Animal Spirits and Acrophobia

The stock market started this year off with a bang after suffering through the wrath of the Great Inflation bear market of 2022, partially fueled by investors cheering lower inflation and the Fed nearing its 5% Fed Funds target rate, along with optimism of the economy potentially sidestepping a major recession.

The CNN Fear & Greed Index, which measures seven indicators of investor sentiment, is now showing signs of Greed and is not far from extreme greed territory. This indicates investors are betting on more good news to sustain this rally and are ready to party like its 1999.

The recent jolt in retail and consumer spending up 3% in January along with the record low 3.4% unemployment rate as noted by the Bureau of Labor Statistics may provide an ominous sign of increasing pain and hawkishness from Jay Powell and the Fed to work even harder to chainsaw inflation down to their 2% target. This may help to squash the optimism of the crowd a wee bit. The economic outlook opinions may shift from the hard or soft-landing debates, to a possible “no landing” at all by year end with the Fed hurling more rate hikes to help tame inflation which may be highly unlikely.

Animal Spirits

The S&P 500 is now only 14% off from breaking even since the top of 2022 while bringing back anxiety to investors that things may get worse. Should you be afraid of heights or a crash and recession on the level of 2008? The short answer is no.

At the same time, increased volatility this year should not come as a surprise. The quants, AI and animal spirits can help drive market volatility up or down in the short run when fear and uncertainty spikes, more so than market efficiency. “Animal spirits” refers to the tendency for investment prices to rise and fall based on human emotion and actions rather than intrinsic value thereby throwing a wrench into the theories of market efficiency.

Investing Acrophobia

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors this may bring back PTSD recollections of the dotcom and housing market heights and subsequent stomach- wrenching plunges.

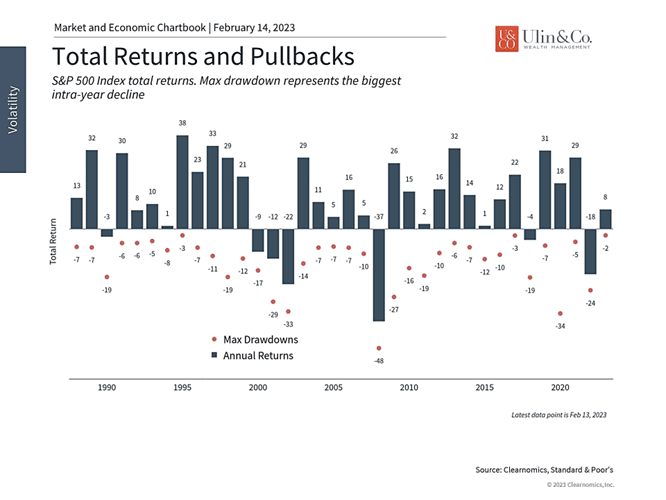

If history tells us anything about investing, it’s that markets never rise in a straight line. As much as all investors would prefer calm periods of steady returns, this simply isn’t how markets work. As I always note, “volatility is the price of admission.” I’m here to help get you over your investing acrophobia.

Investors need to navigate alternating periods of exuberance and gloom, not only across the biggest bull and bear markets, such as the 2008 financial crisis and the decade-long expansion that followed, but also over shorter time frames such as the past year. History shows that focusing on broader patterns while anticipating short-term choppiness can increase the likelihood of achieving financial goals.

Jon here. Mark Twain is often associated with the quote, “History doesn’t repeat itself, but it often rhymes.” I think the same could be said for the stock market. The stock market is known for bull- bear cycles. Their repetition makes one believe that history repeats itself. However, in each black swan episode, the underlying theme, participants and events are vastly different. Consider the following few points to help develop confidence and overcome investing acrophobia for 2023.

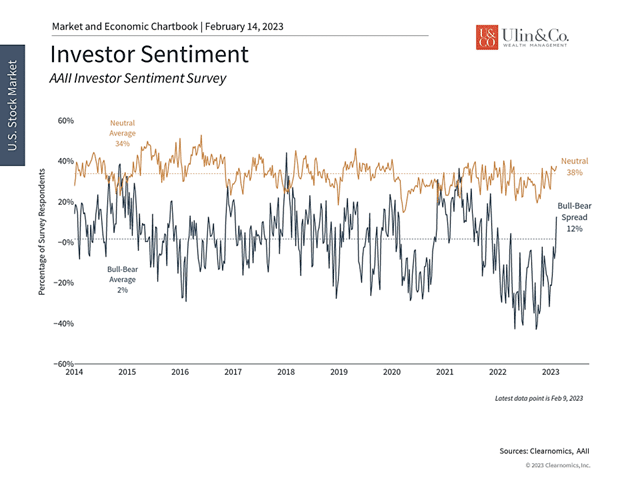

Investor sentiment is beginning to improve

Shifts in investor sentiment occur because markets are forward-looking, try to anticipate unknown outcomes, and incorporate this information into prices today. In doing so, the market may often over- or undershoot, leading to swings which are often to the downside. Of course, many investors know this all too well after experiencing the last three years. What’s unfortunate is that this has led some to become discouraged which, in the worst case, may lead them to be poorly positioned for future opportunities.

However, there are signs that investor sentiment is now improving after falling to historic lows last year. Until recently, poor investor sentiment was partly driven by big issues such as a historic inflationary environment that hasn’t been seen in over 40 years, the possibility of a recession, and the risk of a policy mistake by the Fed. However, it was also driven by large reversals in areas such as tech, crypto, and consumer discretionary spending, frustrating many investors who chased short-term gains.

Thus, how many feel about markets is often driven by what the market has recently done. The latest data from the AAII Investor Sentiment Survey show that while 38% of respondents are neutral on the stock market, bullish attitudes are now outpacing bearish ones by 12%. This is no doubt driven by the improved market environment over the past few months, during which the S&P 500 has climbed 14% since October. In this way, sentiment is often a backward-looking indicator.

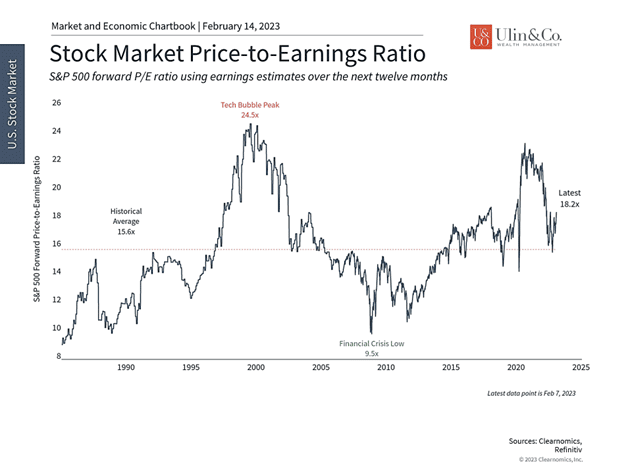

Valuations are still below their recent peaks

Another important metric that can be interpreted as a measure of sentiment is the valuation of the broad stock market. In particular, the price-to-earnings ratio of the S&P 500 currently sits at 18.2 times next-twelve-month earnings. This means that investors are willing to pay $18.2 for every dollar of anticipated earnings over the next year. This is above the historical average of 15.6, but well below the recent peak of 23.1.

In other words, investors are by no means bearish, but are clearly more cautious than they were in 2021 when all asset classes were rallying. This is positive for long-term investors because it means they can invest at a discount compared to just a year ago.

What’s more, recent data generally support this improved level of sentiment since the underlying economic trends are moving in the right direction. This includes better inflation figures, a job market that is still exceptionally strong, and a Fed that may pause its rate hikes soon. However, uncertainty remains due to the possibility of flat growth this year and the direction of core inflation.

Markets are performing very differently this year than in 2022

It’s clear that investors can be fickle and how they feel about the economy and markets can swing wildly on any given day. Learning to deal with uncertainty and to stay invested even when markets feel uncomfortable is an important part of any investor’s financial education. Perhaps counterintuitively, having the discipline to invest when others are still fearful can help to lay the groundwork for future financial success.

The bottom line? Investor sentiment is improving due to the rally of the past few months but investing acrophobia is setting in as inflation remains elevated. Long-term investors ought to remain focused and remember to not get caught off guard by short-term swings.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index. investing acrophobia

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.