Investors Brace for Fed Tapering

The Fed has finally announced that it will begin tapering (reducing) its monthly asset purchases and begin raising short term rates in 2022 to help cool down rising inflation and a heated economy. Higher rates lead to higher borrowing costs and less consumer spending and demand for goods and services. While markets have been taking this in stride, some investors are understandably nervous about what this may mean for their portfolios.

Before you cash-out your nest-egg and buy a bigger mattress, consider that today’s situation is unique as the world economy boomerangs back from last year’s quarantine and shutdown. Prices are rising across the board because of global bottlenecks in nearly all industries combined with rising energy and oil prices purportedly driven by OPEC+ cartel members supply controls. Thus, when investors talk about “inflation” today, what they really mean is “supply chain disruptions.” Similarly, when investors debate whether higher inflation is “transitory” or not, they are really debating whether they are due to short- and medium-term supply difficulties or longer-term factors such as Fed policy.

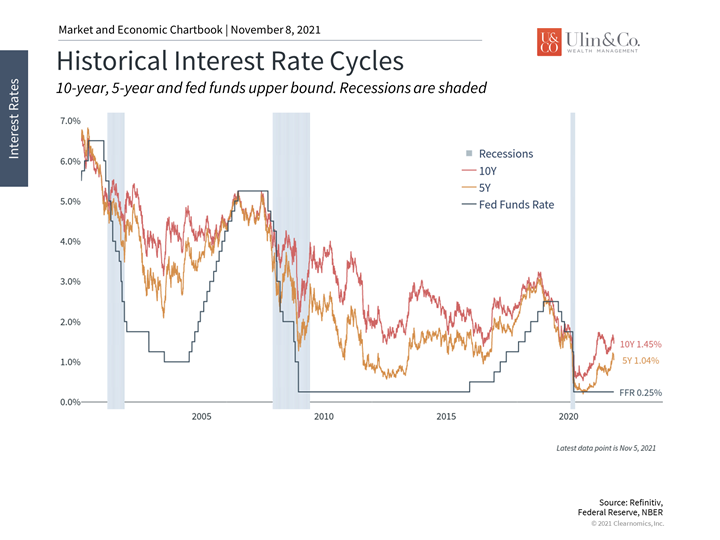

Jon here. It’s also important to keep the broader historical context in mind and that we most likely won’t return to the ultra high rates of the 70’s anytime soon. Inflation has been subdued until recently while interest rates have been declining since the late 1970s for a variety of reasons that have nothing to do with short-term crises. Technology, globalization, an aging population and other factors have conspired to push interest rates lower decade after decade. These effects pre-date the pandemic and even the 2008 financial crisis. The fact that the Fed responded to these emergencies with extraordinary monetary policy (QE), alongside other central banks, has only magnified their impact.

Hedging Portfolios for Inflation and Rising Rates

Tapering impacts interest rates even before the Fed raises short term rates. QE (quantitative- easing) policies lower interest rates, so when the purchasing program is reduced, interest rates will ultimately rise which may lead to a “taper tantrum” across bond prices as we experienced in 2013 (bond values decreased while interest rates ascended).

Even after inflation diminishes over time and supply side problems subside, there is no knowing if the prices of gas and raw materials to residential real estate (your house) will all rapidly reset down to pre-pandemic prices a few years from now when the supply shock issues subside.

Disciplined investors can hedge their portfolios against inflation and potentially rising interest rates to help to deter losses from some asset classes and sectors in the short term while positioning to help keep up with higher prices of goods and services over the long run.

We have deployed common “anti-inflation” asset classes in our client’s strategic diversified portfolios including both taxable and municipal TIPS, floating rate bonds and floating preferred stocks, as well as infrastructure, commodity, oil, energy and REIT tactics. Overall, we are utilizing shorter duration bonds while tilting a bit more to equities, as stocks help hedge against inflation over time.

Fed Policy Basics

Financial topics like Fed tapering, taper tantrum, rate hikes, the Phillips curve and others can seem complex, but it’s important to separate the how from the why. Mechanically, the Fed’s tapering process is simply the first step toward returning to a more “normal” monetary policy.

After all, inflation is rising not necessarily because Fed policy is too loose, but because of strong demand and supply disruptions. The Fed has made it clear that they have little control over these factors.

At the same time, it could still be considered a policy mistake for the Fed to keep financial conditions too easy for too long as inflation heats up, even if they can’t directly control the underlying causes. This is especially true at a time when consumers and markets are beginning to expect higher short- and medium-term inflation.

Thus, there are conflicting fears among investors around a) the Fed normalizing then tightening policy, and b) the Fed not tightening enough to combat inflation. Fortunately, the market has taken the shift in Fed policy in stride so far, and history supports this. After endless concerns and some market volatility in 2013, financial markets performed well the rest of the cycle. This occurred despite not only tapering but a shrinking Fed balance sheet and eventually several rate hikes. Ultimately, it was the strong underlying trends in the economy that mattered most.

Similarly, while there are concerns building within the market as the “everything rally” continues, it’s unlikely that reduced bond purchases or a few rate hikes will be what derail current trends. Instead, all market cycles have their ups and downs related to growth, profits, interest rates and valuations. Focusing on these factors instead can shed more light on the state of the market than focusing on the Fed alone.

In other words, investors should continue to hold balanced portfolios that match their financial goals, rather than focus too much on when the Fed will finally raise rates one-quarter of one percent. Below are three insights that can help investors better understand this shift in Fed policy.

- The Fed is slowing its bond purchases

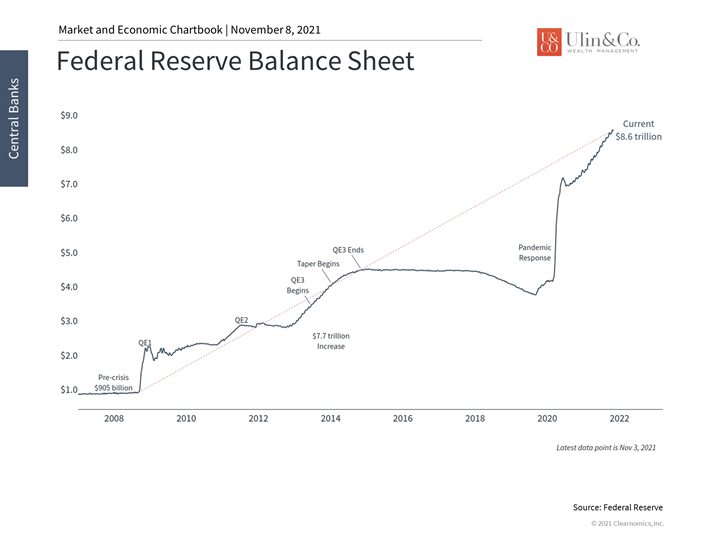

The Fed announced its “tapering” process which simply means that it will slow its bond purchases. Rather than purchasing $120 billion of Treasury and mortgage-backed securities per month, it will reduce this by $15 billion each month beginning in November. Even at this pace, the Fed’s balance sheet will grow to $9 trillion by the time it ends its asset purchases in mid-2022 – significantly larger than the pre-pandemic peak of $4.5 trillion. Shrinking its holdings may not happen until much later. After tapering began in 2014, the balance sheet did not begin to shrink until 2018.

- Interest rates are rising in anticipation of fed rate hikes

Short-term interest rates have been rising. This is because the tapering process is the first step in eventually raising the fed funds rate. The Fed has communicated via their Summary of Economic Projections that most officials expect to hike rates once by the end of 2022.

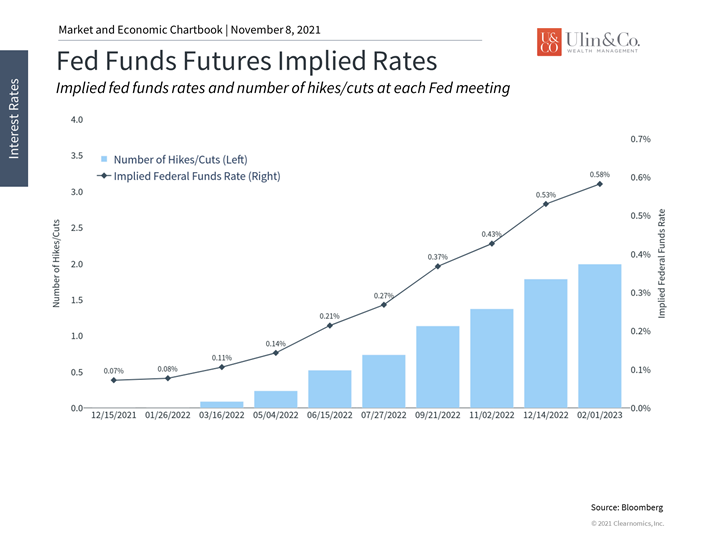

- The market expects the Fed to hike rates faster

Market-based expectations, on the other hand, have been adjusting upward. At the moment, fed funds futures suggest that there could be at least two rate hikes by the end of 2022. Over the past year, the Fed has adjusted its expectations toward the market, not the other way around.

The bottom line? With the Fed tapering its emergency asset purchases to help put the brakes on inflation, investors should focus on long-term trends rather than day-to-day Fed speculation. Inflation may be transitory and is surging because of strong demand and supply disruptions as the global economy boomerangs back from last years quarantine-driven shutdown.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.