3 Rules to Survive a Bear Market Attack

While a bear encounter is a special treat for any visitor to a national park, it can be a more dire experience for investors of all ages. Just like in the wild, each bear market and personal response is unique; there is no single strategy that will work in all situations and that guarantees physical or financial safety.

While remarkably most bear encounters end without injury, many investors end up making poor decisions in the short term that help to create adverse outcomes. While your safety in the wild can depend on your ability to calm a bear, your ability to navigate through a bear market may depend more on your emotional IQ and strategy.

As bears can run as fast as a racehorse and chase you up a tree, the National Park Services basic guidelines to implement when confronted with a bear amazingly include (1) stay calm and talk quietly (2) move slowly away sideways and do not turn your back. (3) If attacked, play dead. Seriously, do nothing! Lay flat on your stomach with your hands clasped behind your neck. Spread your legs to make it harder for the bear to turn you over. Eventually it will leave.

Following are 3 basic rules for investors to follow in the face of a bear (market) attack:

1. Stay Calm: Being rational, calm and unemotional can be difficult when it comes to managing money while being inundated by the terrifying headline news and thousand-point daily market gyrations. In a perfect world, every investor could “buy low and sell high”- however, the realities of markets, behavior and investing “know-how” often prove more complex and require a more measured approach.

Stress can leave a lasting, negative impact on your health and brain while affecting your sleep to your short-term memory and decision-making capability. The answer to this dilemma may be to consume less headline news and spend more time on a hobby or activity that actually brings calmness and happiness to your life.

2. Stay Liquid: Maintain at least 12 months in your “cash reserves bucket” of essential expenses for when inclement weather hits. Also ensure your home equity and credit lines are in order whether you are a family or small business. Avoid “retail therapy” as an emotional outlet. While you may have extra time and money on your hands, now is not the time to go on a major online spending spree to help reduce stress while increasing your obligations.

If you lose your job or are forced into an early retirement, you do not want to have to sell stocks at a low point during a bear market or take a taxable distribution (or expensive loan) from your 401(K) account or IRA because you are cash poor. If you are under 59 ½ you may also end up paying a steep 10% penalty on top of taxes for any retirement account distributions.

3. Stay Diversified: If you are properly diversified and know your portfolio “risk budget” matches your time frame and financial goals, “doing nothing” if properly diversified may provide a better outcome for your investing and retirement goals than making a lot of unnecessary changes or executing a “fire sale” during an ugly bear market.

Market timing is a fool’s game. Investor studies indicate that the human brain is not a rational economic actor. When faced with uncertainty, even the best investing minds may throw good money after bad, sell at the first sign of trouble or make all manner of jumbled financial decisions when stress and volatility hits.

For the past two decades since the Clinton era, the average US investor has returned only 3.88%/yr and greatly lower than the 10% /year US markets based on Dalbar studies.

This 6% “behavior gap” indicates many people of all ages are guilty of a combination of poor market timing and lack of a disciplined investment process.

For long-term, disciplined investors, the answer to market volatility isn’t to jump in and out of the market. Instead, it’s to stick with a well-balanced portfolio that can weather upcoming bear attacks. Sound Investing truly is about your “time in the market” and not “timing” the market.

Bear Market Perspective

In these historic times, it’s important for long-term investors to maintain perspective and clarity. Having perspective is not an assurance that markets always go up or bounce back immediately. It doesn’t mean that there aren’t serious issues affecting public health or the economy. It does not guarantee that the financial journey will be easy.

Instead, just as having the right perspective on a problem can help to solve it, having perspective in investing is about addressing the right issues while knowing what we can and cannot control as individuals.

At the public health level, we cannot control the nature of the coronavirus or change how far it has already spread. At the economic level, we cannot change the fact that growth will slow for several months or even quarters, nor can we directly control the response of governments and central banks. At the market level, we cannot change the fact that there is significant uncertainty and that volatility has increased.

What we can do is react to each of these appropriately. We can heed the advice of public health experts and practice social distancing and proper hygiene. We can keep a close eye on the economic data to assess whether this is a transitory event or whether there are structural implications. And, most importantly, we can maintain discipline in our investment portfolios by staying diversified, maintaining a long-time horizon, and not overreacting. Being reminded of this when the situation seems most uncertain is perhaps the greatest value of investment education and the right financial guidance.

Given recent events, it’s natural to draw parallels to past crises. At the moment, there are two primary reasons that some investors are drawing comparisons to the 2008 financial crisis.

The more superficial reason is simply that markets have fallen into bear market territory with large swings, both positive and negative, on any given day. Last year, the average daily move in either direction was about half of a percent for the S&P 500. This year, the average swing is almost 2%. 12 trading days have been above plus or minus 3%, 9 days above 4%, and two days larger than 9%. Not only are these swings larger than investors have experienced in twelve years, they are some of the largest since the Great Depression.

The second and more substantive reason for investors to draw comparisons to 2008 is the fear of financial contagion. While this is still not the most likely outcome, there are scenarios in which short-term liquidity problems can cascade into long-term solvency ones. For instance, it’s one thing for an individual to go without a paycheck for a couple weeks because their small business is closed. It’s quite another if this spans months and the individual faces a cash crunch.

Multiply this problem across the economy and scale it up for large companies who rely on bond markets for funding, and it can become a serious problem. Credit spreads have spiked in recent weeks and bond market volatility has risen significantly as well. The MOVE index, essentially the bond market’s counterpart to the VIX, has risen to its highest levels since the global financial crisis.

However, the federal government and the Federal Reserve understand this and have begun to act. Economic stimulus and liquidity provisions have been implemented in recent days alongside public health measures. These go hand-in-hand, since one of the main side effects of slowing the virus is an economic slowdown. Thus, a key difference with 2008 is that the Federal Reserve and federal government have playbooks that were developed during the last crisis and can be implemented quickly.

Below are three charts that help to put recent government stimulus actions in perspective.

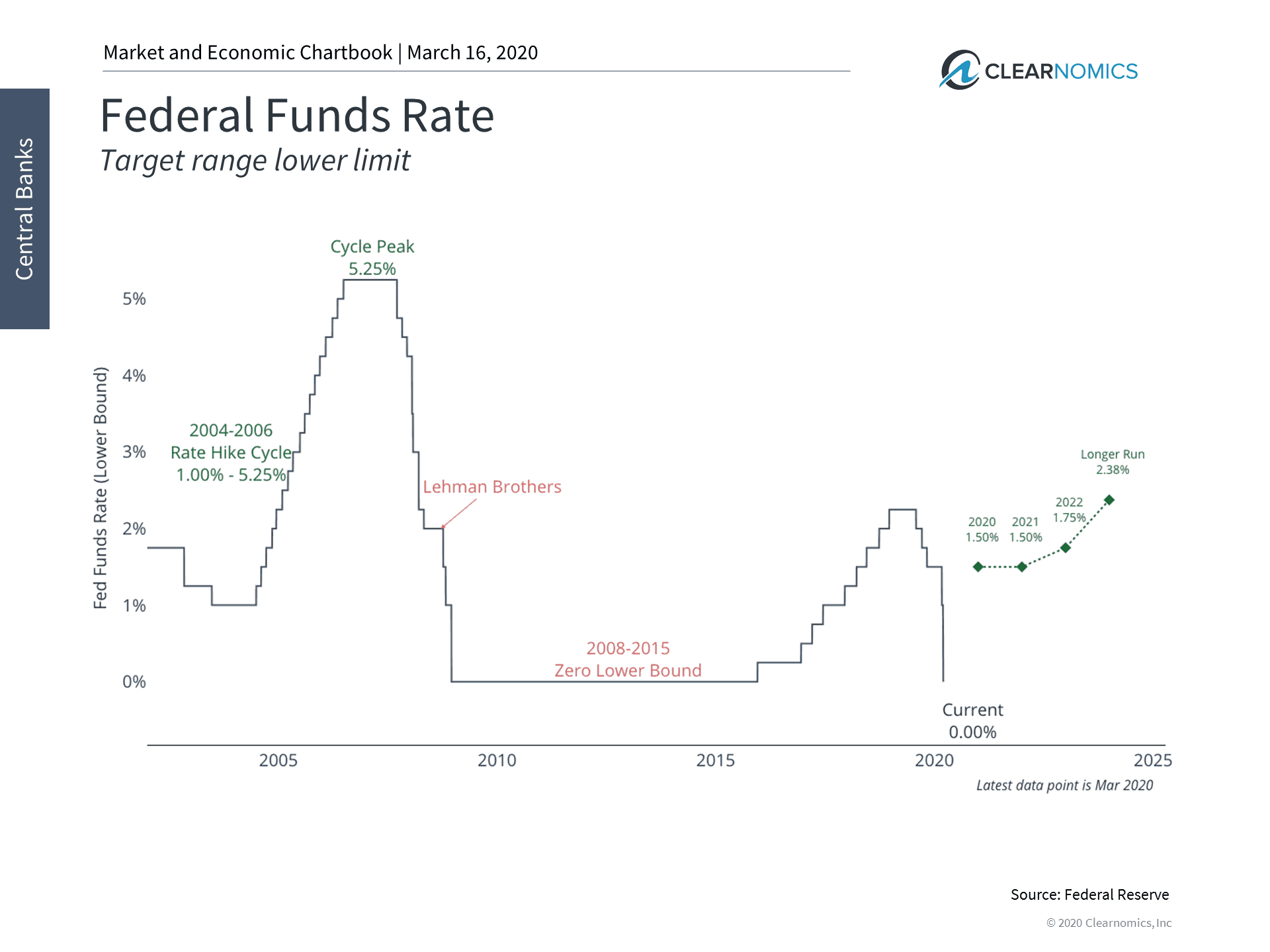

1. The Fed has implemented emergency stimulus measures

The Fed made an emergency rate cut to the zero lower bound just days before its next scheduled meeting. This is the first time rates have been at zero since 2015, and is the largest cut since the 2008 financial crisis. The Fed will release new economic projects at its next meeting which should reflect its latest decision.

In addition, the Fed also announced $700 billion in asset purchases, a resumption of the post-crisis quantitative easing program, in addition to dollar swap lines with other central banks. This is to prevent a short-term crisis from harming the plumbing of the financial system.

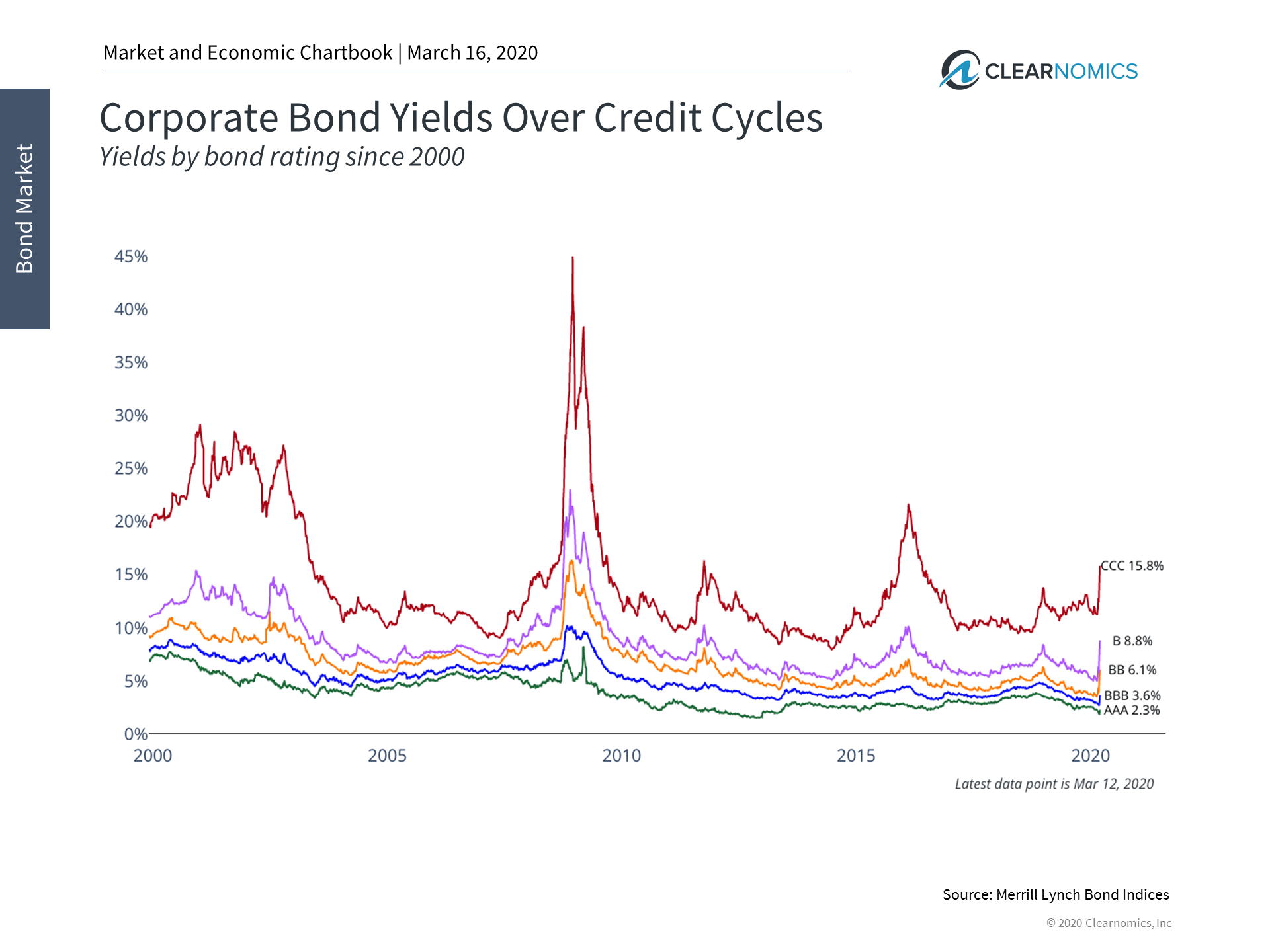

2. Credit spreads have widened as volatility has risen

Bond yields have jumped in recent weeks in response to the coronavirus, although this should be put in perspective relative to the 2008 financial crisis and the 2014-2016 oil price collapse. Still, volatility in the bond market has also spiked to its highest level since the 2008 financial crisis. While the plumbing of the financial system still appears to be orderly, the Fed’s emergency actions along with the government’s public health and fiscal stimulus are an attempt to preempt problems down the line.

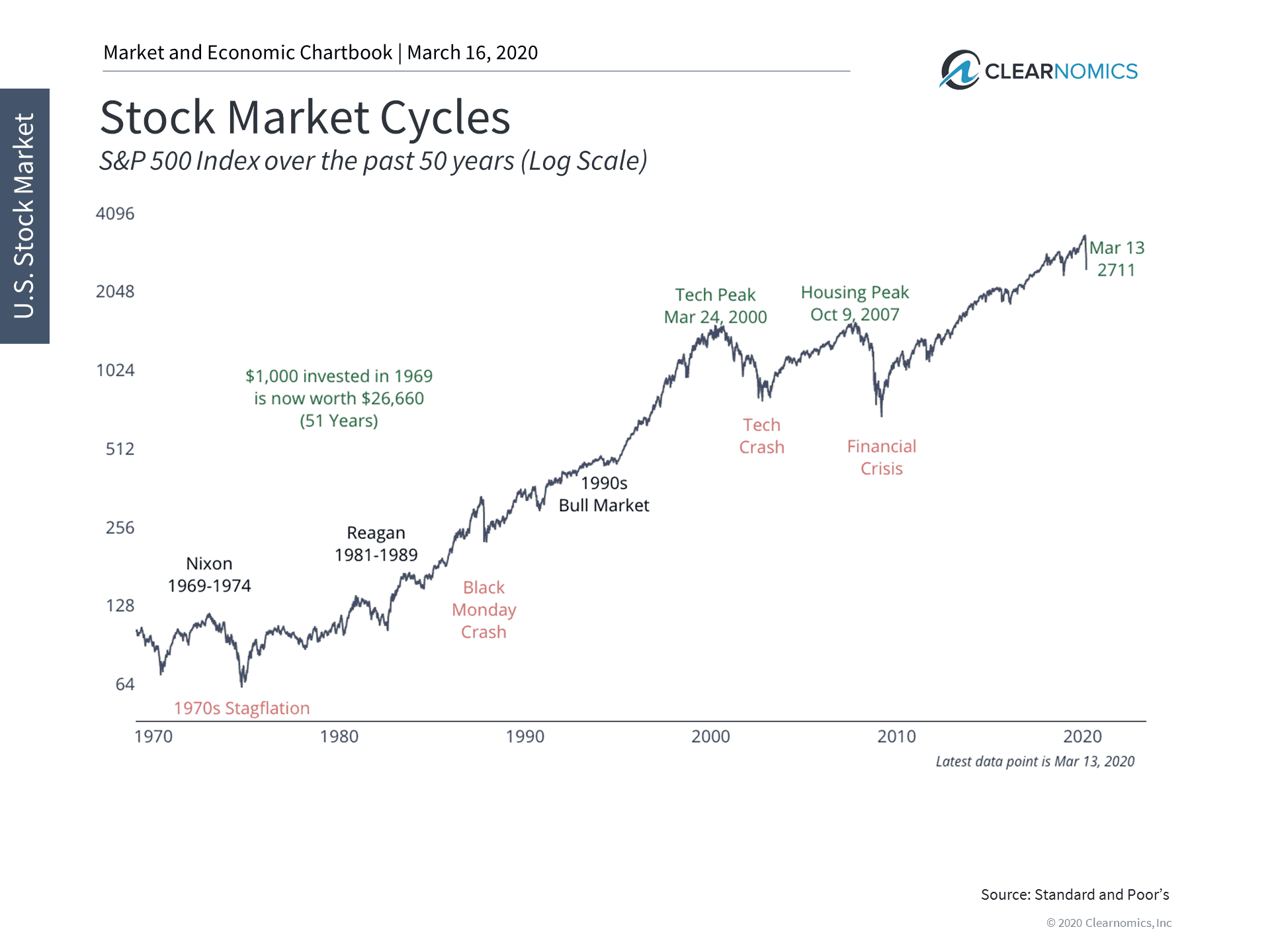

3. While this is a challenging time for investors, it’s important to maintain a long-term perspective

While investors can’t directly control government actions or the spread of the coronavirus, they can maintain the right perspective and focus on what they can control: staying disciplined and maintaining appropriate portfolios. The chart above shows that markets have pulled back at many points across history – sometimes for extended periods. However, those with the right perspective are better able to achieve their financial goals.

The bottom line? The history of the market is filled with manias, panics and crashes which, viewed in hindsight, could have been handled better by investors. While each episode may have its own unique circumstances, the fact remains that staying disciplined and not overreacting to backward-looking market moves is the best way to achieve long-term financial goals.

Investors are facing significant uncertainty due to the nature of the coronavirus. However, staying balanced and disciplined has been the best course of action across all types of bear markets.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.