Perseverance in Boxing and Investing

Despite continued knockout-level blows by COVID19 and now the ravaging Delta variant for the past 18 months, the economy has surpassed pre-pandemic levels after the sharpest recession and recovery in history. That this took place in less than a year and a half is remarkable.

Investor euphoria (the madness of the crowd) seems to be going viral from financial news shows, chat groups and social media posts about “getting rich quick” on different stocks and cryptos, fueling rumors and speculation.

Speculating vs Investing

Greed is a powerful persuader to investors of all ages, education backgrounds and investment experience to throw money “into the ring” right from their mobile phones on Robinhood, E-Trade and other low-cost trading apps, with the ease of use like online sports betting. Many of these living room couch-investors fail to recognize that trying to make a quick buck in a 3-6 month “round” like buying a lottery ticket is the pure example of speculating and not investing or wealth management.

As noted by economist and author Benjamin Graham in his famous book The Intelligent Investor, “Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook.”

However, he warned, it creates three dangers: “(1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.”

Jon here. Our newsletter content is purposely designed to motivate investors to help mitigate risk and not financially “knock themselves out.” A well-known maxim by former professional boxer “Iron” Mike Tyson (pictured/Everett Collection) is that “everyone has a plan until they get punched in the mouth.” In other words, it’s how you react to any adversity that defines you, not the adversity itself.

Now would be a good time to call and check in with your advisor to help shore up your portfolio strategy, risk tolerance and money mindset to help you better manage your nest-egg and your emotions before the next time volatility hits. Boxing is in as much psychological as physical, just like investing is as much behavioral science as portfolio management.

Position for a Long Bout

A common adage in boxing is to watch your opponent’s shoulders and not their hands. Focusing on where the motion of a punch begins, rather than where it ends, allows you to react appropriately and accurately.

The same is true when investing – it’s better to focus on the economy and long-term trends that drive markets and policy, rather than solely on outcomes such as Fed decisions and past returns. In other words, the best way for investors to position their portfolios today is to better understand where we are in the business and market cycles.

Today, market participants widely expect a change in Fed policy by year end (tapering), especially after Fed Chair Powell’s recent Jackson Hole speech.

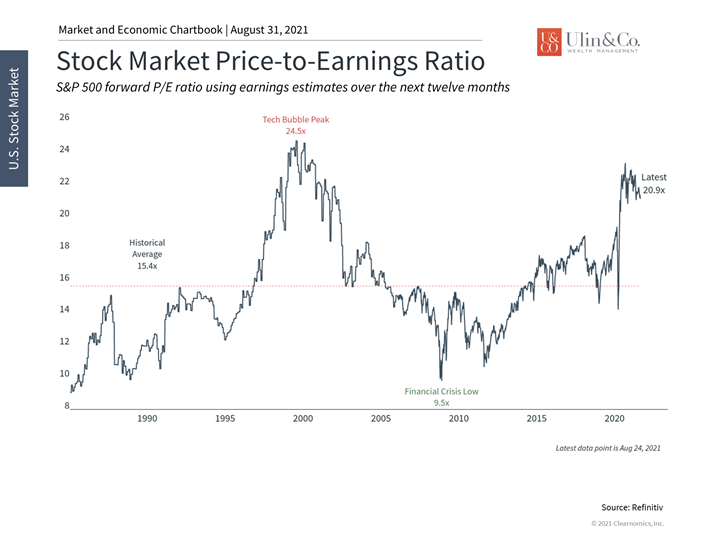

This is because economic conditions are favorable and although the pace of growth may slow a bit, the expansion is still robust. As a result, corporate profits are accelerating further. Consensus estimates are for S&P 500 earnings-per-share to reach almost $198 in 2021. This would represent a staggering 46% annual growth rate and help to support markets by bringing valuation levels back down to earth. (see below)

Cyclical vs Secular

In broader terms, investors are accustomed to distinguishing between cyclical and “secular” (financial industry jargon for “long-term”) trends. Cyclical trends are those related to the natural ups and downs of the business cycle, such as those stocks and sectors that benefit from initial recoveries versus the later stages of an expansion. Secular trends are those that cut across cycles, such as trends in technology and global trade.

What’s made this distinction challenging has been the sharp initial recovery that boosted inflation and growth measures well beyond recent norms. There is a great deal of debate over whether these data are a result of cyclical or secular trends. The best answer today seems to be neither: these may simply be one-time events due to the nature of the crisis and rebound. While some effects, such as supply and demand disruptions in semiconductors or building materials, may linger for months, this is different from arguing that there are cyclical forces that will boost inflation for years to come.

Focus on Long Term Trends

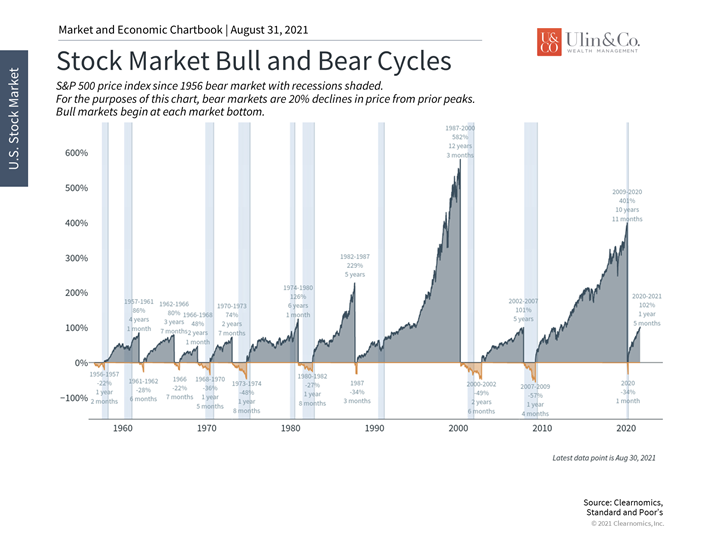

In the end, it’s important for long-term investors to remember that crises are swift and abrupt while expansions are slow and steady. The National Bureau of Economic Research has officially declared that the COVID-19 recession lasted only 2 months. The markets bottomed out over the course of one month and recovered about 5 months later. In contrast, this bull market has now lasted almost a year and a half, and bull markets since the 1980s have lasted between 5 and 12 years.

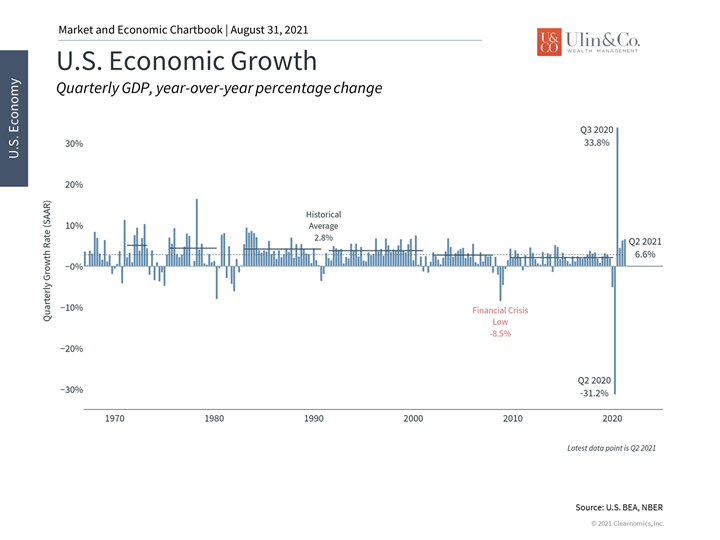

It’s natural for investors to want to know exactly what’s around the bend, and to react to every event. But like the boxer who bobs and weaves too much in response to their opponent’s gloves, investors may only tire themselves out. Focusing on the underlying economic trends helps investors avoid having a short-sighted view of their portfolios. Below are three charts that help provide perspective on the current cycle.

1 It is still early in the bull market and expansion

The average market cycle has lasted between 5 and 12 years over the past 40 years. Although the recovery has been swift, growth trends suggest that the market cycle can still go a long way.

2 Economic growth is expected to be strong

Last week’s upward revision to Q2 GDP showed that the economy grew by 6.6% during that quarter. The economy is expected to grow at a robust pace before it inevitably decelerates to more historically normal levels.

3 Valuations are not cheap but may come down over time

Valuations across the broad market have been high due to the fast market recovery. However, strong and accelerating earnings are helping to deflate these lofty valuations.

The bottom line? Investors should focus on the overall business cycle and long-term trends rather than headlines and day-to-day events. While speculating in headline stocks and crypto’s may provide an adrenaline rush to try to get rich quick, disciplined investors take a more practical, diversified and risk managed approach to managing wealth to help achieve their goals and financial independence over time.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

“It ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward” – Sylvester Stallone as Rocky Balboa from the movie Rocky.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.