US Debt Ceiling and Black Swan Events

Black swan events are defined as rare, unexpected and catastrophic occurrences that are impossibly difficult to predict. The term was popularized by former Wall Street trader and finance professor Nassim Nicholas Taleb, who wrote about the concept in his 2001 book Fooled by Randomness.

The term is based on an ancient saying that presumed black swans did not exist, a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild. Taleb describes a black swan as an event that 1) is beyond normal expectations that is so rare that even the possibility that it might occur is unknown, 2) has a catastrophic impact and 3) is explained in hindsight as if it were actually predictable.

Black Swan events are becoming more frequent rather than being a rarity, from the dot.com crash (2000), 9/11 Terrorist Attacks (2001), Great Recession (2008), Zimbabwe 79.6% hyperinflation (2008), Fukushima Nuclear Disaster (2011), Crude Oil Crash (2014), China Black Monday (2015), Brexit (2016), COVID19 and crash (2020) and the Russia/Ukraine war (2022). These events seem to tie financial and non-financial events together with a reach affecting individuals globally, well beyond Wall Street.

While no one can predict the next black swan event, one elephant in the room to keep an eye on is the almost $31.5 Trillion U.S. debt that is growing by trillions each year and the risk of the U.S. defaulting on the debt that could cause a vortex of problems. The US hit the debt ceiling last week, setting up a confrontation in Washington to either raise it or risk economic turmoil.

The debt ceiling was increased 45 times in the past four decades. While these past predicaments have agitated markets, the long-term effects have thus far been marginal. Still, as the current bear market and rolling recession is a bit past one year old and the Fed is still fighting elevated inflation, now would not be a great time for politicians to be playing chicken with the debt ceiling.

Debt Ceiling Contingency Plan

In the short term, hitting the debt ceiling indicates the government would no longer be able to pay its current bills. A U.S. government default, especially one that is self-inflicted in this manner, would be catastrophic to the global financial system. A preview of this bad movie occurred during the 2011 debt-ceiling crisis under President Obama when politicians on each side struggled to reach a deal. As a result, Standard & Poor’s downgraded the U.S. debt which triggered a huge market pullback to near-bear market levels.

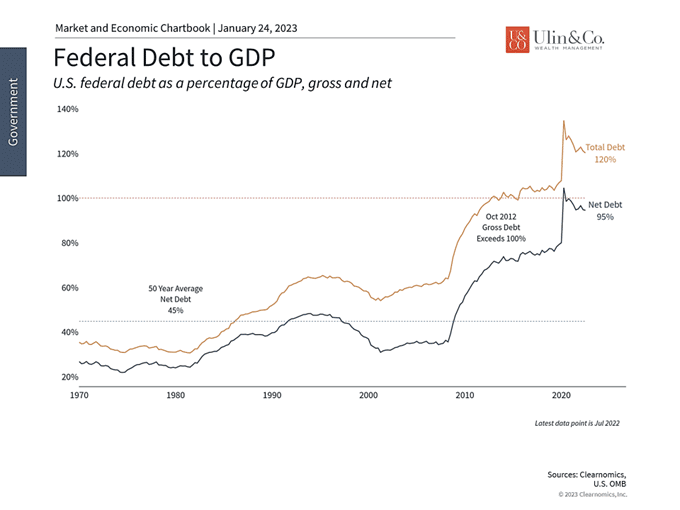

Over the long term, a growing federal debt is like driving cross country on a quarter tank of gas. As the debt-to-GDP ratio increases, debt holders could demand larger interest payments as compensation for an increased risk they won’t be repaid. When the debt eventually passes $50 Trillion and rates remain a bit elevated, the ability for the U.S. to service the debt could lead to an ugly black swan event. A looming debt crisis could result in both pushing back enrollment options and cutting down Social Security benefits as well as hiking income taxes.

While you may not be able to predict a Black Swan event, you can nonetheless put a debt-ceiling contingency plan in place for your portfolio through methods of diversification like installing impact-proof windows on your house. Consider diversifying a bit with international sectors as well as real assets that cover investments in physical assets such as real estate, energy, and infrastructure. Real assets have an inherent physical worth and are not tied to government spending risks in as much as health care and defense/aerospace sectors by example.

How the Debt Ceiling Impacts Investors

Over the past week, there has been nonstop news coverage on the federal government hitting the $31.5 trillion borrowing limit known as the debt ceiling. This once again puts the Washington drama on center stage as the Treasury Department enacts “extraordinary measures” to not default on its obligations. Although this has become a regular occurrence, many investors are still understandably nervous. While it’s unclear how this will play out politically before the estimated June 5th deadline, the fortunate news is that financial markets have taken these events in stride.

The federal government has hit the debt ceiling

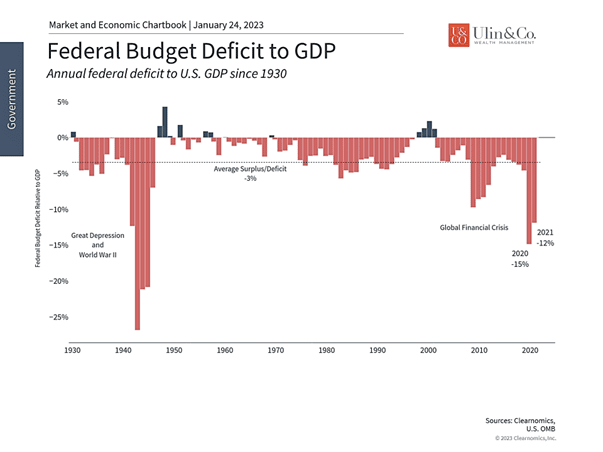

The large and ever-growing national debt is a controversial topic that impacts the economy and markets in complex ways. At its core, budget deficits occur when the government spends more than it collects in taxes and other sources of revenue, adding to the total debt each year. Even though tax revenues increase as the economy grows (even without raising tax rates), they have been outpaced by spending over time. These expenditures have grown across “mandatory” programs such as Social Security and Medicare as well as “discretionary” items such as defense and education, and have only accelerated since the global financial crisis in 2008 and the pandemic in 2020 with over $7 trillion dollars in covid-relief. The difference between revenues and spending is funded by government borrowing, i.e., by issuing Treasury securities. What makes this discussion challenging is that several complex issues are intertwined.

First, the question around the debt ceiling is not about government spending per se, since that spending has already been authorized through the normal budget process. The only question around the debt ceiling is whether the government can pay its bills. This is akin to signing the papers for a new car then afterwards requesting an increase to your credit card limit. For most of us, the decision to buy something can’t be separated from whether we will pay for it, even if it’s with debt. Unfortunately, the Congressional process for approving a budget by September 30 each year is separate from whether the Treasury can actually pay the bills.

The government has run budget deficits throughout history

Second, debt ceiling aside, the national debt at today’s level means that it has more than doubled over the past decade and, with very few exceptions, has grown nearly every year over the past century. While this is often framed as a partisan issue, the unfortunate reality is that neither party has addressed the problem over the past decade. The last major effort was the bipartisan Simpson-Bowles commission in 2010 which had little lasting impact on reducing government spending. The last balanced budgets occurred during the Clinton years and the Nixon administration before that.

Jon here. Given how heated the topic of government spending can be, it’s important for investors to distinguish between their political feelings and how they manage their portfolios. In other words, investors should focus on what they can control in order to differentiate how things work from how they would like them to be.

The unfortunate reality is that deficits are unlikely to go away. And yet, despite how unpalatable this may be to many, markets have done well regardless of the exact level of the government debt and taxes over the past century. In fact, as unintuitive as it might seem, the best times to invest over the past two decades have been when the deficit has been the worst. These represent times of economic crisis when the government is engaging in emergency spending, which tends to coincide with the worst points of the market. And while this isn’t something investors would hope is repeated often, it does underscore the importance of not over-reacting to fiscal policy and politics in one’s portfolio.

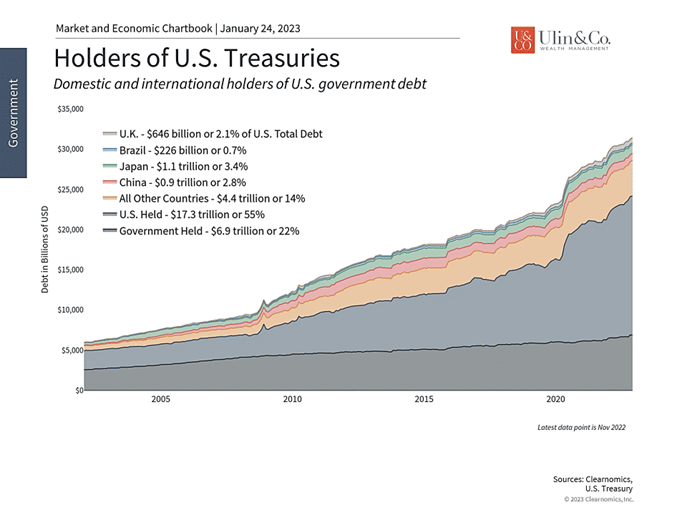

Most Treasuries are held domestically

Finally, many investors worry about who holds U.S. debt – and what this may mean financially and geopolitically as the debt grows and interest rates rise. (see above) While it’s true that Treasuries are held by other countries including China, since Treasuries are important to the global financial system, about 77% of the national debt is held either by the U.S. government itself or by U.S. citizens. The amount held by U.S. government entities is generally excluded by economists when considering the total size of the debt, since this is the equivalent of moving money from one pocket to the other. Thus, the many headline numbers that focus on total debt rather than “net debt,” which excludes intra-governmental borrowing, may not provide the most accurate picture.

That said, many investors worry that growing debt and deficit levels mean that Treasuries could be less attractive in the future. In the extreme, this could hamper the government’s ability to roll its debt, especially given the jump in interest rates. And while this is a possibility, it’s still unclear where the limits will be. Japan, for instance, has been operating with a debt to GDP ratio of about 250% for years. And although interest rates have jumped over the past two years, they have also stabilized and fallen over the past several months.

The bottom line? The debt ceiling and federal debt won’t be resolved anytime soon and there will continue to be media coverage over the next few months. As with many political issues, it’s important for investors to separate their concerns and not react with their hard-earned savings and investments. History shows that staying invested is the best approach to navigating drama in Washington.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.