Mind your Brain as the Bull Market Advances

Instant access to news and trading tools right from our mobile phones while over-consuming opinions online from social media to news sites and chatrooms regarding politics, stocks, and cryptos to real estate can magnify the “madness of the crowd” along with the voices in our heads.

In many cases, the answers to our follies can be found inside our own brains. Psychological errors and how we frame issues can inadvertently trick us to make quick decisions that may often take us far away from our best choices and outcomes in any area of life.

Investors have even greater hurdles to overcome when presuming they can improve their performance and results overtime as they trade more often and consult themselves on “Dr. Google.” Pipes and fittings do not compete against auto mechanics and plumbers to make a fatal mistake, but with investing there are many nuances that can cause you to derail your own savings and retirement from misinformation, personal biases, emotions, and overconfidence.

An excellent example of framing with overconfidence was provided in the article Mental Mistakes (WSJ), where it was stated that you should ask yourself the following two questions:

Are you an above-average driver?

Are you an above-average juggler of three oranges?

Many of the people who were asked these questions placed themselves above average in driving but below average in juggling. People tend to place themselves above average when tasks are easy, such as driving.

Jon here. Investing is a “wee bit” more on the juggling side of ability and expertise, though many people place their ability more on the driving side. Having easy access to tech and “instant” information online can unintentionally make some people feel like they are investing experts.

How Record Profits Are Driving the Bull Market

The corporate earnings season for the third quarter is already off to a strong start. Investors are watching these reports closely as concerns over supply chain bottlenecks, the delta variant, rising rates and other factors threaten company bottom-lines. Although markets have been more volatile in recent weeks, strong profitability has helped the stock market briskly advance this year. (see below)

What can investors expect from corporate profits in the quarters ahead?

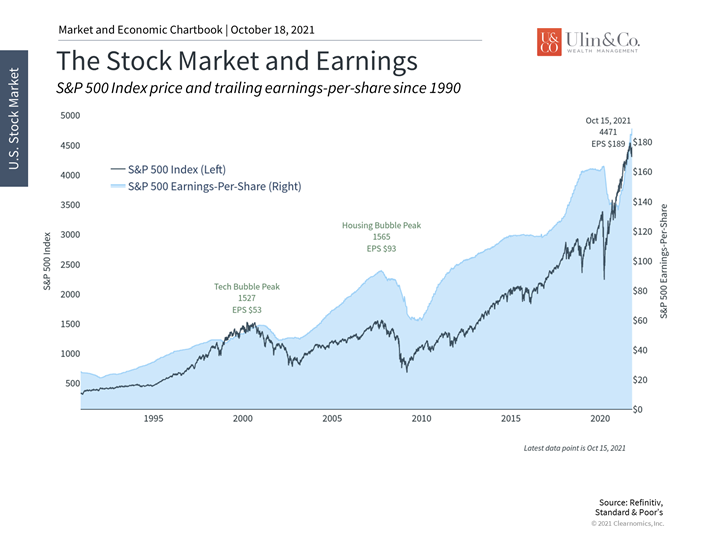

Earnings fully recovered from the pandemic lockdowns during the second quarter of the year, rising alongside the broader economy. Third quarter earnings will likely show that S&P 500 companies generated about $185 per share over the previous twelve months, a significant recovery from $133 at its worst point. Full-year 2021 could see $197 per share which would represent an astounding 46% growth rate. Profits are then expected to grow nearly 10% each of the next two years.

If this occurs, it would be good news since earnings are what drive the stock market in the long run. This is because investors don’t invest in the economy directly. Instead, when the economy grows, companies generate more revenues which can funnel down to greater earnings. This, in turn, supports stock prices over time. So, although investors tend to focus on day-to-day market moves which are driven by multiples, long-term profits are what provide the foundation on which stock markets rise over years and decades.

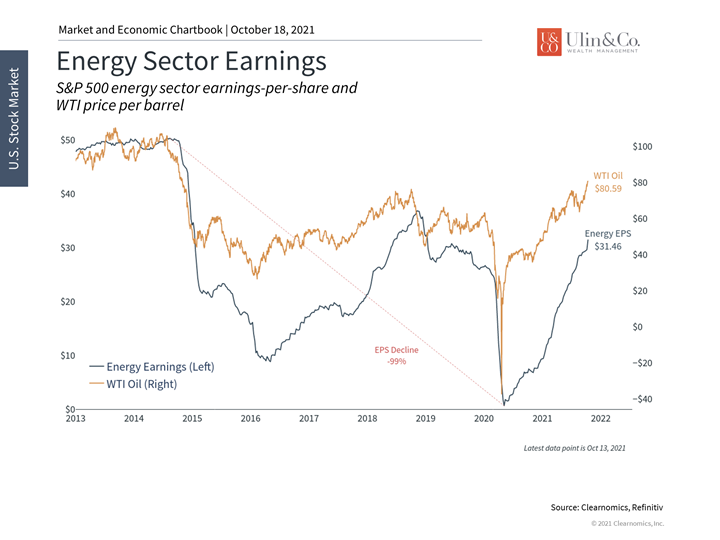

Even sectors which had been left behind the past several years have seen a rebound. The energy sector, for instance, had struggled due to an oversupply of oil and gas prior to the pandemic. With energy prices now at multi-year highs, energy sector profits are expected to reach their highest levels in over three years with the fastest growth rate for the S&P 500. (see below) In fact, all eleven sectors are expected to experience positive earnings growth with industrials and consumer discretionary rounding out the three fastest groups.

Supply Side Debacle

The big question that investors will seek to answer is whether on-going supply constraints will impact corporate profits in future quarters. So far, it’s been an industry-by-industry story with bottlenecks occurring alongside higher prices for final goods and services, thus offsetting their broad negative effects. It’s fortunate that the average consumer is in a strong financial position which has allowed them to absorb higher inflation rates. This can only continue if supply issues are resolved quickly and current inflation rates prove to be “transitory.”

Ultimately, investors should continue to focus on earnings and valuations since, in the long run, they are what drive stock market returns. Although there are always uncertainties, history shows that those who are able to stay invested throughout the business cycle can improve their odds of financial success. Below are three insights that help to set the current earnings season in perspective.

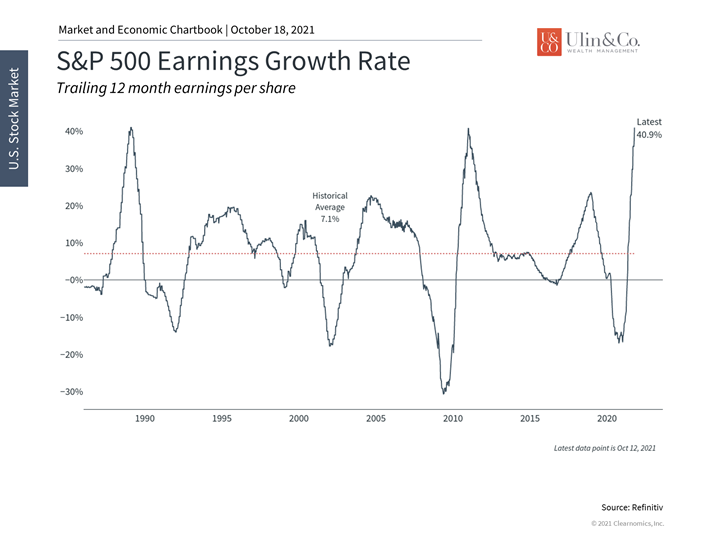

1 Earnings growth has accelerated

The growth rate of S&P 500 earnings-per-share has accelerated in recent quarters and is expected to reach 46% at the end of the year. While this is partly due to the rebound from the low last year, this growth rate is expected to remain above average over the next two years.

2 Profits have supported the market

Rising profits have supported stocks which are near all-time highs. This is true not only over the past year but across cycles, since earnings are a primary driver of bull markets. Over time, this will also help to deflate valuation levels.

3 Sectors such as energy are benefiting

The energy sector is benefiting from rising oil and gas prices. Earnings-per-share have risen to levels not seen in about three years after multiple sharp declines over the past decade.

The bottom line? Earnings are expected to be strong in the quarters to come which could support financial assets and valuations. Investors should continue to focus on long-run drivers such as profits instead of short-term concerns from inflation and energy prices to supply side matters.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.