Fed Paving the Path to Economic Recovery

With the spread of COVID-19 around the world still advancing, businesses and individuals everywhere are feeling the pain and economic impact, with many states still on a full or partial lockdown.

On March 11, 2020 we officially entered a bear market after a bit over a decade-long bull market run. It was the fastest plunge into a bear market in history. Like many Americans, you’ve likely heard the terms “bull” and “bear” in regards to the market, but what do they mean exactly, and how does a bear market relate to a recession? We’ll discuss below.

Where Does the Name “Bear” Come From?

Bears and bulls may seem like two unrelated animals to associate with investments. However, the correlation between these two can actually be traced back to the late 1500’s. During this time, people enjoyed gambling on bull- and bear-baiting and betting.

In the 1700s, the phrases bull and bear market were published in “Every Man His Own Broker,” by Thomas Mortimer, and in 1873 a painting of the stock market crash by William Holbrook Beard depicted the two animals prominently.

Is a Recession Imminent?

According to the National Bureau of Economic Research (NBER), a recession is “a significant decline in economic activity spread across the economy, lasting more than a few months (typically defined as two quarters of negative GDP), normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.”

Indicators of a recession hitting America may include:

- Recent graduates unable to secure jobs

- An increase in businesses going bankrupt

- Unemployment rates rising

- Housing market collapsing

- Consumers buying less

While the stock market entering a bear market is common amidst a recession, the stock market is not necessarily an indicator that a recession will happen. Instead, there are certain indicators and warning signs such as a slowdown in production in the manufacturing sector, retail sales and the real gross domestic product (GDP) growth rate declining.

While the impact of a recession can be long-lasting, the recession itself typically only lasts between 9 and 18 months, according to the NBER.

Volatility is Expected

The stock market is experiencing renewed uncertainty only days after it recovered its year-to-date losses. Many investors are justifiably concerned about the pace at which the market recovered and the ongoing COVID-19 crisis around the world. There are also mixed feelings about the Fed’s continuing stimulus and what it means for the speed of the economic recovery. After several topsy-turvy months, it’s important for investors to see past short-term market movements and focus on the longer-term trends as the economy reopens.

Specifically, the stock market has now seen 10 large pullbacks over the course of the year, measured based on the number of 5% declines an average investor might experience. This is on par with 2011 which was an exceptionally volatile year due to the downgrade of the U.S. debt and problems in the Eurozone. The fact that these declines occurred in such a short period of time, only to be followed by a swift recovery, has left some investors unsure about what to do next.

Fed’s Outlook

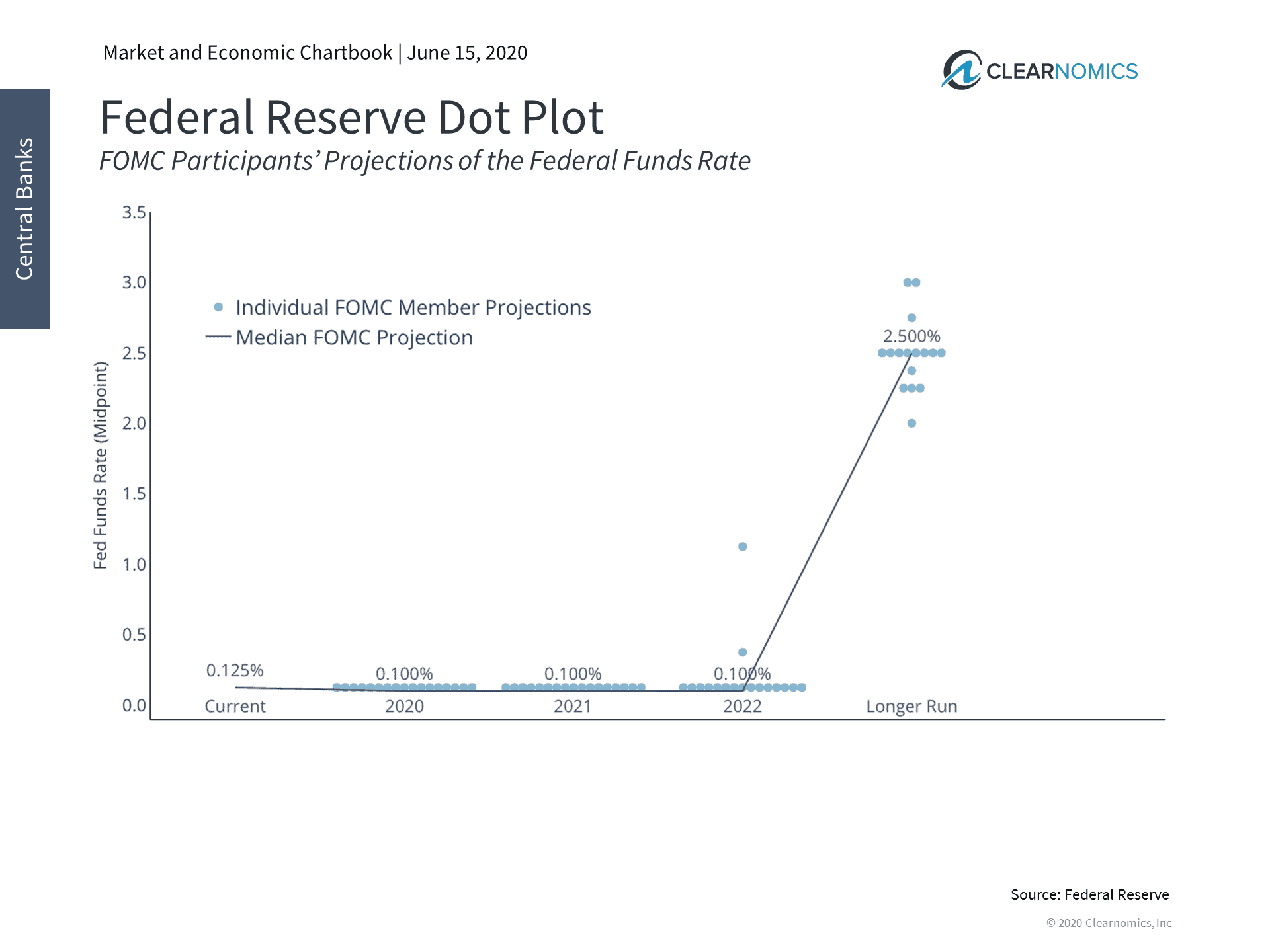

One reason for recent market concern is that the Fed released its summary of economic projections for the first time since last December. It highlighted that the Fed does not expect to raise rates through 2022. This is the case despite their projections showing a one-time dip in GDP growth of -6.5% for 2020, which then is expected to rebound by 5% and 3.5% in 2021 and 2022, respectively. It also expects unemployment to fall to 9.3% by year end and then slowly recover to 5.5% by 2022. Inflation is not expected to reach 2% in the near future.

Although the Fed’s economic forecasts are nowhere near infallible, they do provide a glimpse into how policymakers view the current situation. Although the direct impact of the economic shutdown is expected to be relatively short-lived, their effect on employment and inflation may persist for years. In any situation, the Fed expects that it will maintain its supportive monetary policies well into the future. This includes not just low interest rates but also its expanding balance sheet which has now ballooned past $7.2 trillion.

Monetary Life Support

In our opinion, this has resulted in mixed feelings and cognitive dissonance for investors. On the one hand, lower rates for longer are often cheered since they tend to boost asset prices and valuation levels. On the other hand, not only are investors naturally concerned that the Fed is “artificially” propping up the stock market, but low rates suggest a poor prognosis for the economy. In the meantime, it’s widely understood that the Fed’s recent actions are an attempt to keep the financial system functioning smoothly and to keep the economy on life support.

Rather than react to every Fed decision and tick in the stock market, investors should instead focus on the longer-term economic trends. After all, this is what drives the Fed’s decision-making and is the foundation of stock returns over the long run.

Right now, the data suggest that growth can recover as businesses and cities reopen, even if it may take some time. As long as good companies don’t go bust because of forced shutdowns and bad companies don’t create ripple effects across credit markets, it’s likely that commercial and industrial activity can begin to recover over the next several quarters. Right or wrong, this is why the market rebounded so quickly in April and May, and what many investors and economists continue to hope for.

Below are two charts that help to put recent market volatility and Fed guidance in perspective.

Investors have experienced many stock market pullbacks this year

The number of stock market pullbacks now ties the number experienced in 2011 at the onset of the economic recovery. This is measured based on what an average investor experiences if they check the market occasionally. It’s not unusual for the average year to see several pullbacks. For instance, although there have been 10 pullbacks of 5% or worse this year, there were almost just as many in 2018. It’s important to keep this in perspective in order to stay invested for the long run.

The Fed expects to keep rates near zero for years

The Fed’s latest summary of economic projections suggests that it expects to keep interest rates near zero through at least the end of 2022. While the Fed’s projections don’t always pan out, this suggests that the Fed prefers to err on the side of caution as the economy gets back on track.

The bottom line? Although the recovery would be much smoother with viable treatments or a vaccine, it can occur without them. Sensible public health policy, social distancing, and targeted shutdowns are some of the tools that can be used to combat COVID-19 while keeping the economy functioning. However, the added uncertainty and global spread of the virus means that markets may continue to be volatile. As always, this suggests that investors should stay calm but also remain diversified in order to navigate the months to come.

Although markets are experiencing volatility and the economic recovery may be rocky, investors should remain disciplined and focus on their long-term financial goals while maintaining a strategically diversified “all weather” portfolio.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.