Acrophobia -Investing Through All Time Highs

After five zigzag moves down and back up in January, the S&P 500 still managed to land a 2% gain, fueled again in part by a few big named tech stocks that are part of the “Magnificent 7” generative- AI revolution.

While we do not promote investing based on market timing, maxims, or calendar effects, solid stock market results in January should not be ignored. The “January barometer” says that if the market performs well in January, it’ll perform well for the rest of the year. To-boot, in the pre-election years the market has also historically performed well. None of this may matter to the most cautious investors as most trends are not guaranteed.

Ulin Recession Watch

“Did you know economists have predicted nine out of the last five recessions?”

The second year of this bull market cycle appears set to move forward through the 2024 pre-election year despite lingering inflation, elevated interest rates, geopolitical risks, and many other unique headwinds. Inflation has fallen quite a bit from the high of 9.1% in June 2022, despite resilient jobs reports, and consumer spending helping to drive the economy and corporate profits forward.

The notorious Bank of America outlook is predicting a soft landing rather than a recession, despite downside risks. More than 76% of economists recently said they believe the chances of a recession this year is under 50%, according to a December survey (NABE). Then again, many times the consensus is quite wrong.

Jon here. We agree with a low 20% chance of a recession for 2024 with a potential “soft landing” albeit a slowing economy. This is not withstanding if or when new unforeseen black-swan events hit the system. The central bank’s next two policy decision dates are scheduled for March 20th and May 1st, yet investors are getting a bit flustered with Fed Chair Jay Powell’s recent remarks stating that a March rate cut does not appear likely due to the strength of the economy and inflation.

It’s good to see Powell standing his ground and not taking action based on political theater. Acting too quickly to cut rates may fire up inflation while acting too late may create a harder landing with unemployment shooting higher. With the Fed’s favorite core U.S. PCE price index at 2.93%, perhaps pivoting out to May after a few more months of economic data arrives will better help to shape the path of Mr. Powell’s rate cuts through the balance of the year.

Fear & Greed Index

“The point is, ladies and gentlemen, that greed, for lack of a better word, is good.” Gordon Gekko

The CNN Fear & Greed Index, which measures seven indicators of investor sentiment, is now showing signs of Greed which may be a positive indicator. This indicates investors are betting on more good economic news to sustain this rally even though good news can be bad news for the Fed. Perhaps some of the near $6 trillion dollars in cash will be moved off the sidelines and back into the stock market at some point. Greed and FOMO (fear of missing out) do help to drive the markets a bit.

It should come as no surprise that investors are feeling better about the stock market after a near 18% turnaround by the S&P 500 index since last Halloween through the end of January, while putting the index just a wee bit ahead of when the inflation led crash incepted January 2022. In other words- we are not that far out of the woods just yet to be popping champagne bottles.

As the S&P 500 finally crossed a threshold and hit a new stock market record high on January 19th, 2024, the first time it had done so in more than two years. Should you be cashing in your chips or staying on course? We believe the latter as history suggests that more substantial gains are on the horizon based on market cycles, history, trends and actual data.

Acrophobia

“Limits, like fear, is often an illusion.” – Michael Jordan

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors this may bring back PTSD recollections of the dotcom and housing market heights and subsequent stomach- wrenching plunges.

If history tells us anything about investing, it’s that markets never rise in a straight line. As much as all investors would prefer calm periods of steady returns, this simply isn’t how markets work. Investors need to navigate alternating periods of exuberance and gloom, not only across the biggest bull and bear markets, such as the 2008 financial crisis and the decade-long expansion that followed, but also over shorter time frames such as the past year.

History shows that focusing on broader patterns while anticipating short-term choppiness can increase the likelihood of achieving financial goals. We have covered in many newsletters a chart and concept that there is on average a 14% correction or pullback almost every year. As I always note, “volatility is the price of admission.” Working with an accredited financial advisor can help you to better develop a disciplined investment plan and stick to it. Investing is equal parts portfolio design in as much behavioral finance.

What History Says About Markets Reaching All-Time Highs

“Man only likes to count his troubles; he doesn’t calculate his happiness” Fyodor Dostoevsky.

The idea that the glass is always half empty perfectly captures how many investors feel about the economy and financial markets, especially over the past few years. During recessions and bear markets, investors worry that the situation will never improve. When the economy and markets do recover, investors worry that it won’t last. In both cases, investors often find it difficult to stick to their long-term financial plans, regardless of the historical record. In today’s strong market environment, how can investors stay focused and invested?

The market has achieved several new all-time highs this year

The stock market has achieved several new all-time highs this year following last year’s bull market recovery. The S&P 500 and Dow Jones Industrial Average are now just a few points above their previous peaks from early 2022. While this is positive for investors, it’s natural to also wonder whether markets have run up too far, too fast. After all, it was less than a year ago when many investors and economists were predicting a recession and worrying about the rapid pace of Fed rate hikes. The following are three important facts to keep in mind.

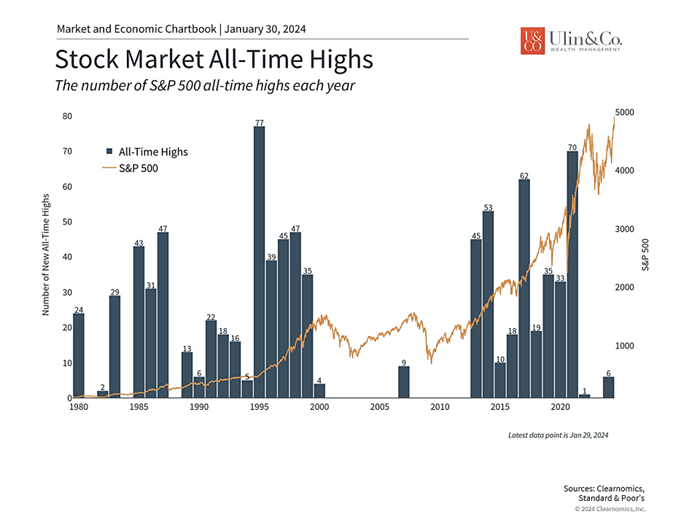

First, it’s important to understand that it is not unusual for the market to reach new highs during a bull market. By definition, since markets trend upward over long periods, bull markets spend much of their time at new record highs. The accompanying chart (above) shows how frequently these occur during market cycles. From 2013, when the S&P 500 recovered from the 2008 financial crisis, to 2021, the average year experienced 38 days closing at new all-time highs, or roughly 15% of trading days. Years such as 2017 and 2021 experienced many more. Thus, new all-time highs are not, on their own, reasons to be worried about the market or a signal that the market is about to reverse.

Second, what matters is not the level of the market, but the business cycle and underlying trends. While there is still much uncertainty today due to inflation and the timing and size of Fed rate cuts, market sentiment has improved due to steady economic growth. This has driven rallies in technology-related sectors, including across the so-called Magnificent Seven stocks, as well as in areas such as Industrials, Financials, and Health Care.

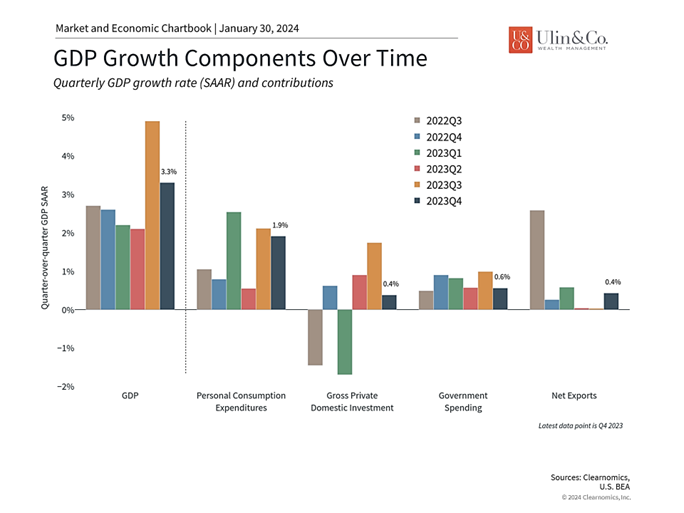

In particular, the latest GDP report for the fourth quarter of 2023 showed that growth was stronger than expected at 3.3% quarter-over-quarter, exceeding economist expectations of only 2.0%. This means that real GDP (adjusted for inflation) grew by 2.5% across all of 2023, one of the fastest growth rates over the past decade. Consumer spending, business investment, government spending, and trade all contributed to these results. In the long run, these factors drive markets more than day-to-day headlines and short-term swings.

The economy grew at a healthy pace in 2023

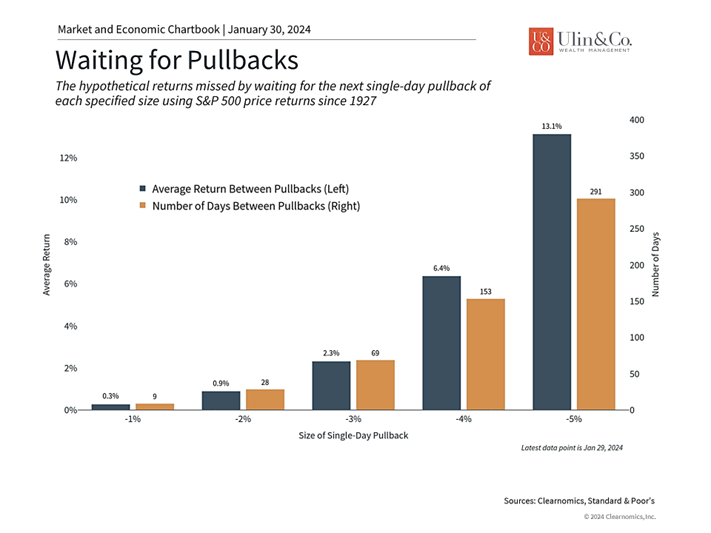

Third, while it’s natural for investors to feel that they should wait for a market pullback before investing new cash or returning to the market, history shows that this can often backfire. The chart below measures the “opportunity cost” of being out of the market and waiting for a better price, compared to simply staying invested.

Waiting for a 3% pullback, for instance, has required being out of the market for 69 days on average across history. Over that period, the market rose much more than 3%, resulting in a missed opportunity of a 2.3% gain. In other words, it would have been better to simply have stayed in the market the whole time. Waiting for a 5% pullback requires 291 days and results in a missed opportunity of 13.1%. Similarly, waiting for 10% market corrections or 20% bear market crashes can take years. In all cases, the peace of mind that comes from sticking to a plan, rather than trying to time the market perfectly, is an added benefit.

It’s often better to stay invested than wait for a pullback

Unfortunately, doing so requires battling our own tendency to see the glass as half empty when markets are rallying. Of course, none of this is to say that the market only moves up in a straight-line during bull markets. Investors should always be prepared for market swings and unexpected events, as the past few years have demonstrated. However, it does suggest that it’s often better to avoid making rash decisions based on news headlines and the level of markets, and focus instead on sticking to a well-constructed portfolio, ideally with the guidance of a trusted advisor.

The bottom line? The market has achieved several new all-time highs this year due to steady economic growth. Investors should continue to stay focused and invested and not make decisions based on the level of major market indices alone.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.