Tariff Shocks to Market Mayhem: Don’t Get Fooled Again!

“A change, it had to come. We knew it all along. We were liberated from the fold, that’s all. And the world looks just the same…” – The Who

April delivered one of the most volatile months in recent memory, triggered by a wave of tariff shocks. The S&P 500 and the Nasdaq dropped sharply—falling 17% and 22%, respectively, from their March peaks to April troughs (Source: BigCharts, based on S&P 500 and Nasdaq declines March–April 2025). Between geopolitical tension, algorithmic selling, and investor angst, the market took it on the chin—only to snap back with a vengeance.

It all felt like déjà vu from 2018, when tariffs were used more as negotiating tactics than permanent policy—and markets swung just as much on emotion and crowd psychology as on hard data. To paraphrase The Who: maybe it’s time to tip our hats to the new constitution… but we’re not quite ready to bow to any kind of revolution. At the end of the day, our job is to help clients grow and preserve capital—through calm, chaos, and everything in between.

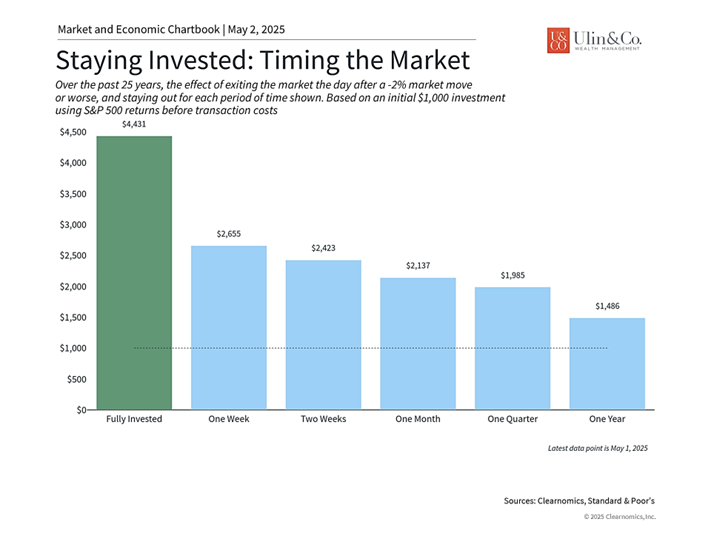

As we’ll break down in this week’s newsletter, even if the tariff headwinds intensify or linger, the broader economic backdrop—from GDP and interest rates to unemployment and inflation—remains digestible. The key is staying on course. One principle continues to hold: long-term investors are better served staying invested through volatility than trying to time it. That’s because big up days and big down days tend to cluster—and missing just a few of the best can set you back years.

In short: don’t get fooled. Not by headlines, not by emotions, not by hunches or political opinions. Mr. Market is famously indifferent to drama—and long-term success comes from discipline, not reaction. At the same time, don’t get swept up in the relief rally. Stay focused, stay invested—and stay vigilant.

What Happened?

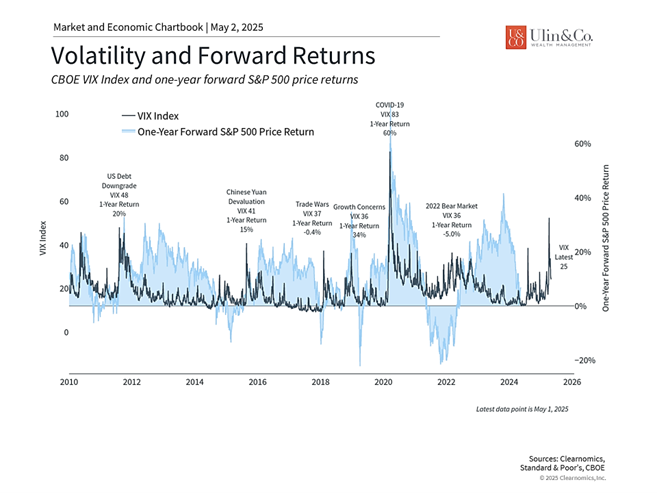

Two major indicators flashed “oversold” just before the rebound, giving savvy investors a reason to pause before panicking. First, the CBOE Volatility Index (VIX)—Wall Street’s fear gauge—spiked above 50 for the first time since the 2020 COVID crash. Moves like that don’t stem from mild worries. They typically signal systemic stress, margin calls, and pure emotion. Ironically, when fear maxes out, opportunity often knocks.

Second, the AAII sentiment survey showed extreme bearishness fueled by the media, with pessimists far outnumbering optimists for several consecutive weeks. Historically, lopsided sentiment like this tends to appear at major market bottoms—think March 2009—when selling has run its course and surprise rallies are born leaving many anxious investors in the dust. Case in point the Barron’s cover story this week noting “Our Money Pros Are the Most Bearish in Nearly 30 Years.” As a friendly reminder, the same consensus at the top of 2023 led to two strong years for stocks.

Third, add in the administration’s sudden decision to delay the new tariff wave by 90 days (excluding China), and a short-covering rally kicked into gear. The result? A sharp, V-shaped bounce that left many investors dizzy—wondering whether they’d missed something or narrowly dodged a bullet.

Headlines vs. Hard Data

Smile and grin at the change all around. Pick up my guitar and play…

Reflex rallies are nothing new. But the recent surge feels more like exhaustion than strength – a snapback from oversold technicals, not a sign of improving fundamentals. Warning lights are still flashing, with more volatility likely ahead.

Case in point: the Port of Los Angeles expects shipments to drop 35% this week, largely due to the escalating U.S.-China trade conflict. That’s a canary in the coal mine for inventory levels, supply chains, and retail margins.

Jon here. We may be entering a phase of supply-side inflation that’s not fueled by growth – a kind of “stagflation-lite” marked by slowing output, rising costs, and pressured profits. Q1 GDP contracted, in part because firms front-loaded inventories ahead of the tariff spike. That temporary boost helped mask underlying softness. While international stocks, bonds, gold and other value/defensive plays have softened the blow for diversified investors so far and helped to greatly minimize losses year to date, those cushions may wear thin if pressure continues to build. After a two year tech -led run, we are not in Kansas anymore.

Time will only tell if Jay Powell will recap that he and the FOMC react to the U.S. import tariffs with either rate cuts or even rate hikes as the tariff medicine sets in to the world economy.

Lessons from April – Stay Buckled Down

Just like yesterday… Then I’ll get on my knees and pray we don’t get fooled again.

April delivered a gut check for every investor. It started with a jolt—April 2’s sweeping tariff announcement—and markets promptly nosedived. Fears of inflation, supply chain stress, and a global slowdown took center stage. But just days later, a 90-day pause and carve-outs for key tech imports helped spark a ferocious rebound.

The month ended with stocks mostly flat—but emotionally, it was a roller coaster. Diversified portfolios held up well, thanks to bonds and global equity exposure. And while the S&P 500 is still down about 5% year-to-date with dividends, many balanced investors are closer to breakeven (Source: S&P Dow Jones Indices). This was a real-time lesson in how patience, education, and diversification pay off more than panic or market timing—especially amid the madness of the crowd.

Still, the VIX crossing 50 is no small feat. It highlights how fragile confidence is—and how quickly sentiment can swing. The biggest down days were often followed by the biggest up days. Trying to time these moves rarely works. Staying invested and disciplined has historically delivered far better results than bailing out in moments of fear. This is a reminder that market swings can move in both directions, and trying to time these moves can often be counterproductive.

While markets have stabilized somewhat more recently, uncertainty remains and many of the drivers of April’s volatility will continue to be in focus. The situation around trade policy is still evolving, although the 90-day pause suggests that the worst-case scenarios may be less likely but then again there has been no discussion or resolution for China nor the Canada-U.S.- Mexico situation. Investors should expect that tariff headlines could continue to drive volatility in the near-term, even as markets adapt to the new trade landscape.

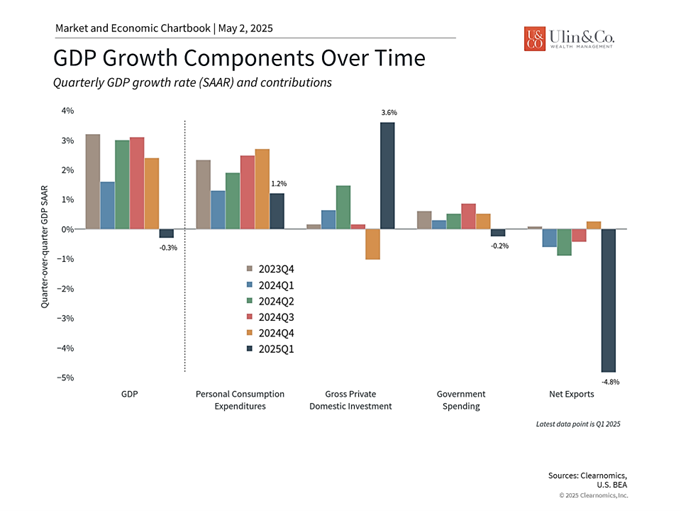

GDP declined in the first quarter

One of the key concerns among investors is whether tariffs will drive inflation higher and growth lower. The latest economic reports show that the economy shrank slightly in the first quarter, with GDP declining by 0.3% over the period, the first contraction since early 2022. This is due almost entirely to trade as businesses accelerated their imports to stockpile inventory. Consumer spending slowed but remained positive. It’s important to note that these figures are only the first estimate of GDP and are subject to change.

As the accompanying chart shows (below), consumer spending has been a key driver of economic growth in recent years. The latest surveys suggest that consumers expect a rapid acceleration in prices over both the coming year and in the longer run, resulting in historically low consumer confidence. While this has not yet impacted consumer spending or inflation in a significant way, it could be an important factor in the coming months.

The mixed picture on economic growth and inflation also makes the Fed’s job more difficult. Not only does the central bank face challenging interest rate decisions in the coming months, but its independence was briefly called into question by the White House, driving further market uncertainty. At the moment, markets expect the Fed to cut rates about four times this year, possibly beginning in July.

These events also resulted in unusual bond market swings, although they ended up near where they started. The 10-year Treasury yield ended the month at 4.16%, while corporate bonds saw yields edge higher. Some investors worried about a flight from U.S. assets, especially with the U.S. dollar falling to multi-year lows.

Staying invested has historically been rewarded

In times like these, one principle continues to hold: staying invested through volatility is often the best path to long-term success. The chart below highlights the danger of trying to time the market after sharp drops of 2% or more. That’s because big up days and big down days tend to cluster. In short: market timing is a costly gamble. Gains and losses rarely happen in neat sequences—some of the best days tend to follow the worst. And missing just a handful of those rebounds can do lasting damage to returns.

The temptation to sell into fear may feel stronger in today’s market—rattled by soft data, rising tariffs, and global tensions—but reacting emotionally rarely ends well.

Final Chord: Don’t Mistake Noise for Signal

Periods of heightened volatility can rattle even seasoned investors—but they also offer a gut check. Rather than reacting impulsively, this is when staying grounded in a disciplined plan and diversified strategy matters most. Lower valuations may create opportunities, but they can also signal risks still working through the system.

The key takeaway from April? Fast drops and fast recoveries don’t always cancel each other out—sometimes they’re just tremors before a larger shift. Emotional decisions during turbulence often lead to missed gains or deeper losses.

Yes, the market was technically oversold after being driven up the past couple of years by the hope of tech and ai creating a new tech revolution since the 90’s. Yes, the rebound had merit. And yes, much of the volatility was driven by emotion from the tariff shocks, not fundamentals. But that doesn’t mean we’re in the clear. Whether this rally sticks or fades will depend on how today’s soft data—like slowing growth and spiking tariffs—plays out in the real economy.

For now, caution—not complacency—is warranted. Investors should revisit allocations, stay globally diversified, and prepare for continued instability as inflation, policy uncertainty, and global growth concerns evolve.

Let’s talk about how your portfolio is positioned—and whether it’s built for the road ahead.

And above all: Don’t get fooled again.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Note: This content is for informational purposes only and should not be construed as financial, legal, or tax advice. Please consult your financial advisor, attorney, or tax professional regarding your specific situation.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.