Build Your Ark Before a Great Recession Arrives

Negative headlines du jour are flooding the airwaves led by no other than billionaires- club usual suspects of Jamie Dimon, Carl Icahn, Elon Musk, Sam Zell, Michael Burry and Kevin O ‘Leary touting that the end is near with dire recession predictions.

Wall Street’s consistent warnings have led 81% of U.S. adults to say they think the U.S. economy is likely to experience a recession this year, according to a CNBC survey. In addition, a recent Reuters poll indicated that 40% of economists believe a recession will appear within 24 months.

Influencing retail investors to panic-sell or time the market based on opinion, is no better than celebrities and athletes from Matt Damon to LeBron James shilling for Crypto.com ads noting that “fortune favors the brave” to get regular people to gamble their life savings.

Jon here. As I frequently note, hope for the best and plan for the worst like organizing your hurricane supplies before a disaster. At the same time through all the ups and downs, you can save yourself from emotional pain by tuning down the noise and staying focused on your financial plan. Like meteorologists on the weather channel charting the path of a CAT-5 hurricane, financial pundits make many incorrect assumptions or take credit for any half- baked commentary they may have made before a major event transpired.

Plan Ahead

It wasn’t raining when Noah built the ark. Being naive or unprepared can turn opportunities into threats and make short term crises into long term debacles whether you own stocks and crypto or real estate in South Florida. A hurried, poorly thought reaction to risk or danger if not prepared can create a cycle of reactionary solutions, each creating their own new problems.

Strategically and tactically managing and diversifying your portfolio while incorporating different sectors (cash, bonds, stocks, alternatives, real estate etc.) while maintaining a global approach can help buffer the effects of corrections and crashes while providing a smoother ride. Building the proper risk-allocated diversification for your savings is in essence like building an ark filled with different animals.

Don’t Forget the Past

While 2022 has been one of the worst starts to a year simultaneously for stocks and bonds while crypto got sliced in half, the volatility comes as no surprise as the stock market is “repricing in” the risk for the Fed’s rate hike plan, a slowing economy, geopolitical uncertainty (war) and more after quite the “V” shaped rebound from the pandemic crash.

Almost every year there is an outlier event that throws a monkey wrench into the gearbox of the market. Going back 42 years to 1980, the S&P 500 has experienced an average annual 14% peak-to-trough decline . Despite these selloffs, the annual return of the index was positive in 31 out of 41 years, or over 75% of the time. These odds are much better than going to Vegas, playing your State Lottery or getting bitten by a shark.

The question at the forefront of investors’ minds is whether the economy can achieve a so-called “soft landing” in the face of high inflation, rising interest rates, Fed rate hikes, geopolitical conflicts, and other challenges. A soft landing would require the economy to slow gradually without creating a downward spiral in consumer demand and business investment. While the market correction this year has created a challenging investment environment, especially with the steep pullback in growth stocks, a recession is possible but not inevitable.

Hard vs. Soft Landing Recessions

First, it’s important to define what is meant by “recession.” When many investors think of a recession, what comes to mind is a historic market and economic crash like the ones experienced during the pandemic shutdown of 2020, the global financial crisis of 2008, or the dot com bust of the early 2000s.

While events like these are always theoretically possible, the problem occurs when investors worry about them at the expense of long-term growth. History shows that doing so is not only unnecessary but counterproductive. For example, during the bull market from 2009 to 2020, investors constantly worried about another financial crisis. Staying invested in a diversified portfolio built to withstand market uncertainty would have been the much better approach.

Instead, a more useful definition of “recession” is simply a temporary decline in economic activity. Prior to the 1990s, there were many short recessions that occurred on a regular basis. These were nothing more than periods of adjustment that reallocated resources within the economy. While there is a real consequence to individuals and businesses, these periods are necessary to move precious economic resources and capital away from unproductive areas to where they can be most valuable. In other words, recessions are a natural part of the business cycle and help sow the seeds of future growth.

Slowing Economy Yet Strong Jobs

Today, an important consideration is that the economy did shrink in the first quarter by 1.5% compared to the end of last year, based on official measures of gross domestic product. Thus, it’s possible for there to be a “technical recession” – that is, two consecutive negative quarters. However, a slowing of the economy, and possibly shrinking by a percent or two, is far different from what many consider to be a recession. Additionally, many other measures of the economy suggest that consumers and businesses are still doing quite well, despite rising prices. The National Bureau of Economic Research, the official organization that determines recession dates, looks at a variety of economic factors and not just at GDP.

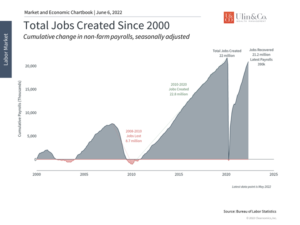

Specifically, last week’s jobs report showed that the economy added 390,000 new jobs in May, exceeding what economists had expected. In total, more than 95% of the jobs lost during the pandemic downturn have been recovered, including in hard-hit industries leisure and hospitality. (see below) This monthly gain is also well above the historical average of 148,000 per month over the past ten years. This has kept unemployment at 3.6%, one of the lowest levels in history, and near pre-pandemic lows.

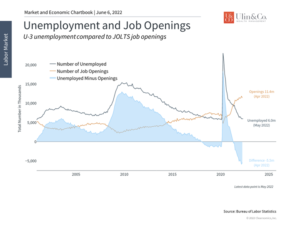

The data also show that businesses continue to hire too. Job openings still far outpace available workers by 5.5 million, a historic level. (see below) The problem is not whether businesses want to hire – it’s whether they can find qualified workers. Individuals are also quitting their jobs at an above-average pace, a sign that the “great resignation” is continuing. While all of this could change if inflation deeply impacts sales and profits, there are also signs that businesses are successfully passing costs onto customers and sharing gains with workers. Hourly wages of production workers rose 6.5% on a year-over-year basis in May, one of the largest gains on record. (see below) All told, workers and the average consumer are in a strong position.

Other recent data highlight that the economy may be slowing but is stable. The housing market, for instance, has been hit by a sharp rise in mortgage rates which have risen above 5%. Still, broad measures of housing prices and activity remain robust. Measures of industrial activity, such as the ISM Manufacturing index, actually accelerated in May. Durable goods orders sped up in April, a sign that industrial and commercial activity was also strong following the first quarter’s negative GDP number.

Thus, the trends suggest that a deep economic downturn is not inevitable. Even were a recession to occur, it would likely look very different from those of the past twenty years. Below are three charts that shed light on whether the economy can achieve a soft landing.

1 The job market is strong

The job market has regained over 95% of the jobs lost during the pandemic. In May, 390,000 jobs were added which, although slower than during the initial pandemic recovery, is well above historical averages. Many areas, including leisure and hospitality, made strong gains. Employment in “retail trade” was the only major sector to have a significant decline in employment.

2 Companies continue to hire aggressively

Businesses continue to seek out qualified workers. Job openings are at historic highs, outpacing unemployed individuals by 5.5 million. This is a sign that businesses would hire more if they could.

3 Hourly wages are rising for many workers

Wages are also rising, partly due to the strength of the labor market which gives employees more bargaining power, and partly due to the overall rise in inflation. In general, higher wages are positive for consumers and the economy.

The bottom line? While there is still significant uncertainty, economic conditions are far different from 2020, 2008 and 2000. Investors ought to stay invested and diversified, rather than constantly worry about a great recession.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.