Art & Science of Investing Through the Pandemic

Many trades and industries incorporate both art and science into their goods and services. For example, constructing automobiles to smart phones involves the science of engineering, while design from a Tesla car to an iPhone is an art. Taking this full-circle, Steve Jobs eloquently said that “design isn’t just what a product looks and feels like, design is how it actually works and interfaces with the user.”

Famed investor Peter Lynch once stated that “it’s obvious that studying history and philosophy was much better preparation for the stock market than, say, studying statistics. Investing in stocks is an art, not a science, and people who’ve been trained to rigidly quantify everything have a big disadvantage.” This dichotomy is presented in a bit more of a balanced rationale by blogger Housel:

-Gathering numbers and information is a science. Filtering out noise is an art.

-Net present value is a science. Identifying the trust and passion of a CEO is an art.

-Measuring what worked in the past is a science. Understanding why things are different now is an art.

Housel further established that the difference between science and art is basically this: Science often provides multiple ways of getting something done. If any of those ways contradict each other, then art is playing a role.

Jon here. Tying this all together, while science is the system of acquiring knowledge, art is the application of knowledge. Investing and portfolio management is equally both a science and an art.

Gathering and creating economic, market and securities charts and information is a science. Understanding and interpreting market history and human behavior to construct and manage portfolios while effectively working with clients is an art.

Tale of Two Pandemic Recoveries

While there is a divergence between individuals that are working successfully through COVID19 as an employee or small business owner, and those that have lost their jobs and are suffering from industries that may take a couple of years to rebound while reengineering for “new” ways of doing business, the stock market appears to be operating on a bandwidth separate from the edgy headline news stories and political banter on jobs, inflation and the economy.

Going back to the “art” of investing, it’s important to separate personal and political feelings from your investments and not make any rash short term moves that may derail your goals. When it comes down to it, long-term investors should be wary of any financial predictions in general. Economist Edgar Fiedler best said that “he who lives by the crystal ball soon learns to eat ground glass.”

Analyzing Slower GDP for Investors

The business cycle is advancing despite a number of investor concerns, one quarter after the economy returned to pre-pandemic levels. And while the pace has decelerated, this is normal after last year’s extreme rebound. For investors, this is important because an economy that is expanding – even at a slower rate – is what helps support a robust bull market.

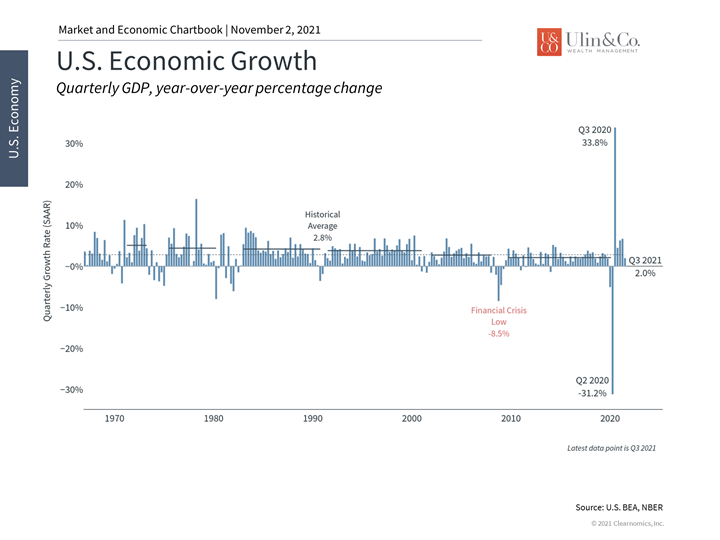

Last week’s data shows that U.S. GDP grew by 2% in the third quarter compared to the second. (see below) Although this is slower than many had hoped, this was due to factors that were widely anticipated: the delta variant, supply chain bottlenecks and a deceleration in consumer spending.

The glass-half-empty view is that last quarter’s growth rate is the slowest since the recovery began, especially compared to the previous quarter’s 6.7% figure. The reality is that investors should not expect the types of growth that occurred right after businesses reopened last year, regardless of supply constraints and inflation. The 33.8% rebound in Q3 2020 was possibly a once-in-a-lifetime event, and only occurred because the economy shrank by 31% at the start of the pandemic. The strong growth rates of the past year benefited from the reopening and should taper off over time.

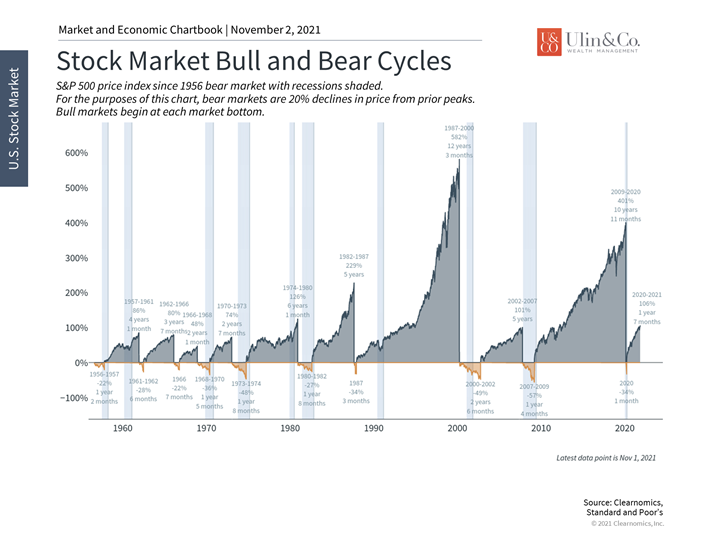

Of course, the situation never seems perfect. During the previous cycle, investors were constantly faced with intractable concerns such as structural debt problems, Fed policy, government spending, the Eurozone crisis and, ironically, the fact that inflation was too low. Despite this, the S&P 500 advanced over the course of an 11-year period. Similar patterns can be found across all business cycles through history. (see below)

While pessimism can occasionally pay off in the short run, it almost never helps over the long run. Even when the situation fails to evolve as investors hope, investment portfolios that are properly positioned and diversified often find a way to perform well nonetheless.

Thus, the more optimistic perspective for investors is that the economy can continue to grow at a steady pace. The average consumer is in a strong financial position, especially as the unemployment rate continues to fall, and industrial activity continues to expand. Although not all Americans are doing well, they may begin to benefit with cases of the delta variant low and with industries and businesses growing and hiring.

For long-term investors, it’s important to keep in mind that recessions and bear markets tend to be sudden and last for months, while bull markets and economic expansions tend to be steady and last for years if not decades. (see below) Positioning for the latter, without focusing too much on any individual data point, is the best way to help achieve financial goals. Below are three insights that can help investors to view the economy with a long-term perspective.

1 The economy grew less than expected in the third quarter

The economy grew at a 2% annualized rate in the third quarter when compared to the second. This is slower than expected but is due to well-understood factors. What matters is that the economy is continuing to grow despite a number of challenges.

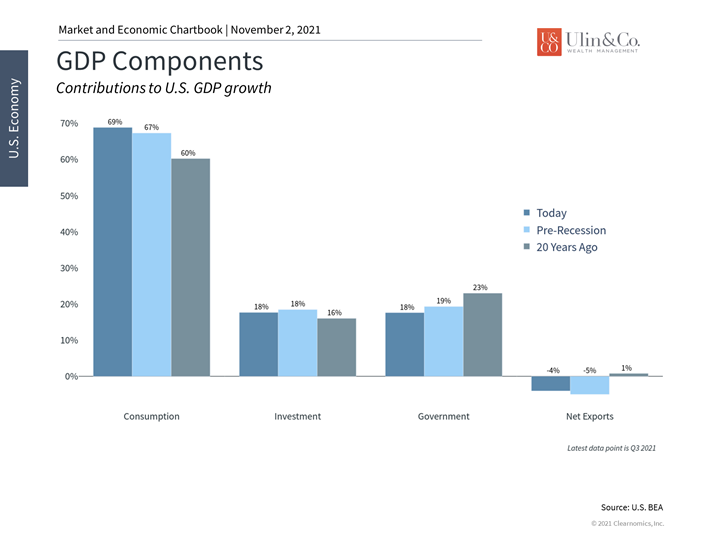

2 Consumer spending is the largest part of the U.S. economy

Consumer spending continues to be a major part of the U.S. economy. The fact that consumers are in a strong and stable position is a positive sign.

3 A strong economy can support long market cycles

History shows that recessions and market crashes are short while bull market expansions are long – if they are supported by steady economic growth.

The bottom line? investing and portfolio management is equally both a science and an art. Investors should continue to focus on the long run, especially as short-term economic challenges evolve.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.