Market Heights Worry and Excite Investors

As the economy roars back from the COVID19 shutdown, the stock market is adjusting quickly while continually setting new all-time highs. In this environment, some investors may be enthusiastic about this momentum while others may be worried that stock prices and market indices have run too high too fast. Perhaps this may be due to fear of heights.

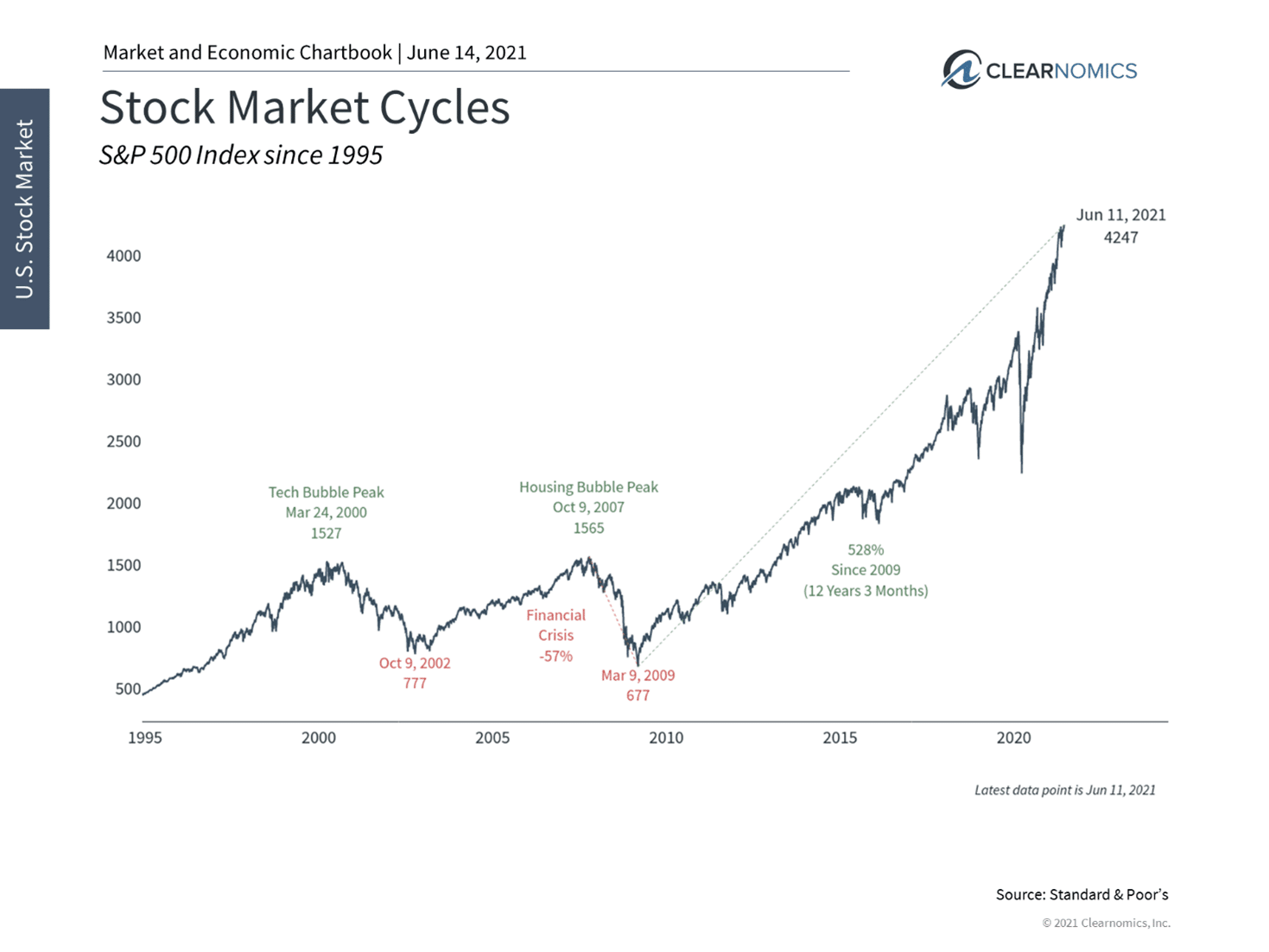

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors this may bring back PTSD memories of the dotcom and housing market heights and subsequent stomach- wrenching plunges.

Bubble Basics

Consider that bubbles are psychological by nature. Pay attention to three “over” metrics when getting close to the top of a market cycle which would include overconfidence (bullish sentiment), over consumption (greed) and overvaluations (price disparity). As bubbles are a reflection of greed, speculation, and emotional biases; valuations are a reflection of those emotions.

However, the elevated levels of bullish sentiment, stock valuations, housing prices, lumbar, oil prices and inflation appear driven more due to economic “reopening” effects and supply/demand imbalances, than the usual bubble suspects or business cycle factors and investor psyche.

Inflation Signals

Last fall, Barron’s amazingly warned that the coronavirus pandemic and brisk recovery has made the aggregate inflation data mostly useless. Aggregate indicators are informative only to the extent that the importance of the underlying components are constant over time.

While the fall in certain goods and services a year ago was not normal (nor the hoarding of toilet paper) we are experiencing this effect today in reverse. The current temporary inflation flair-ups driven by the reopening does not affect all goods and services at the same time or in the same way.

The question of whether there is a “bubble,” at least the way most investors understand the term, should be distinguished from “will stocks fall?” This is because short-term stock market pullbacks are normal every year- and can occur without notice. The U.S. stock market as represented by the DJIA index has historically experienced a few large pullbacks almost every year including declines of over 10% -14% while still advancing up the “wall of worry” by about 10%/year over time. Consider the larger the DJIA index number gets (now at 33,823), the more severe a 5-10% drawdown “sounds” in the headline news like an approaching CAT-5 hurricane.

Three ways investors stay disciplined

Last week, the S&P 500 reached another new all-time high (see below) while the NASDAQ and Dow Jones Industrial Average each finished within one percent of record levels. As the economy accelerates and corporate profits beat estimates, the stock market is adjusting quickly. In this environment, some investors may be enthusiastic about this momentum while others may be worried that stock prices have run too far too fast. The following are three ways investors stay disciplined in this environment:

One source of investor concern arises from focusing too much on market prices and daily returns. While this information is easily accessible and widely reported, it does not tell the whole story. First, the fact that the stock market has risen does not guarantee it will crash in the near future. For instance, some may find it surprising that this is the 30th time the market has achieved a record level this year, while the biggest intra-year decline has been far below average at under 4%.

This is because, almost by definition, the stock market often spends most of its time at or near all-time highs as it rises during bull markets. There have been many periods when the market defied expectations for months or years, including during the decade after the 2008 financial crisis. Rather than try to avoid short-term market pullbacks, it’s much more important to hold balanced portfolios that can withstand these stumbles.

Of course, it’s true that stock market volatility is a normal and unavoidable part of investing. The reason investors are rewarded over time is because they are willing to stomach risk, especially when it is least expected. However, it’s also the case that missing potential upside is just as harmful to achieving long-term financial goals. Case in point: those who stayed on the sidelines after the initial pandemic market crash last year have missed out on the strongest recovery in history.

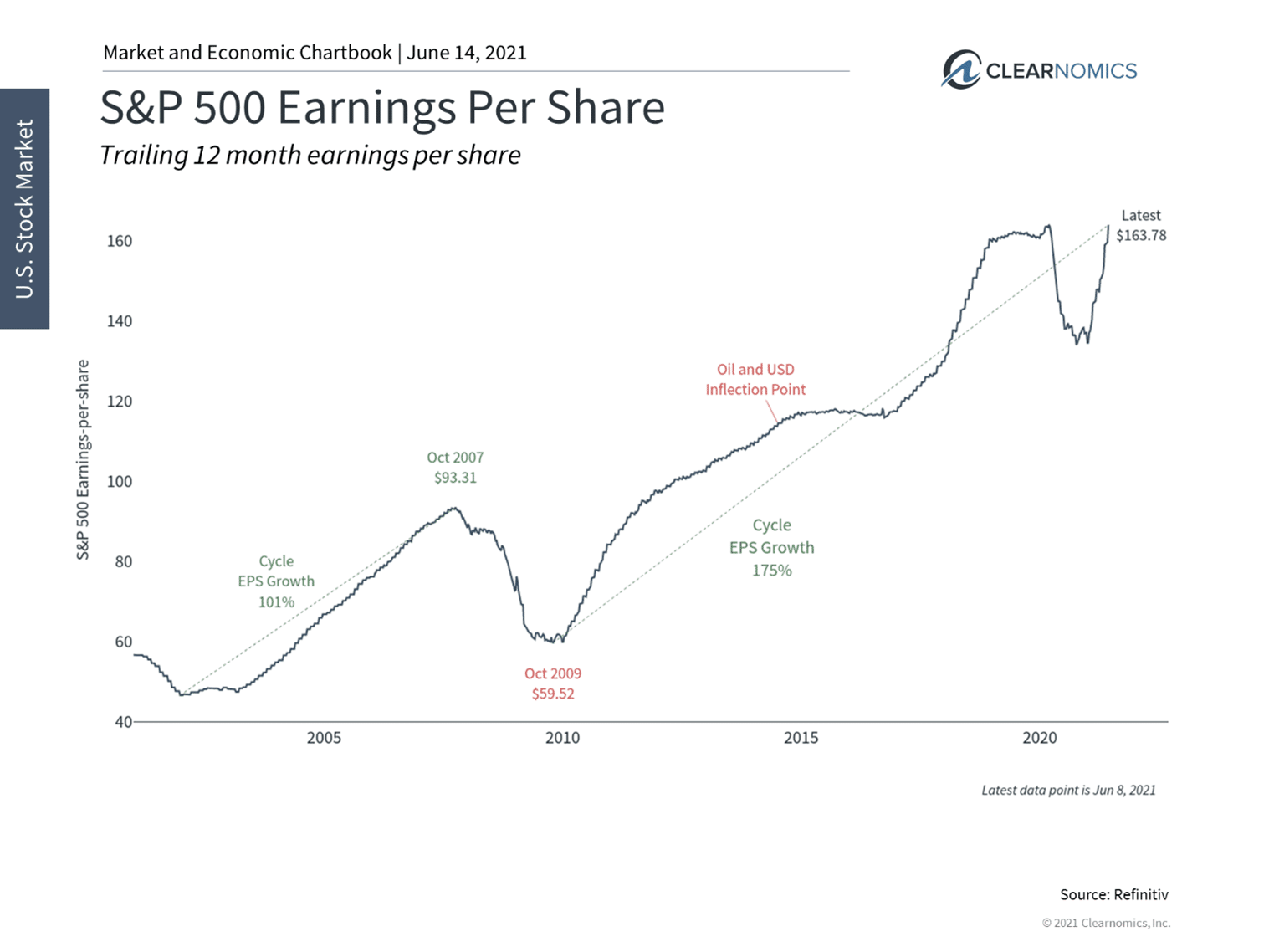

Second, what truly matters to investors isn’t what it costs to buy a share of stock, but what they get for that price. Stocks are one of the foundations of any portfolio because they provide investors with a “share” of corporate profits which tend to grow over time. This is why financial ratios such as price-to-earnings matter much more to investors since they show what it costs to buy a dollar of earnings.

At this stage in the recovery, corporate earnings have returned to pre-pandemic levels at least two quarters faster than originally expected. (see below) Consensus estimates suggest that earnings could continue to accelerate into 2022 as demand heats up, fiscal policy stimulates the economy and monetary policy keeps financial conditions loose.

Finally, the stock market is forward-looking and incorporates new information quickly. Even if the market isn’t perfectly “efficient,” it is difficult to consistently guess what it will do next. Holding a portfolio that can balance risk and return – even when the market appears to be at a summit – is the best way to achieve financial goals. Below are three charts that can help to put recent all-time market highs in perspective.

1 The stock market continues to reach new all-time highs

The S&P 500 reached new record levels while the NASDAQ and Dow are following closely behind. While investors should always be ready for short-term pullbacks, the market can also defy expectations for long periods of time. Thus, staying balanced is often a better approach that trying to time the market.

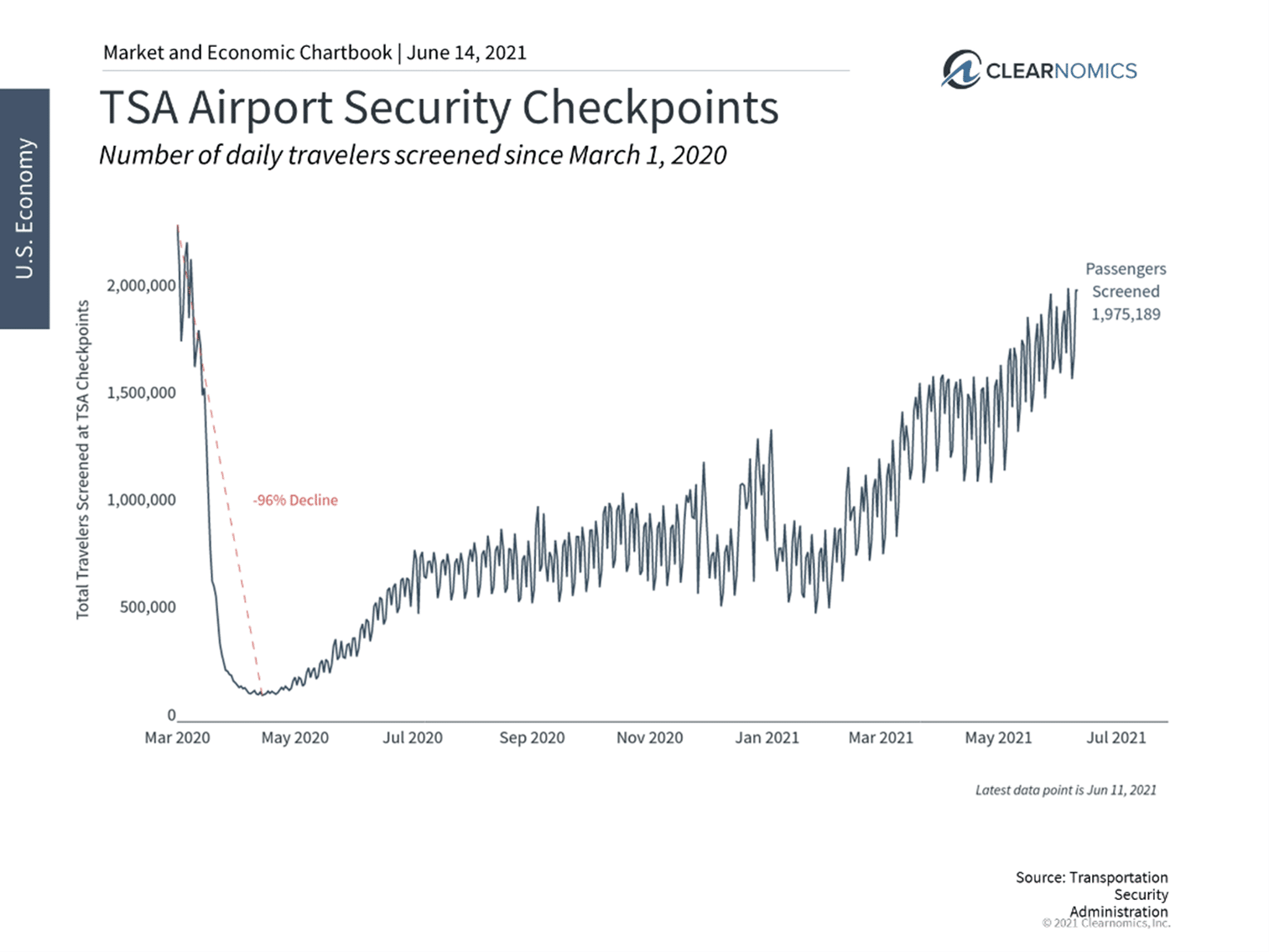

2 The economic recovery is accelerating

Many measures confirm the ongoing economic recovery. Air travel is nearly back to pre-pandemic levels and restaurant activity in many parts of the country are nearing a full recovery.

3 Corporate profits will soon surpass pre-pandemic levels

This economic rebound has driven corporate profits back to their 2019 year-end levels. Earnings are expected to continue to grow as demand heats up.

The bottom line? We like to think we invest rationally, but the field of behavioral finance has shown there are social, emotional, and even cognitive factors that can affect our investing decisions based on headline news of inflation to market bubbles and our perception of that news.

Investors should focus less on the price of the market than what they’re getting for that price. Holding a diversified portfolio while consuming less headline news is the best way to take advantage of upside while protecting from downside risks or being mentally thrown off course.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.