Reading Corporate Earnings Tea Leaves

While the anxiety and anguish from the past year’s crash of stocks, bonds, crypto and most all asset classes has hardly subsided in investors brains and portfolios, the financial markets kicked off 2023 with a strong advance led by tech stocks in January. Adding additional confidence, the share of S&P 500 stocks closing above their 200-day moving averages advanced recently to 77%, the highest since September 2021 (source: BarChart)

Even with a solid start to the year, investors continue to receive mixed signals. On the one hand, inflation is improving which has allowed interest rates to stabilize at a lower level. On the other hand, last week’s jobs report was a significant surprise to the upside in January with the unemployment rate falling to 3.4% as noted by the FRED January unemployment rate report. Although the diminishing inflation data suggests the Fed could slow or pause its rate hikes, this positive data indicates that they may stay hawkish and vigilant.

While no one wants to fight the Fed fighting inflation, only time will tell if the Fed is right to be playing hardball that could result in a deeper recession, or perhaps investors are fittingly optimistic and correct to be pricing in rate cuts later this year along with a slower

Will this recent robust stock rebound continue to build over time while the Fed is fighting inflation, or is it just a temporary reprieve like a dead cat bounce? The quick answer may be the former, as long as the Fed does not get overzealous with rate hikes much above their 5% target discussion in the news. Even if the Fed holds and does not pivot down the markets may still unusually advance.

A dead cat bounce is an investing term for the temporary increase in the price of a stock, sector or other asset during a long period of decline. The morbid term comes from the idea that if it falls far enough, even a dead cat will bounce. Technically speaking, a dead cat bounce can only be identified after it happens. The “bounce” is the short-term price increase that is preceded and followed by a swift decline.

The most important way to stay grounded this year is by being familiar with the trends, facts and figures that drive markets in the long run past any short-term potholes, like jobs and corporate earnings, rather than the speculation and ominous opinions that occupy headlines to financial news shows with celebrity investors, CEO’s and media personalities that can head-fake investors to take unsuitable action. In the long run, the stock market follows corporate profits, which is the focus of this week’s discussion.

Corporate Earnings Can Lead the Way

Jon here. It’s for this reason that investors focus heavily on following corporate earning readings like tea leaves, since they are the link between the economy and markets. Although markets can fluctuate in the short run, rising earnings are what allow stocks to create wealth for investors over full business cycles.

Stock market investors don’t directly invest in the economy. Instead, they are impacted by economic trends through the revenues and profits of the companies in which they invest. When the economy is growing rapidly and consumers are doing well, company sales tend to improve. When inflation is rising or the job market is competitive, costs may rise. At a macroeconomic level, the job of companies is to balance these opportunities and risks.

Stock market follows earnings trends over decades

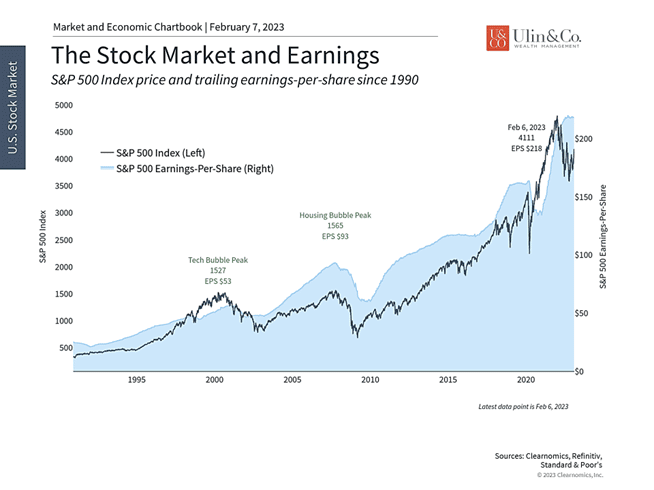

Over long periods of time, the stock market tends to follow earnings trends, which in turn follow economic cycles.

Given the importance of earnings, it’s no surprise how much coverage there is of individual company earnings reports in the news and in the investment industry. However, for long-term investors, the aggregate earnings picture for the S&P 500 matters much more.

So far many of S&P 500 companies have reported fourth quarter earnings. This was a quarter during which costs were elevated compared to the year before due to inflation and rising wages, while consumer spending was weakening and there were fears of an upcoming recession.

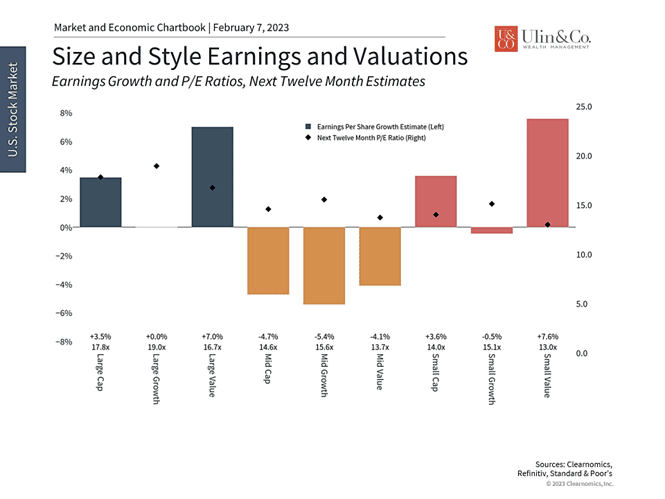

This led to lowered earnings estimates which has allowed 69% of S&P 500 companies that have reported to beat expectations so far, while 65% have beaten on revenues as reported by FactSet. Overall, S&P 500 companies are estimated to have grown earnings by 7.4% in 2022 but will only experience 3.5% growth over the next twelve months (see below), before accelerating again in 2024.

Earnings may slow across market categories

Just as many economists expect flat or slightly negative economic growth in 2023 before seeing a recovery in 2024, many expect earnings growth to be meager this year as well. In this way, both sets of data point to a “reset” as the world adjusts to the shocks of the past few years – or as many investors like to refer to it, a “v-shaped recovery.” In this context, there are two facts to keep in mind.

First, corporate earnings are still at record levels for large cap companies with S&P 500 earnings-per-share reaching about $218 on a trailing basis (source: macrotrends chart). Analysts are not anticipating negative growth in 2023 – just slower growth. This does differ across market size and style categories, however. Mid-caps, for instance, are expected to see earnings decline in 2023 while small caps could see faster growth. However, both of these size categories are much more attractively valued than their large cap counterparts, despite these earnings trends.

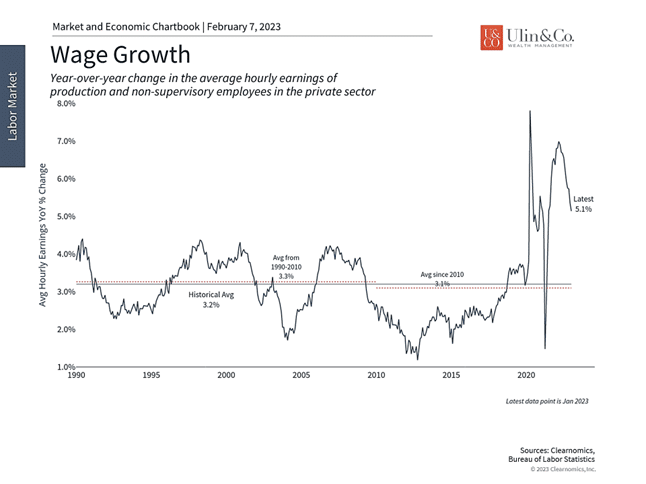

Second, if inflation continues to slow, costs may improve and help support profitability across companies of all sizes. After all, rising costs due to higher goods prices and growing wages have crimped earnings over the past year. Similarly, if consumer confidence returns and spending rebounds, this could help prop up earnings.

This is a balancing act since the flip side of consumer spending is wage growth, which represents higher costs for businesses. Wages are still growing 5.1% year-on-year (see chart), but this has eased from recent peaks.

Corporate costs could improve as inflation eases

Of course, the specific circumstances differ across individual companies and industries. We expect earnings growth from the commodity-sensitive materials and energy sectors which benefited from rising prices last year, and the real estate sector which has been directly hit by rising rates despite the challenging environment.

It’s important to keep in mind that analyst forecasts are not always accurate and are subject to change based on economic conditions. Still, expectations for this year align with slower growth trends across the economy. However, they also suggest that earnings could rebound once the underlying fundamentals improve and inflation stabilizes. Either way, record earnings continue to support valuations which are the most attractive in years.

The bottom line? To cut through the noise, investors should continue to focus on fundamentals such as corporate earnings as the Fed and inflation stories play out.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Corporate Earnings.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.