Keep Calm and Invest On – Year in Review

Investors are staying calm and not rattled that Trump just became the third U.S. President in history to be impeached.

Wall Street does not seem to care much about impeachment debacles and that is unlikely to change anytime soon unless there is a shift in widely held expectations that President Donald Trump will not remain in office.

So perhaps the most relevant concern for investors is whether the impeachment damages Trump’s prospects in 2020. Some analysts contend the impeachment is more likely to benefit Trump.

No matter what the election results will bring in 2020, managing and safeguarding your portfolio should be an ongoing habit and routine, like brushing your teeth. Don’t make any big money- moves this week based on predictions, tweets or chicken-little news reports.

If you are already in a diversified portfolio, now would be a good time to check and verify your strategy and process while recalibrating both strategically and tactically based on your own risk tolerance, goals and time horizon.

If you are not in any sort of specific strategy and are just “winging it” as a DIY (do it yourself) investor, or have a “buy, hold and hope” approach with big portion of stock in your 401K (such as company stock,) now would be a good time to retain an accredited financial advisor and to update your strategy and financial plan accordingly. (Click to learn how we may help!)

Markets (and humans) hate uncertainty. Trump exudes uncertainty and the media eats it up. Our number one advice to investors: Stay calm and invest on amidst the chaos and increased volatility as we are approaching the 11th anniversary of the most hated and misunderstood bull market in U.S. history.

Consider that most financial expert’s predictions do not come true. The stock market, like hurricanes, elections and fashion trends. can only be reliably predicted if you have a working crystal ball.

Year in Review

Stock markets are riding high as we approach the end of 2019. The S&P 500 has returned nearly 30% with dividends, the MSCI EAFE index of developed markets is up over 21%, and the MSCI Emerging Markets index has gained about 15% (see below). What’s more, the largest pullback in the S&P 500 this year was only -7%. There are three key reasons for this outsized performance, and one important takeaway for investors as we enter 2020.

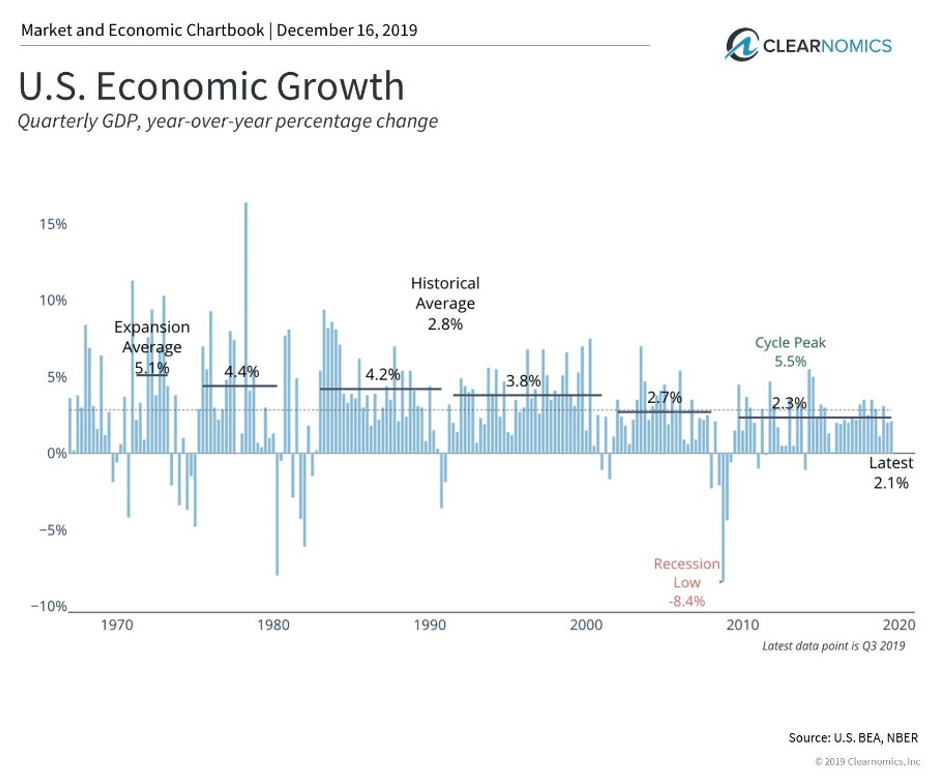

Perhaps the most important reason that major markets have experienced double-digit returns is that the economy is still growing at a healthy pace. Not only has the recession that many investors feared only a year ago not materialized, but very few economists now expect a recession in the near future. The unemployment rate has continued to fall to 50-year lows and consumer net worth is at record highs. And yet, with inflation at around 2% or less, there are no signs of the economy overheating just yet.

Not everything is rosy – corporate investment is lackluster which may hurt future productivity. Additionally, the manufacturing sector is effectively in recession with most indicators suggesting that output is shrinking. Of course, some of this effect is tied to the U.S.-China trade dispute which may improve over time. Still, these factors have not dissuaded many investors that the U.S. economy can experience real GDP growth of 2% per year.

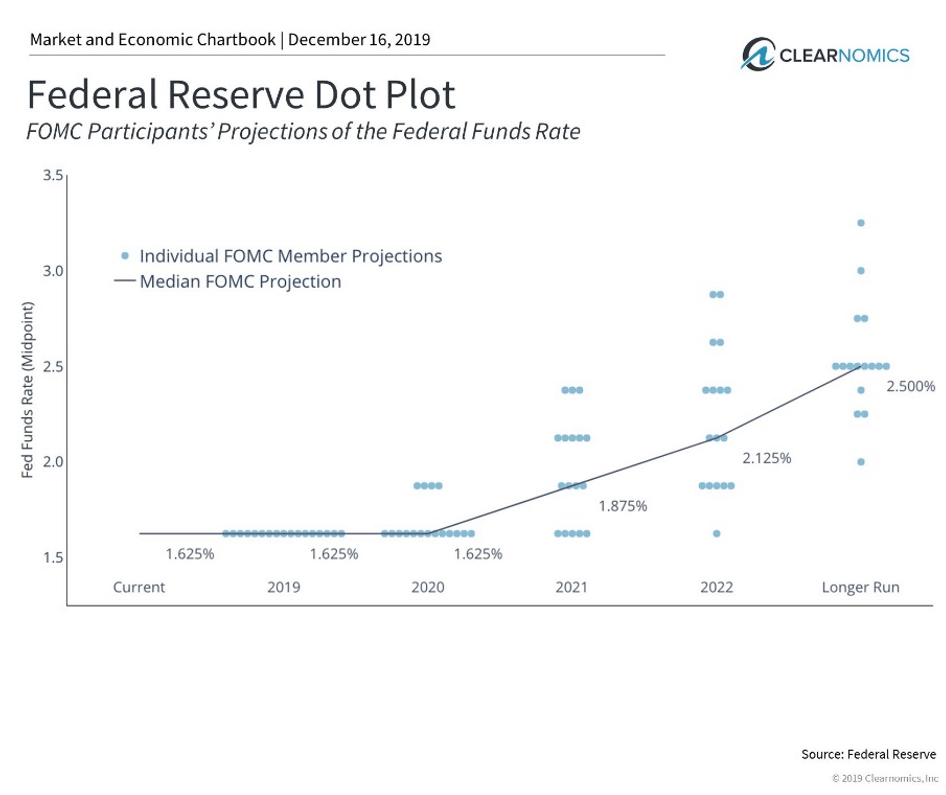

Another important reason for this year’s gains is that central banks are still pouring stimulus into the system. The Fed made a full U-turn from hiking rates last December to lowering rates in July. They’ve cut rates three times and are signaling that they are on pause for the foreseeable future. Their latest Statement of Economic Projections from last week show that they expect rates to be flat until 2021 at the earliest (the second chart below).

Finally, there is a technicality in the market return numbers. Since 2018 ended near the market lows during an almost 20% stock market pullback, a significant part of this year’s return was simply returning to previous levels. From last year’s market peak to today, the S&P 500 has gained only about +11% with dividends. While this is a terrific return, it’s not the number that will be advertised in headlines.

It’s clear that macro-economic drivers have played a large part in market returns in 2019. The most important takeaway for investors, however, is that these factors may be of less help in 2020. The global economy would have to accelerate, and the Fed would need lower interest rates further, in order to excite investors. So, while the stats this year are outstanding, investors should have healthy expectations for their portfolios going forward.

Below are three charts that highlight the factors that drove markets this year:

1. Global markets rose significantly in 2019

Global markets have all risen by double-digit percentages this year. There are several macro-economic reasons for this including healthy economic growth and stimulus by the Fed and other central banks. Additionally, measuring this year’s market return from last year’s market low, which happened to be right around the end of the year, has helped to inflate the numbers.

2. The Fed and other central banks increased stimulus measures

The Fed reversed course in 2019 and has been providing monetary stimulus. Their latest economic projections suggest that they expect the federal funds rate to be flat until 2021.

3. The economy is still growing at a healthy pace

Economic growth continues at a healthy pace despite some hiccups within the economy, such as in the manufacturing sector. Still, if the economy can continue to grow, this could support stock market returns even if they are not at the levels experienced in 2019.

The bottom line? Global market returns were outsized in 2019 for a variety of reasons. Going forward, investors should have healthy expectations yet remain disciplined and balanced in their portfolios.

Just remember In extreme market conditions, it’s not about the strength of the hurricane, it’s about the strength, allocation and downside performance of your portfolio tied into your own long term emotional resolve. Successful long-term investing is equal parts market strategy and investor psychology.

F

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.