Will Three Times Be a Charm for the Markets?

The Rule of Three is ingrained into the foundation of our culture from art, theatre, music, math, speeches, science, comedy and nursery rhymes.

Our minds seem to be better engaged when absorbing information grouped into patterns of three. Perhaps this is because one element can be considered chance, a second as coincidence and a third as evidence.

Examples include the obvious such as 3 act plays, 3 primary colors, 3 branches of the US government, and 3 feet in a yard. Storytelling has a ton of examples including the 3 Kings, 3 wise monkeys, 3 little pigs, 3 blind mice, 3 stooges and the 3 musketeers.

Even in our everyday language we hear things like (ready, aim fire), (stop, look, listen) (lights, camera, action) and even (blood, sweat and tears.)

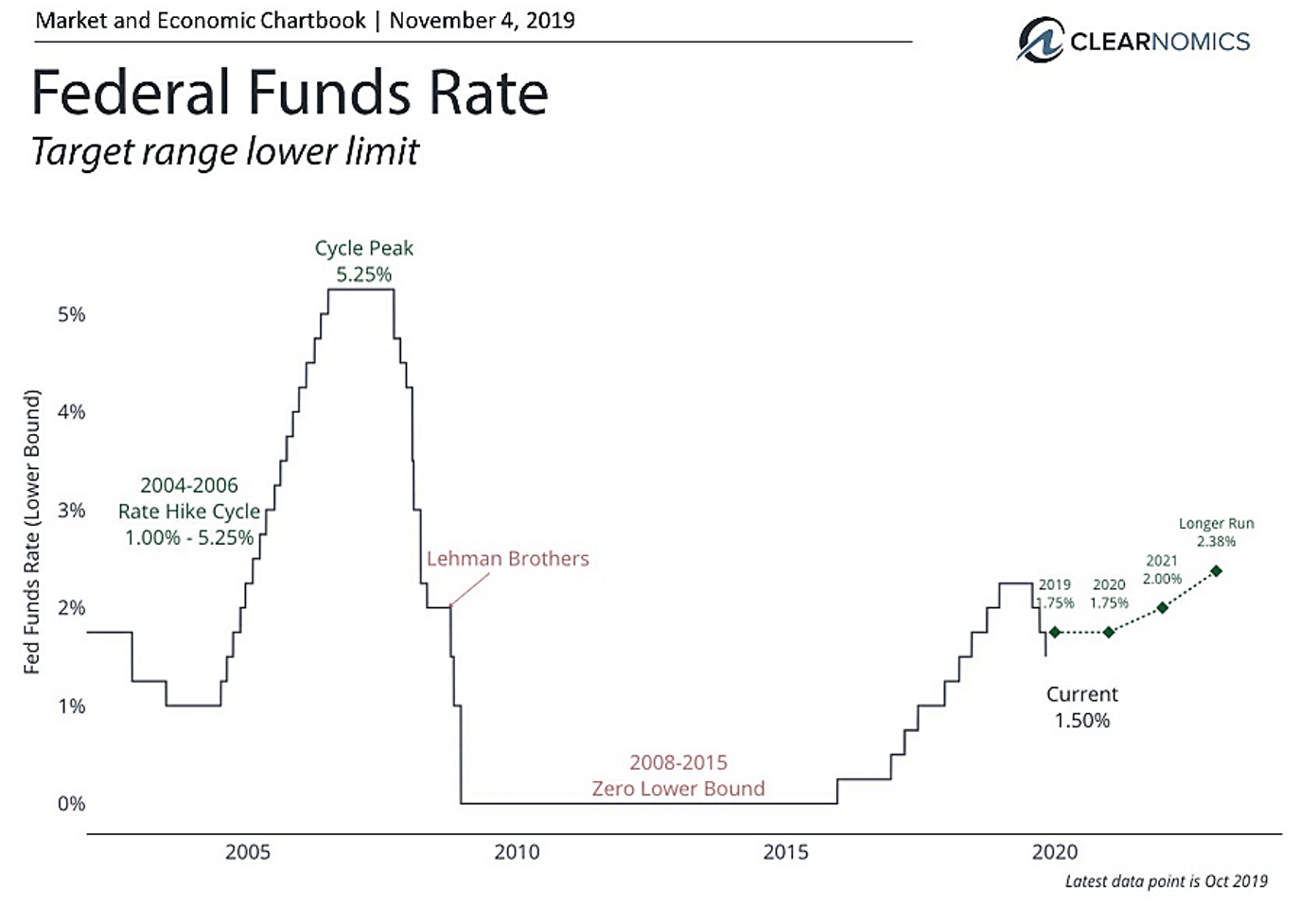

With Fed Chair Jerry Powell’s “hat-trick” of three interest rate cuts in a row (Fed funds rate), will the markets and investors now see Trump, the US markets and the longest economic expansion in US history as a three-ring circus….or perhaps…. the third time will be a charm?

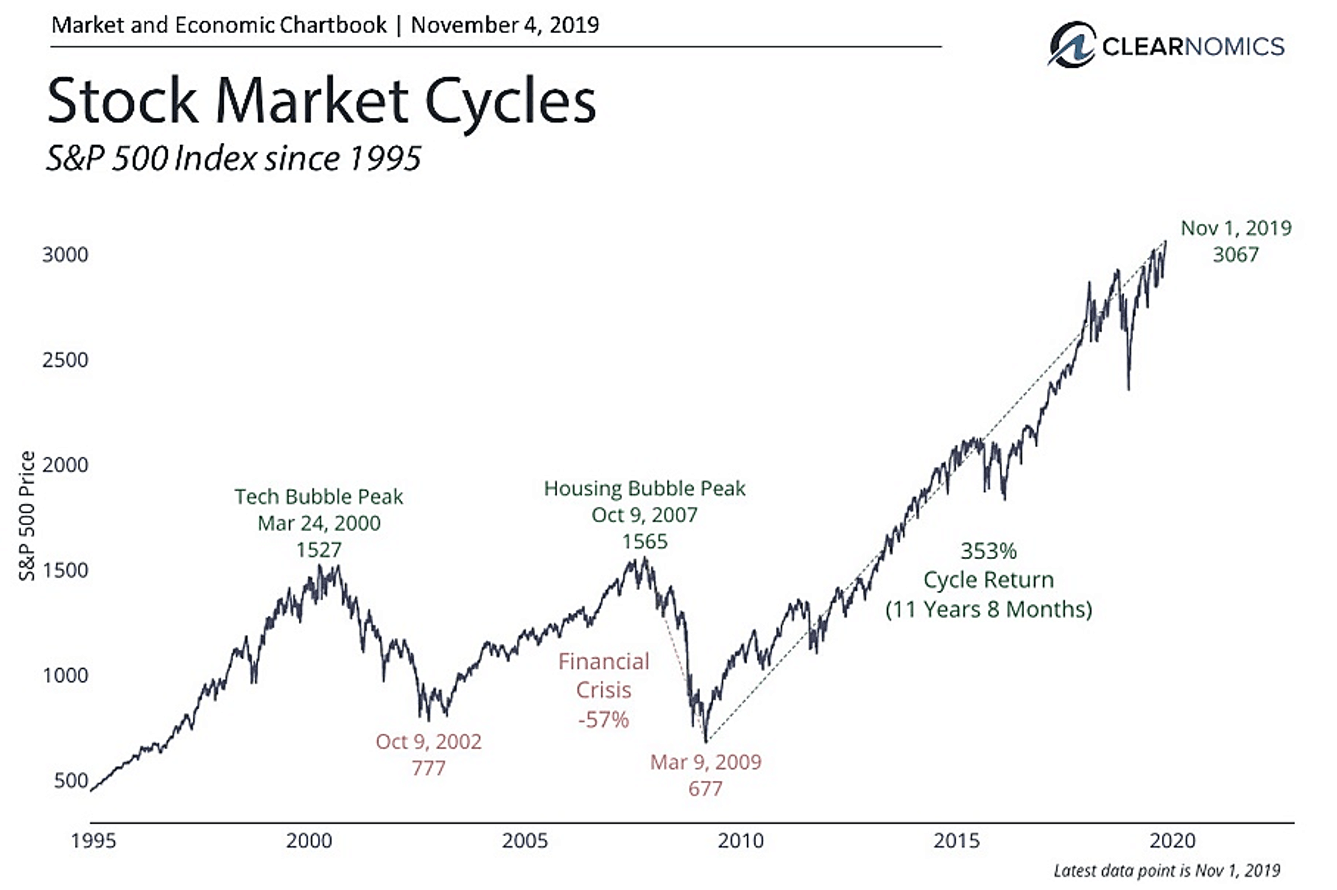

The stock market has once again hit new all-time highs, bringing this year’s total return for the S&P 500, including dividends, to over +24% (shown below). This is in no small part driven by last week’s Fed rate cut and other accommodative measures. How should investors react to rising markets and can the Fed be expected to support markets for the foreseeable future?

As is always the case, it’s important for investors to maintain perspective on this year’s market rally. After all, it was only a year ago that the market nearly fell almost -20% (shown below) into bear market territory amid investor fears of a recession. The fact that the economy has been able to grow at roughly +2% is one reason that markets rebounded. However, it’s also clear that growth has slowed in the U.S. and globally. Despite new record highs for many market indices, it’s likely to be prudent for investors to stay balanced.

This is because long-term investors know that market volatility can strike at any time, as we’ve seen over the past few years. Fed rate cuts – now totaling three in a row – can keep markets happy for a time, but not indefinitely.

Between 1995 and 1996 and in 1998, the Alan Greenspan-led Fed cut interest rates 3 times and then stopped, in order to combat an economic downturn and sustain the expansion. In each of these cases the S&P 500 returned 24.76% and 19.39%, respectively, over the next year. (shown below)

The central bank’s decision Wednesday to lower the overnight lending rate to a target range of 1.50% to 1.75% marks the third rate cut since July 2019. Data show that when the third-rate cut is the last cut in the series, stocks go up the following year. But when the third cut was followed by more rate cuts (2001, 2007) stocks fell greatly. (shown below)

At the moment, the Fed isn’t expected to cut rates again this year, but the nature of the “Fed put” is that investors expect the Fed to come to the rescue when needed.

With fewer policy tools available that only work with a lag, and with a variety of economic forces creating uncertainty, it could be increasingly difficult for the Fed to meet all investors’ expectations. Thus, investors should stay disciplined and even be careful about what they wish for.

Even if Fed stimulus helps in the short run, this is usually a negative sign in the long run. This is why long-term investors, who can afford to be both patient and disciplined, should continue to stay balanced across asset classes to navigate global uncertainty.

Below are three charts that put the stock market rally and Fed rate cut in perspective.

1. The stock market has hit new record highs

The S&P 500 hit new record highs last week due to the widely expected rate cut as well as increased optimism for a U.S.-China trade deal.

2. This is partly driven by Fed easing

The Fed cut rates again for the third time this cycle last week. They’ve signaled that this may be it for now but only time will tell. If the economy continues to slow, U.S.-China trade talks worsen, or markets react negatively to headlines, the Fed may have no choice but to act again.

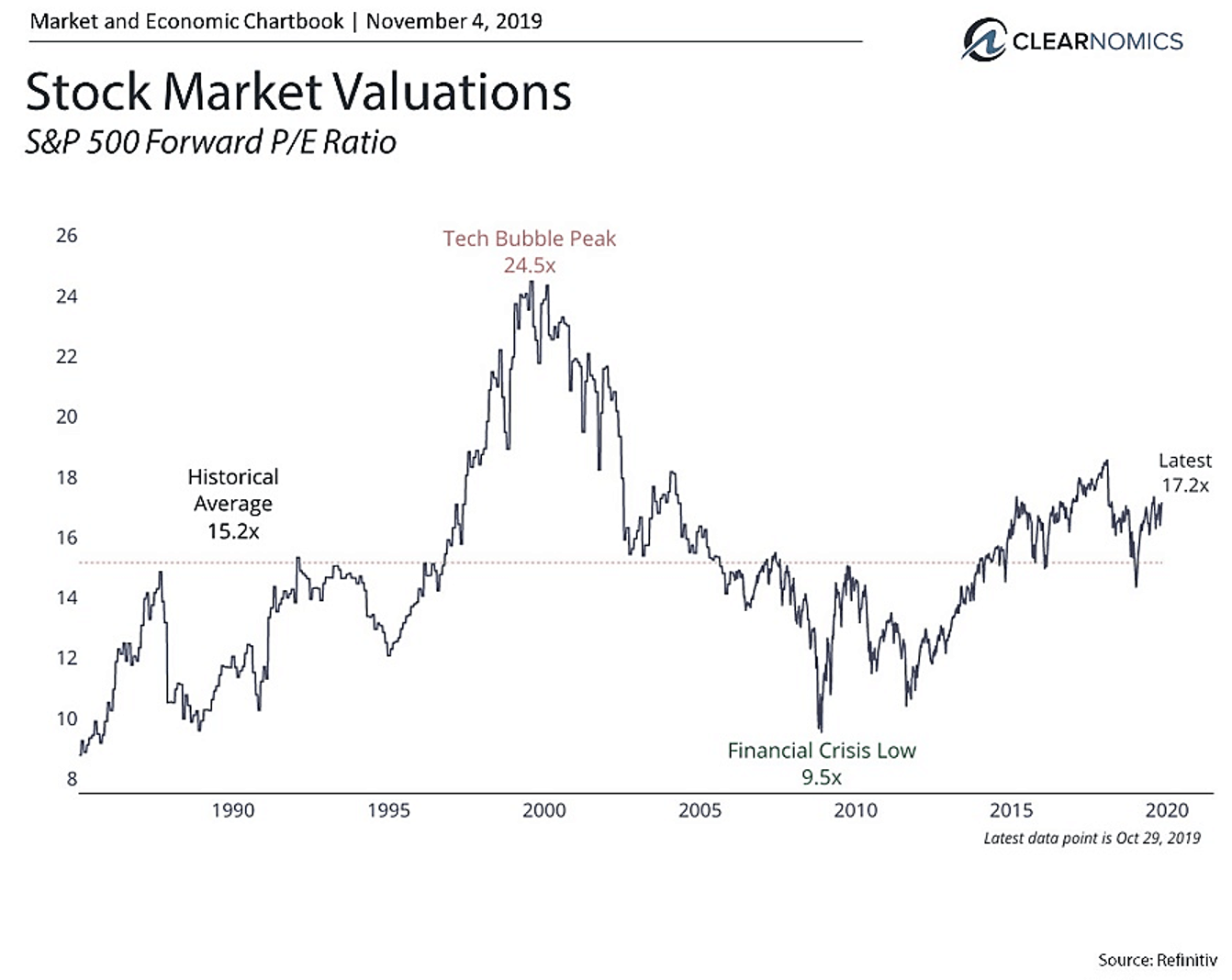

3. Valuations are above average but still not stretched

Despite hitting record highs, valuations are not too far stretched. So, while markets are not cheap, it’s still important for investors to stay invested in a healthy mix of stocks, bonds and other asset classes.

The bottom line? The market has once again reached all-time highs, fueled in no small part by Fed rate cuts and perhaps a little bit of magic, luck and patterns. Long-term investors should stay disciplined and maintain perspective in a diversified portfolio based on their age, goals and appetite for risk.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.