Sell-Off Strategy amid China Real Estate Debacle

When the irrational exuberance of the crowd turns into irrational anxiety leading to a brisk market sell-off, should you buy a bigger mattress or “buy the dip?” The short answer is more towards the latter.

Headlines on the impending default of an $83 Million interest payment due this week by Chinese property developer Evergrande on it’s $300 Billion in debt is raising concerns about a potential liquidity crisis among all Chinese and Hong Kong property companies, leading up to a potential real estate debacle and financial crisis that could seep into other world economies.

Our fundamental thesis remains unchanged that China will contain this dilemma as the underlying U.S. economy appears to be solid and should advance into and through 2022. We see the selloff as an opportunity to continue buying securities through methods of rebalancing, dollar-cost-averaging, and or going in with cash (buy the dip) into well-diversified, risk allocated portfolios.

Markets (and humans) are supposed to be irrational and sometime illogical. Disciplined investors know that smart money is made on the downside not upside. Market pullbacks and corrections also can provide a great opportunity like an emergency test or fire-drill, to check how your portfolio is holding up while reviewing what changes you may need to make as far as your asset allocation and risk tolerance.

Maintain Perspective Amid Multiple Local and Global Concerns

Markets have previously brushed off geopolitical events, but the behavior gap between the US markets and world events appear to be narrowing as the planet feels like it’s getting even more interconnected from tech, social media and trade to viral health and financial issues. While China is the second largest world economy second only to the United States with 15% of world GDP and near triple America’s 328M population, there may not be a direct financial impact.

Jon here. There are many scary bewitching issues abound as we are turning the corner into October. Most of the global selloff this week was more human and algorithm driven ahead of potential problems with China, Delta pandemic worries, Powell’s interest rate and taper talks, Biden’s $6 Trillion Budget proposal, tax hike proposals, the debt ceiling approaching, and heated inflation anxieties in addition to seasonality issues where historically, September has been one of the worst months for stocks.

While these events have all captured the market’s attention, there are three facts that investors should remember.

First, markets have been worried about a “China hard landing” since at least 2010 as the country’s growth rate has slowed. From 1980 to 2010, Chinese real GDP grew by 10% per year – an astonishing pace as it caught up to the rest of the world. Growth then slowed to between 6-8%, although this still outpaces the rest of the world.

Many feared that this slowdown would worsen the imbalances that had been growing within the Chinese economy. One key area of concern has been the so-called “shadow banking” system – financial activity that takes place in non-traditional and less regulated channels such as through wealth management products – and whether it would create a 2008-style “Big Short” financial crisis. So far investors’ worst fears haven’t materialized.

More recent concerns around Chinese government interventions and regulations add to this backdrop. Government scrutiny and rules on education companies, tech, and even video game limits, have hobbled Chinese stocks which in turn has hurt the performance of emerging markets.

Second, while investors may be concerned about these issues and their repercussions across markets, these risks are exactly why investors are rewarded over long time horizons. Despite recent market volatility, emerging markets have contributed significantly to diversified portfolios over the past twenty years. Investing in China and EM requires accepting a large degree of uncertainty. These uncertainties may be due to systemic risks, debt “bubbles,” regulations, market efficiency, the rule of law, and many other issues that are less common in developed markets.

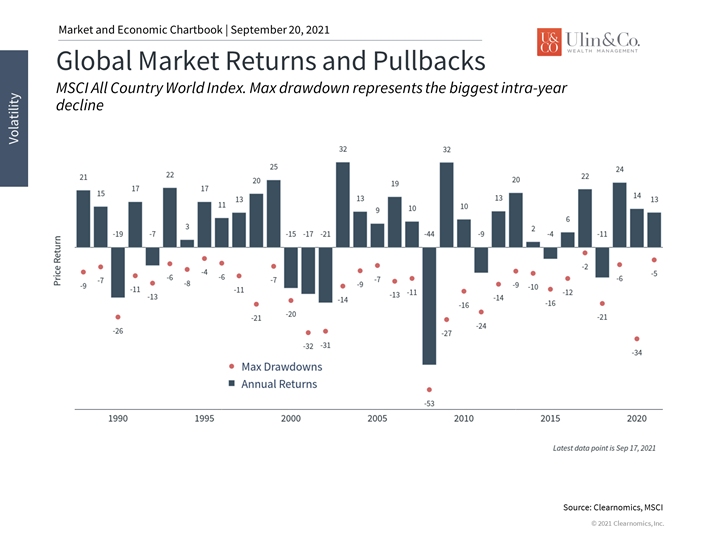

Third, some are calling for a market correction as a result of this episode, combined with uncertainty from the Fed’s tapering and rate hike discussions along with tax hike proposals currently on the table. Investors should remember that market corrections are both normal and unpredictable. There are always those who believe a market crash is right around the corner throughout bull market cycles. As we near the end of the third quarter of the year, the largest decline for the S&P 500 this year is still less than 5%. Even if this changes in the coming days and weeks, the average year experiences much larger drawdowns. (see below)

Thus, while every market pullback is challenging and each new situation feels unique, the reality is that diversified portfolios tend to stabilize and recover regardless of the underlying causes. The possible debt default situation in China could worsen but this has been on investor and government officials’ minds for over a decade. Resisting the urge to overreact to every new development is the best way for investors to help achieve their financial goals. Below are three charts that help provide perspective on recent market worries.

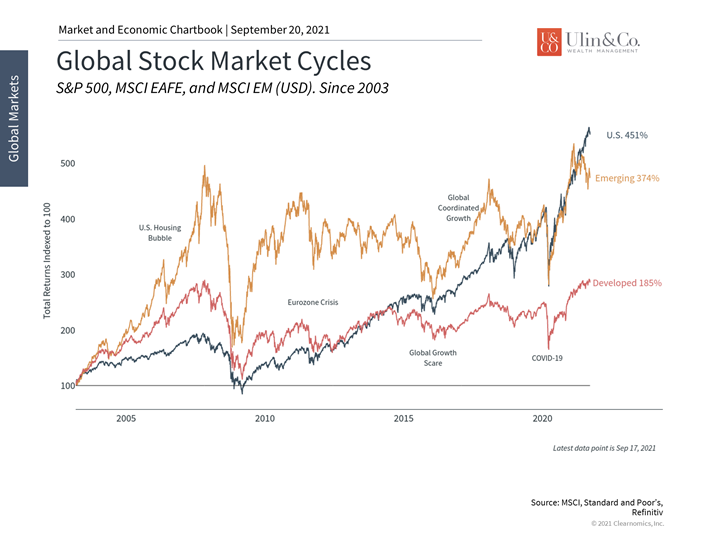

1 Emerging markets are volatile but have rewarded patient investors

Emerging markets have been the most volatile region. However, investors who include these assets in well-diversified portfolios have been rewarded over long time periods.

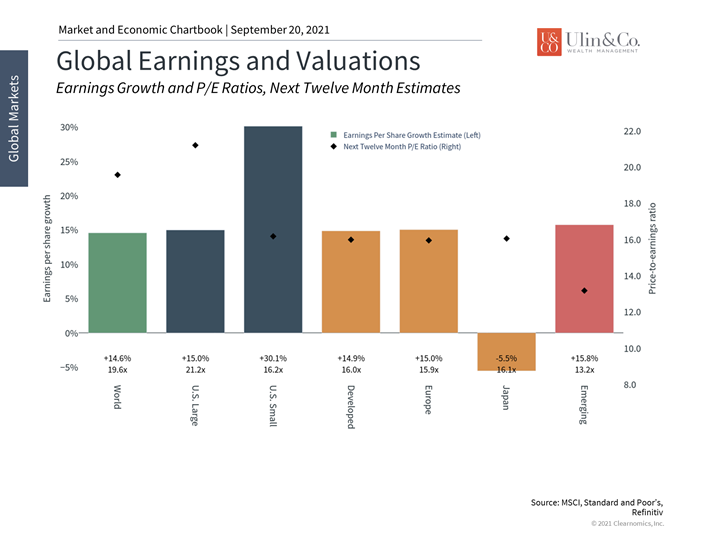

2 EM stocks are attractively valued, especially with new concerns

Unlike U.S. and developed market stocks, emerging markets have faced significant volatility over the past several months. In addition, they have been slower to recover from the pandemic slowdown. As a result, their valuation levels are much more attractive than other regions despite comparable earnings growth rates.

3 Market corrections are normal – and impossible to predict

The bottom line? Investors ought to maintain perspective and stay diversified through periods of market uncertainty, whether due to the China real estate debacle, the Fed or other concerns. Investing in stocks, as part of a diversified portfolio, is a long run proposition over years not days.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Image: Shanghai.China-Feb.2021 /istock

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.