Higher for Longer – Fed Impact to Investors

Disagreements around the direction of the economy and Fed policy have driven investor sentiment and market swings all year resulting in the recent two-month stock market sell off partly driven by hawkish-Fed language indicating rates will be flying “higher for longer.”

At its September meeting, the Federal Open Markets Committee (FOMC) kept rates unchanged with a target range of 5.25% to 5.50%, in a decision that was widely anticipated by investors. Still, markets responded negatively with bond yields jumping to levels not seen since 2007, 30-year mortgage rates near 8%, and the S&P 500 index dropping near 7%.

September Effect

This has pushed the AAII Investor Sentiment Survey’s bearish sentiment indicator up 25% this month to 40.9% and the needle of the CNN Fear & Greed gauge down to the “extreme fear” level. Are these ominous signs to strap on a parachute and jump off the airplane midflight, or are these instead contrarian indicators to continue to “buy low,” and stay on course? The quick answer is the latter, as no one has a working crystal ball.

Despite a healthy (and not unusual) stock market pullback this summer that may be a bit due to the seasonal September Effect, the S&P 500 index is still up more than a respectable, if not amazing +12% YTD after a disastrous 2022. The September Effect is an anomaly in which stock market returns are historically weak during the month. The S&P 500 index has generally posted losses in September since 1945, but not every year has yielded the same result.

Markets have rallied this year due to factors such as better-than-expected economic growth, greatly improving (decreasing) inflation, and a more stable financial sector. This confirms the maxim that good news can be bad news. It’s important to remember that today’s environment is not only far better than most investors had hoped for just a year ago but exceeds many of the rosiest projections by Wall Street analysts. Despite this, the central question that still divides investors is whether the Fed will make a policy mistake, which in this case could involve keeping rates too high for too long. This is because the Fed has maintained a “hawkish” posture as it combats inflation, utilizing not only higher interest rates, but a shrinking balance sheet and firm forward guidance.

Conflicting Headlines

In addition to lingering inflation and interest rate stressors, headline issues such as an imminent government shutdown October 1st, a snowballing U.S. debt, the UAW strike, cracks in China’s economy, student loan payments starting back up, higher oil prices, the Russia/Ukraine war, the banking crisis and more, are worrying investors of all ages.

Just this week one MarketWatch headline noted “The stock market can’t catch a break. Good news is bad news, and now bad news is bad news,” while right underneath this another article noted “Wall Street analysts expect the S&P 500 to rise 19% over the next 12 months.” This significant amount of contradictory information could lead investors down the path of paralysis by analysis or motivation to run for cover into expensive, illiquid alternative investment, insurance, and annuity products as a fear-hedge or to pivot a good bit of their liquid savings into high yield cash instruments.

Jon here. As we continually remind investors, not taking risk is the biggest risk of all for long-term investors. The crowd is not always right and many times, as we witnessed in Q1, the markets can turn back up quickly and unexpectedly on a dime. No one can time the market top or bottom quick enough to get out or back in at exactly the right time. This is why most of our charts and discussions incorporate a historical perspective on many market and economic nuances while pulling back over years and decades to better look at trends and results.

Higher for longer

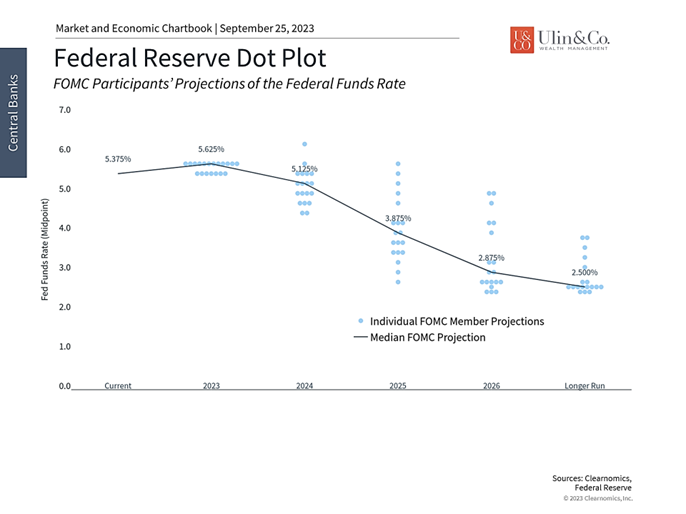

The Fed’s latest projections show that it expects to raise rates one more time in 2023, with only two meetings to go. (see chart below) While markets are somewhat skeptical, there is a higher probability of this occurring in December based on fed funds futures. The Fed also revised its forecasts to reflect a much stronger economy, with expected GDP growth this year shifting from 1.0% to 2.1%, and the unemployment rate falling from 4.1% to 3.8%.

Perhaps most importantly for market expectations, the FOMC’s estimate of future policy rates jumped as well in response to these stronger economic conditions. Rather than the fed funds rate falling to 4.6% and 3.4% by the end of 2024 and 2025, respectively, the committee now believes rates will stay higher at 5.1% and 3.9%.

Fed Communication and Guidance

The term “forward guidance” refers to the expectations that the Fed sets through its communications. These communications have evolved significantly over the past three decades. During the Greenspan era of the mid-1980s to mid-2000s, Fed decisions were typically made with simple written statements, often only a few short paragraphs. Beginning in 2011 under Ben Bernanke, the Fed began holding quarterly press conferences and publishing its Summary of Economic Projections “to present the Federal Open Market Committee’s current economic projections and to provide additional context for the FOMC’s policy decisions.” During Janet Yellen’s tenure, further changes were made to expand the Fed’s forward guidance and provide more clarity on the expected path of rates.

Today, under Jerome Powell, the Fed Chair now hosts a press conference after every meeting, even when there is no change in the fed funds rate. This is in addition to the numerous other speeches and written pieces by the Fed Chair and other Fed officials. The Fed’s use of forward guidance means that rate decisions are often telegraphed well in advance, resulting in few surprises. Thus, the market’s reaction is often more in response to the press conference and the Summary of Economic Projections.

Shrinking Balance Sheet Tightens Conditions

This is one reason that interest rates have jumped with the 10-year Treasury yield rising above 4.5% for the first time in 16 years, acting as a drag on both stock and bond prices. Additionally, two other factors complicate the outlooks for policy and inflation, even if they don’t undo the strong improvements of the past year.

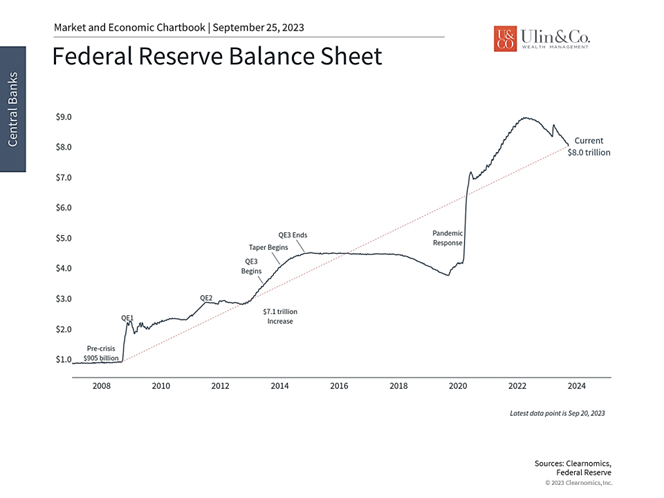

First, the Fed is not just raising rates but has also been shrinking its balance sheet, often referred to as “quantitative tightening.” By not maintaining or increasing the size of its balance sheet, the Fed reduces the amount of liquidity in the system. Mechanically, the Fed is bidding on and buying fewer Treasury and mortgage-backed securities, potentially lowering their prices and raising their yields. In effect, this raises rates and tightens financial conditions. Thus, this has the opposite effect of the asset purchases the Fed employed during 2020 and throughout the 2008 financial crisis.

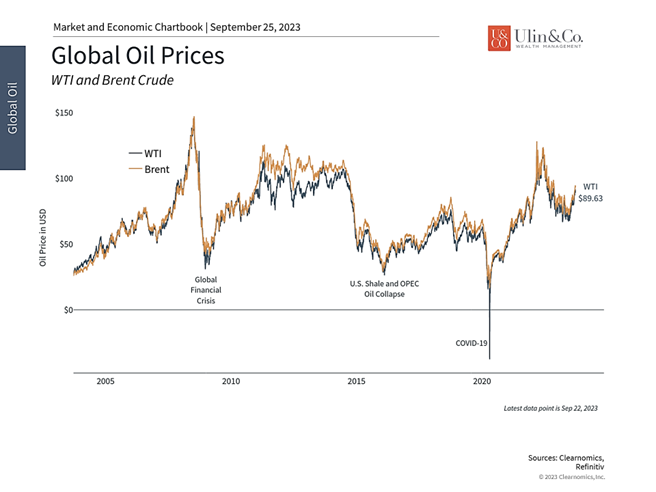

Second, many signs of inflation still persist including higher rent prices, wage growth, and rising oil prices. In particular, oil prices that have jumped back to $90 per barrel and above may be worrisome since this was one of the original catalysts for higher headline inflation in early 2022. Similarly, wage growth around 4.5% year-over-year, while positive for households and consumers, can be problematic from an economic standpoint if this drives prices higher. This is especially true given the historic strength of the labor market.

Oil prices have rebounded in recent months

Of course, investors are worried about many other issues beyond the Fed. This is nothing new – the endless stream of headlines always contains reasons for investors to be fearful of the market. And, although stock and bond prices have pulled back in the third quarter, year-to-date gains are still quite strong by historical standards. This goes to show that it is difficult to predict what the market may do next.

Ultimately, what drives returns for investors are not individual Fed decisions or economic data releases, but the longer-term trends in the economy and markets. In times like these, it’s important to stay disciplined and remember that conditions today are far better than investors could have hoped for a year ago.

The bottom line? The Fed kept rates steady in September, but the higher for longer Fed projections suggest that rates could remain elevated for some time. Long-term investors should continue to maintain perspective by focusing on continued economic and market progress, rather than individual data points.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.