Different Dynamics Driving Stock Sectors

The COVID19 led quarantine, shutdown of America and recession has created a dichotomy of sorts on consumer behavior and consumer spending which typically drives two-thirds of U.S. output and is a critical factor in recovery.

Spending patterns can provide some insight on why some stocks, sectors, companies and industries are excelling despite a recession, while others have greatly declined.

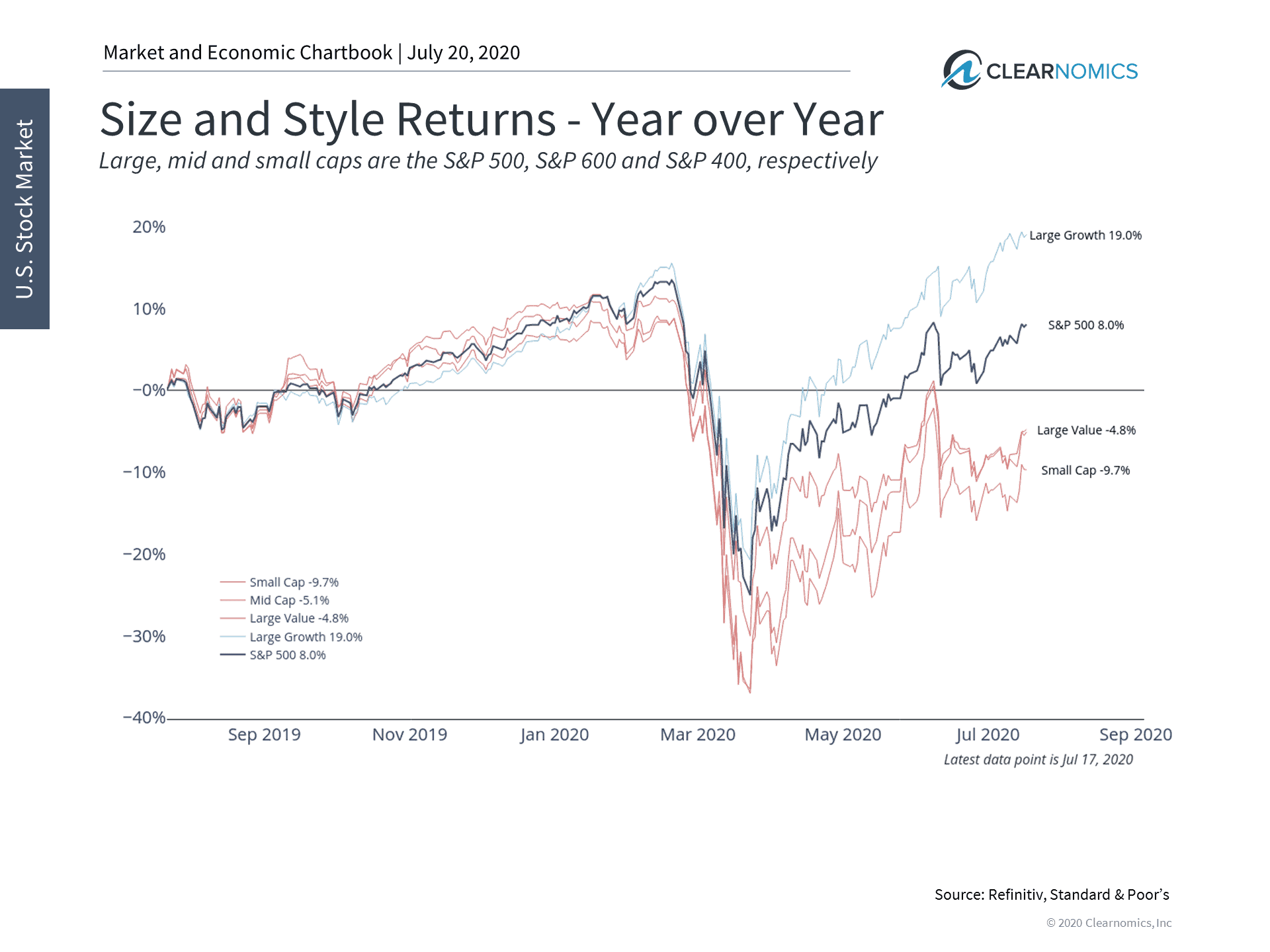

Consumer discretionary, technology, healthcare and the communication services sectors have excelled (see below) helping support the stock market to recover from the recent crash. At the moment, the S&P 500 is flat year-to-date and less than 5% below its all-time high in February. However, the strong performance of the overall market hides differences between investment styles and sectors.

Nesting Mode

Sheltering in place, home schooling and working from home for the past four months has led many people into a “nesting” mentality to spend money on home improvements and renovations from upgrading their backyards and pools to their kitchens, home gyms, home offices and living areas. In our opinion, this new way of remote working, shopping and living may be the “new normal” for years to come even after a cure for the pandemic is found.

Americans are transforming backyards into gardens, outdoor kitchens, campsites, movie theaters and water parks, looking to create zones to offer a sense of different destinations – and to allow social distancing when guests visit.

People are also shelling out money on furniture to home-improvement spending, up 40% in the week ended June 24 from the same period last year. The technology sector has also been a direct benefactor of sheltering in place while providing “new” ways of living, working, shopping and consumption.

Sector Regimes

The NASDAQ, which is comprised of technology stocks, has risen over 18% since the start of the year and has made new record highs. Small cap stocks, on the other hand, are still down 12%. These dynamics have not only affected returns but are a reminder to investors that properly diversifying across the market is the best way to achieve long-term goals.

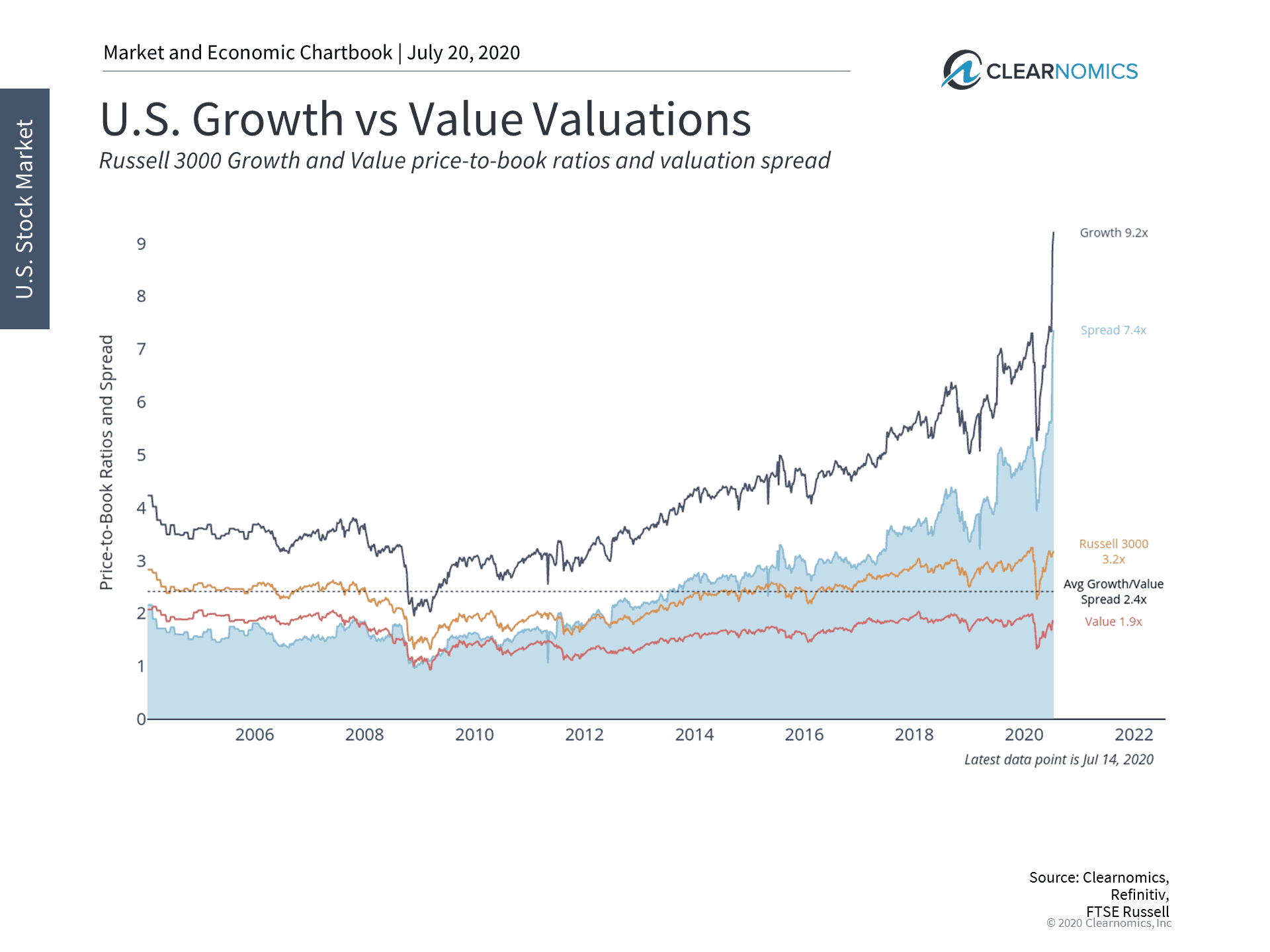

The market is often said to operate in “regimes” – periods when certain types of investment factors outperform. These regimes can last months, years, or even decades and are studied by industry professionals and academic researchers. For instance, value stocks outperformed for many decades until growth stocks took over during the dot-com boom and bust. Value stocks then outperformed again until the last several years when growth stocks once again began to lead. While it’s difficult to know exactly when and how regimes will switch, history makes it clear that no market dynamic lasts forever.

This is one reason that NASDAQ and “FAANG” stocks have made new highs even as the COVID-19 crisis continues. Many of these stocks tend to be classified as growth stocks and are large cap companies, which has allowed those investment styles to outperform their value and small-cap counterparts. It’s important to note that what most investors consider to be technology stocks are not confined to the Information Technology sector. Many large household tech names are within the Consumer Discretionary and Communication Services Sectors as well.

Valuations Matter

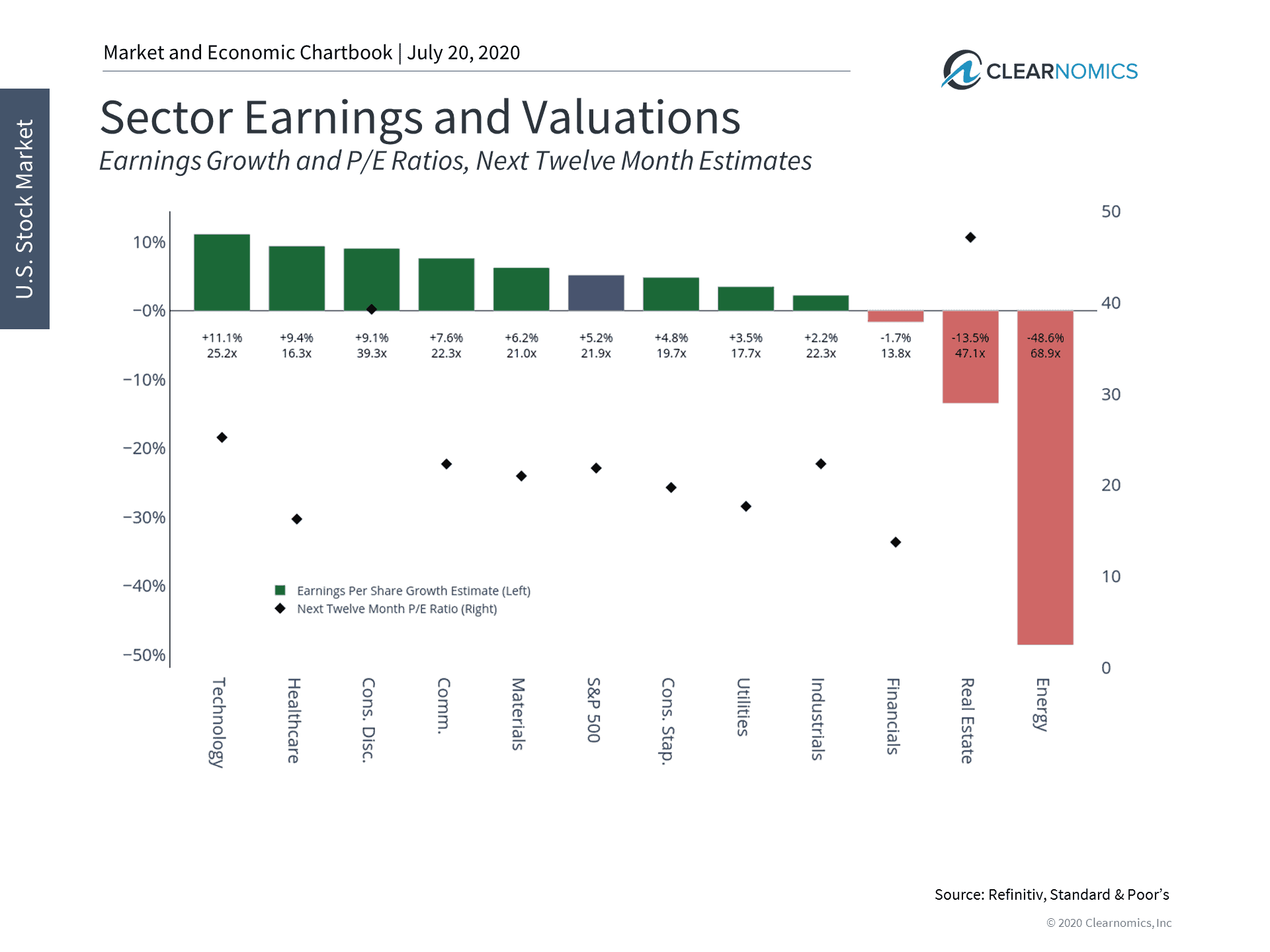

As is always the case, an important principle when investing for the long run is to be aware of but not overreact to short-term trends. After such large market moves, this is more relevant than ever. At the moment, the Information Technology, Healthcare, Consumer Discretionary and Communication Services sectors are estimated to have the highest earnings growth over the next year. At a time when the economy and corporate earnings are uncertain, this has been highly valued. (see below.)

However, these sectors also have the highest level of valuations. One reason that market dynamics often flip is that seemingly attractive investments become overpriced, which then lowers their expected returns. This paves the way for other stocks, sectors and styles to generate higher returns. While growth stocks have done extremely well, their valuations have greatly surpassed value stocks and the broader market.

It’s difficult to determine with certainty whether growth stocks will continue to outperform value ones indefinitely, and which sectors will do well over the years to come. But that’s the point – ultimately, this is not a matter of market timing but of holding the appropriate balance of each. This is more important today with different long-term trends driving each investment style.

Below are three charts that put these underlying stock market dynamics in perspective:

1. Certain styles have outperformed following the bear market crash

In general, large caps and growth stocks have outperformed since the market bottom just a few months ago. This is partly due to on-going uncertainty around the economy and corporate earnings, but also due to large tech companies performing well during this period.

2. However, valuations have become very expensive as well

Although growth stocks have outperformed significantly, they also have much higher valuations. The chart above highlights the difference between growth and value price-to-book ratios. This spread has skyrocketed in recent weeks as a result of this dynamic.

3. Tech and health-related sectors have led the way but are also the most expensive

While many of these market trends could continue for some time, it’s important to remain diversified across styles and sectors. Tech and health-related sectors have done well and are expected to generate sizable earnings, but other sectors are much cheaper. In fact, all but 3 sectors are expected to have positive earnings growth in the next twelve months – not just those in tech.

The bottom line? Although the overall stock market is flat again for the year, not all parts of the market have behaved the same. This highlights the importance of staying diversified across styles and sectors to achieve long-term investment and financial goals.

For more information on our firm or to request an investment and retirement check-up, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today

Asset allocation and diversification do not guarantee a profit or protect against losses.

Past performance is no guarantees of future results.

You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.