Investing Through The Ides of March

“Beware the Ides of March,” a soothsayer told Julius Caesar in Shakespeare’s famous play of the same name. Whether you believe in superstitions or not, March of 2020 went down as a historic month on Wall Street and will be forever ingrained on our brains from historic COVID19-led market volatility to the shutdown of modern-day society.

Life (and market volatility) is what happens to us while we are busy making other plans. Whether we have an L, U, W or K shaped economic recovery matters less than asking yourself the following three questions to help determine if your financial and retirement plan is on track:

- What is your “risk budget” to attain your long-term goals?

- How much risk can your portfolio financially absorb?

- How much risk can you physically stomach?

The recent market crash and amazing rebound would be a good time to open your statements and preform a “sanity” and financial “performance” check of your volatility and progress while adjusting accordingly based on your age, goals and tolerance for risk. Investing should be an active, involved approach, not “set it and forget it.”

Soothsayers

Soothsayers were a class of ancient Roman minor priests that could read the guts of sacrificed animals to predict the future. The idea was the gods would reveal the future to their most sincere worshipers. Going back to our tale, the soothsayer was telling Caesar to avoid coming out to the Senate on March 15 (the Ides of March) or he will surely die. In the play, Julius Caesar ignores the soothsayer and calls him ”a dreamer”.

Jon here. The current bull market is still a “baby bull” in its infant stage. Now in its second year, many investors I have recently spoken to are already getting PTSD symptoms over frothy market headlines predicting the next market demise. While Caesar should have heeded the outlook provided to him, investing based on headline forecasts or friends opinions on social media can get you in hot water most of the time and end up derailing your long term goals.

When consulting the “top” soothsayer aggregator, “Dr. Google,” there are over 262 Million search results for “when will the stock market crash.” The next time you feel inclined to time the market, remember the maxim “He who lives by the crystal ball soon learns to eat ground glass,” by economist Fiedler.

A year ago, COVID-19 was named a global pandemic on March 11th. COVID-19 has been named for the last 12 months as the #1 investor “tail risk.” This month however, for the 1st time since Feb’20, it is no longer the largest risk. Inflation (37%) & taper tantrums (35%) are now seen (predicted!) as bigger risks. (BofA Global Research). When (not whether) the Fed decides to unwind its unlimited bond buying program (quantitative easing) and whether that may cause a “taper tantrum” like we experienced in 2013, will only be known after it happens.

Why Investors Shouldn’t Fear the Fed

As the economic recovery gathers steam and vaccine distribution accelerates, many investors are concerned about how the Fed may react. If inflation and long-term interest rates continue to rise, will the Fed keep policy (short term) rates at zero and allow the economy to overheat? Or will they be forced to finally raise short term (Fed Funds) interest rates and end the party sooner than expected?

In a way, history is repeating itself as worries about the Fed take center stage, just as they so often do during recoveries. The irony is that, during the mid-2010s after the global financial crisis, investors were worried about a Fed “liftoff” – i.e., the start of federal funds rate hikes. Today, investors are more concerned that the economy may overheat and spark runaway inflation if the Fed doesn’t raise rates. All of these concerns are taking shape even as the COVID-19 crisis continues, a factor that is well outside of the Fed’s control.

The role of the Fed has traditionally been mundane: to manage interest rates to keep the economy balanced. Their dual mandate to keep inflation low and employment high requires careful monitoring of economic conditions and adjustment of interest rates. Low interest rates can spur economic growth, which is why they are used in times of crisis, while high rates tend to slow the economy. This is a careful balancing act that is as much art as science.

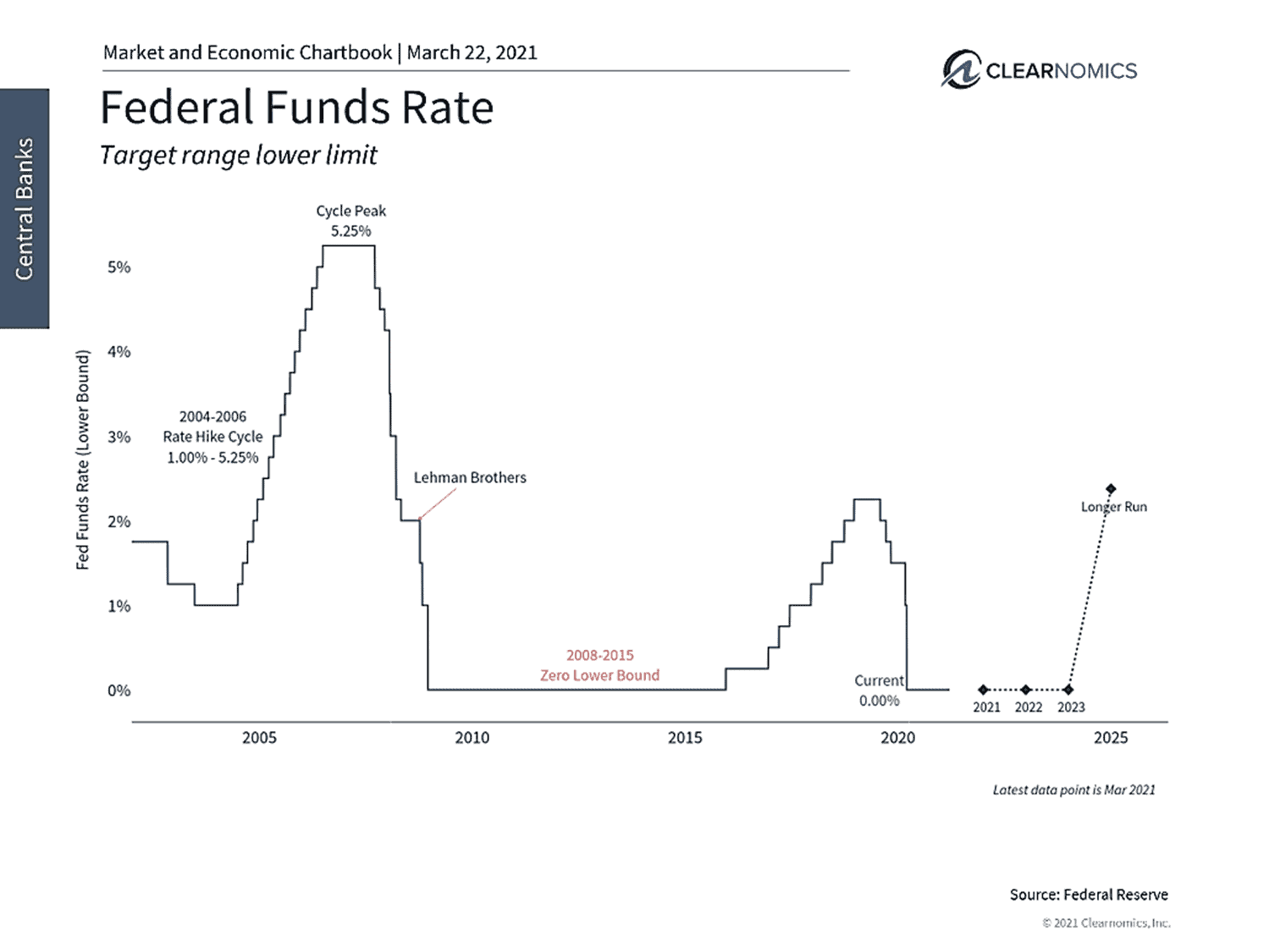

At the moment, Chair Powell and the Federal Reserve Open Market Committee have made it clear that they don’t intend to increase the federal funds rate until at least 2023 and possibly 2024. (see below) This is partly because many sectors of the economy may take longer to recover from the pandemic. For instance, the Fed and other policymakers consider a wide array of job market data beyond the headline unemployment numbers. Many data, including individuals that are newly discouraged from seeking work and those that may have been misclassified by official surveys, suggest that “true” unemployment is still much higher than average.

An equally important consideration for the Fed is that inflation has been much lower than expected since at least 2008. Whether this is due to trends such as technological deflation and globalization is the subject of academic debate. Regardless of the causes, the Fed’s position is that it will tolerate overheating inflation since it has run so cool for so long. It will likely do so especially if this allows unemployment to fall to pre-crisis levels.

What does this mean for investors? First, inflation has been declining for decades. And while there are reflationary pressures as the economy bounces back from the pandemic, this is a far cry from the double-digit inflation rates heading past the peak of the Regan Years in the earl 80’s before declining over the past 40+years till today.

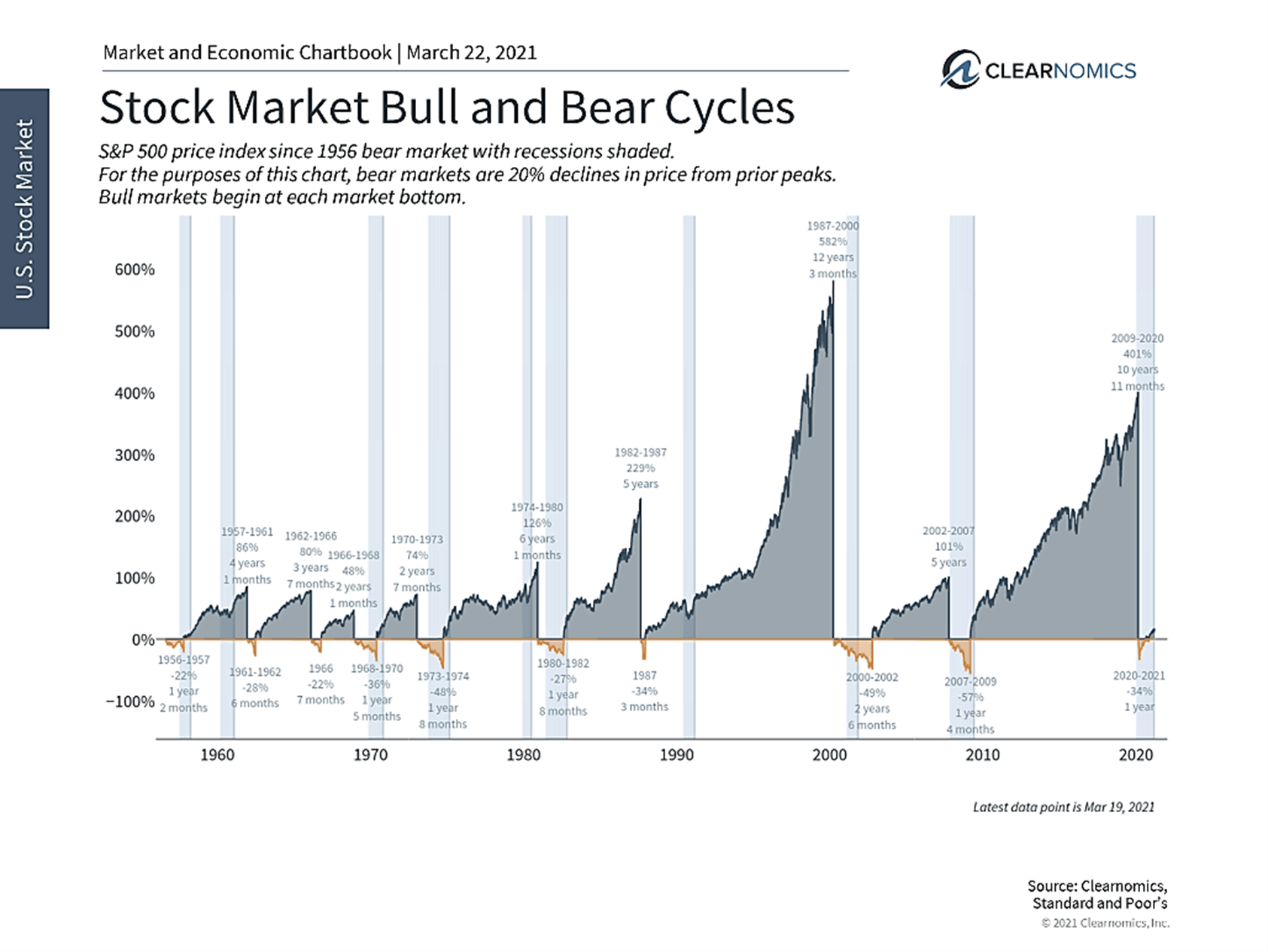

Second, investors often fear the onset of Fed rate hikes even though history suggests that they are a natural and inevitable part of the business cycle. A few tumultuous periods such as the 2013 taper tantrum aside, the normalization of the Fed’s balance sheet and rate hikes from 2013 to 2019 occurred alongside a strong bull market.

Of course, market expectations and projections made by Fed governors are based on information available today – an improvement or deterioration in any of the economic data could lead to a different policy path. Additionally, none of this addresses concerns that the Fed has provided too much stimulus over the past two cycles – and that there could be long-term consequences.

What these consequences will entail and when they will occur are the subject of speculation. What’s certain is that focusing too much on Fed decisions distracts investors from what truly matters: sticking to their long-term asset allocations and achieving financial goals. Below two charts that help to put the Fed’s monetary policy in context.

1 The Fed has kept policy rates low throughout the pandemic

This chart shows that the federal funds rate is adjusted based on economic conditions. The Fed kept policy rates low from 2008 to 2015 in response to the global financial crisis. The Fed also took emergency action last year to stimulate the economy at the start of the pandemic. The federal funds rate is still at the zero lower bound today, and the Fed is still buying assets and growing its balance sheet, despite the ongoing economic recovery.

2 Fed rate hikes are a natural part of bull markets

If history tells us one thing about Fed rate hikes, it’s that they are nothing to fear. Rate hikes have occurred alongside rising stock markets across history, whether or not investors have agreed with monetary policy decisions.

The bottom line? Investors should consider what higher inflation and interest rates mean to their asset allocations and personal income statements without over-reacting. Remain focused on your long-run strategy, consider the potential effects of rising inflation and interest rates, and resist over-reacting to short term ominous headlines.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.