Calibrate Your Financial Vitals – 2021 Market Insights

Vital signs (vitals) are the four most important indicators of the body’s vital (life-sustaining) functions which include body temperature, blood pressure, pulse (heart rate), and breathing rate.

These measurements are taken to help assess the general physical health of a person, give clues to possible diseases, and show progress toward recovery. There is no better time than the top of the new year to meet with your primary care physician and your financial advisor to check on your physical and financial vitals, put a plan in place and make adjustments.

Metrics in many areas of life help us to better visualize, benchmark and understand distance, pace and results, like when running a marathon. Two important vitals that can be financially life sustaining to help meet your goals over time include your investment and retirement policy statements.

Investment Policy Statement

Investment Policy Statements (IPS) provide specific guidelines for informed decision-making between advisors and clients, while serving as a roadmap to investing. The IPS covers the investor’s age, time frame, risk tolerance, investment goals, asset allocation and financial objectives. The IPS should also cover the standards for selecting investments and the specifics of how – and how often you will monitor the process.

Your IPS can change year to year based on your age, beliefs and life events. Running your portfolio without an IPS is like driving across the country without a GPS. The IPS can help you to “stay the course” through market corrections and crashes when volatility hits. Investing is truly about your time in the market and not “timing” the market which was very apparent in the swift roller coaster effect down and up in 2020.

Retirement Policy Statement

Retirement Policy Statements (RPS) are critical to develop and maintain whether you are aspiring to retire or living in retirement. With advances in healthcare and longevity, many people are experiencing a retirement longer than their working years. The RPS should address the specifics of your household cash flow: your targeted income needs and how much of them will be covered by Social Security, pensions, annuities or other recurring revenue streams; your portfolio spending (distribution) rate and the extent to which it might change over time; and whether you are utilizing an income-centric, total-return, or blended approach.

Another big part of your RPS is managing the asset and liability side of your household balance sheet while deciding what debts to hold or eliminate along with their interest rate and any related tax benefits. Whether you are 10 years away from retirement or 10 years into retirement, be sure to account for taxes and inflation over time. Consider the cost of living can increase by 50% every 10 years – just based on a 3.4% COLA (cost of living adjustment.)

Top 7 Market and Economic Insights for 2021

For investors, the new year is a time to reflect on the lessons of the past twelve months. There is much to consider after the COVID-19 pandemic led to an economic collapse, bear market crash, historic government stimulus, plummeting interest rates and more – not to mention the impact on everyday life. Other events and headlines that added to investor concerns include a heated presidential election, cybersecurity breaches and government action against large tech companies, just to name a few. These events are a reminder that, despite one’s best efforts, it is impossible to predict and plan for every scenario.

Jon here. This is why the biggest investor lesson of 2020 is perhaps the importance of resilience, both psychological and financial. Those with the fortitude to endure months of uncertainty by staying invested were ultimately rewarded. Doing so was undoubtedly made easier with a sound financial plan, proper guidance, an understanding of financial market history and a cushion of savings.

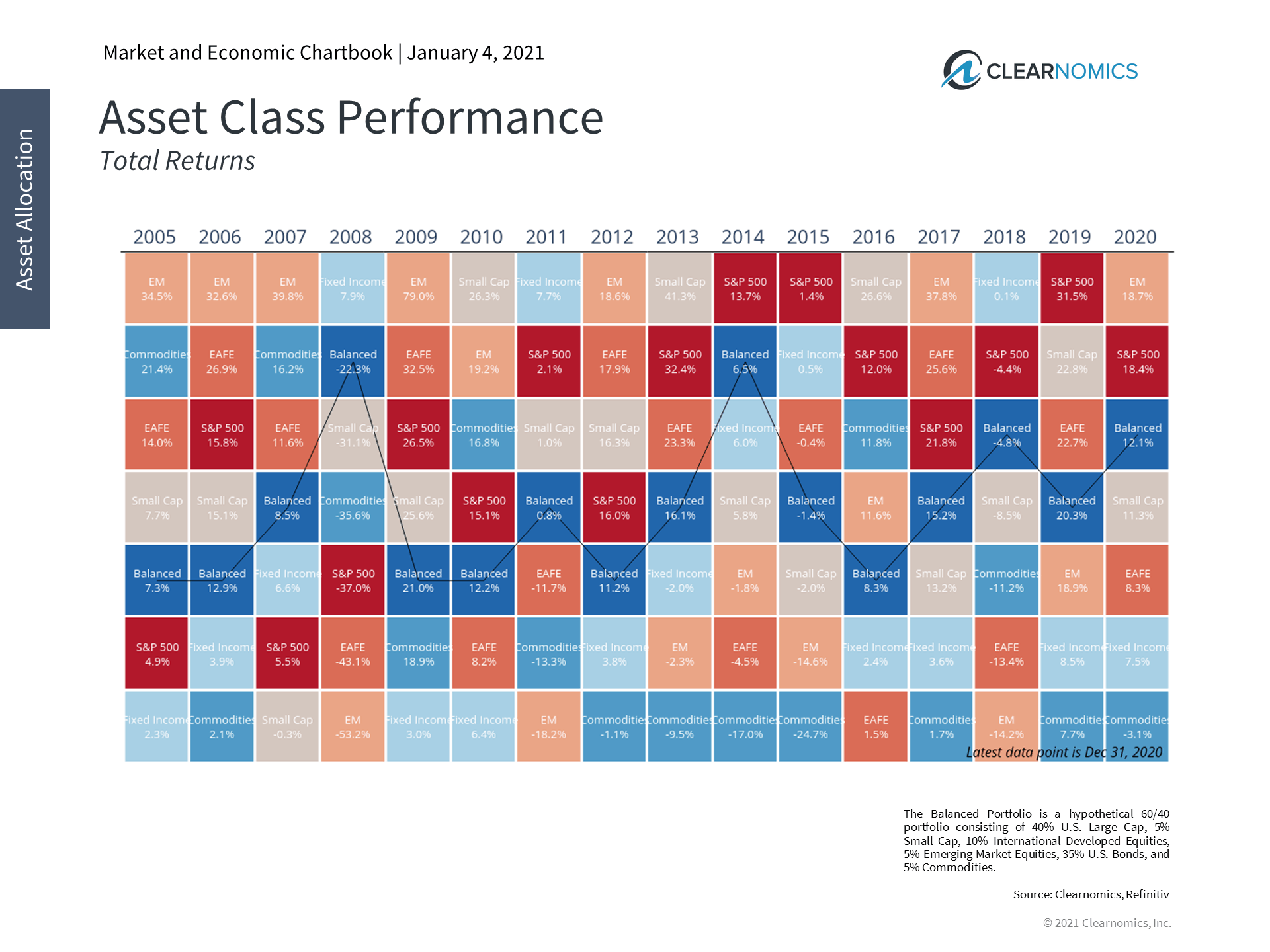

Only months after bear market declines across all major global indices, the S&P 500 ended 2020 at all-time highs with a return of 18.4% for the year while the Dow climbed 9.7%. This includes a historic 70% rebound from March lows. Fixed income investments also served their intended function as diversifiers in portfolios. The Bloomberg Barclays U.S. Aggregate bond index was in the red only briefly and ended the year up 7.5%. (see below) All told, investors who remained diversified across multiple stocks and bond sectors had a smoother ride and benefited from a mix of asset classes.

As we begin 2021, the public health situation is mixed. In the short run, the pandemic rages on as new cases in the U.S. and around the globe accelerate, pushing governments to enforce restrictions and lockdown measures. In the long run, however, the deployment of vaccines and the ability to manage economic conditions are reasons for optimism.

Current consensus forecasts suggest that as life returns to some semblance of “normal” in the coming year, economic growth and corporate profits can return to pre-COVID levels by the end of 2021 or in early 2022. This depends on many factors including the successful roll-out of vaccines, their long-term efficacy, the ability to fully reopen businesses safely, the willingness of consumers and businesses to spend, etc. Despite these challenges, there is clearly a light at the end of the tunnel.

This is helped by the resilience the economy has already shown even without a vaccine. Overall U.S. economic activity fell by nearly a third during the second quarter of the year before rising at the fastest pace in history as cities and states reopened. Stimulus measures by the Fed and Congress likely helped to prevent an even worse disaster, including one where the financial system seizes up as it did in 2008.

Unlike the Great Depression nearly a century ago, government policy did not actively make financial conditions worse. Companies that were able to shift to remote work did so swiftly and many even prospered as digital trends accelerated. Manufacturing and some service sector businesses were able to recall workers as they instituted safety measures.

Of course, these aggregate statistics mask the divergent outcomes among sectors, types of jobs, income levels and more. For this reason, the second half of the COVID-19 recovery, which will take place throughout 2021, is already proving to be more difficult. At this point, over ten million jobs are still lost and five million Americans are receiving unemployment benefits each week. The latest round of government stimulus may help those individuals and businesses that are still feeling the pinch, but its delay has already been costly.

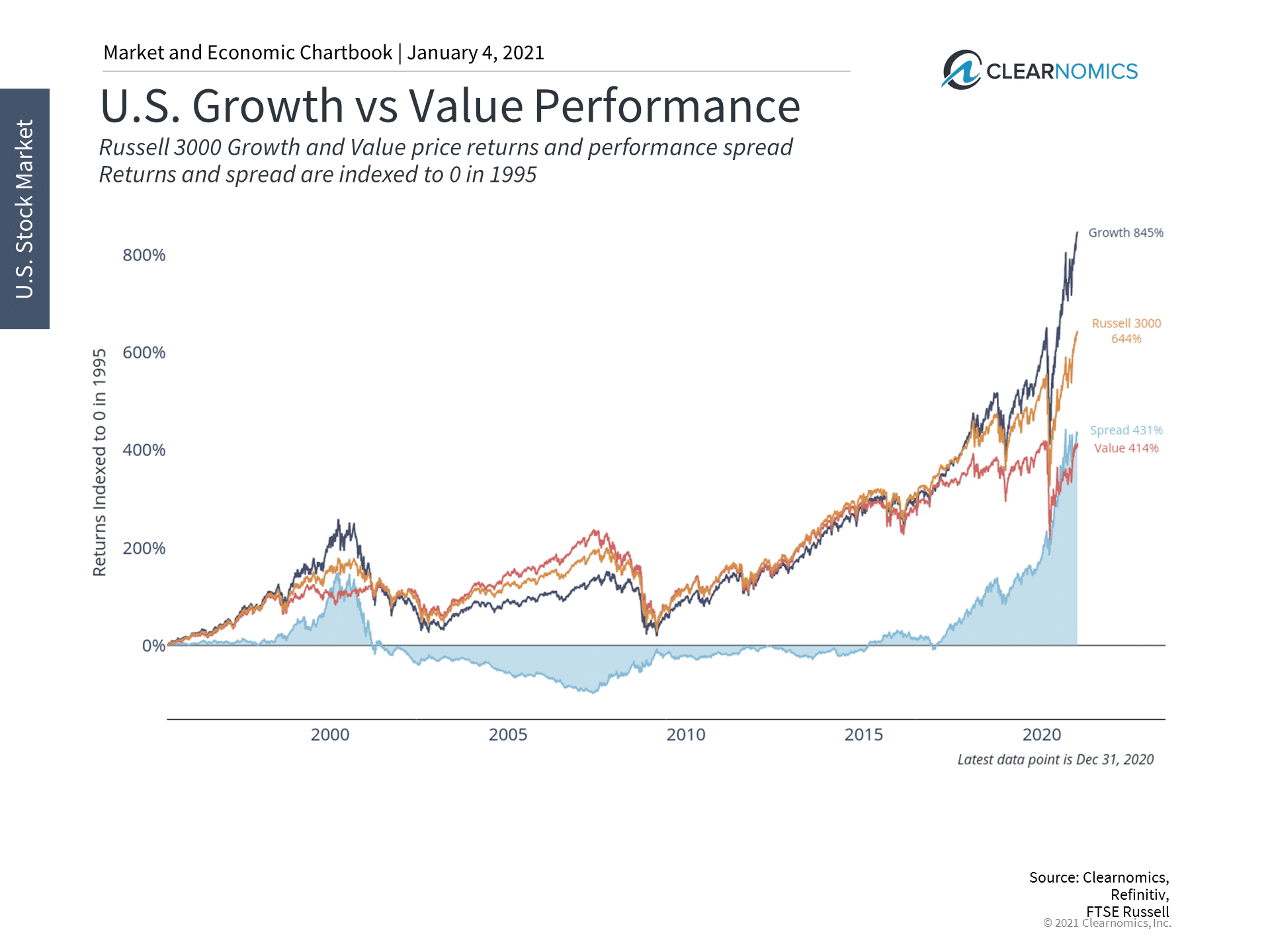

In spite of this, the stock market ended 2020 at new record-setting highs. (see below) Many of the trends from the past year could continue for some time as uncertainty continues. This has largely benefited growth and technology-driven sectors at the expense of value and sectors directly harmed by economic restrictions.

However, there is already evidence that performance across sectors, styles and stocks is broadening. Valuation differences between growth and value are at historic levels. (see below.) Technology-driven stocks have already risen sharply since the recovery began. At some point, investors may prefer investments that will benefit from a full economic recovery. There are no guarantees that this will happen soon, nor does this need to be at the expense of what has already done well. Rather, it is a reminder that investors should stay broadly diversified as the world heals in the coming year.

Unfortunately, it’s likely that the early part of 2021 will resemble the past year as the pandemic rages on and the recovery continues. What has worked for investors not only during the crisis but also over the full history of financial markets is to stay resilient and disciplined. Below are seven important lessons and insights for the coming year to help investors maintain perspective.

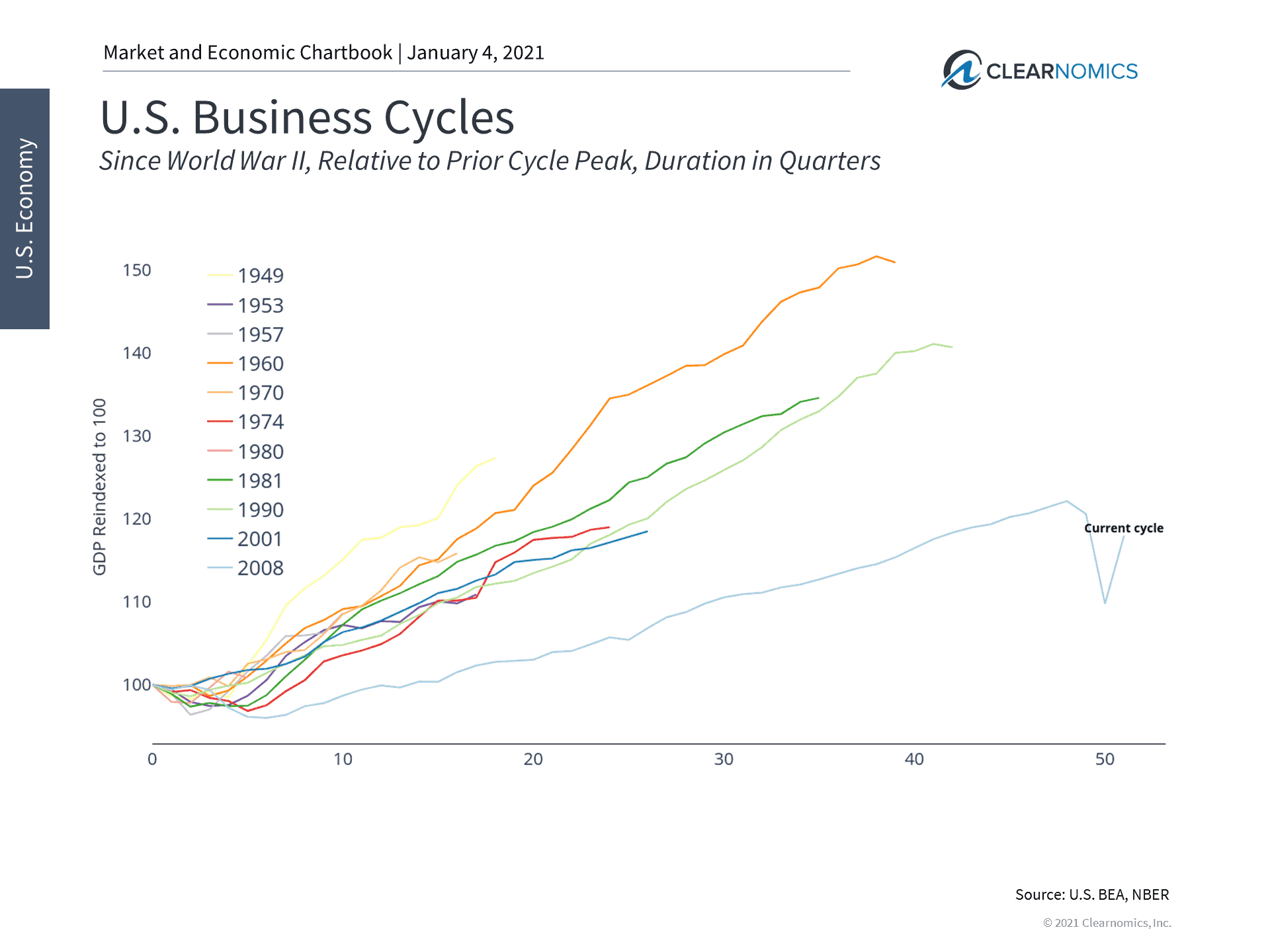

- The economy could be on track to fully recover by year-end

The U.S. economy officially fell into recession last February. However, consensus estimates among economists and investors suggest that the economy could fully heal from its historic decline by the end of 2021. This depends on a number of factors that are still uncertain, but the fact that multiple vaccines are being deployed and the resilience the economy suggest that there is reason for optimism.

- Diversification worked in 2020 and will continue to be important

Many investments across asset classes and geographies performed well despite the pandemic. U.S. stocks and emerging markets (in local currency and USD terms) outperformed which helped to drive many “balanced” portfolios to significant gains for the year. Throughout this period, fixed income investments, especially Treasuries and high-quality corporate bonds, helped to keep portfolios steady. In total, diversification helped to protect investors from downside risk during the crisis and provided upside as markets recovered.

- Investors should be cautious with high-flying sectors and styles

Not all parts of the stock market performed equally well during and after the crisis. Specifically, growth stocks significantly outperformed value ones, and many technology-driven stocks outperformed other sectors. Trying to time when this might reverse is difficult if not impossible given the on-going circumstances. However, history shows that while periods of outperformance can last years, valuation differences often give way to reversals. Thus, all of these sectors and styles are important in portfolios as the market normalizes in the coming years.

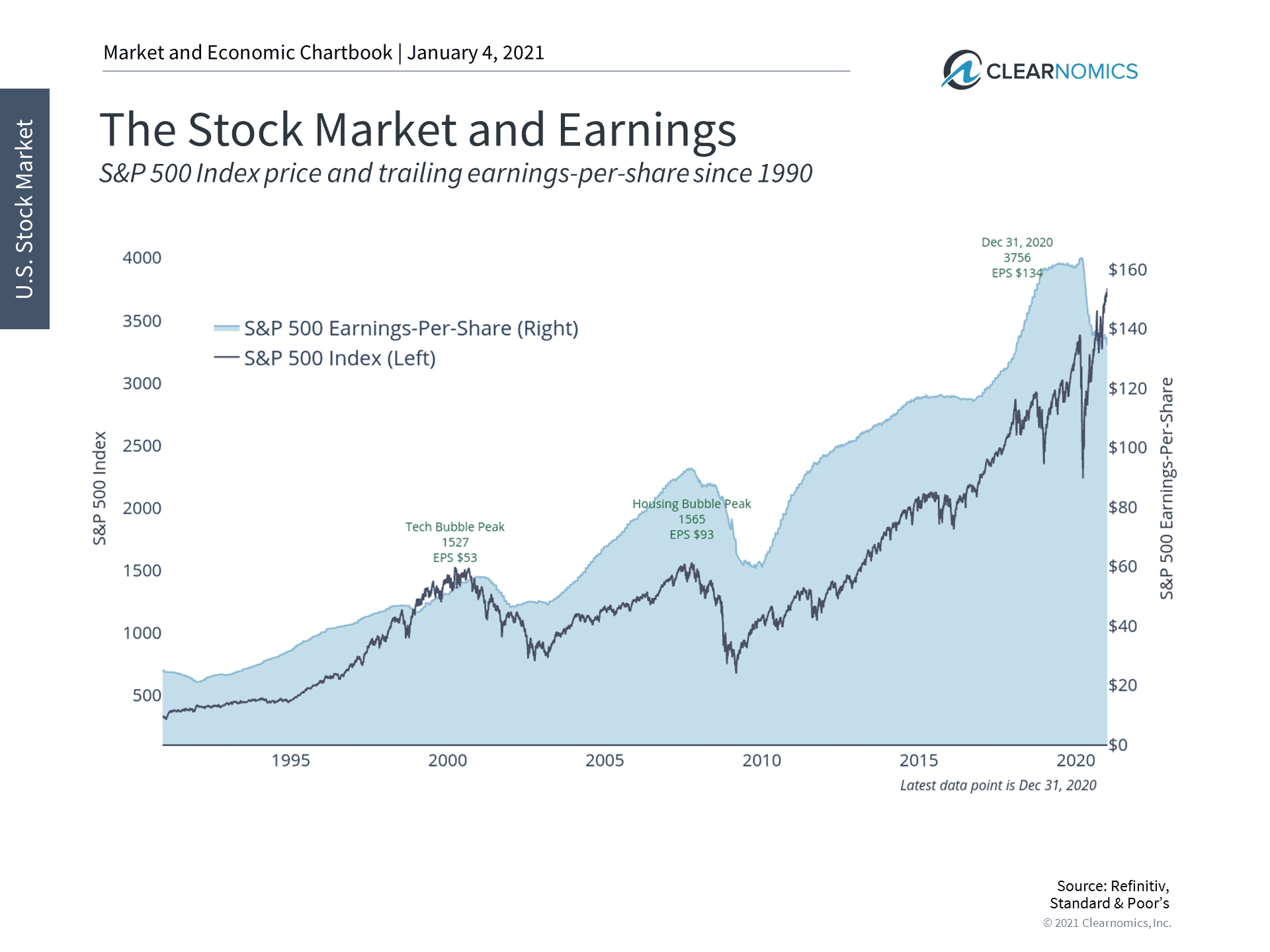

- Corporate earnings could also recover by the end of 2021

With the economy on track to recover, corporate earnings could do so as well. Consensus Wall Street estimates are for S&P 500 earnings to surpass $160 per share – i.e. its pre-COVID level. Like the economy, this depends on a number of factors that are still uncertain. However, there is already evidence that many companies can not only stabilize their revenue growth rate, but can boost profitability as well. Earnings growth will likely support stock market prices just as it does across all cycles.

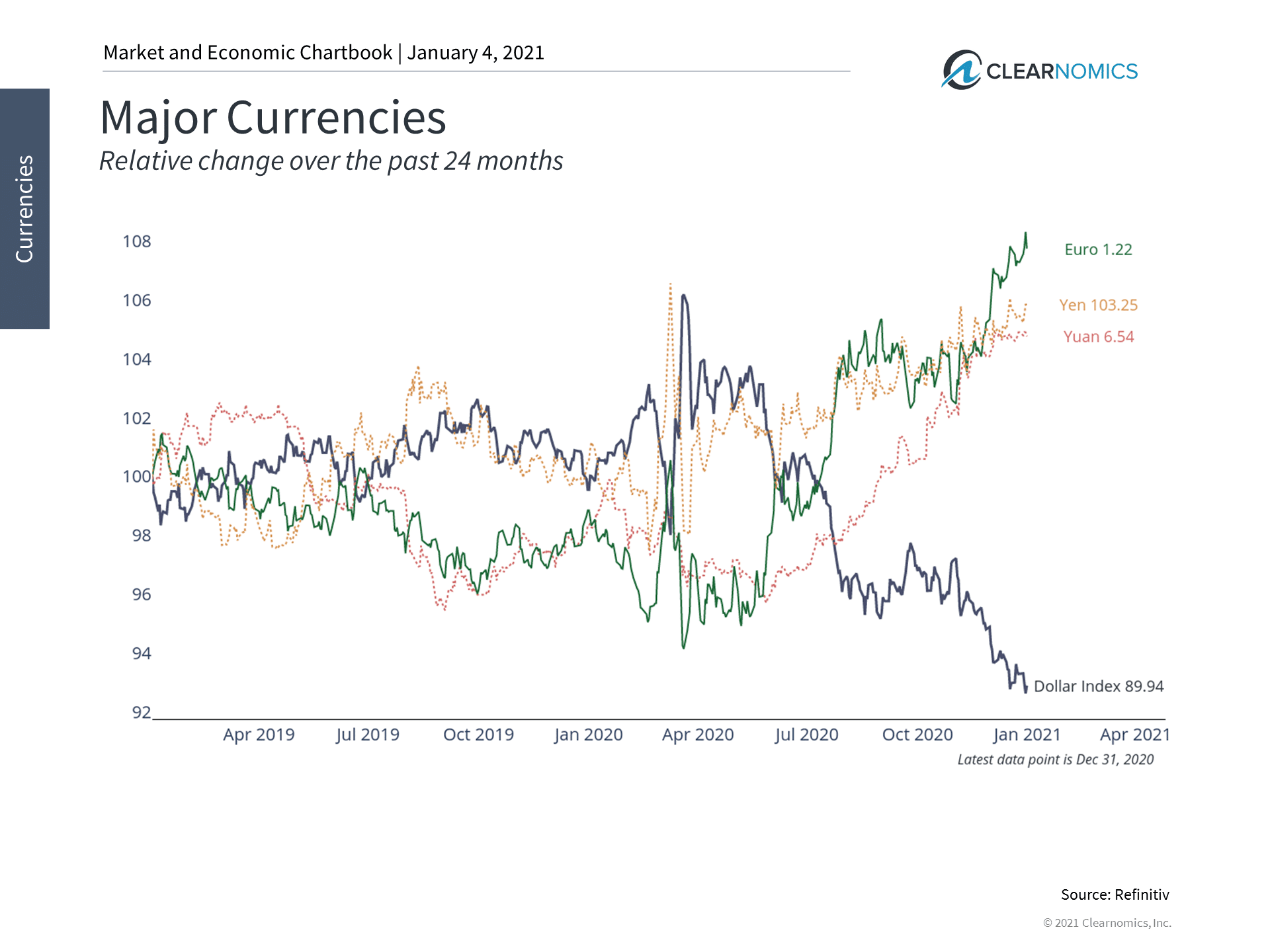

- The weak dollar could impact portfolios over the next year

Although the U.S. dollar acted as a safe-haven asset early in the crisis, it has been falling in value since the recovery began. Record levels of government stimulus, Fed intervention, historically low interest rates and the possibility of a rebound in inflation all conspire to keep the dollar weak. This can create a tailwind for portfolios in two ways. First, a weak dollar can boost international investment returns in USD terms. Second, a weaker dollar can bolster overseas revenue for U.S. multinational corporations. Together, a weaker dollar is often positive for investors in the long run.

- Having a cash cushion helped investors during the crash

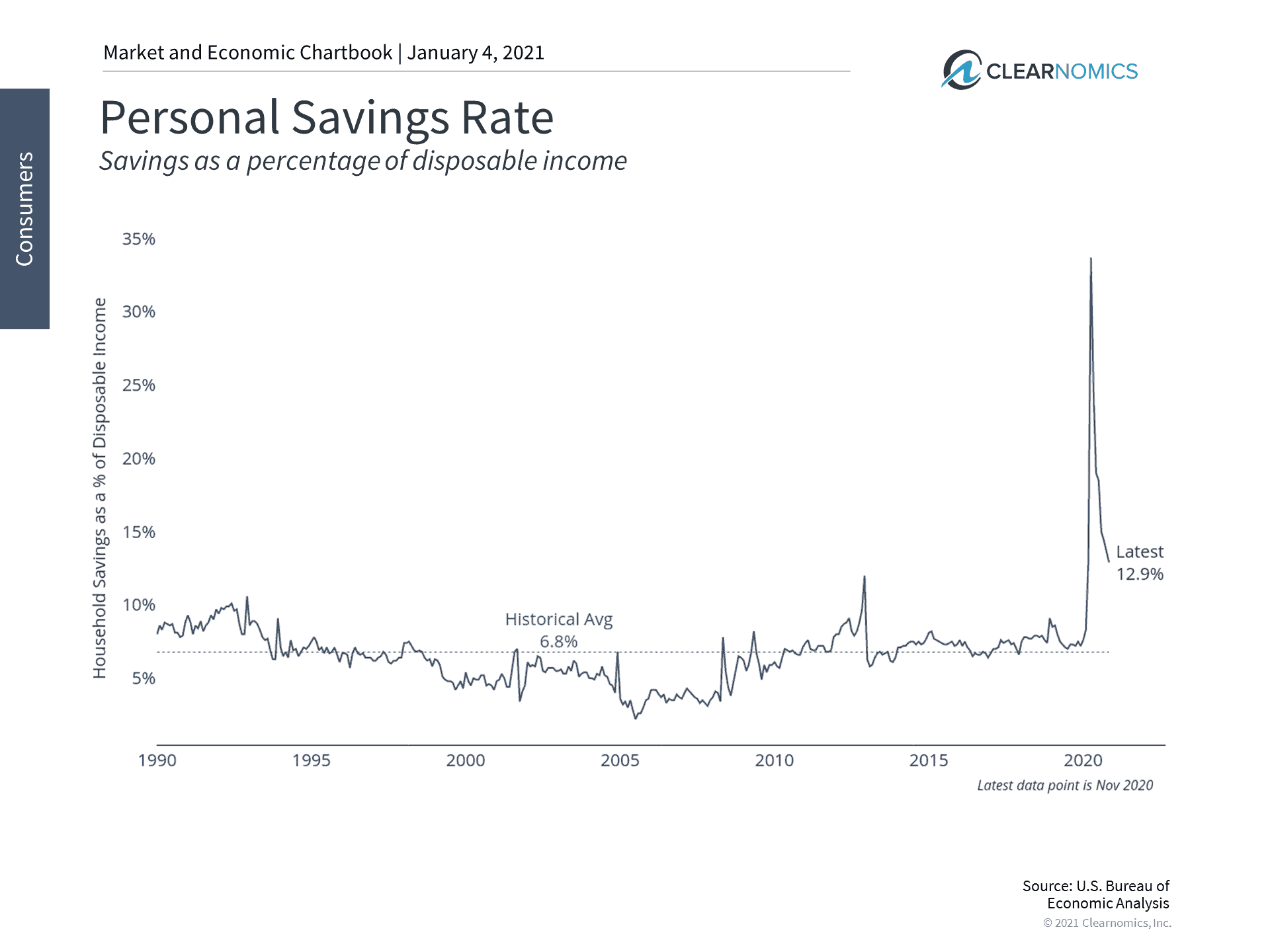

One of the most striking economic data points during the crisis was the spike in household savings rates. This was partly due to the inability to spend in stores during the lockdown and partly due to consumers being cautious about the future. Although savings rates have fallen and retail sales have recovered somewhat, consumers are still saving more today than at any point over the past 30 years. As a financial habit, this is a positive sign. It’s also a reminder that having a sufficient cash cushion is within the control of many and can help investors to weather any storm.

- Interest rates will likely remain low for the foreseeable future

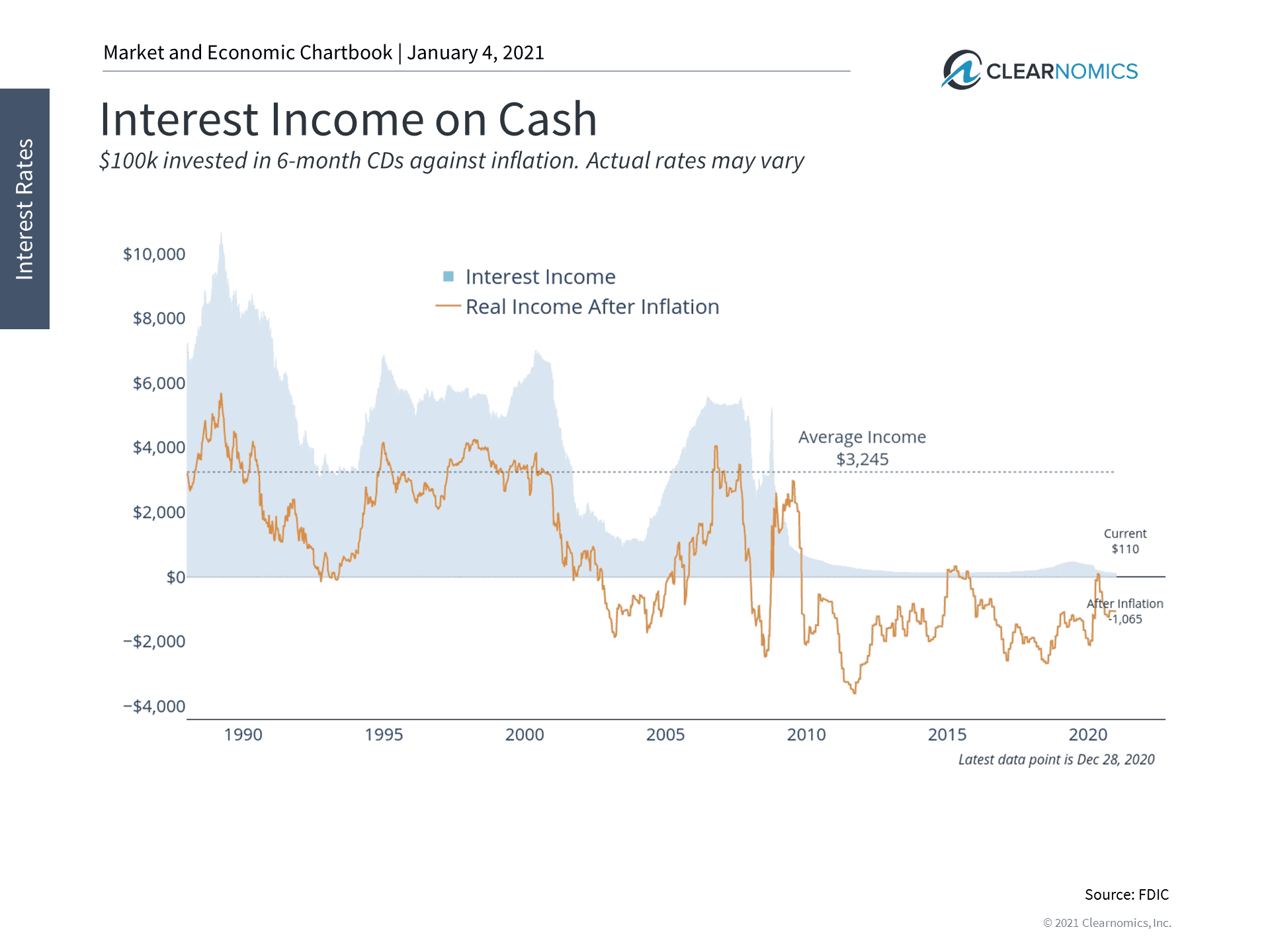

Despite the economic recovery, interest rates are expected to be near historic lows for years to come. The 10-year U.S. Treasury yield finished the year at only 0.9% and the 30-year mortgage is still below 3%. The Fed’s own forecasts suggest it expects to keep the federal funds rate at zero percent through at least 2023. Low rates are great for borrowers and can spur business investment. However, they make it difficult for investors in or near retirement to generate sufficient income. This has been a central investment challenge since 2008 and will likely continue for years to come.

The bottom line? The COVID-19 pandemic is still the primary challenge facing a broad economic recovery as vaccines are deployed. Investors ought to remain diversified, disciplined and resilient in 2021 as markets and the economy heal.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.