4 Biggest Investor Adversaries on Wall Street

History rhymes and at times repeats. Almost every year since 1980 the stock market experienced a 14% or greater drawdown that continually causes professional and amateur investors alike to contemplate whether stocks are on sale, or if the end of the Bull market is near. Millions of trades are being placed every minute while thousand-point market swings are covered by the media like an approaching Cat-5 hurricane.

In 35 of the past 42 years, or 85% of the time, the S&P 500 index has sported a positive return even with these disturbing drawdowns that perhaps should not be overly shocking. The odds of success are quite a bit better to make profits in the stock market over time than a table game in Vegas, hitting the state lottery or getting bit by a shark.

Investing in the stock market may feel like you are watching or participating in a sports event, except you can’t see the opponents on the field. As well stated in the book, Four Pillars of Investing, “trading stocks is like playing tennis against an invisible opponent; what the investor doesn’t realize is that he’s volleying with the Williams sisters.” If you are a do it yourself investor, be aware of your own abilities and limitations, or work with an accredited professional. Warren Buffett famously advised along these lines to “know your circle of competence and stick within it.

Four Adversaries

With easy access to information, research (Dr. Google) and trading platforms right from our mobile phones where we can upload cash and crypto like online sports betting, many retail investors may develop a false sense of confidence to be serving a tennis ball against experts with powerful (human/tech) resources that may be 50 steps ahead of their buys and sells with millions to billions at risk under their direction. Behind the wizard of oz curtain of wall street, consider the following four adversaries to investing.

1 Institutions: The entire number of actual, active investors, both institutional and retail, is hard to know. While retail investors’ share of total equities trading volume is near 20%, institutional investors account for more than 80% of the volume of trades on the New York Stock Exchange and can move markets. Institutional investors can be pension funds, mutual funds, money managers, banks, insurance companies, investment banks, commercial trusts, endowment funds, hedge funds and private equity investors.

2 Mr. Market: Mr. Market is an imaginary investor devised by Ben Graham in his 1949 book, The Intelligent Investor. Mr. Market is a hypothetical investor who is driven by fear and greed and approaches his investing as a reaction to his mood, rather than through fundamental (or technical) analysis.

The herd behavior of many individuals mimicking Mr. Market can at times also move the markets from the crowd’s erratic swings of pessimism and optimism. Not as much contrarian, but disciplined investors understand the benefits of buying during times of Mr. Markets pessimism and selling during periods of optimism. Easy to say, a bit harder to execute.

3 Quants: There are studies indicating algorithm-driven “quantitative investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers. These robots can pick up data from Elon Musk’s tweets to Fed Chair Powell’s comments instantly from a TV interview and take action before you finish your morning coffee.

4 Your Brain: The largest adversary for most investors is right between their ears. Regardless of your age, IQ, education or career as a brain surgeon or high-tech engineer, it can be very difficult at times to get out of your own way.

Many behavioral studies illustrate that many investors end up underperforming the markets and their own goals due to poor market timing and taking short term emotional action with their savings. Dalbar studies noted that for the 20 years ending December 31, 2019, the average equity fund investor earned an annual market return of only 4.25%.

What significantly drives markets and your money in the long run once you get your brain in the game are not day-to-day headlines, stock predictions, quants or even year-end targets. Instead, the vibrancy of the economy, the strength of the consumer, and the profitability of companies large and small are what support stock prices over the course of decades.

What Happened and Why Stay on Course (Charting the Market)

Perhaps nothing summarizes the investor experience better than the old quote that “nothing worth doing is easy.” The current market environment, as uncomfortable as it may be, serves as a reminder that staying invested is difficult. The very definition of investing involves sacrificing what we could buy and consume today in order to achieve more tomorrow. Over long periods, this is how all investors can transform hard-earned savings into true wealth and financial freedom. What can investors do to focus on the long run when the daily headlines and market swings are alarming?

The tendency to react to what’s happening today at the expense of the next year or decade is a natural one. Last week, the Federal Reserve raised interest rates by half a percent (50 basis points), the largest increase in over twenty years. After a short recovery, major stock market indices began to struggle once again. At the moment, all major U.S. indices are down more than 10% for the year, with the Nasdaq now deeper in bear market territory.

One of the core principles of investing is that there is no reward without risk. Simply put, having the fortitude to stick it out when times are tough is exactly why long-term investors are rewarded. In general, this is why stocks have historically achieved greater average returns than “safer” assets such as bonds: these returns are compensation for withstanding greater uncertainty.

Occasionally, there may be times when investing seems easy and all prices rise, irrespective of risk, such as over the past two years or during the dot-com boom. When these periods inevitably end, it becomes clear which investors were truly following a disciplined plan and which were just following trends. In times like these, it’s important for long-term investors to remember a few historical facts.

First, it’s important to maintain a broader perspective. While the stock market is in the red for the year, zooming out paints a very different picture. The S&P 500 has gained 65% over the past three years, 22% since the pre-pandemic peak in early 2020, and 79% from the pandemic bottom. (see below) While investors may prefer a smooth ride, with steady gains day after day, this is unfortunately not how the market operates. Instead, the price of long-term gains is the ability to stomach short-term declines.

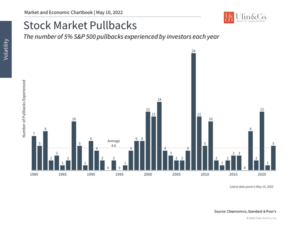

Second, a common refrain from the investment profession is that “market volatility is normal.” What this typically means is that the stock market can swing wildly even when there is little new information. This year, the S&P 500 has experienced four distinct 5% declines. While this may seem like a lot, the average year experiences four to five of these pullbacks, most of which recover in weeks or months. The pandemic caused 12 such pullbacks in 2020 and there were eight in 2019 during the global growth scare that year – a time when many expected an immediate recession which never materialized. (see below)

After all, owning a stock is nothing more than owning a share of the profits of a company. While interest rates, inflation, geopolitics, and other factors affect the calculated value of this ownership, these effects also tend to average out over time. At the moment, consensus expectations are that S&P 500 earnings-per-share could rise 10% this year and 9 to 10% each of the next two years. Even if these forecasts decline a bit, these levels of growth can help to support valuations and market returns.

None of this discussion is meant to ignore or downplay the challenges that lie ahead for markets. However, many of these challenges are already widely understood by investors who have been grappling with them for months, if not years. The point is that investing activity can occur over many timeframes, so it’s important for investors to pick the one that matches their financial goals, and to know that the process will be worth it even if it isn’t always easy or comfortable. Below are three charts that put this challenging market in perspective.

1 Major indices have swung wildly over the past week

All major indices are in correction territory and the Nasdaq is officially in a bear market. This level of volatility, while extreme compared to the past two years, is par for the course when investing in stocks. In fact, the reason stock market investors are rewarded over time is exactly because they are willing to withstand a higher level of risk.

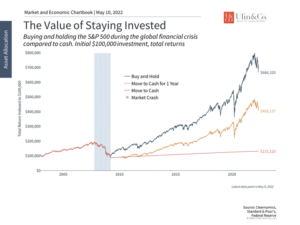

2 Staying invested is the best way to manage challenging markets

While the temptation to react to market events is natural, history shows that simply staying invested is often the better approach. This is because timing the market is hard if not impossible. Big down days are often followed by up days shortly thereafter. Trying to predict these day-to-day swings is unnecessary and often counterproductive.

3 In the long run, fundamentals are what matter

Over the course of years and decades, fundamentals like valuations and earnings matter much more than daily headlines on the Fed, individual stocks, politics and more. The strength of the economy, fueled by business innovation and consumer spending, have propelled the stock market forward cycle after cycle.

The bottom line? Although Investor Adversaries are plentiful, play the long game. Staying invested to achieve financial goals is worth the short-term discomfort. As stocks tumble, smart investors are calmly focusing on the long game and tweaking their portfolio accordingly.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.