2024 Market Outlook – Soft Landing Perspectives

As we phase into the new year with a bit of market turbulence, the 2024 market outlook presents a landscape filled with lingering challenges from last year. Amidst ongoing concerns of an inverted yield curve, negative investor sentiment, and the specter of high-interest rates and inflation, one prevailing belief stands firm – the resilience of the consumer, the powerhouse behind 70% of the GDP.

We are still of the minority consensus of the “no recession” crowd, and a soft landing for 2024 through an election year. While the obvious headwinds have not weakened the progress of the consumer powering the economy or the employment numbers, many other unforeseen black swan events from commodity spikes (crude) to supply side issues with semiconductor chips could derail the Fed from getting to their 2% CPI target over the next year.

While leading indicators that look promising provide valuable insights into the future direction of the economy, their accuracy is not foolproof. Economic conditions are complex, influenced by a multitude of factors, and subject to unexpected events. Economic data, including leading indicators, often undergo revisions. Initial reports may not capture the full picture, and subsequent adjustments can alter the interpretation of the data.

The S&P 493

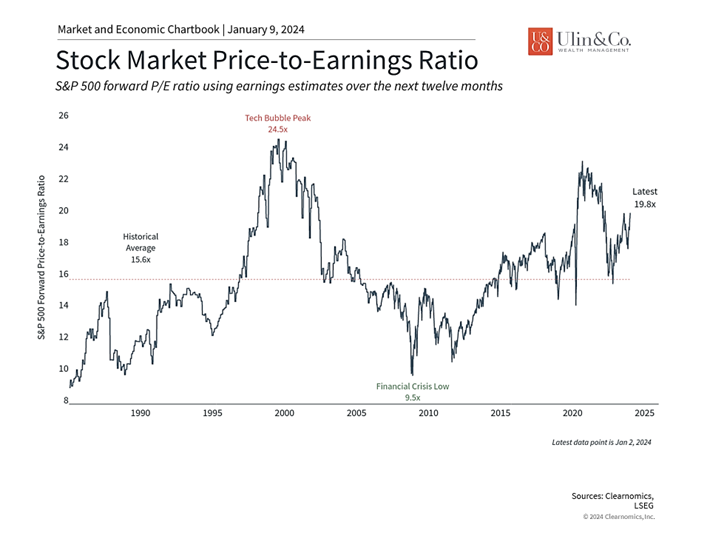

Our contrarian view of a soft-landing continues through 2024 despite all the Armageddon doom and gloom reports. The stock market should continue to hit new highs over time as the second year of the most misunderstood bull market continues. As historically most bull markets survive about five to six years, we may be just at the forward end of this run as the Fed is now discussing potential rate cuts and not rate hikes.

More than just generative AI and tech boosting a handful of stocks as we saw over the past couple years, the balance of the S&P 500 stocks and sectors, as we refer to as the “S&P 493,” may give tech stocks a run for the money with lower valuations and more room to run as rates and inflation cool off over time while benefiting other industries and sectors.

We expect to see continued traction by small and mid-cap stocks with a focus on banks, financials, industrials, staples, real estate, commodities, and healthcare. Keep an eye on dividend stocks, preferred stocks, and equally weighted S&P 500 strategies. We are also optimistic on upward performance by longer duration bonds including Treasuries that created headaches over the past few years for many banks and investors. As inflation and interest rates eventually settle down and gravity reverses, there could be profits made.

Presidential Elections

While the country is getting riled up again for a potential Trump vs. Biden Presidential rematch for POTUS47, we remind investors that the markets are not overly sensitive to either party winning. Regardless, it will not be a straight line up through 2024 for stocks. Pullbacks and a correction before year end should not be unexpected, pre-election year or not, whether due to seasonality or by many of the other macroeconomic factors to geopolitical risks evolving.

On a positive note, pre-election years tend to be robust, markedly when you have a new president. Also, it is good to point out that there has not been a recession in a pre-election year since WWII. Overall, since 1928, the S&P 500 has gained about 7.5% on average in presidential election years regardless of who wins, according to RBC Capital Markets.

Still, we’ll chew over potential Presidential outcomes in coming newsletters that may consider the potential for post-election changes in taxation, fiscal spending, social benefits, and other policy areas. Not as much a policy issue but a growing concern, we will continue to monitor the Federal debt (currently at $34 Trillion dollars) and is expected to surpass $46T by 2028 in just 4 years, regardless of the party in the White House. (US debtclock.org.)

Soft Landing Perspectives

Market-based measures still suggest that the Fed could cut rates only a few times this year, but may not start as soon as March as originally forecasted. So, while investors might prefer to start the year off on a positive note, it’s important to not overreact to a couple of weeks of bumpy market activity, especially in the context of the strong trends of the past twelve months. Consider the following factors to maintain a longer-term perspective on markets with our 2024 market outlook:

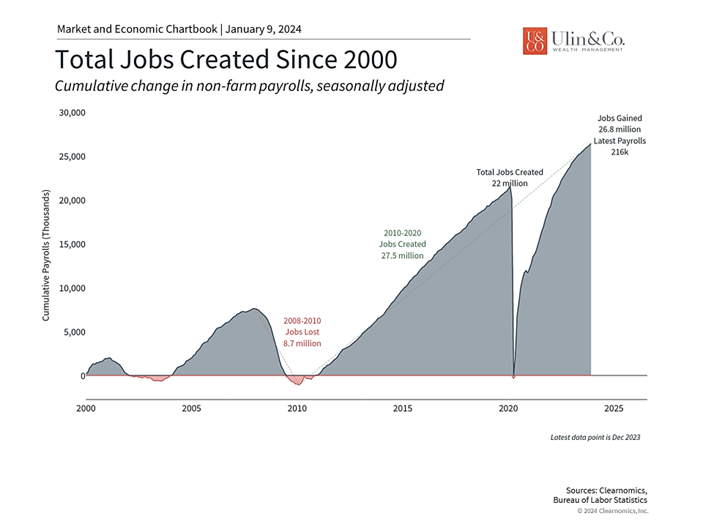

The economy added 2.7 million new jobs last year

First, it’s important to define what a soft-landing entails. The Federal Reserve’s Congressional mandates since 1977 have been to maintain stable prices (i.e., keep inflation low) and achieve maximum employment. From 2008 following the global financial crisis to early 2020, inflation was exceptionally low, allowing the Fed to keep policy rates near zero for much of that decade. The inflation spike of the past few years reversed this trend for the first time since the early 1980s, resulting in one of the fastest rate hike cycles in history. Since rising rates tend to slow the economy, the Fed’s challenge has been to tighten policy in a way that slows inflation without causing a deep recession.

The probability of a soft landing increased last year as the economy remained robust even as inflation fell. The Fed has traditionally maintained a 2% inflation target on the Personal Consumption Expenditures (PCE) Price Index, a measure of inflation, and these figures have now decelerated to 2.6% and 3.2% on the headline and core measures, respectively. (Note: CPI sources data from consumers, while PCE sources from businesses.) Absent any major shocks to the economy, energy prices, or rents, these figures could be on track to reach 2% on a year-over-year basis later this year.

Last week’s jobs data indicated that the labor market has slowed but remains historically strong. Unemployment was steady at only 3.7% and 216,000 new jobs were added in December (see chart) although there were also 71,000 in downward revisions to the prior two months. Still, this means that 2.7 million new jobs were created in 2023, an exceptional pace that adds to the cumulative job gains shown in the accompanying chart.

The economy is expected to slow but few expect a deep recession this year

These improvements in inflation and the strength of the economy are the opposite of what most economists anticipated just a year ago, serving as a reminder to take forecasts with a grain of salt and a dose of humility. This upside surprise allowed markets to not only rebound but also for the Fed to pause its rate hikes and pave the way for rate cuts. Just as the bear market in 2022 was defined by the spike in inflation and rapid rate increases, markets are anticipating that the next couple of years could be defined by a reversal in these trends.

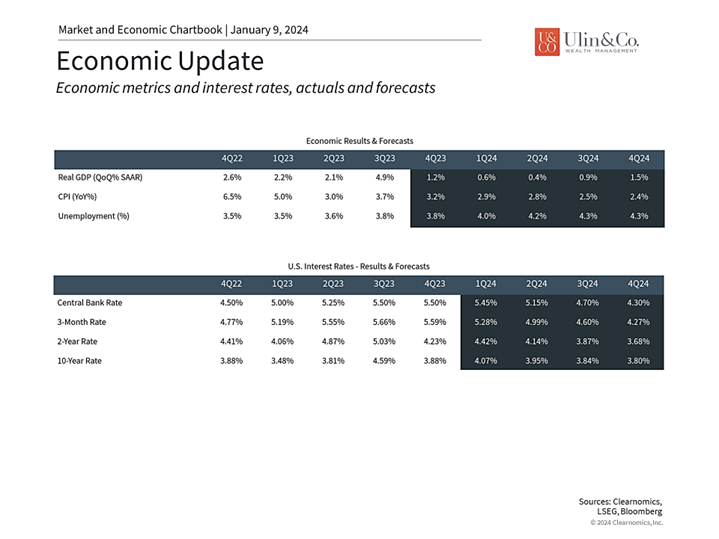

Of course, things never go as smoothly as investors would like. One possibility is that the economy could slow in 2024 after avoiding a recession last year. The accompanying chart shows that economists anticipate a deceleration in GDP growth during the first three quarters of the year. This could happen as consumers tighten their belts and the impact of high rates continues to filter through the economy. Of course, the irony is that a slowing economy would further justify Fed rate cuts which is generally positive for both stocks and bonds. Another possibility is that the last mile of inflation is difficult to navigate, especially among categories that are “sticky.” This could be the case if wage growth remains strong which, while positive for households, could keep price pressures higher than the Fed would prefer.

Valuations have risen as stock prices have priced in positive trends

All of this matters to investors not because small changes in inflation or the difference between one or two rate cuts will dramatically alter the path of the economy or monetary policy. Instead, it’s because markets have “priced in” quite a lot over the past few months since, after all, the job of financial markets is to incorporate all available information. The S&P 500 price-to-earnings ratio, for instance, has climbed to 19.8x, well above recent lows and the historical average. Much of last year’s market gains were in anticipation of positive events, pushing valuations higher until fundamentals such as corporate profits can eventually catch up.

Thus, investors need to maintain perspective in this environment. When professional investors and portfolio managers debate whether inflation will be stuck at 3% on a year-over-year basis or whether the Fed will begin cutting rates by May, this can cause short-term market swings. However, for long-term investors, this amounts to splitting hairs since they don’t affect the overall trajectory of the market and economic trends. While investors should always expect the unexpected, debating on a daily basis whether or not the Fed will cut three, five or seven times this year loses sight of the bigger picture.

The bottom line? The 2024 market outlook, despite challenges such as lingering inflation, inverted yield curves, negative investor sentiment, and high-interest rates, reconfirms the belief in the resilience of the American consumer. As the driving force behind 70% of the GDP, the consumer’s strength provides a solid foundation for positive returns in the stock market. In a landscape where traditional indicators may be less reliable, a nuanced and adaptive approach is crucial for investors looking to navigate the complexities of the evolving market.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.