Elevated Oil Prices Drive Stocks Down

The US stock market beaten down by oil prices and inflation put up a worst first-half performance than the Patriots 28-3 halftime score to the Falcons in the 2017 Superbowl LI which was the only Super Bowl to be decided in overtime. It also was noted as the largest comeback in Superbowl history. Just the same, it’s not a question of will we see a comeback by stocks and the economy, but when.

Oil Everywhere

Demand for oil is here to stay for decades to come. Global oil demand reached 100 million barrels per day prior to the COVID-19 crisis and is back on track to surpass that level over the next year.

Any major decline in use will be very gradual, despite the wishes of environmental activists that big oil firms stop production of crude immediately and leave the world to run on green energy. Although there is increasing attention on renewable energy sources, fossil fuels still constitute the vast majority of energy use in many industries.

Crude oil touches quite a bit of our lives and is utilized as a base for more than just jet fuel, gasoline, diesel fuel, heating and electricity generation. It is also part of petroleum byproducts for tar, asphalt (roadways), paraffin wax, and lubricating oils, to chemical use in fertilizers, perfumes, insecticides, soap, cosmetics, and vitamin capsules. Plastics derived from oil are utilized in heart valves, and artificial limbs to carbon fiber in aircrafts, PVC pipes, wind turbine blades, car tires and paint, even for fancy electric vehicles.

Energy Crisis and Policy Politics

Oil is up more than 40% since Russia invaded Ukraine and up nearly 90% over the past year when looking at the global Brent crude benchmark, which has risen as high as $123 a barrel in recent days when compared to its level of around $63 a year ago

How did we get here? This time around, rising prices are being blamed on a confluence of events. Those include the reopening of economies from pandemic shutdowns, China issues, the Russia/ Ukraine war, worries about major energy producers not ramping up output, a sporadic shift to renewable energy sources along with cutbacks to domestic oil production.

Biden is facing renewed criticism over his restrictive energy policies. While there are multiple difficulties surrounding energy prices, just a change in dialog and perception could help push oil prices lower by $10 or more, even if it takes time for oil production to kick in if leases are freed up, or it takes more than four years to build out the Keystone pipeline. In the meantime we are importing over 6 million barrels per day of crude oil just last year to make up for domestic shortfalls while China has ramped up coal production.

How Record Gas Prices Impact Consumers and Investors

Energy prices have been a major factor driving inflation higher this year. The strong economic recovery and the war in Ukraine have boosted the demand for energy at the same time that supplies of oil and natural gas have fallen. Gasoline prices, in particular, have become a symbol of the burden that inflation places on consumers, and where they go from here will affect consumer spending, Fed policy and stock market returns.

The challenges in the energy market of the past six months only add to the storylines of the past few years. During the pandemic lockdown, the front-month oil contract fell into negative territory. This had never occurred in history and was due to a collapse in demand made worse by a lack of oil storage capacity. A negative price meant that contract holders were so desperate to not take delivery of oil that they were willing to pay others to take their contracts.

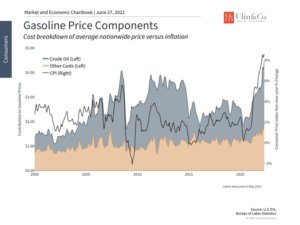

Gasoline Price Components

Since then, the oil market has turned around completely as prices first recovered alongside the economy, then spiked this year following geopolitical events, with a few bumps along the way due to growth concerns. Brent crude jumped to nearly $130 a barrel immediately after Russia’s invasion of Ukraine. It has since settled in around $110 a barrel, the same level as in March, but these are still the highest oil prices since 2014.

Three Significant Developments

First, energy prices have been a major contributor to rising inflation. Last month’s Consumer Price Index report, for instance, showed that energy prices rose 35% over the previous year and gasoline prices skyrocketed 49% and are now above $5 per gallon on average, a new record.

The chart above, which breaks down the components of gas prices, shows that the largest contributor is simply the jump in crude oil prices. Costs associated with refining, distribution and marketing, and taxes have contributed also but to a much smaller degree. The chart also highlights the strong relationship between gasoline and the Consumer Price Index.

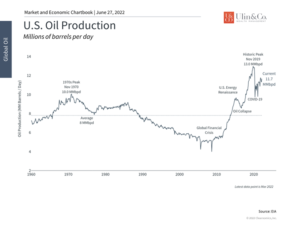

U.S. Oil Production

For this reason, gasoline and oil are perhaps the most important indicators for the path of the economy and markets. To combat higher energy prices, especially at the pump, the U.S. administration has released oil from the Strategic Petroleum Reserve, is negotiating with Saudi Arabia to increase their output, and has floated the idea of a gas tax holiday. This situation may seem odd given that the U.S. was a top oil producer in the world only a couple of years ago.

Second, this has unsurprisingly become a contentious political and policy issue since higher gas prices hurt consumer pocketbooks and reduce discretionary income, effectively functioning as a tax. For businesses, higher energy prices boost manufacturing and transportation costs, affecting all products and services.

The Fed has become especially sensitive to the impact of gas prices on headline inflation, even though their policy tools can’t directly fix the disruptions to supply partly caused by the government. This has spurred the Fed to raise rates at the fastest pace since the early 1990s. Whether the Fed maintains this pace will be determined by consumer expectations on inflation which are largely driven by energy costs. Steadier oil prices over the past three months are a positive but uncertain sign of where inflation may go from here.

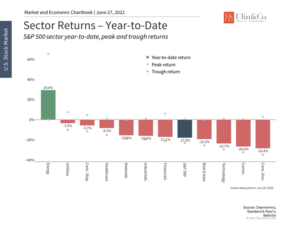

Sector Returns

Third, the energy sector of the stock market has benefited from higher prices and is the only sector in the black this year, although its year-to-date gain has been cut to 29% from a peak of 65%. However, for those who are properly diversified, the energy sector accounts for less than 5% of the S&P 500’s market capitalization, even after all other sectors have fallen. The fact that the sector has made these gains emphasizes the importance of investing within and across markets.

The next several months will be challenging for investors as markets continue to adjust to high inflation. However, investors are always faced with potential problems whether it’s financial crises, trade wars, the pandemic, lofty valuations, rising interest rates, geopolitical conflicts, or other challenges. Clearly understanding the key issues while resisting the urge to overreact is still the best approach to achieving long-term financial success.

The bottom line? Energy is a key factor driving inflation. Oil prices have been more stable recently which could be a positive sign. Investors ought to stay disciplined as markets adjust to inflation.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.