Mind the Gap of Financial Headline News

“Mind the gap” is a worldwide audible warning phrase issued to rail passengers to take caution while crossing the horizontal gap between the train door and the station platform ultimately to avoid a potential disaster.

It can be acutely more challenging to avoid falling into typical investing pitfalls than boarding a train as there are no guardrails or warning signals to help investors minimize making significant financial mistakes.

With today’s over proliferation of information 24/7 and many unjustified audible warning calls by the financial news “experts,’ it takes a bit of effort to maintain a calm, unemotional approach to investing for the long run and not jump off a fast moving train.

Yer bum’s oot the windae!” Scottish Translation: You’re talking nonsense! Well, not exactly. The fundamental facts presented on most financial news shows are pertinent. Still, remember to take opinions and forecasts with a grain of salt as no one has a working crystal ball.

Excitement and sizzle sell ratings for the financial news shows in as much as any other topic. It’s amazing to flip through the channels while watching the financial pundits excitedly argue whether interest rates will trend up or down, how Trump may affect the markets and reports on each 100-point move of the Dow Jones (DJIA) index like they are reporting on an NFL playoff game.

When peeling back the onion of financial headlines and news, consider that volume does not equal quality. Do not assume that there is an impartial world of news on investing to draw upon. Like working on a fitness routine at the gym, by consuming an abundance of financial news & information every day, you may, overtime build up some resilience to discern relevant news and information from a sea of useless or even caustic data and reporting.

Headline Winner of the Year

It’s no secret that U.S.-China trade talks (Trump’s Trade Wars) have dominated market headlines in 2019. Escalating tariffs on both side of the Pacific and the possibility of an extended trade war have led to swings in the stock market all year long. Investors focused on these day-to-day headlines might be led to believe that the stock market is either going to crash or will continue to be stuck in neutral until these issues are resolved.

Nothing could be further from the truth. Not only have major U.S. indices reached new record highs this year, but international markets have rebounded as well. While there are real risks if the world’s two largest economies can’t reach a trade agreement, the reality is that these headlines have only resulted in short-term volatility so far. This is especially the case when tariff deadlines are looming – many of which have already come and gone this year.

Another such deadline is December 15 when new tariffs are scheduled to be imposed – specifically, 15% tariffs on $160 billion of Chinese goods. This would impact a wider array of consumer goods and thus have a larger impact on U.S. consumer spending. However, both the White House and Chinese government officials have expressed optimism on reaching a deal and avoiding this round of tariffs, to which the stock market has reacted positively.

Regardless of what happens over the next few weeks, market strategists and economists will continue to argue over global growth forecasts in 2020 and the impact from trade.

But one thing is certain – investors who focus too much on day-to-day headlines and short-term market swings may lose sight of the bigger picture. Patient, long-term investors know that the stock market can pull back swiftly in a short period of time. The deepest of these was 7% for the U.S markets as benchmarked by the S&P 500 earlier this year.

Historically, on average the U.S. markets can fall over (-14%) in any given year. This is normal for markets regardless of whom is in the white house and whether there are worrisome headlines or not.

It’s still likely that a trade agreement is ultimately reached. Whether this takes a week or a year is unclear, and lingering issues around intellectual property and tariffs on specific goods will remain. The point is not that the market will rise indefinitely – it certainly won’t – it’s that predicting what markets will do, even when confronted with big global headlines, is difficult. The key for most investors is to stay disciplined in the face of these uncertainties.

Below are three charts that highlight the market’s reaction to trade headlines this year.

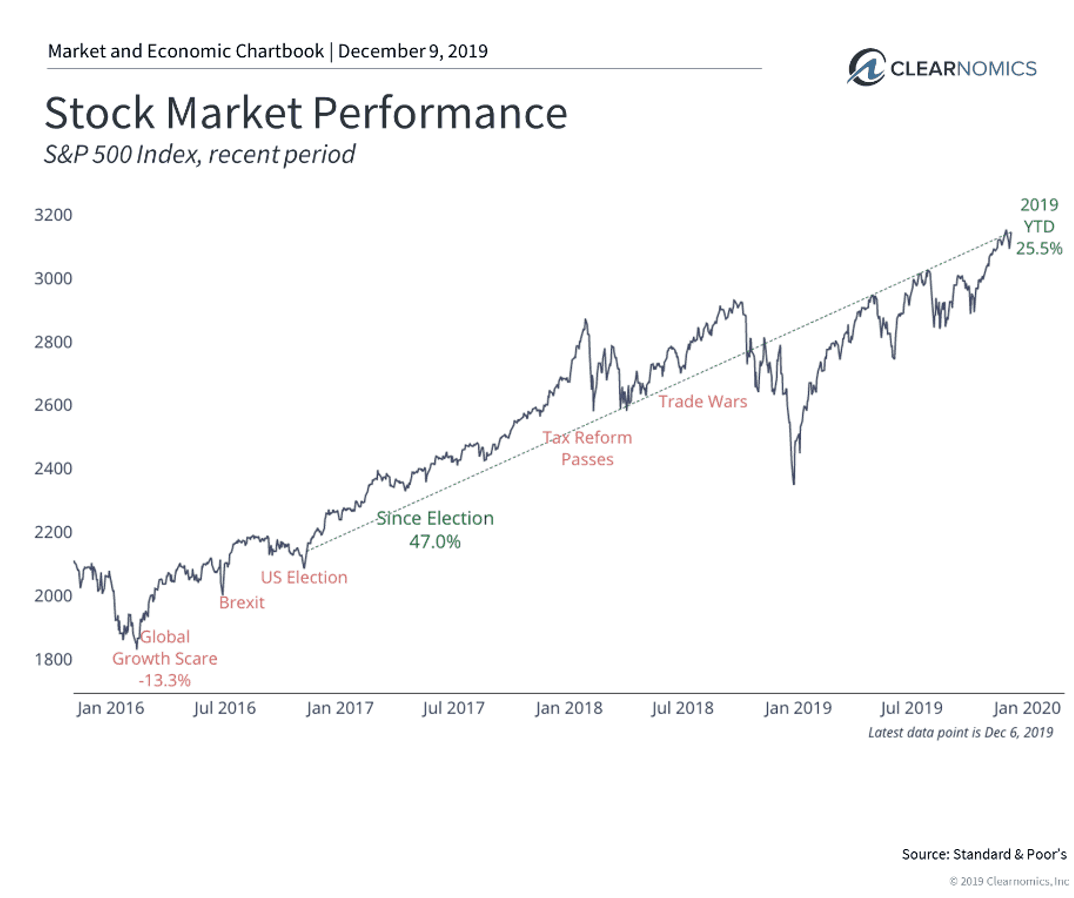

1. Despite large swings due to trade headlines, the stock market reached new record highs in 2019

The stock market has seen increased volatility over the past twelve months. Not only did the market nearly fall into bear market territory a year ago, but also faced large swings in May, July and October. Despite the negative headlines around trade, the stock market continued to make new highs and has risen 50% since Trump was elected President in 2016.

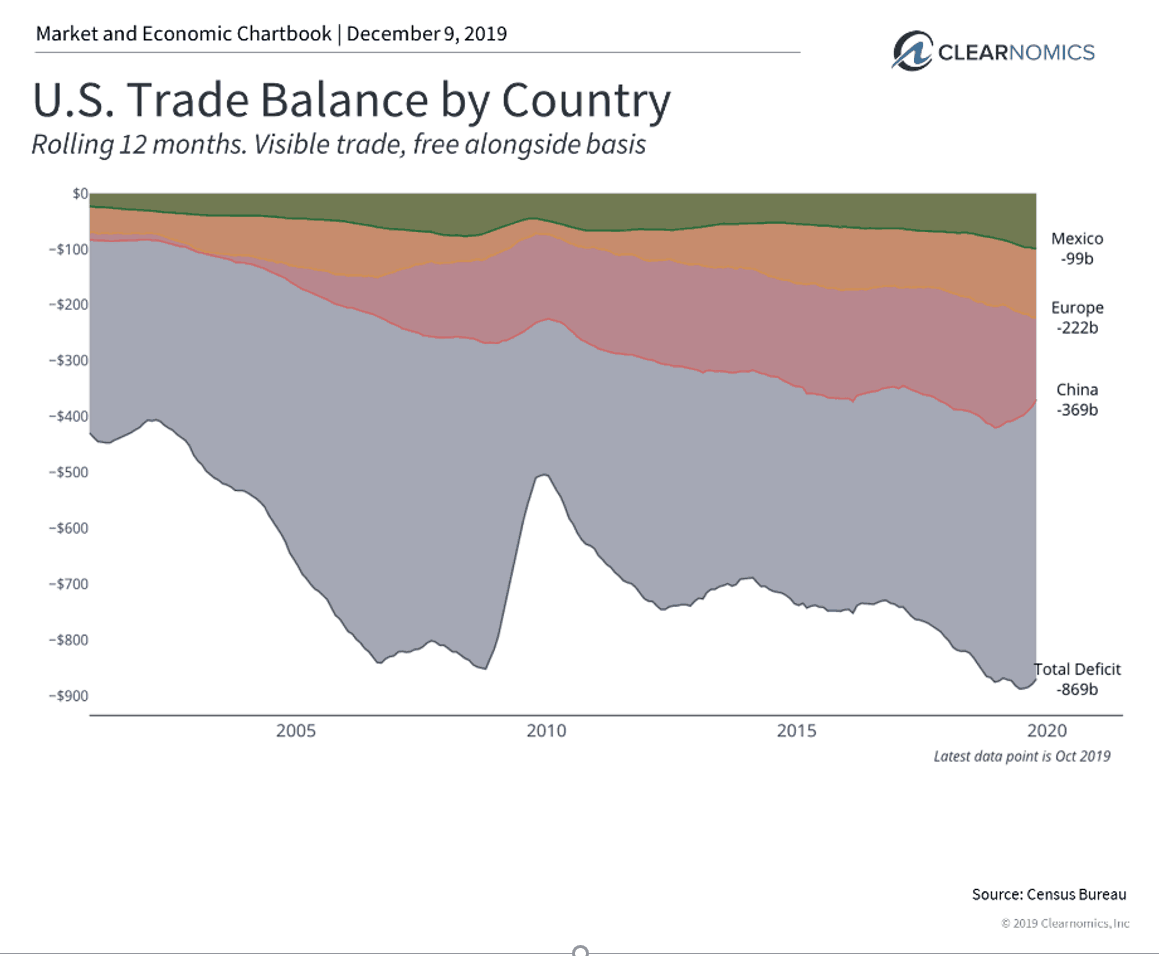

2. Trade will continue to be a focus for this administration

Regardless of whether a deal is reached with China before December 15 or sometime next year, this will continue to be a central issue for the administration. The White House has made is clear that they view international trade as a zero-sum game – i.e. a trade deficit means we are “losing.” With deficits only continuing to widen, trade re-negotiations will likely continue.

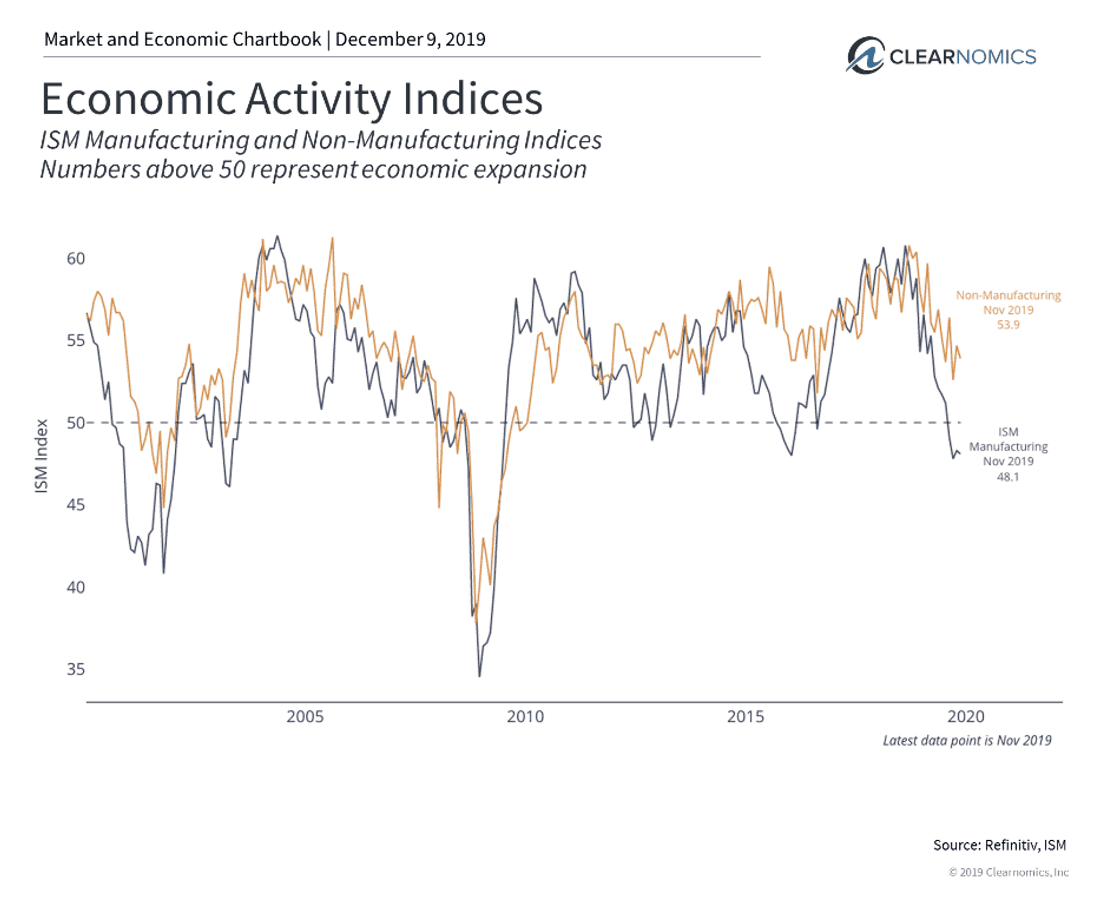

3. Manufacturing has been hurt by trade uncertainty, but other sectors are doing well

Economic uncertainty resulting from trade has harmed some parts of the economy more than others. Specifically, manufacturing has not only slowed but is now shrinking. In contrast, other parts of the economy including consumer-focused sectors are still doing well. If a truce can be reached, it’s possible for manufacturing to recover both in the U.S. and globally.

The bottom line? Trade headlines have been a fixture of market and economic news for nearly two years. Investors who can stay patient and disciplined should continue to focus on their long-term goals instead.

Our Advice? Digest less headline news if it is worrisome to you. Also, retain an experienced, accredited, fiduciary financial advisor to help you develop a disciplined investment plan and retirement strategy for the long run.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.