Three Investor Lessons –Back to School

Just a week out from the Labor Day weekend while getting back to the grind of work, school or college, we wanted to provide a few valuable “investor lessons” to help get your brain and portfolio on track for the rest of this most unusual year for Wall Street and the U.S. economy. As our firm has a rich history of providing financial literacy and education workshops and resources for Fortune 500 high tech corporate employees and executives, down to our own local municipality and client events, this is right up our proverbial wheelhouse.

Right on cue due to a combination of seasonality, tech stocks falling, rising unemployment and recession fears, the September Effect stock market pattern is in full gear. The month began with amplified stock market volatility with the S&P 500 and Nasdaq indexes shaving off 4% and 5% respectively in just the first week, one of the worst weeks in 18 months.

This past Wednesday’s inflation report led to a roller-coaster of fears on whether the Fed may be doing too little too late with a potential quarter point rate cut next week, or if larger rate cuts discussed may be the canary in a coal mine for a future recession. Stocks fell over much of Wednesday’s session with the DJIA index plunging nearly 743 points by noon, before ending with its biggest intraday comeback in two years up 2% off the 40,000 low.

The increased volatility when nothing material has changed except the labor market numbers and inflation cooling off down to 2.5% (CPI) from a 40 year high, goes to show that unease and uncertainty over headlines, inflation, interest rates and politics are driving both humans and the big Wall Street “quant/ AI” trading algorithms to be making unnecessary reactive trades helping fuel the madness of the crowd.

Utilize the Right Measuring Stick

Ominous headlines combined with sudden, broad market drops can make investors of all ages steer off course from their long-term goals by making short-term, sudden moves like cashing out due to panic. While it can be challenging for investors to determine their portfolio results while measuring different volatility and allocation targets, we continually run performance and X-Ray analysis reports for our ongoing client meeting reviews, like going to a doctor for a blood test and MRI. If you don’t measure your results with the right tool, it can be difficult to gauge how you are performing, or where you are going.

Make sure to utilize the right measuring tool based on your portfolio risk profile, not the S&P 500 and NASDAQ index levels that are being splashed across the financial news shows like an approaching CAT-5 Hurricane with up to 1000-point swings. For example, if you are in a moderate risk (60/40) portfolio, utilize a similar allocated moderate target benchmark for comparison basis for returns, volatility and other metrics.

History Rhymes but Does Not Always Repeat

Two years ago, the notorious “inverted yield curve” fueled by the historic Fed rate hike cycle on the short end of the curve panicked investors that a recession was approaching. Now Wall Street pessimists have a new concern: The yield curve is back to normal where longer-dated bond yields are above shorter-dated Treasuries as the bond markets are doing some of the heavy lifting for the fed with short term rates dropping in advance of next week’s potential cuts.

Traders are still placing the highest odds on the Fed slashing its target rate- now in a range of 5.25% to 5.5% – by a quarter-percentage-point this month, though some other banks are betting on a half-point move. By mid-2025, swaps markets are pricing in that it will be cut to about 3%, (over 8 quarter point cuts) roughly around the level that’s seen as neutral to economic growth. How should you invest moving forward? Will a proactive Fed approach to save the economy from a hard landing succeed? With only a 35% probability of a U.S. and global recession starting before end-2024 and a wee bit higher in 2025 as predicted by J.P. Morgan Research, it appears possible.

Three Investor Lessons

Investors should always be prepared for volatility, especially with possible market-moving events in the coming months. There is still uncertainty around the Fed’s full rate cut path, the upcoming presidential election between Trump and Harris, and ongoing geopolitical risks from two major wars. Consider the following three lessons to navigate through these events to keep a long-term perspective.

Stock and Bond Markets have rebounded over the past month

First, diversification is working and is not dead in the second year of the current bull market. With the Vanguard balanced moderate benchmark up nearly 11% year to date and 14% for the past on year rolling, diversification is definitely not dead and is rewarding disciplined, diversified investors.

Despite crazy market swings over the past couple months, the S&P 500, Nasdaq, and Dow have gained nearly 17%, 19%, and 9% this year, respectively. The S&P 500 has experienced only two periods of sustained pullbacks this year, with the largest decline measuring 8%, well below the historical drawdown average of 14%. Bonds have struggled much of this year as rates have remained high, but the anticipation of Fed rate cuts has helped to boost returns more recently. (see chart) So while market volatility is never pleasant, it is important not to overreact to short-term events.

The stabilization in the stock market has shifted investor focus back to fundamental factors, particularly corporate earnings. This is because the stock market tends to mirror the trajectory of corporate profits over time, which in turn rises alongside the economy. Current earnings projections are positive with an expected growth rate of 10% in 2024 and nearly 14% over the next twelve months. While this may sound a bit high, the numbers will evolve as we coast into December.

Jon here. You can see in one of my favorite stock vs bond charts below going back 35 years, stocks are up almost 85% of the time with a major crash occurring about every six years. Bonds, that typically outperform cash yields over time appear to be up over 90% of the time and do work as an insurance policy when crashes and recessions hit as you can see through the dotcom and Great Recession credit crisis, bonds did their jobs In helping conserve wealth for diversified investors.

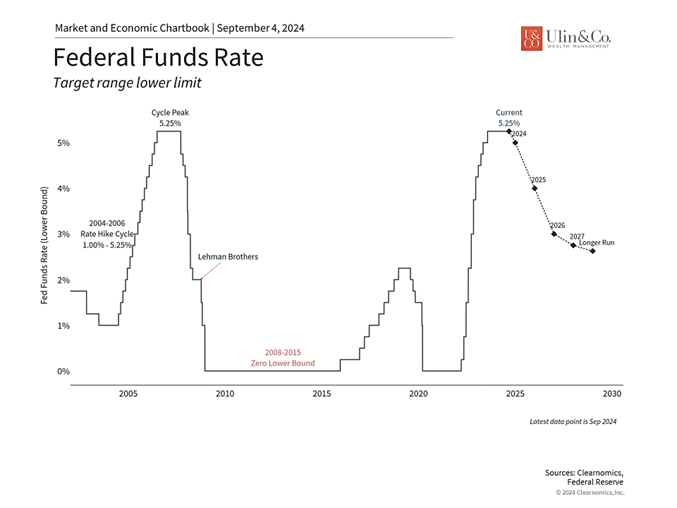

The Fed is expected to cut rates in September

Second, Markets get ahead of themselves. The Fed is expected to begin cutting rates later this month after a rapid rate hike cycle from early 2022 to mid-2023. (see chart) This is primarily because inflation has continued to improve. The Fed’s preferred inflation measure, the Personal Consumption Expenditures Price Index, has decelerated to 2.5% overall and 2.6% when excluding food and energy. Similarly, the headline Consumer Price Index has fallen to only 2.9% year-over-year with the core index declining to 3.2%. While prices are still much higher for consumers than prior to the pandemic, these improvements are enough for the Fed to justify a shift in monetary policy.

Much of the market volatility experienced this year is the result of changing expectations around the Fed. The year began with investors forecasting several rate cuts due to a possible “hard landing.” Then when inflation ran hotter than anticipated in the first quarter, investors believed there would be no rate cuts this year. Now, the Fed is expected to cut rates by about one percentage point through the end of the year. Each of these turns resulted in shifts in the market. This is yet another reminder that markets can get ahead of themselves, and that it’s often better to focus on the underlying trends.

In addition, recent jobs data show that the labor market is still strong but is also softening. The latest employment report, for instance, revealed that 114,000 new jobs were added in July, well short of the 175,000 projected. Unemployment rose from 4.1% to 4.3%, exceeding expectations and reaching a level not seen since the pandemic (though still not a historically high number). In a recent speech, Fed Chair Powell discussed the downside risks to the job market, saying “we do not seek or welcome further cooling in labor market conditions.” Whereas the Fed had been primarily focused on bringing down high inflation, it is now shifting its focus to the job market.

Interest rates are adjusting to a shift in Fed policy

Third, the markets are doing some of the Fed’s heavy lifting even before the cuts begin. With Fed rate cuts approaching, market-based interest rates have adjusted on their own. As the accompanying chart shows, not only have yields moved lower, especially on the short end of the curve, but the yield curve is no longer inverted. The spread between the 10-year and 2-year Treasury yields has flattened in recent days due to the expected trajectory of rates.

If these moves continue, they could have several potential implications for the economy and markets. One reason some investors expected a recession in 2024 was precisely because the yield curve experienced its sharpest inversion since the 1980s. Historically, yield curve inversions precede recessions since they typically occur later in the business cycle when the Fed has overtightened. While a recession is always possible, this time could be different since higher short-term yields were the result of inflation shocks.

While nothing is certain, lower rates could be positive for economic growth, especially in rate-sensitive areas such as real estate, technology, small caps, midcaps, industrials, financials, and more. As discussed earlier, bonds have benefited from improving rates as well, partially restoring their traditional role as portfolio diversifiers. Now could be a good time to consider moving some of your shorter duration bond holdings to longer duration bonds that could have greater potential upside over time as rates decrease.

The bottom line? How we react to stock market swings is perhaps more important than the market moves themselves. The uncertainty experienced by investors during the summer is a reminder to always stay focused on the long run as they work toward their financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.