Be Mindful of Cash & Portfolio Ingredients as Inflation Soars

Mise en place is a French culinary phrase roughly implying to “put everything in its right place.” It refers to the precise setup chefs utilize to prep and organize numerous ingredients in advance that will be utilized for different menu items.

A chef’s station is an extension of their nervous system, with different flavors and components ready to work together, such as salt, pepper, spices, wine, garlic, olive oil, meats, sauces and chopped vegetables. Whether cooking for two or two hundred, an experienced chef can find almost everything blindfolded.

Portfolio management, like cooking, is also about planning ahead with various ingredients in a formulated and measured manner before executing. An investors “station” can be composed of several core components that may include cash, bonds, stocks, alternative investments, commodities, real estate and perhaps even a pinch of crypto as part of their asset allocation “recipe” for portfolio construction and diversification measures.

While the sum of the parts working together for your prepared dish is of more importance than each individual ingredient, it can be a bit more frustrating when the short-term outcome of your diversified investment strategy appears ineffective.

Heated Inflation

U.S. inflation data just climbed to 8.5%, the worst in four decades. This is at the top of most everyone’s minds and wallets every time bills are paid. Gas prices jumped 48% year over year while home and auto prices are skyrocketing.

Heated inflation along with continued headwinds from the Russia/Ukraine war, oil and commodity prices, continued supply side shocks, pandemic variants and the past few years of trillions of dollars infused into the economy by the Fed, have made elevated inflation and prices less transitory.

The fallout has led the NASDAQ and S&P 500 index down near -19% and -13% respectively over the past quarter, while both are still treading water in the red. Even more remarkable, U.S. investment-grade corporate bonds have registered a negative -10% total return YTD in line with the S&P 500 losses, after booking their worst quarterly loss since the global financial crisis 14 years ago.

While we have discussed in many past newsletters that diversification may be the closest thing to a free lunch and can help to smooth out volatility and returns over time for long term investors, there are times like these where many of the ingredients of a diversified portfolio from stocks and bonds to crypto, appear correlated and heading in the wrong direction. Should you cash out your portfolio- and and instead sit on the sidelines with a larger mattress? The short answer is no. Market timing is a fools game.

Cash is Not Always King

With the uncertainty and market swings of the past few years, it’s understandable that some investors would seek the safety of cash. On the surface, holding cash means not having to cope with the ups and downs of the stock market due to the pandemic, global conflicts, rising interest rates, the Fed, and more.

However, this is only true over the shortest of timespans. Over months, years and decades, the value of cash is quietly eroded by inflation, and the missed opportunities of not being properly invested can add up. This is why, for long-term investors, managing behavior and emotions is just as important as managing portfolios. Doing so helps investors stay on track to achieve their financial goals, while helping them to sleep well at night too.

Three Concerns with Cash

First, high inflation is eroding the value of cash, especially when it sits in a regular checking or savings account. By not earning a sufficient level of interest or generating a return, the purchasing power of one’s hard-earned money falls each year. According to the Consumer Price Index, energy costs have increased more than 25% over the past year, food price nearly 8%, the cost of shelter 4.7%, medical care services 2.4%, and so on. Even as inflation rates settle down, this corrosive effect will no doubt continue.

This is the hidden cost when investors seek the safety of cash. The balance on a bank statement may feel safe since it is stable, unlike the fluctuating value in an investment account. However, what matters isn’t the dollar amount of cash but what it can purchase. Inflation means that the same number of dollars buys fewer goods and services each year, even when the number remains the same. Thus, portfolio growth is needed to keep an investor’s purchasing power at par, let alone to create real wealth.

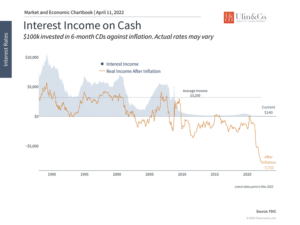

The second problem is that cash and savings accounts still generate little to no income, even with medium and long-term interest rates rising. As of March, the national rate for a 12-month CD was still only 0.14%. In other words, locking up $1,000 of cash for 12-months would only yield $1.40 when inflation would have eroded its spending power by $80, based on the Consumer Price Index. In this example, the real inflation-adjusted rate is what matters.

Additionally, Treasuries with the shortest maturities still yield very little relative to long-term rates, and it will take time for savings accounts and Certificates of Deposit (CDs) to catch up. The 3-month Treasury yield has risen to 0.7% but this is still well below its peak of 2.45% in 2019.

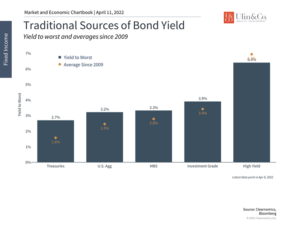

The picture is very different for other parts of the bond market. The yields on Treasuries, mortgage-backed securities, and corporate bonds are now above their historical averages. Investment grade bonds, for instance, now generate 3.9% per year compared to their average of 3.4% since 2009, and 2.2% one year ago. Of course, investing in corporate bonds and those with longer maturities involves risk, especially as interest rates rise. This is why it may be important to build a portfolio using diversification, laddering, and other tools, ideally with the support of a trusted advisor.

Third, for those saving and investing to achieve financial goals, shifting a portfolio to cash may provide short-term comfort but will most likely jeopardize long-term gains. Finding the right balance between resisting the urge to react to short-term news, while taking advantage of the long-run growth of the market, is the biggest challenge all investors face.

For professional investors, cash is simply another asset class with particular characteristics that can be combined with stocks, bonds, alternatives, and more. The right mix that takes advantage of all asset classes can achieve a much better balance of risk and reward. This is the preferred way to manage portfolios while improving investor confidence and avoiding the urge to time the market.

Ultimately, cash is an important part of any portfolio if used appropriately and in moderation. Having the discipline to save enough cash in the first place is the first step toward financial freedom. Investing that cash in the right portfolio is what grows savings into real wealth. Below are three charts that put the value of cash in perspective.

1 While cash is attractive when markets are scary, its value quietly erodes over time

Many investors are drawn to cash when markets are volatile. However, the challenge with cash is that it doesn’t protect against inflation. Even savings account and CD rates are still at historic lows despite rising interest rates.

2 Rising bond yields make savings accounts less attractive

In contrast to savings accounts, bond yields for government and corporate issues are rising. In many cases, these yields are above their historic averages.

3 Diversified portfolios have performed well over time

For investors who prefer cash to protect their portfolios, holding diversified assets is often a much better approach. Not only does this protect investors on the downside, but it helps to generate long-run growth.

The bottom line? While cash can be alluring, rising inflation means that staying diversified with more attractive bonds is likely to be a better approach.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.