Bob and Weave Through Market Volatility & Inflation

Today’s headlines du jour include the gamut of the ominous opinions and warnings behind FedEx and Bed Bath and Beyond tanking and closing locations, the Fed fired up to hike rates, raging inflation, the Ukraine war commodity spillover problems and the dollar swiftly going up. Quite a bowl of soup. We are getting calls from investors asking whether to buy certain stocks or sectors low, or on the flip side, should they be going to cash and putting up hurricane shutters.

Speculation vs Investing

Fear and Greed are powerful persuaders to investors of all ages, education backgrounds and investment experience to either cash out on a dime, or to throw money “into the ring” right from their mobile phones on Robinhood, Betterment, E-Trade, Coinbase and other low-cost trading apps with the ease of use like online sports betting.

Many of these couch-investors fail to recognize that trying to make a quick buck in a 3-6 month “round” in stocks, crypto, NFT’s or other alternative assets is the pure example of speculating and not investing or wealth management. Perhaps today’s easy access to information, tech and trading may be making many people worse investors. Timing the market is a fool’s game, whereas time in the market is your greatest natural advantage.

As noted by economist and author Benjamin Graham in The Intelligent Investor, “Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook.” However, he warned, it creates three dangers: “(1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.”

Jon here. Our newsletter content is designed to help investors mitigate both behavioral and investment risks and not financially “knock themselves out.” A well-known maxim by former professional boxer “Iron” Mike Tyson is that “everyone has a plan until they get punched in the mouth.” In many instances, an investor’s biggest adversary is not the stock market, but themselves.

Now would be a good time as any for long term investors to shore up their portfolio strategy, rebalance and make any needed adjustments. Boxing is as much psychological as physical endurance, just like investing is as much behavioral science as portfolio management for the long game.

Position for a Long Bout

A common adage in boxing is to watch your opponent’s shoulders and not their hands. Focusing on where the motion of a punch begins, rather than where it ends, allows you to react appropriately and accurately. The same is true when investing – it’s better to focus on market drivers and trends rather than solely on outcomes such as stock market prices and returns.

It’s important for long-term investors to remember that crises are swift and abrupt while expansions are slow and steady. It’s natural for investors to want to know exactly what’s around the bend, and to react to every event. But like the boxer who bobs and weaves too much in response to their opponent’s gloves, investors may only tire themselves out. Focusing on the underlying economic trends helps investors avoid having a short-sighted view of their portfolio results.

Underlying Market Drivers

Global stock markets have fluctuated all year, alternating between significant pullbacks and recoveries that have lasted months at a time while adding to investors’ frustrations. Depending on how you count them, the S&P 500 has experienced at least three distinct periods of declines that were interrupted by brief recoveries, with the longest rebound occurring from mid-June to mid-August. In an environment like this, it’s natural for investors to focus on stock prices and returns as markets swing back and forth. These surface-level measures are easily accessible and thus tend to draw investor attention.

However, focusing on performance alone misses what really matters. This is because it’s underlying factors such as interest rates, commodities, and the U.S. dollar that are truly driving markets. In some cases, this is due to real financial and economic data, such as the Consumer Price Index, GDP and the supply of oil and gas. In other cases, it’s due to changes in market expectations, such as with projected Fed policy rates. In either case, focusing on these underlying measures is far more important than watching the day-to-day headlines on what the market has already done. Among these many factors, there are at least three that will continue to matter to long-term investors.

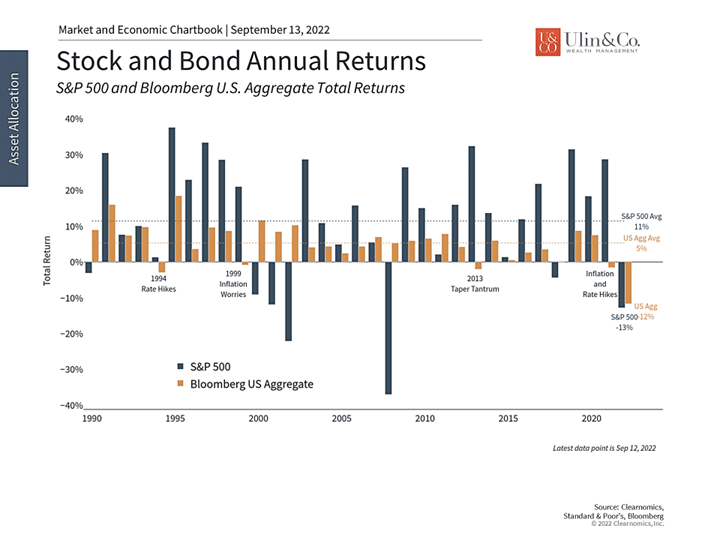

Stocks and bonds have both fallen due to rising rates

First, this year has been defined by swiftly rising interest rates in response to inflation and Fed policy. This is the primary reason that both stocks and bonds have performed poorly since bond prices naturally fall as rates rise, and sudden rate shocks have historically been associated with stock market drops too. What makes this year unusual has been the relative size of these declines in response to historic inflation levels. As the chart above shows, there have been other rising rate episodes in the past, such as in 1994, 1999 and 2013, but this has been a uniquely challenging period for both asset classes.

At the same time, rates have not risen in a straight line. Like the broader market, they have climbed in fits and starts, with the most dramatic taking place from March to June when the 10-year Treasury yield rose from 1.7% to almost 3.5%. Rates have bounced around since then and are still below their June peaks. It’s not just rising rates that matter – it’s whether investors expect them. An important driver of the June to August recovery was that markets had not only digested the path of Fed rate hikes, but supported this policy in order to fight inflation. This matters because investors who overreacted during periods of market volatility throughout the year would most likely have missed the inevitable rebounds.

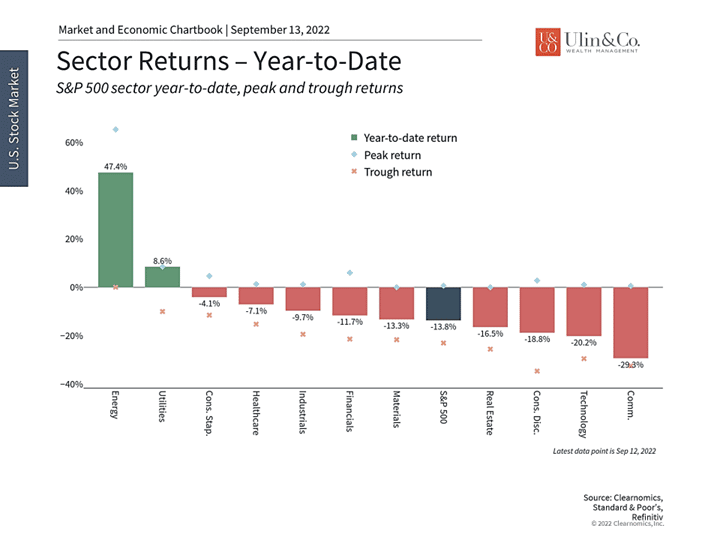

There has been wide dispersion between sectors

Second, commodities prices have pushed inflation higher due to energy costs. This is one important reason that markets struggled after Russia’s invasion of Ukraine when oil prices surged to $127 per barrel of Brent crude. Notably, this has driven headline measures of inflation higher, including the Consumer Price Index with a 32.9% year-over-year increase in the energy subcomponent in July. Inflation was already high and rising prior to the conflict in Ukraine so rising oil and food prices only made matters worse. But, like interest rates, oil prices have not continued to rise in a straight line. In fact, oil is back to levels last seen at the end of February with Brent trading under $95/barrel and WTI still under $90.

These swings in commodities prices have also driven significant dispersion among S&P 500 sectors this year. 9 of the 11 sectors are in the red with the Communication Services and Information Technology sectors performing the worst with declines of 29.7% and 21.5%, respectively. In contrast, Energy and Utilities have yielded positive returns this year of 44.8% and 7.5%, respectively. The interaction between commodities, inflation and interest rates have helped these sectors at the expense of former tech high-fliers that are sensitive to rates. Still, many of the worst-performing sectors have already rebounded off their lows.

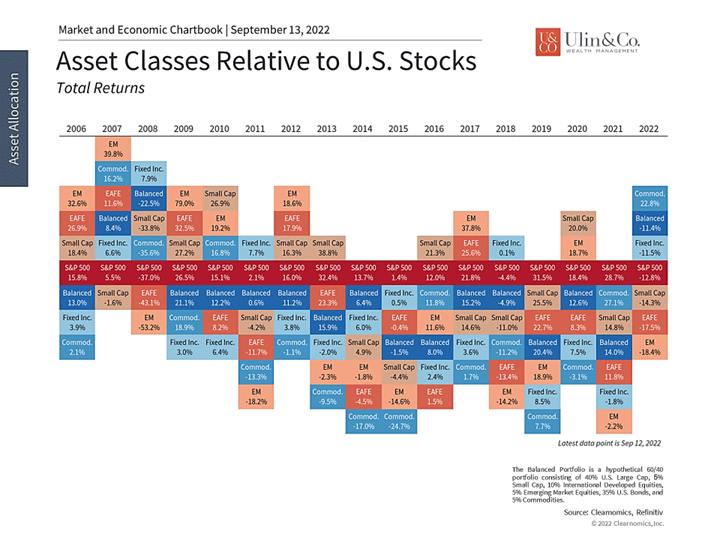

Global stocks have struggled due to the dollar

Third, the strong U.S. dollar both slows the economy and is a drag on international stock markets for U.S.-based investors. The dollar has strengthened significantly this year due to tighter Fed policy and the relative strength of the U.S. economy. A rising dollar can be a headwind for U.S.-based investors since the foreign currencies used to buy international assets weakens, reducing total returns. The MSCI Developed Market index, for instance, has experienced a total return of -6% this year in local currency terms but -19% in dollar terms. For the MSCI Emerging Markets index, these numbers are -16% and -19%, respectively.

However, currencies tend to mean-revert over time. The dollar is now at its strongest level in twenty years, with the Euro still hovering around parity, and there are early signs that it could turn around. Additionally, if the main economic challenge is inflation, a strong dollar can be good news. For American travelers and consumers buying foreign goods, the dollar will go much further. So, like interest rates and commodities, investors should not overreact to the dollar at current levels. If it were to reverse or drive inflation lower, this could become a tailwind to international investments and global markets overall.

The bottom line? Investors should focus on the underlying drivers of markets rather than stock prices alone through market volatility. The factors that have driven markets this year continue to evolve and require that investors not overreact. Staying diversified and maintaining a long-time horizon are still the best ways to achieve financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.