic concerns.

The bottom line? The possibility of a recession is back on investors’ minds but long-term investors should maintain a broader perspective. While tariffs have increased uncertainty and some economic data has been mixed, history shows that staying invested through challenging periods is the best way to achieve financial goals.

Final Thought: Protecting your portfolio isn’t about timing the market—it’s about time in the market with a strategy that can withstand the storm. Regularly review your asset allocation, rebalance when needed, and tune out the noise. Long-term success is built on discipline, not panic.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Note: This content is for informational purposes only and should not be construed as financial, legal, or tax advice. Please consult your financial advisor, attorney, or tax professional regarding your specific situation.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.