Cash is King While Stocks Rule for Retirement Investors

Whether you are in or nearing retirement, there are critical factors that come into play with your financial plan when determining whether to hold cash for high yields and safety or invest your life savings into the stock market through volatility and uncertainty to better help meet your goals while keeping up with taxes and inflation for the long run.

There is no denying the attraction to invest in today’s cash, annuity, insurance and alternative hedging products that are paying record high yields as a an alternative to stocks, or because the ominous economic headlines are motivating you to pivot retirement savings off the table into less liquid strategies. Many of these non-cash products are often sold, and not bought. Still, consider a year or so from now when rates are cut in half, the next economic cycle commences and investors are cheering the stock market, you may have been better off staying course with stocks while buying low, dollar cost averaging and utilizing methods of diversification.

Consumers Stay Afloat

Before chewing over cash vs stock investing, let’s review how we got here and why the past three quarters of GDP have been positive despite overwhelming consensus by economists and the media experts in Q1 that inflation and rates were to lead to a major recession that never happened.

Inflation has dropped dramatically over the past year from 9.1% to near 3.2% while despite Fed intervention, unemployment numbers remain historically low and consumers keep spending. Despite the 5.5% Fed Funds rate and near 8% 30-year mortgage rates, consumers are still spending money like it’s 1999, fueled a bit by wage inflation and cash on hand. Many individuals benefiting from the past decade of low interest rates had already locked in ultra-low rates on auto loans and mortgages, or refinanced down debt right before the rate hike spike that began last year, helping to insulate them.

While rates on some loans such as credit cards and HELOC’s are floating up, locked in low rates have kept the consumer afloat, which helps drive 70% of GDP despite ongoing recessionary fears. Households are paying near 9.6% of their disposable income to stay current on their debts in the first quarter, according to the Fed. That is above where it was in the depths of the pandemic but below the postcrisis average.

As noted by the WSJ, “as of Q1 this year, only 11% of outstanding household debt carried rates that fluctuated with benchmark interest rates, according to Moody’s Analytics. That metric has hovered around this historically low level for over a decade. But it only started to matter when the Fed began its campaign.” Fixed rate loans became the trend again after the credit-led 2008 Great Recession when adjustable-rate mortgages and home equity lines of credit were fashionable.

Cash is King For Now

Cash has traditionally been considered a safe-haven for preserving capital. However, the allure of holding cash has evolved due to the changing interest rate environment. With the prevalence of high-yield savings accounts and money market funds paying near 5%. Individuals can earn a reasonable yield on their cold-hard cash not seen in over 15 years, while maintaining a level of liquidity and safety.

One advantage of holding cash with high yields is the flexibility it offers. Cash provides immediate access to funds to navigate unexpected financial challenges while acting as a cushion during market downturns. This level of security and liquidity can be especially advantageous for those that may need cash quickly due to a life triggering event.

On the other hand, cash is not risk free as it does not keep up with taxes and inflation over time and does not pay dividends like bonds, provide tax free income like municipals, or provide growth like stocks. The most significant risk of holding cash is reinvestment risk. By the time you feel better about the stock market and the headlines a year from now, your money market and CD yields may reset at less than half of today’s rates, while you would end up getting back into the stock market at a higher point. This goes against the grain of the Buffet maxim to be greedy when others are fearful while continuing to buy low.

Having cash on hand for one to two years of cash reserves in high yield instruments as part of your bucket-strategy approach and financial plan may be a smart idea. Overconcentrating in cash instruments may end up throwing off your long-term goals while not keeping up with inflation and taxes for retirement investors.

Stay Balanced with Diversification

Rather than viewing cash vs stock investment options as mutually exclusive, a balanced approach often proves to be the wisest course of action while considering your risk tolerance and financial objectives. Maintaining a cash cushion ensures you’re prepared for immediate financial needs and capitalizes on short-term opportunities. Simultaneously, a well-constructed stock portfolio can provide the growth potential needed to achieve long-term financial goals.

Time is a crucial factor when considering long-term investing in stocks. The longer your investment horizon, the more you can benefit from the market’s historical tendency to recover from downturns and deliver solid returns over extended periods. Investing is truly more about your time in the market than timing the market. Market timing is truly the fool’s game. Next, we’ll cover a few factors on why investing early is key to helping achieve your financial goals.

Investing Early

For long-term investors, knowing the difference between what can and cannot be controlled is the key to both financial success and peace of mind. While all investors would like to believe they can predict or even control the direction of the market, experience teaches us that this is difficult to do. Constructing and managing an appropriate portfolio, while making strategic and tactical allocations based on market opportunities, ideally with the guidance of a trusted advisor, is often the best approach. However, while following markets and maintaining perspective on the economy is important, an even more fundamental key to success is simply to start saving early, stay invested, and remain focused on long-term financial goals.

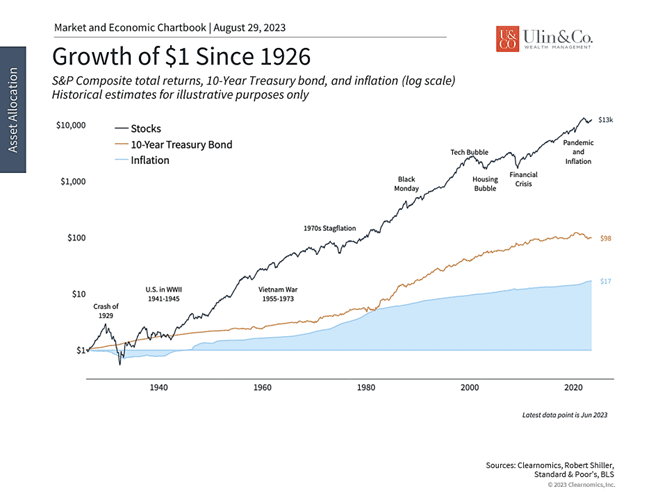

The growth of an initial $1 investment over the last century has been remarkable

Staying financially disciplined has never been more important due to the sheer volume of noise from the media and the financial services industry. It seems as if headlines bounce from one concern to the next every week, with markets constantly swinging from exuberance to distress, as they have already done many times this year. For inexperienced investors and financial professionals alike, this can often be overwhelming.

The reality is that this is nothing new. In 1979, for instance, the cover of BusinessWeek famously proclaimed “the death of equities” due to inflation – just as many did last year. In the short run, these assessments were correct as markets pulled back due to economic shocks and recessions. However, both the market and economy eventually recovered. Not only has the market experienced strong returns this year, recent volatility notwithstanding, but the past forty years since that magazine cover was published have been some of the best in history.

This pattern plays out when looking back even further: the accompanying chart highlights the growth of $1 invested in 1926 in stocks and government bonds. Amazingly, a $1 stock investment almost a century ago would have grown to over $13,000 today despite the numerous challenges along the way. Even when invested in risk-free government bonds, the value of that dollar would have climbed to $98. In comparison, inflation has eroded the purchasing power of cash, with $17 now needed to buy what $1 used to.

What this chart shows is that over this time frame, the stock market has created significant wealth for patient investors. However, bonds are also needed to smooth out the bumps along the way in order to help preserve wealth. A proper asset allocation that takes advantage of both asset classes, and possibly many others, is the best way to navigate turbulence while positioning for long run growth. (Please note that this chart uses a “logarithmic scale” to highlight the comparison between stocks, bonds, and inflation. If shown on a linear scale, the steepness of the stock market line would be even more dramatic.)

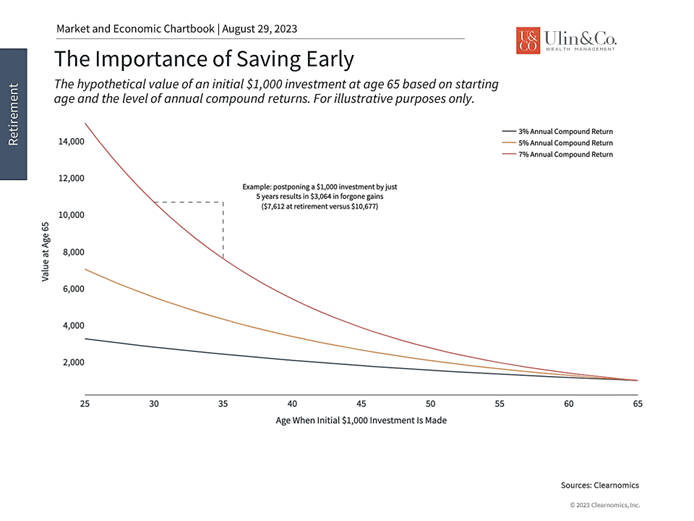

Saving early can have a significant impact on portfolio values

What’s just as important, and fully within an investor’s control, is when they begin to save and invest. For example, an initial $1,000 investment, compounded annually at 7%, can hypothetically grow to over $10,000 by age 65 if the investment is made at age 30. If it’s instead made at age 35, only 5 years later, the investment will only grow to about $7,600. The accompanying chart shows this pattern across different ages and return assumptions, highlighting how significant a difference any delay can make.

While investing is often viewed as the activity of following markets, economic data, stocks, and current events, this underscores the fact that budgeting and planning are equally important, if not more so. After all, investors don’t get to choose whether they live in an era of low or high annual returns. However, this chart shows that investing at age 30, instead of age 40, makes as big a difference as experiencing a 5% or 7% annual return over the course of one’s life.

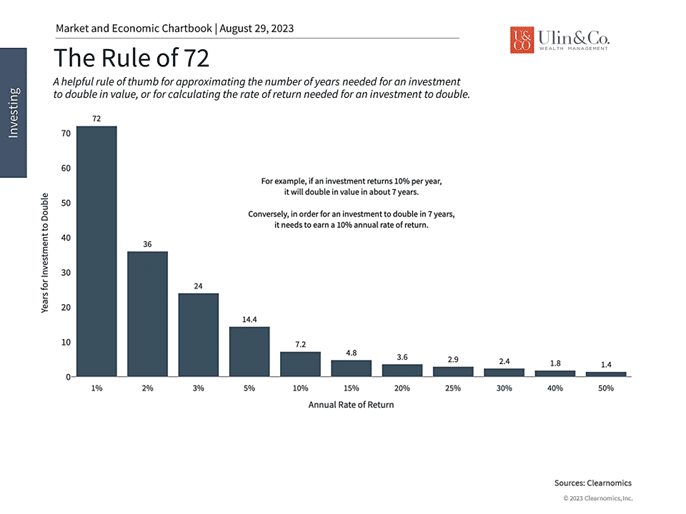

The compounding effect of investments requires time

This is because the compounding nature of investments can only work if there is sufficient runway. Given enough time, not only do investment returns add to a portfolio, but those returns generate their own returns, and so on and so forth. In this way, compound interest is what creates true wealth for investors over long periods of time.

The rule of 72 is a simple way to understand this compounding effect. It is a rule of thumb that estimates how quickly a rate of return would lead to a doubling of a portfolio, or similarly, what return is needed to double a portfolio in a certain amount of time. For example, with a 5% to 10% annual rate of return – a range consistent with long run historical returns – a portfolio would double in 7 to 14 years. Thus, starting early creates more opportunities to benefit from this effect. Of course, while the rule of 72 is based on pure arithmetic, markets can vary wildly on a week-to-week or month-to-month basis.

The bottom line? While investors should understand and maintain their perspective on the market and economic environment, it’s equally important to invest early and stay invested through challenging times. History shows that this is the best way to achieve long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.