Groundhog Day and Inflation Déjà vu

The euphoria of January’s stock market bounce wore off suddenly on February 2nd, just in time for Groundhog Day. America’s beloved groundhog meteorologist Punxsutawney Phil rose from his burrow last month and saw his shadow, meaning there will be six more weeks of winter. Maybe there is a bit more ominous inflation outlook connotation behind his shadow as market volatility and reversals started about the same time.

With the Fed and inflation data circling the headline news at the top of every month in a déjà vu repetitive cycle, it may feel a bit like the movie Groundhog Day, where weatherman Bill Murray (as meteorologist Phil Connors) finds himself in a time loop, and the day keeps repeating until he gets it right. Except in this instance, Fed Chair Jay Powell is our fearless weatherman reporting on inflation readings, trying to navigate a narrow- yet visible landing in this evolving narrative.

Like Phil Connors continually making changes to his environment with different outcomes each new day while learning from his past mistakes, Jay Powell continues to make adjustments to Fed policy every month while trying to get inflation under control. After all, the numerous market swings last year were driven by ever-changing expectations around the Fed – both when investors believed the Fed was doing too little, and when they thought the Fed was tightening too much.

Only a month ago at the Fed’s press conference, Powell stated that “the disinflationary process has begun.” This is undeniably true across many parts of the economy as inflation has eased. However, recent data raises new questions around how quickly inflation is improving and whether the Fed will need to act more forcefully in the coming months. Not surprisingly, this has spooked the markets. More on this below.

Fed Fighting Inflation

Don’t let the recession outlook headlines get into your head. It does not appear likely there will be an economic catastrophe on the level of the 2008-2009 Great Recession based on the strengthening economy and record low unemployment numbers, even if technically there is a slight blip down in the economic data like the first two quarters of 2022 where experts were mulling over the definition of a technical recession.

Still, the Fed faces its highest inflation fight in the last 40-years, now at 6.2%, and some experts may be optimistically pricing in rate cuts by year end. Yet, it is in our opinion that the Fed is not doing enough to break inflation and that the Fed hitting its 2% CPI goal by December of 2025 may be a bit out of reach regardless of their words and actions.

In other words, it’s technically possible for this to happen, just like giving yourself a big weight loss target goal by next year, but both may be a struggle to achieve. Powell signaled he will not change the 2-year target path nor consider moving the Fed’s 2% target up to a bit higher level. This makes sense, as a more dovish Fed with a higher target would only fuel more inflation.

When the Fed potentially executes three more 25-basis-point hikes, in March, May, and June, to a 5.25%-5.50% target range, we can expect even higher 2- and 10-year treasury rates above 5%. This will continue to add pain and discomfort to bond and stock investors. If the Fed throws even more rate hikes at inflation to cool off price pressures, there could be more crash-level stock volatility in store for this year on top of a slowing economy. Still this potential fear- based sell-off should only be short lived as we may be 80% or more through the worst of the Great Inflation bear market.

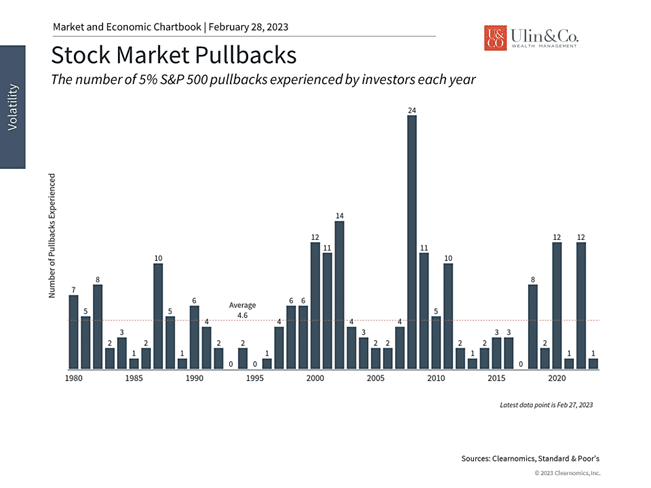

While investors have grown accustomed to daily swings, it’s still important to remember that stock market fluctuations are normal, expected and unavoidable. After all, it’s the willingness and ability to withstand pullbacks in the short run that allows investors to be rewarded in the long run.

Dynamics Driving Markets

During periods of uncertainty, understanding the underlying trends driving markets can help investors to maintain perspective. Specifically, the S&P 500 declined 2.7% last week and is now up 3.4% year-to-date. There has been a divergence between the Dow which was strong last year but is now slightly in the red, and the Nasdaq which struggled last year due to its tech concentration but is now up 8.9% on the year. This is further evidence that markets can turn around when it’s least expected, and investing based only on recent patterns doesn’t always work.

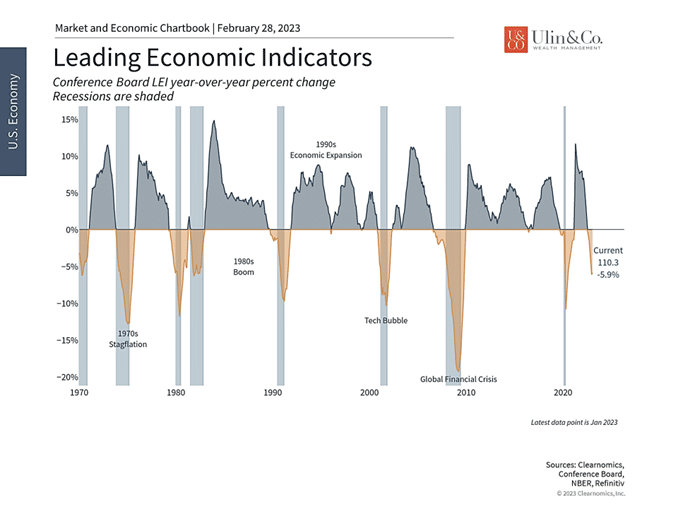

The economy has decelerated in recent months

What dynamics are driving markets beneath the surface? First, there is no doubt that the economy has slowed in recent months. The accompanying chart (above) shows that an index of leading economic indicators has contracted on a year-over-year basis. U.S. GDP data for Q4 was also revised down slightly to 2.7%, meaning that growth was still positive at the end of last year, but was weaker than originally believed. This was due to slower consumer spending and exports.

Meanwhile, inflation figures for January were unexpectedly hot with PCE inflation – the measure that the Fed favors – still far above the Fed’s 2% target, stoking concerns that the central bank may need to raise rates more aggressively. They are now expected to push the fed funds rate to nearly 5.5% later this year as we discussed.

Second, and perhaps more importantly, is the divergence between goods and services. Goods are tangible items that consumers and businesses need such as cars, food, gasoline, clothing, home appliances, and more. Services are everything else, such as eating at restaurants, rent, education, medical care, etc. One defining characteristic of the past few years is that the demand for goods skyrocketed during and after pandemic lockdowns, while services languished as consumers stayed home. This has reversed as life has returned to normal across the country, shifting spending back to services.

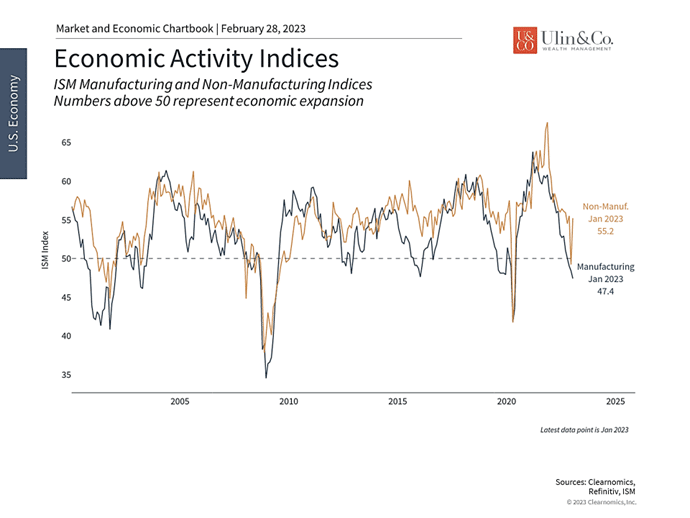

Manufacturing activity has slowed but services are still growing

Much of this is by design as the Fed attempts to slow the economy. A textbook explanation is that raising interest rates makes it more attractive for consumers to save instead of spend, slows interest-rate sensitive parts of the economy like housing, and reduces consumption and business investment activity. Combined with the fact that households only need so many toasters and exercise bikes, it’s not surprising that goods have led the slowdown across all consumer spending.

This, in turn, has resulted in a slowdown in manufacturing which can be seen across a variety of data. The accompanying chart (above) shows that the manufacturing PMI – a measure of economic activity – has contracted. Services PMIs, on the other hand, are still expanding after a brief dip. This can also be seen in other data such as industrial production which has decelerated to a year-over-year growth rate of less than 1%.

This is occurring at a time when “reshoring” manufacturing back to the U.S. is part of the economic and political debate. One lesson of the past few years is that while global supply chains can be a boon when things are running smoothly, they can also be fragile when there are unforeseen economic shocks, whether related to the pandemic or Russia’s invasion of Ukraine. Securing these supply chains through policies such as the CHIPS Act and individual business decisions will likely be a priority in both the public and private sectors over the next several years.

Despite recent swings, markets have been calmer in 2023

So, what does this all mean? It’s clear that the economy has slowed and that the differences between goods and services are driving both growth and inflation. However, not only is this widely expected with GDP anticipated to be flat in 2023, but there are always swings and uncertainty in the data. The fall in durable goods, for instance, is largely due to a decline in aircraft and parts orders after it surged the month before.

Inflation can vary significantly from month-to-month too, especially as rent and housing prices stabilize due to rising rates. Fed expectations have shifted higher in recent weeks, but they have also fluctuated wildly over the past year. While data is important, focusing too much on any individual data point can be problematic.

The bottom line? Despite feeling like a Groundhog Day and inflation Déjà vu cycle with the Fed, investors should remember that markets have regained significant ground since last summer. Diversified portfolios are mostly in the black this year and the S&P 500 has only experienced one 5% pullback in 2023 (see above). Staying invested can be difficult amid all of the negative market headlines but it’s ultimately what allows investors to achieve their long-term goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today- Contact Us below

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.