Crude Oil Prices Driving Inflation and Politics

The Fed has been wrestling inflation down over the past year while crude oil prices are now driving it back up. This could lead to expectations for more Fed rate hikes going into 2024 along with the odds of a more turbulent economic landing.

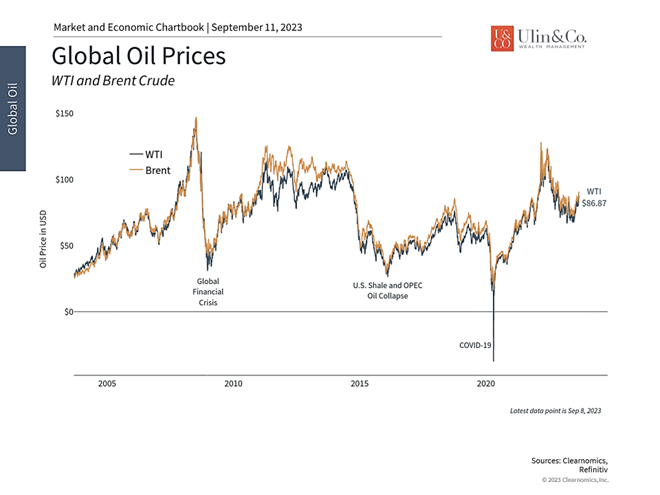

Since mid-June, Brent crude prices have risen over 26%, from around $72 per barrel to above $90. (See chart below) Oil and gas prices going back up should not come as a great surprise. Russia, Saudi Arabia, and OPEC+1 had discussed in March about cutting oil supply, China reopened after three years of zero-COVID policies, and President Biden utilized a good portion of the U.S. Strategic Petroleum Reserves (SPR) to help squash inflation.

The SPR is an emergency stockpile of petroleum maintained by the United States Department of Energy (DOE). It is the largest publicly known emergency supply in the world; its underground tanks in Louisiana and Texas have capacity for 714 million barrels. Biden’s drawdown brought the reserve to about half its capacity as he sought to minimize high gas prices of more than $5 per gallon nationwide. Tapping the reserve is among the few actions a U.S. president can take to try to control inflation, an election-year liability for the party in control of the White House.

Oil Dependency

Demand for oil is here to stay in the coming decades and any decline will only be very gradual, despite the wishes of many environmental activists that big oil firms around the globe will stop pumping oil immediately and leave the world to run on green energy.

Crude oil touches quite a bit of our lives and is utilized as a base for more than just jet fuel, gasoline, diesel fuel, heating and electricity generation. It is also part of petroleum byproducts for tar, asphalt, paraffin wax, and lubricating oils, to chemical use in fertilizers, perfumes, insecticides, soap, and vitamin capsules. Plastic involves use in heart valves to plastic bags, otherwise carbon fiber in aircrafts, PVC pipes, cosmetics and even for windmill parts.

Energy Sector and Inflation Correlation

Oil prices affect 95% of transportation and can create higher food prices. It also impacts 45% of industrial products and around 20% of residential use. As a result, higher oil prices increase the cost of everything you buy, creating inflation.

Oil volatility affects more than stock prices. Higher energy prices are effectively a tax on consumers and businesses. Gasoline prices have been rising steadily since last year with the national average of regular unleaded climbing to $3.90 per gallon, prices not seen since March 2022. (See Y Charts below) Higher gasoline prices eventually filter through to all goods and services.

Oil Price Impacts On Markets and Consumers

Oil is still a critical input into economic activity with the International Energy Agency estimating that global demand will rise to 102 million barrels per day this year. Demand plummeted during the pandemic and the price of oil even briefly turned negative, but this reversed quickly as economic growth surged when lockdown restrictions were lifted. Oil prices then spiked in February last year when Russia invaded Ukraine, raising concerns over the supply of energy for Europe and the rest of the world. Fortunately, oil prices began easing soon thereafter, falling from nearly $128 at the peak.

Oil matters to markets and investors for many reasons. Not only does the price of oil interact with broad markets and the U.S. dollar, but it is also an important driver of inflation. For these reasons, the recent increase in oil prices could hinder improvements in inflation and act as a drag on the broader economy.

Energy and Sector Comparisons

When it comes to the stock market, these dynamics have driven significant volatility for the energy sector of the S&P 500. The sector has risen nearly 17.2% over the past year (see chart) but this includes a decline of 18.8% from November 2022 to March 2023 followed by full recovery. On a year-over-year basis, its return is third only to the information technology and communication services sectors which have led markets this year.

This is another reminder to investors that it is exceedingly hard to predict which parts of the market might outperform in any given year, and chasing what’s already performed well can backfire as well. Changes in leadership between energy, tech, consumer sectors, and others have been commonplace as the world stabilizes, the inflation story unfolds, and investors look to the next market cycle.

As always, the best course of action is simple: long-term investors should maintain balanced allocations across a variety of sectors and asset classes. Doing so in a way that is tailored to financial goals is still the best approach for increasing the odds of investment success.

The bottom line? Crude Oil Prices Driving Inflation in recent months has been due to a steadier than expected economy and production cuts. While this may act as a headwind, the economy remains healthy and there are other signs that inflation is improving. Investors should stay balanced in the months ahead.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.