Consumers Driving GDP Through Market Volatility

It sounds counterintuitive that the S&P 500 index deteriorated into correction territory last week despite robust consumer spending this year on home, travel, cruises, cars, luxury items, concerts, movie theaters, sporting events, dining out and more, while continuing to boost corporate profits and the economy.

The consumer driving GDP greatly surprised to the upside despite elevated interest and mortgage rates, lingering inflation, a banking crisis, two wars, union worker strikes, a wobbly China economy, and a snowballing U.S. debt.

Taylor Swift Effect

Overall GDP and consumer spending both recorded the fastest pace since late 2021. Perhaps we should call this the “Taylor Swift effect” as the epitome of consumers nonchalantly burning through the still extra trillion dollars of COVID- relief and wage inflation cash floating around the financial system, more so than someone sailing by Santorini while sipping on a Sauvignon Blanc.

Taylor Swift swept the box office with the highest-ever concert film opening, eventually reaching an estimated $129.8 million so far. But it’s nothing compared to the $4.1 billion projected revenue from the current tour itself. This is epic income, considering companies from Rooms to Go to New Balance generate about the same revenue per year.

Original tickets for Taylor Swift’s The Eras Tour selling for up to $500- resold for an average price of $2,183 in the secondary market. Resellers may need to prepare to receive form 1099-K from the IRS this upcoming tax season, as they likely “easily exceed” the new reporting threshold. I can appreciate the maxim that millennials, more so than their boomer-parent counterparts want to pay more for “experiences” more so than for tangible items, but this is insanity for a few hour concert plus other add-ons.

Don’t’ Count on Forecasts

Following the 2022 market crash, the consensus of many economists betting on a 2023 recession did not pay off. JP Morgan’s CEO Jamie Dimon recently stated that “18 months ago central banks were 100% dead wrong, so maybe there should be some humility about financial forecasting.” This reminds me of the saying “economists were invented to make weather forecasters and astrologers look good.”

The exponential increase in the value of their homes, combined with higher wages and extra savings on hand provided investors’ confidence to spend confidently. These factors, along with the fact that many Americans having locked in lower home and auto loan rates over the past decade, has helped their household balance sheet to weather the inflation storm. All the while the DJIA, S&P 500 and NASDAQ indices all decreased down more than 10% into correction territory as of last Friday. The holy-grail S&P 500 index is down near -12% and -7.6% since the top of 2022 and 2021 respectively.

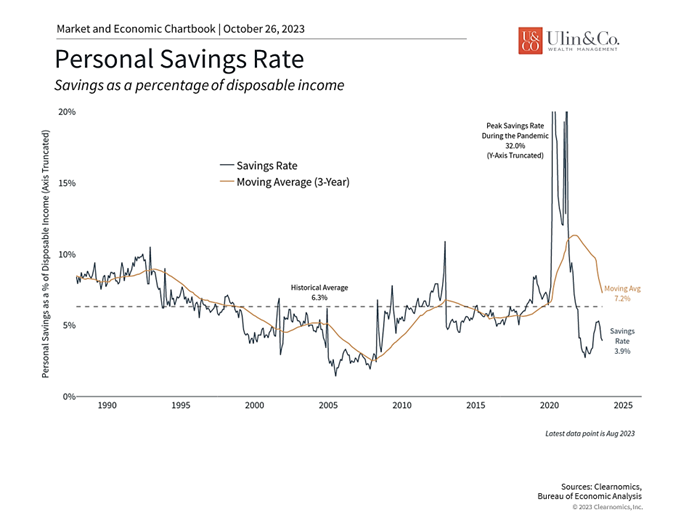

The Fed’s rate hike medicine along with higher rates on longer term Treasury bonds may just be starting to sink in, as Americans’ billions of excess cash amassed from post- quarantine savings, COVID relief money and wage inflation diminishes over time while credit card spending is increasing. In September, they saved 3.9% of their income, about half the rate they saved in the fall of 2019, the Commerce Department said (see chart below). The good news is that spending, income, and inflation all are moderating while the Fed appears to be at the end of its historic rate hike cycle while taking a needed hike- pause this week.

Watch Less News

The media makes it difficult for long term investors to remain calm and focused through months or quarters of volatility as ominous headlines focus more on reporting on all the negative domestic and geopolitical events that could possibly throw the stock market into a recession-led tailspin, rather than discuss the positive financial mechanisms that could lead to a soft landing.

Jon here. When driving your diversified portfolio through hurricane weather and fear cycles with low visibility, it helps to stay calm and go the speed limit based on your personal risk tolerance, rather than to slam on the brakes and or pivot your portfolio into less liquid insurance and or alternative positions that come with other costs and risks. Many times, inadequate asset allocation, poor security selection and overtrading can derail your long-term retirement plans more so than market results over the long run.

Somewhere between the Personal Consumption Expenditures Price Index (excluding food and energy) ticking down last month (September) to 3.7% from 3.8% and CPI ticking back up to 3.7% from 3.1% over the past few months, three words, Higher-for-longer, may continue to trouble investors brains, quant trading systems and the markets till the Fed’s 2% CPI goal gets closer in sight for them to start lowering rates, which may be closer to being achieved by the end of 2024 in our opinion. Still conditions are improving while inflation is slowly cooling off over time. Shelter, which is a huge 40% of CPI will take a while to decelerate and will help greatly to lower CPI over time.

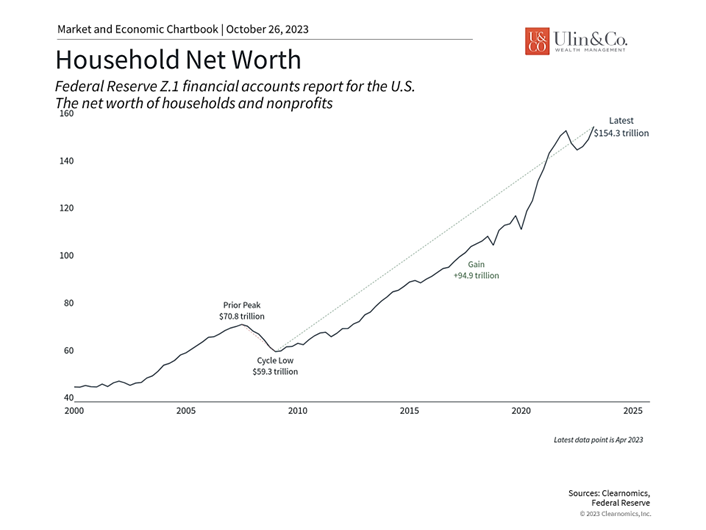

Household Net Worth is High

The strength of consumer spending and household balance sheets has been a bright spot in an otherwise challenging market and economic environment as we noted above. These factors have helped to keep the economy out of recession and have bolstered corporate earnings, but they have also kept inflation hotter than the Fed might otherwise like, resulting in higher interest rates.

For investors and savers, recent consumer data are a reminder that staying the course, and not overreacting to short-term news, is still the best way to build and preserve long-term wealth. Consider the following factors and three charts regarding the state of consumer finances as market and economic ambiguity continues.

Household net worth has reached a new record level

Consumer finances both affect the economy and markets and are affected by them. In the U.S., consumer spending makes up 68% of all expenditures each year, forming the foundation of overall economic activity. How consumers feel about their personal financial situations can thus have an important impact on economic growth, and vice versa. When times are difficult, such as during a recession, consumers naturally tighten their belts which can lead to a spiraling economic slowdown. On the other hand, when the economy and job market are strong, consumer sentiment improves. This in turn supports corporate revenues and profits, spurring hiring and wage increases which can drive further consumer spending. Ideally, this then supports financial asset prices and valuations.

The economic swings since 2020 are proof of this – from the sudden collapse in consumer spending during the pandemic to the surge in activity during the subsequent rebound, driven in no small part by government stimulus. Fortunately, despite high inflation rates over the past two years, consumer spending has continued to support the economy. This is partly because the average household balance sheet has never been stronger. The Fed’s latest Z.1 report on the Financial Accounts of the United States shows that household net worth climbed to a record level of $154 trillion in the second quarter of the year. (see chart above) This measure includes household assets such as stocks and bonds, bank deposits, defined benefit entitlements, real estate, and more, as well as liabilities such as credit card debt and mortgages.

The chart above summarizes the positive net effect on household net worth. It also shows that net worth has more than doubled since the prior 2007 peak. This has occurred despite the never-ending challenges investors faced along the way, including market pullbacks, geopolitical crises, economic slowdowns, problems in Washington, and more recently, inflation, Fed rate hikes, and more. This is a reminder that having a long-term focus has historically been rewarded, regardless of how worrying the short-term headlines may be.

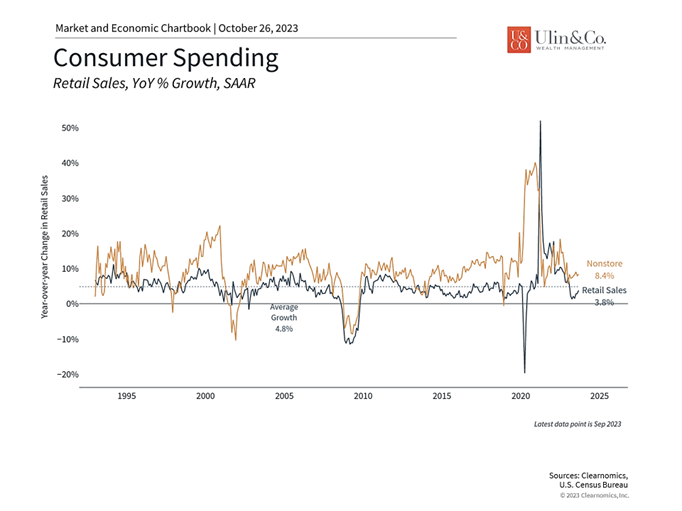

Retail sales have picked up

Of course, not all households have benefited equally from these trends. Those with wealth invested in the stock market and real estate have done better since those assets have appreciated significantly. Perhaps more importantly, those that stayed invested and resisted the urge to stray from their financial and investment plans when times were the toughest most likely benefited the most. Fortunately, another bright spot in today’s economic environment is the stronger-than-expected labor market. With unemployment still near historic lows, more Americans have benefited from job security and wage growth, supporting consumer spending even more than in past cycles.

This can be seen in recent retail sales figures. The September data published by the U.S. Census, for instance, were better than economists expected with total retail sales growing 0.7% month-over-month. The previous month’s numbers were also revised up significantly. Other data such as Personal Consumption Expenditures, which serve as an input to GDP calculations and are adjusted for inflation, show similar patterns. There may be headwinds in the near future as consumers draw down on the excess savings of the past few years and if oil prices remain high, but overall, consumers have been remarkably resilient.

Personal savings have declined after a sharp uptick

From a financial planning perspective, there is possibly nothing more important than saving and investing enough to meet future goals. This is because, unlike daily market swings, how much you save and how you invest those savings are completely within your control. The accompanying chart shows that savings rates spiked in 2020 but have been low since then as consumers have spent on goods and services. While this has helped support the economy, households will eventually need to tighten their belts. Investors should continue to stick to their long-term financial plans in order to navigate this uncertain environment and benefit from future growth.

The bottom line? Household net worth has returned to historic highs this year and the economy has been stronger than expected as consumers driving GDP has helped to avoid a recession. This is a reminder that all investors should maintain a long-term perspective rather than focus on daily market swings.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.