3 Investor Opponents Through Corrections and Crashes

Over the past year, investors have navigated uncertainty from ominous economic headlines to stock and bond market turbulence due to interest rate swings, fluctuating inflation, the banking crisis, union worker strikes, a snowballing Federal debt, two ongoing wars, and more. And yet, through all of this, major market indices have thankfully held onto strong gains, reversing much of last year’s declines.

History Repeats and Rhymes

To paraphrase Mark Twain, history may repeat and rhyme. While some investors may have got a bit anxious over the stock market recently pulling back into correction territory, we remind them that nearly 14% drawdowns have occurred almost every year since 1980 and should not come as a shock. While every drawdown and trigger may be different, keeping your head above the headline news and staying invested through short term volatility is critical for long term investor success.

If you zoom-out over the long term, in 35 of the past 42 years, or 85% of the time, the S&P 500 index has sported a positive return even with these disrupting drawdowns. The odds of success are quite a bit better to make profits in the stock market over time than a table game in Vegas, hitting the state lottery or getting bit by a shark.

Investing in the stock market may feel like you are watching or participating in a sports event, except you can’t see the opponents on the field. As well stated in the book, Four Pillars of Investing, “trading stocks is like playing tennis against an invisible opponent; what the investor doesn’t realize is that he’s volleying with the Williams sisters.” If you are a do it yourself investor, be aware of your own abilities and limitations, or work with an accredited advisor. Warren Buffett famously advised along these lines to “know your circle of competence and stick within it.

Know Your Opponents

With easy access to information, research (Dr. Google) and trading platforms right from our mobile phones where we can upload cash and crypto like online sports betting, many retail investors may develop a false sense of confidence to be serving a tennis ball against experts with powerful (human/tech) resources that may be 50 steps ahead of their buys and sells with millions to billions at risk under their direction. Behind the wizard of oz curtain of wall street, the following few adversaries can help to accelerate market volatility and your heart rate.

1 Institutions: The entire number of actual, active investors, both institutional and retail, is hard to know. While retail investors’ share of total equities trading volume is near 20%, institutional investors account for more than 80% of the volume of trades on the New York Stock Exchange and can move markets. Institutional investors can be pension funds, mutual funds, money managers, banks, insurance companies, investment banks, commercial trusts, endowment funds, hedge funds and private equity investors.

2 Mr. Market: Mr. Market is an imaginary investor devised by Ben Graham in his 1949 book, “The Intelligent Investor.” Mr. Market is a hypothetical investor who is driven by fear and greed and approaches his investing as a reaction to his mood, rather than through fundamental (or technical) analysis.

The herd behavior of many individuals mimicking Mr. Market can at times also move the markets from the crowd’s erratic swings of pessimism and optimism. Not as much contrarian, but disciplined investors understand the benefits of buying during times of Mr. Markets pessimism and selling during periods of optimism. Easy to say, a bit harder to execute.

3 Quants: There are studies indicating algorithm-driven “quantitative investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers. These robots can pick up data from Elon Musk’s tweets to Fed Chair Powell’s comments instantly from a TV interview and take action before you finish your morning coffee.

What significantly drives markets and your money in the long run once you get your brain in the game are not day-to-day headlines, stock predictions, quants or even year-end targets. Instead, the vibrancy of the economy, the strength of the consumer, and the profitability of companies large and small are what support stock prices over the course of decades. Fortunately we are seeing this play out now as supply side bottlenecks are easing, inflation is cooling, interest rates as benchmarked by the 10 Year Treasury is falling and the Fed is signaling a potential end to it’s historic rate hike program. There are a few rate cuts projected for 2024.

Two Factors Investors Should give Thanks For

Through a chaotic year fueled by often wrong or conflicting headlines, investors should give thanks for the following two factors.

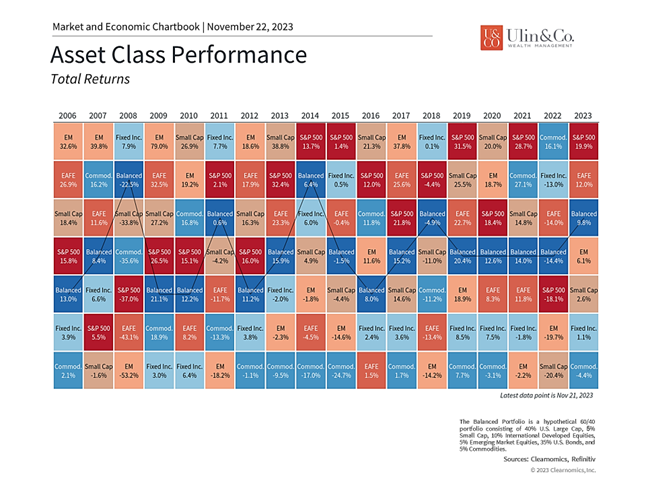

Many major asset classes have made strong gains this year

Financial markets and the economy have defied expectations in 2023. In many ways, the current environment represents the best-case scenario for which investors and economists could have hoped just a year ago. With only six weeks left in the year, the S&P 500 has returned 19.3% with dividends and the Dow 7.5%. International stocks have also performed well with developed markets gaining 11.5% year-to-date and emerging markets 4.8%. (see chart) Interest rates climbed throughout the year but have retreated in recent weeks. The 10-year U.S. Treasury yield, for instance, has declined from just above 5% to just under 4.5%. While a diversified bond portfolio has only returned about 1% this year, this is far better than last year’s historic bear market decline.

An important reason for these gains is the health of the economy. One year ago, economists expected a recession by the second half of the year due to Fed rate hikes and early signs of stalling growth. Not only did this not occur, but the job market is still one of the strongest in history with the national unemployment rate near 3.9%. GDP growth for the third quarter, a 4.9% annualized rate, was one of the fastest in recent decades. The strength of consumer spending, driven by excess savings during the pandemic, has helped to drive the demand side of the economy as the supply side recovers.

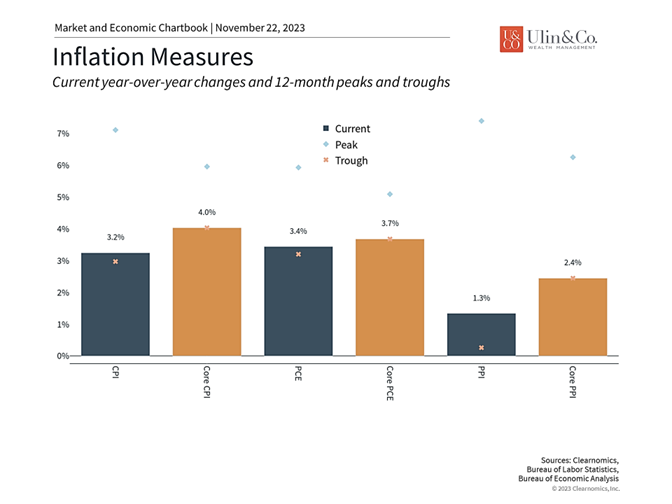

Another reason for these trends is the fact that inflation has improved significantly. Major inflation measures, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE), are now in the 3% range on a year-over-year basis, down from highs of 9.1% and 7.1%, respectively. (see chart) On a month-over-month basis, inflation improvements are even more striking with the CPI index flat from September to October. Other measures, such as the Producer Price Index (PPI) which measures inflation for businesses, have improved even more. Once again, these figures represent the rosiest scenario that economists could have predicted at the start of the year.

Inflation has improved significantly

Unfortunately, slowing inflation rates do not mean that prices will decline – only that they will rise at a slower pace. While this provides some relief, many households, especially those in or near retirement, may continue to find higher prices challenging. From an investment standpoint, however, both stocks and bonds have already benefited from greater price stability. The fact that the Fed may be near the end of its rate hike cycle as we discussed above, only adds to the tailwinds that have propelled markets this year.

For example, technology-related stocks have been particularly sensitive to inflation and interest rates due to the forward-looking nature of their products and businesses. While they have performed well over the past decade, they also led declines in 2022 when rates rose suddenly. Decelerating inflation and stable interest rates have helped this group drive markets higher this year. Sectors such as Information Technology, Communication Services, and Consumer Discretionary have led major indices. As inflation continues to improve, the hope among many investors is that other sectors will begin to benefit as well.

Staying invested is still the best way to achieve financial goals

One lesson that this past year underscores is the importance of sticking to a financial plan. While it’s tempting to wait for the next pullback to re-enter the market and get back on track, history shows that it’s often better to simply be invested. This is because markets tend to rise over long periods of time, making both higher highs and higher lows. As we discuss in most of our workshops and frequently in our newsletters, many times an investors worst opponent is themselves. Market timing is a fool’s game. Staying diversified according to your risk profile and time frame can help to weather the storm whether you are in or nearing retirement.

The bottom line? Investors do have much to be thankful for this year. This can be difficult to recognize since it often feels as if markets move from one crisis to another. With the benefit of perspective, it’s easy to see that the economy and financial markets have come a long way this year, hopefully setting the stage for investors to achieve their long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.