It’s all in your Brain – As Economic Recovery Continues

Todays’ instant access to news and trading tools right from our mobile phones while listening to friends and “experts” online contemplating the elections, pandemic, economy and the markets, can magnify the “madness of the crowd” along with the voices in our heads.

In many cases, the answers to our follies can be found inside our own brains. Psychological errors and how we frame issues can inadvertently trick us to make quick decisions that may take us far away from our best choices and outcomes in any area of our lives.

Investors have even greater hurdles to overcome when presuming they can improve their performance and results overtime as they trade more often and consult themselves. Pipes and fittings do not compete against auto mechanics and plumbers to make a fatal mistake, but with investing there are many nuances that can cause you to derail your own savings and retirement from misinformation, personal biases, emotions, and overconfidence.

A good example of framing with overconfidence was provided in the WSJ article Mental Mistakes, where you should ask yourself these two questions:

- Are you an above-average driver?

- Are you an above-average juggler of three oranges?

Many of the people who were asked these questions placed themselves above average in driving but below average in juggling. People tend to place themselves above average when tasks are easy, such as driving.

Jon here. Investing is a “wee bit” more on the juggling side of ability and expertise, though many people place their investing ability more on the driving side. There are no direct links between your age, education, career or emotional IQ and your “investor IQ.”

Economic Recovery Despite Pandemic and Election Uncertainties

Despite uncertainty from the 2020 presidential elections and stock market turbulence from ongoing pandemic and quarantine headwinds, there are evident signs that the economy continues to recover. For investors, this is another reminder that focusing on long-term trends (reality) rather than day-to-day viral headlines can help to improve the odds of achieving one’s financial goals.

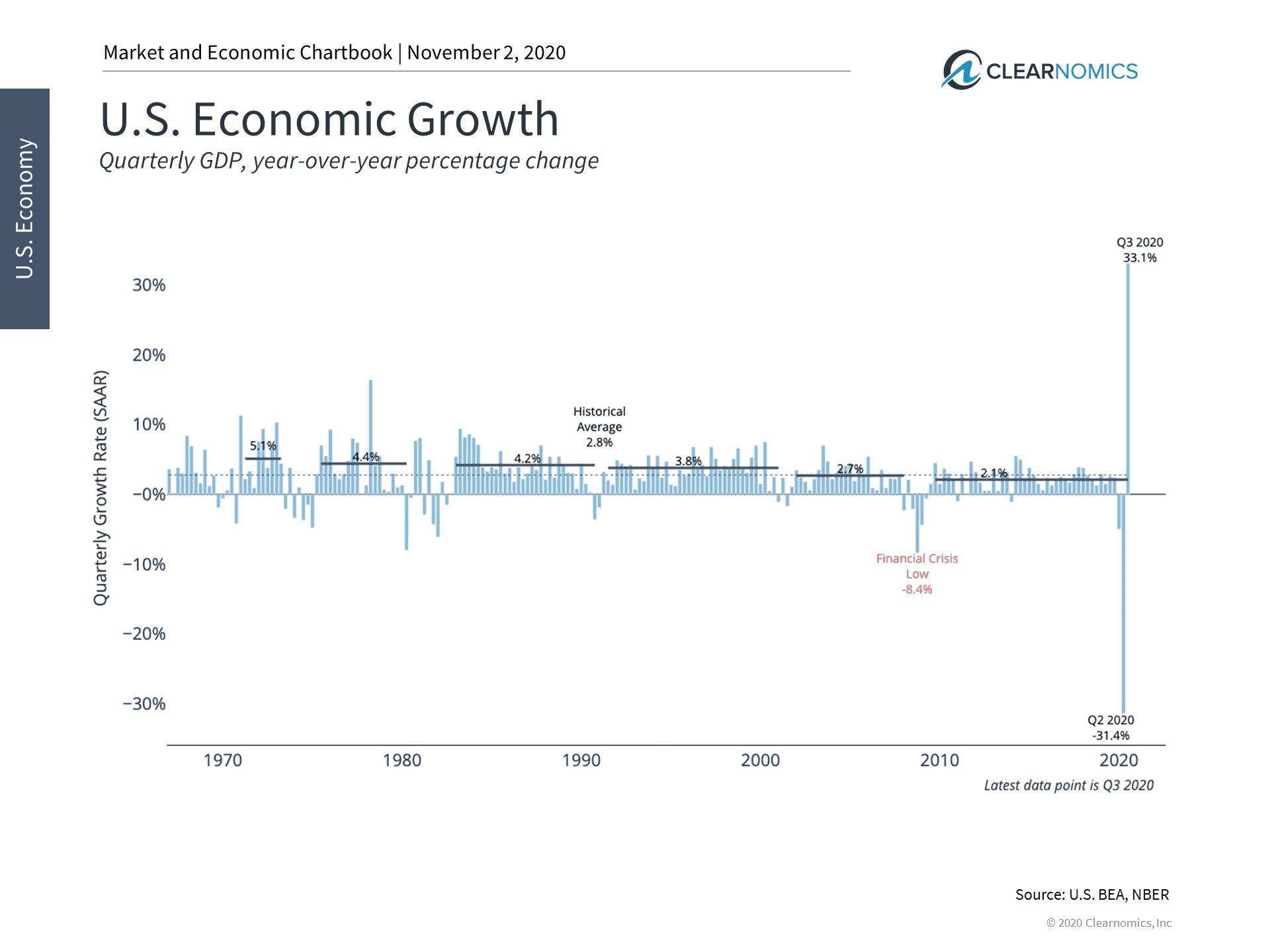

Specifically, the economy grew in the third quarter at a 33.1% annual rate, the fastest quarterly growth rate on record. (see below) This is after it fell by 5% in Q1 and 31.4% in Q2, prompting the National Bureau of Economic Research to declare that a recession began in February. Keep in mind that due to the way growth rates are calculated, the economy is still about 13% below where it started the year, let alone where it would be if growth had continued apace.

The strong Q3 growth rate reflects the fact that many parts of the economy have been able to endure and recover. This is because businesses not directly impacted by COVID-19 have been able to operate remotely or were able to reopen once nationwide lockdowns eased. Of course, this is not true across all industries with many people still unemployed. The second half of this recovery will be more challenging and may require balancing economic and public health objectives by the next presidential administration. Current forecasts among economists are for more moderate growth of 3 to 4% rolling through 2021.

Through the recent presidential election “race to the White House” there was significant blame and credit for the COVID-19 recession and subsequent recovery being passed around. While personal political views are important, the hallmark of a disciplined long-term investor is the ability to set these aside when managing finances. The reality is that it’s unlikely that the recession would have been avoided or the recovery would have been any less strong under either party.

In most cases, who controls the White House or Capitol Hill matters less than the forces that drive the economy and influence the stock market.

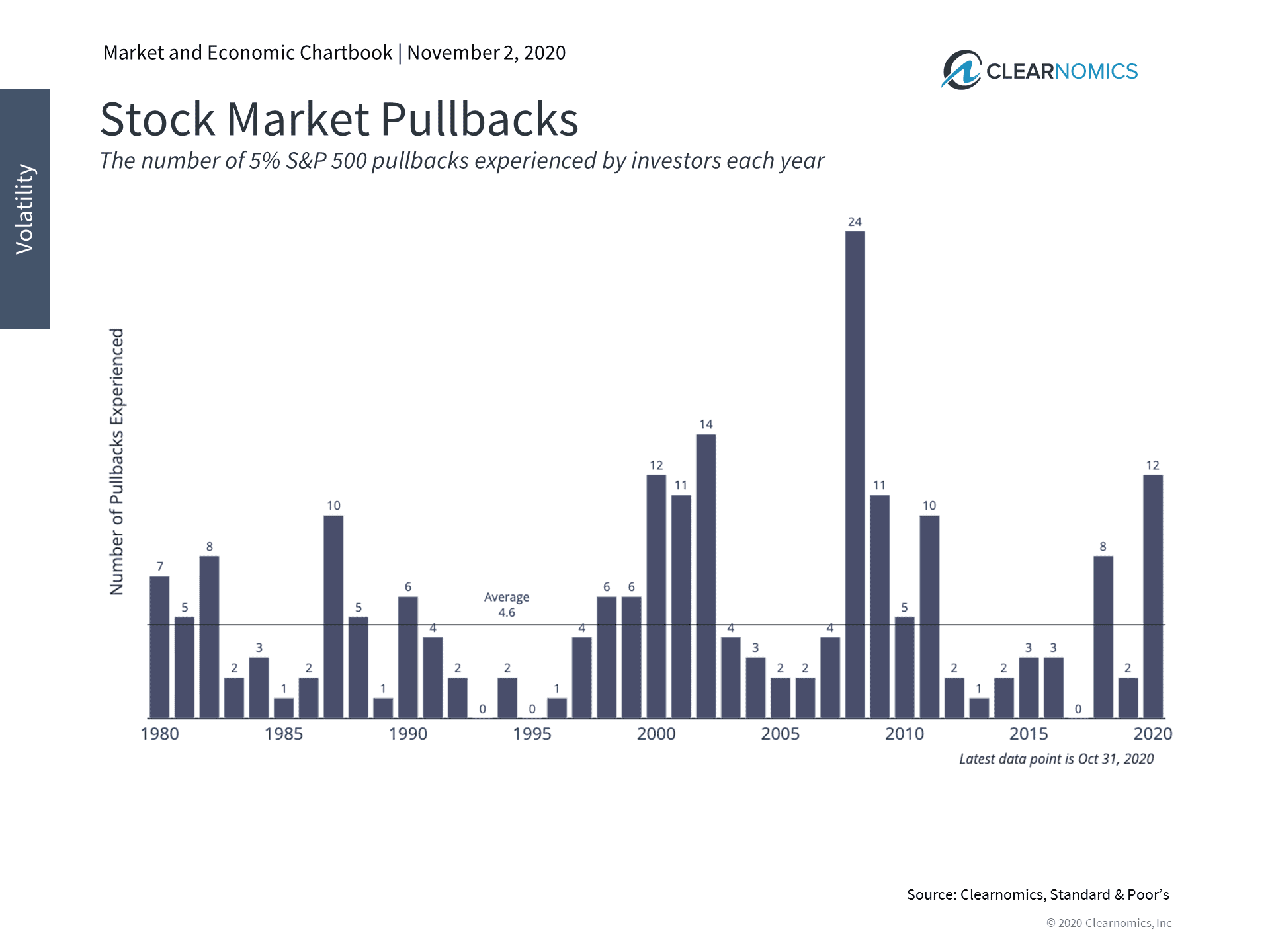

That has not stopped investors off all kinds from humans to the AI Quants to continue to panic sell at increased rates. So far, 2020 has seen more hypothetical 5% stock market declines than any year in history since 2008. (see below) For investors focused on the day-to-day, it’s felt like a rollercoaster ride, further magnified by incredible headline news reports.

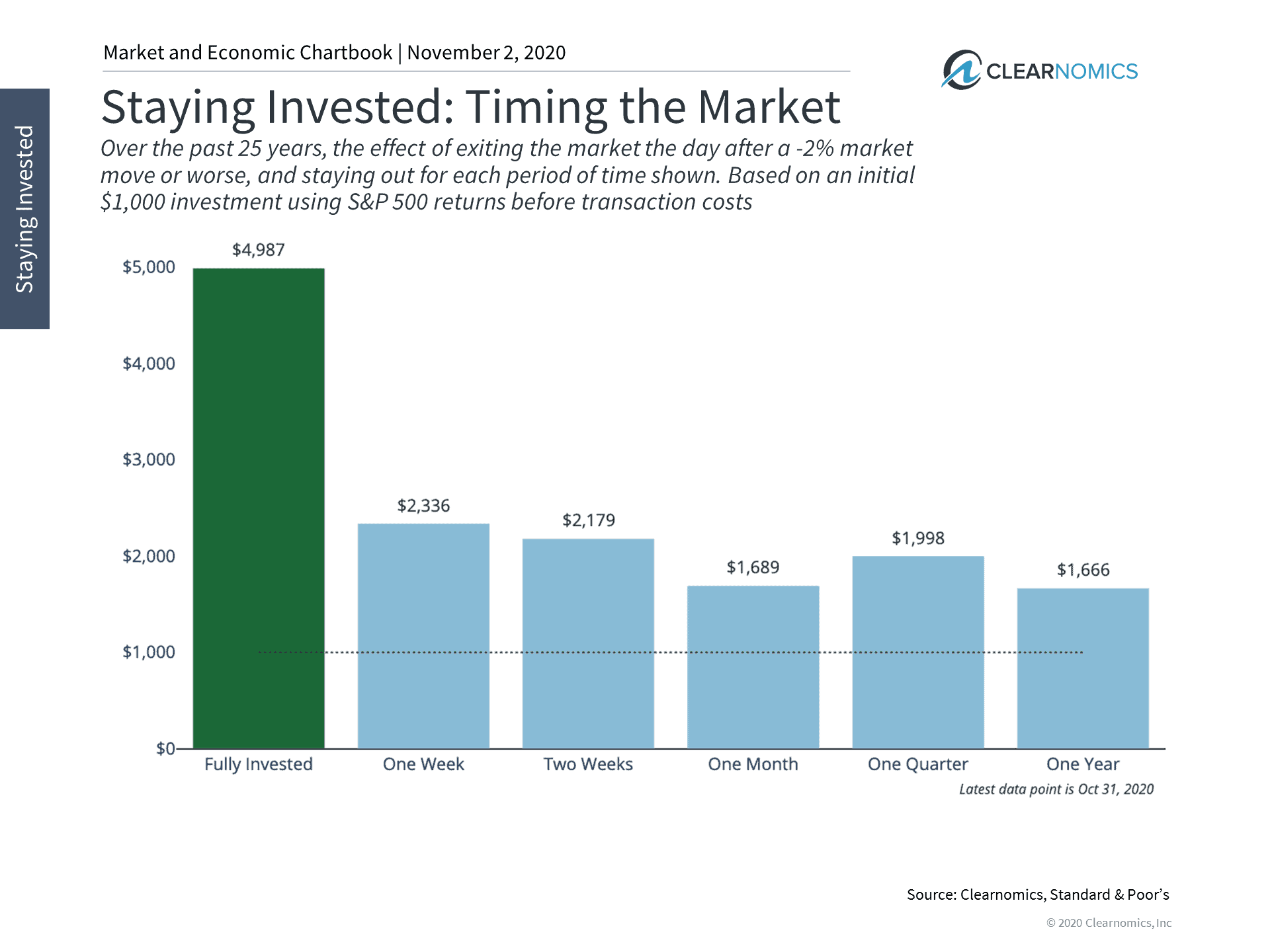

It’s times like these when it pays to be disciplined and seek level-headed advice. Trying to jump in and out of markets (with overconfidence bias) in your trading abilities or crystal-ball predictions often hurts more than it helps in the long run.

History shows us time and time again that focusing on the bigger picture is what improves the odds of achieving financial goals. Below are three charts that can help investors to stay focused in the days and weeks to come.

1 The economy came roaring back in Q3 but still has a way to go

GDP grew by +33.1% in the third quarter after declining by -31.4% in the second on an annualized basis. These are the best and the worst growth rates on record, respectively. These numbers reflect the economic recovery that has taken shape, especially in industries that have been able to weather the shutdown and even grow during the pandemic.

2 This is the most turbulent stock market since 2008

Despite positive economic trends, the stock market continues to be volatile due to uncertainties such as the presidential election. A hypothetical investor who checks their account statements too often would have experienced a DOZEN 5% market declines so far this year, the worst since 2008.

3 It pays to be disciplined and invested in uncertain times

Despite the rockiness of the market this year, history shows that it often pays to stay invested and focused on the long run. Overreacting to short term declines, even when they are 2% or worse in a single day, is often counterproductive. Markets tend to rebound when investors least expect it – exactly what has happened since March.

The bottom line? Investors ought to remain focused on the long run despite uncertainty around headlines news of the economic recovery. History shows that those who can stay invested through turbulent periods (elections, hurricanes, wars and other black swan events) often have a better chance of achieving their financial goals.

Working with an experienced wealth manager and planner can help you to better see the forest through the trees and help your brain (and money) to stay on course and in the game.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.