Fed and Strong Dollar Fighting Inflation

The U.S. dollar endured a few tumultuous years due to the pandemic repercussions followed by record-high inflation and supply side shock debacles. In general, inflation tends to devalue a currency since inflation can be equated with a decrease in a money’s buying power. As a result, countries experiencing high inflation tend to also see their currencies weaken relative to other currencies.

Flip a switch to Q3, the US dollar has been making a robust comeback this year fueled in part by the hawkish Fed rate hike program and a bit from the Russia/Ukraine war. In Q1 as the war commenced, the dollar jumped to its highest level in nearly two years and the Russian rouble plunged to a record low as investors fled risk assets and moved toward safe-haven assets.

The dollar is an important, yet sometimes overlooked economic indicator that, like interest rates, reflects a wide array of global trends. As the world’s reserve currency and most reliable medium of exchange across the planet, its value affects every part of the economy and everyday life. Most recently, the U.S. government is now delving into the prospect of creating a “digital dollar.”

Gold Standard

There are some cynics betting against the dollar or fearful the US Government may go bankrupt while stockpiling gold and or crypto for a future Armageddon. The dollar may not be going anywhere anytime soon, and capitalism is alive and well. In fact, it may be a wee-bit more difficult today to conduct business or simply buy a chicken at Costco with your satchel of bitcoin or gold, otherwise have your life savings tied to a shiny commodity that has barely broke even over the past decade, after wiping out almost half its value in 2015.

Consider that no major country is currently using a gold standard where the value of money is based on any physical item. However, many countries do keep gold reserves. As the price of gold tends to rise during economic uncertainty and when inflation is high you can expect it to follow inflation back down again and into the next bull market. Gold may have better use on your shiny Rolex or as a filling or crown for your tooth than as a big part of your nest egg.

In the meantime, the dollar is alive and well and doing some of the Fed’s heavy lifting to help cool down inflation. There are wide-ranging implications for investors in the back half of 2022, especially with the stock market back down to attractive valuation levels, banks and consumers well capitalized, and bonds for the first time in years are paying decent yields with less correlation to stocks than what we experienced at the top of the year.

Fed Balancing Act and GDP

The Fed is caught between a rock and a hard place as it tries to balance historic inflation levels with a slowing economy. Many leading economic indicators suggest that growth is decelerating due to rising prices, geopolitical events, and the natural end to a strong recovery.

Typically, GDP reports are closely followed but entirely backward-looking since they reflect events that took place the previous quarter. GDP reports can shed light on the magnitude of the impacts on consumer, business and government spending, as well as trade activity. However, this week’s report will be scrutinized for another reason – whether or not we are in a recession – or if the definition of a recession is even valid in 2022.

The economy shrank at an annual 0.9% pace in the second quarter of 2022 to mark the second decline in a row after Gross domestic product (GDP), the scorecard of sorts for the economy, fell 1.6% in Q1. Yet consumer spending ticking up over the past quarter supported by historically low unemployment rate numbers does not help meet the typical recession definition. Perhaps it should be called a light recession?

Jon here. The two recent quarters of real GDP decline are quite small relative to the Great Recession, where the annualized quarter-to-quarter changes amounted to -8.5% for the first half of 2008. Politically speaking (not following science or logic on either side) the Biden White House has argued the U.S. is not in recession, but Republicans want to pin the blame on Democrats for the slowdown in economic growth.

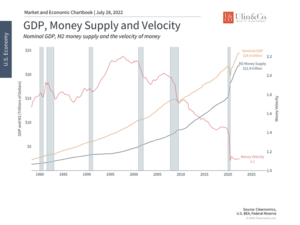

The money supply has grown significantly since 2020

What is driving inflation, how long it will last, and who is politically to blame are matters of heated debate. One contentious area is around the money supply and whether this has driven prices higher across the economy. The chart above shows one measure of the money supply known as M2 which includes components such as U.S. currency, checking and savings accounts, and money market funds. This measure rose dramatically as the Fed responded to the pandemic.

However, unlike the cost of oil which has clearly driven gasoline prices higher for consumers and businesses, the jury is still out on the long-term effects of loose monetary policy. Historically, inflation has been worsened or prolonged by central bank errors. If there is too much money chasing the same amount or fewer goods and services, then the prices of those goods and services will rise.

But the supply of money isn’t the only factor here. The concept of the “velocity of money” matters too – it measures how many times each dollar flows through the system. If there are many more dollars, but they move through the system fewer times, then growth and inflation could remain the same. This is one reason that the stimulus after the crisis of 2008 never spurred inflation – velocity fell as banks held onto reserves and slowed their lending activities. This is also what we see over the recent period – the velocity of money has plummeted because nominal growth has not picked up faster than the growth in the money supply.

A stronger dollar naturally tightens economic conditions

All of this is fairly technical but there is a simple point: Fed actions affect the economy with a long lag and can often impact consumers and businesses in unexpected and indirect ways. For example, interest rate hikes have helped to strengthen the U.S. dollar, to the point that even the Euro is hovering around parity. This has two implications for inflation and growth.

First, a strong dollar is great news for American travelers and consumers buying foreign goods who will find that their currency goes much further. This naturally lowers inflation since the prices that consumers pay will decline. In theory, a stronger dollar and lowers oil prices, since the commodity is mostly denominated in U.S. dollars.

Second, a strong dollar also slows the economy somewhat since foreign buyers will find U.S. dollar-denominated products more expensive. This can also drive down inflation since there will be less demand for certain goods and services. Thus, a stronger dollar naturally tightens financial and economic conditions which may slow the economy, but perhaps more importantly combats inflation.

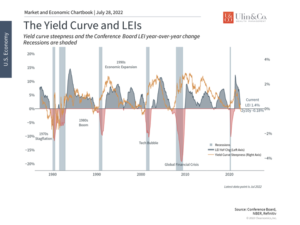

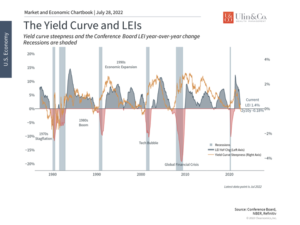

Leading indicators suggest the economy is slowing but in a controlled fashion

Of course, the challenge lies in the balance between battling inflation and preventing a deep recession. Fortunately, corporate earnings and consumer balance sheets continue to be robust which increases the hopes that any recession may be mild. Regardless of the exact outcome, markets have been preparing for the worst for some time. The S&P 500 is still hovering slightly above bear market levels, with valuations at their most attractive levels in years. Investors ought to take a long-term perspective and not focus too much on any one Fed meeting or GDP report.

The bottom line? Although the Fed fighting inflation is may lead to a light recession, it is still important to stay invested and diversified, especially given attractive market valuations.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.