Presidential Elections 2024: Where to Invest & Market Impacts

The upcoming president elections 2024 cycle of Biden vs Trump will be unprecedented unlike anything before in U.S. history, and never more important to domestic and foreign policy, otherwise world order. There are many unique, unsettling issues about this race, even more so than it’s the first time two incumbents are running against each other.

Trump’s decision run again puts him among a small group of ex-presidents who have subsequently run for elective office which is as unique as the many lawsuits against an ex-President. Biden was already coined the oldest person in history ever inaugurated president at 78, and by the next inauguration day in January 2025, he’ll be 82.

Never has America had to choose between two candidates so old, and never in modern times has the choice been between two so strongly disliked candidates. If there is even a debate, greater focus will be placed on appearances and indications of cognitive decline tied to their advanced ages, than the actual policies discussed.

Both presidents have something in common with one unsuccessful policy/challenge that may contribute to a future economic black-swan event and pose a major long term fiscal problem for the country. Both the Trump and Biden administrations have presided over significant increases in the federal debt (now at $34 Trillion) through massive Covid-relief bills, infrastructure and military spending, debt relief and recently sending billions to other countries for foreign aid.

For example, Biden has directed more than $75 billion in assistance to Ukraine since the war began and the amount is about to double. This marks the first time that a European country has held the top spot since the Harry S. Truman administration directed vast sums into rebuilding the continent through the Marshall Plan after World War II.

Trump vs Biden: Where to Invest

The potential impact of a presidential election on the stock market sectors can be significant, as different policies and agendas pursued by each candidate may favor certain industries while adversely affecting others. Let’s explore the potential effects on various sectors if either Donald Trump were to be reelected or Joe Biden were to be elected president:

If Trump is Reelected:

Energy Sector: Trump has been supportive of the traditional energy sector, including oil and gas. His policies favor deregulation and expansion of fossil fuel production, which could benefit companies involved in oil exploration, drilling, and refining. This may help to lower inflation. Consider U.S. energy Sources: Petroleum (crude oil and natural gas): 28% Coal: 17.8% Renewable energy: 12.7% Nuclear electric power: 9.6%. (AGI Institute)

Financial Sector: Trump has pursued deregulation within the financial industry, which has generally been beneficial for banks and financial institutions. At the same time remember the past. Under President Clinton, deregulation in the financial industry was the primary cause of the 2008 financial crash Tax cuts implemented under Trump have also supported profits in the financial sector. Continuation of these policies could maintain a favorable environment for banks and other financial services firms.

Healthcare Sector: Trump has aimed to repeal and replace the Affordable Care Act (ACA), which could affect healthcare companies, especially insurers. Pharmaceutical companies might continue to benefit from a less restrictive regulatory environment under Trump’s administration. Biotechnology companies might also see positive effects from continued efforts to reduce regulations.

Defense and Aerospace Sector: Trump has emphasized military spending, which could benefit defense contractors and aerospace companies. Increased defense budgets could translate into higher revenues for companies involved in supplying military equipment and services.

Trade-sensitive Sectors: Trump’s policies on trade have been characterized by protectionism and tariffs, which could impact industries reliant on international trade. Sectors such as manufacturing and agriculture might continue to face uncertainty due to trade tensions with China and other countries.

If Biden is Elected:

Renewable Energy Sector: Biden has proposed significant investments in renewable energy infrastructure and initiatives to combat climate change. Companies involved in solar, wind, and other renewable energy sources could benefit from increased government support and incentives. Traditional energy companies may face challenges under policies aimed at transitioning to cleaner energy sources.

Healthcare Sector: Biden’s healthcare agenda includes expanding the ACA and implementing a public option, which could benefit healthcare providers and insurers. Pharmaceutical companies might face pressure to lower drug prices under a Biden administration. Biotechnology companies may see increased regulation, which could impact their operations.

Technology Sector: Biden’s approach to the technology sector is likely to focus on regulation and antitrust measures.

Big Tech companies could face increased scrutiny and potential antitrust actions under a Biden presidency.

Infrastructure Sector: Biden has proposed a substantial infrastructure plan, which could benefit companies involved in construction, engineering, and materials. Investments in transportation, clean energy, and broadband infrastructure could create opportunities for related industries. Yet not much has progressed.

International Trade-sensitive Sectors: Biden’s approach to trade policy is expected to be more multilateral and less confrontational compared to Trump’s. Industries reliant on global supply chains and international trade could see reduced uncertainty under a Biden presidency.

How Presidential Elections Affect the Stock Market and Economy

Although a lot can happen between now and November, it’s natural for some investors to be concerned about the impact of politics on the stock market and economy. After all, the political climate has never felt more polarized not just due to elections, but also disagreements in Washington around the budget, immigration, foreign policy, and more. Consider the following factors.

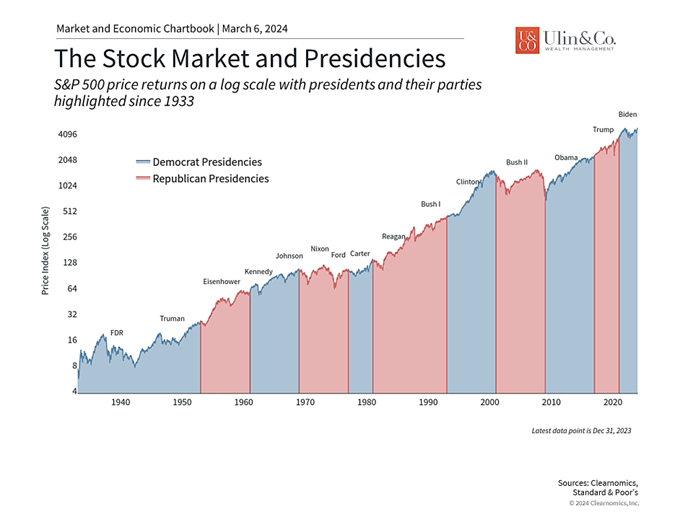

The stock market has performed well under both parties

As citizens, taxpayers and voters, elections are extremely important regardless of which side of the aisle you’re on and which candidate you support. Your vote helps to determine the principles that will be upheld by the country in the years to come.

However, when it comes to our investments, it’s important to vote at the ballot box and not with our hard-earned savings. When it comes down to it, long-term investors should be wary of claims that one candidate or another will “kill the market” or “ruin the economy.” It’s likely that this has been said about every president in modern times across 15 presidencies since 1933 (7 republicans and 8 democrats), and was certainly said about Obama, Trump, and Biden. Thus, it’s important to separate personal and political feelings from financial plans and investments.

The accompanying chart highlights the broad fact that the economy and stock market have performed well across both parties. Focusing too much on who was in the White House would have resulted in poor investment decisions over history, regardless of how strongly one felt. For example, from 2008 through 2020 across the Obama and Trump administrations, the S&P 500 generated a total return of 236%. This occurred despite the vast perceived differences between the parties and the increasing polarization of Washington politics. This also occurred despite many budget battles, fiscal cliffs, debt ceiling crises, U.S. credit rating downgrades, etc., not to mention the global financial crisis, the pandemic, and more.

Of course, this is not to say that good policy doesn’t matter. Policies on taxes, trade, industrial activity, antitrust, and more can have important impacts on specific industries which can then affect the broader economy. However, not only do policy changes tend to be incremental, but also history shows that it is very difficult to predict how any particular policy might affect the economy and markets, despite conventional wisdom about each party. Stock prices account for new policies quickly and companies and industries tend to adjust and adapt.

The business cycle matters much more than who is in the White House

This is why for most long-term investors, it makes more sense to focus on fundamentals such as those related to the business cycle, rather than day-to-day election coverage. On a short-term basis, election headlines have the power to move markets and create stock market volatility. However, these moves are eclipsed by the long-term gains created by market and business cycles. These cycles are influenced by many factors, from technological revolutions to globalization, and not just who is sitting in the Oval Office. The reason the returns since 2008 have been historically strong, with the market now back at all-time highs, is less about Obama, Trump, or Biden, than the underlying economic trends.

This is perhaps best illustrated by the 1990s and early 2000s. Bill Clinton’s two terms were perfectly timed with the information technology boom while the ensuing dot-com bust coincided with the start of the George W. Bush presidency. Unfortunately, the 2008 financial crisis also occurred at the tail end of George W. Bush’s second term, resulting in his presidency encompassing both market crashes. Despite this, it would be a stretch to argue that their presidencies were the reason for these booms and busts. While policies influenced these events, they had much more to do with technological and financial innovations. These and other historical episodes suggest that presidents often receive too much blame and credit for economic conditions.

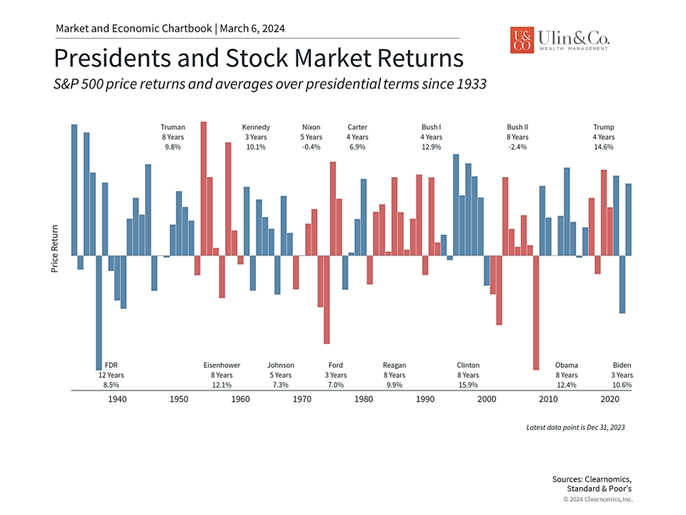

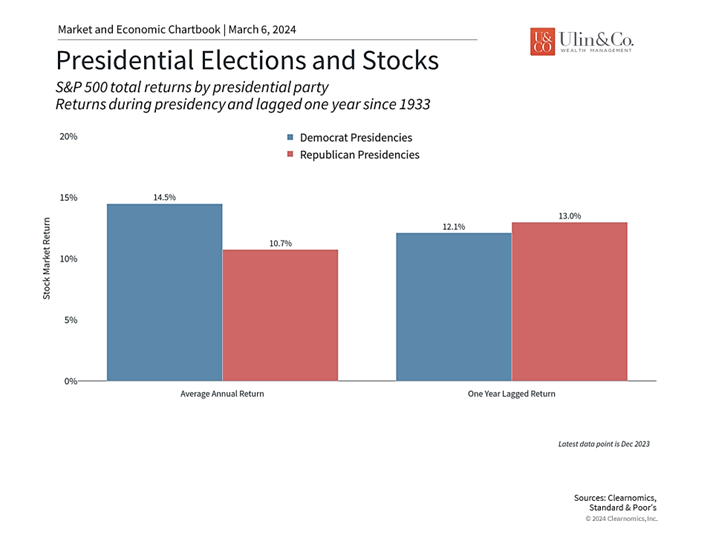

Stock market returns are positive on average across both parties

For those who are unconvinced that they should avoid day-to-day political headlines when it comes to investing, the final point is that average stock market returns have historically been positive under both parties. To underscore this point: it is not the case that markets always crash under one political party.

The accompanying chart shows that no matter how you slice it, the S&P 500 has averaged double-digit gains whether democrats or republicans are in the White House. Additionally, history tells us that market returns are positive on average during election and non-election years alike. While the past is no guarantee of the future, and returns in any individual year are unpredictable, jumping out of the market due to the outcome of an election, or simply because an election is occurring, is not a decision supported by history.

The bottom line? The best course of action for long-term investors is to stay balanced and not make investment decisions based on political preferences.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.