Riding the Trump Trade: Sector Standouts and Market Valuations

Presidential policies often spark speculation about market winners and losers, but history tells a more nuanced story. While elections generate headlines and stoke emotions, the real drivers of market returns lie in broader economic cycles and fundamentals.

Overreacting to policy proposals by a new president can lead to poor investment decisions. Markets have historically performed well under both parties, navigating varied tax regimes and policies. While the big picture shows resilience, zooming in reveals that administrations can significantly affect specific sectors—benefiting some while pressuring others.

The economic effects of President-elect Trump’s proposals will depend on their scale and scope. Some anticipate slower growth next year, enhancing the appeal of Treasuries, while others expect inflation fears to push long-term yields higher. A rare “steepening twist” scenario could arise if the Federal Reserve continues trimming short-term rates to support growth while investors demand higher yields on longer-term bonds.

Sector Losers

Certain industries face significant headwinds in the Trump trade:

- Trade-Sensitive Sectors: Manufacturing and agriculture may struggle under heightened tariffs, increasing costs and disrupting demand.

- Renewable Energy: Pro-fossil fuel policies could slow momentum for green initiatives.

- Tech: While deregulation benefits tech, trade protectionism and immigration limits may disrupt supply chains and talent pipelines.

- Healthcare Providers: Companies reliant on ACA provisions may face instability amid potential healthcare reforms.

Sector Winners

Trump’s policies could bolster several industries:

- Energy: Deregulation and expanded fossil fuel production may support oil, coal, and natural gas sectors, accounting for 28% and 17.8% of U.S. energy production, respectively.

- Financials: Continued deregulation and corporate tax cuts may benefit banks and financial institutions, though lessons from 2008’s deregulation-induced crash shouldn’t be ignored.

- Crypto: Trump’s pro-Bitcoin stance could reduce regulatory hurdles, driving demand for Bitcoin ETFs and encouraging institutional adoption.

- Defense and Aerospace: Emphasis on military spending may favor contractors in areas like cybersecurity, advanced weaponry, and aerospace technologies.

- Pharma and Biotech: Reduced regulations could enhance profitability for pharmaceutical and biotech companies.

Market Valuations

Markets rallied post-election, with the S&P 500 gaining 3.7%, the Dow rising 4.2%, and small-cap stocks surging 6.1%. Bitcoin also hit $80,000 for the first time. However, valuations remain stretched, with the S&P 500 nearing levels last seen during the dot-com bubble. High valuations call for caution and diversification, not avoidance.

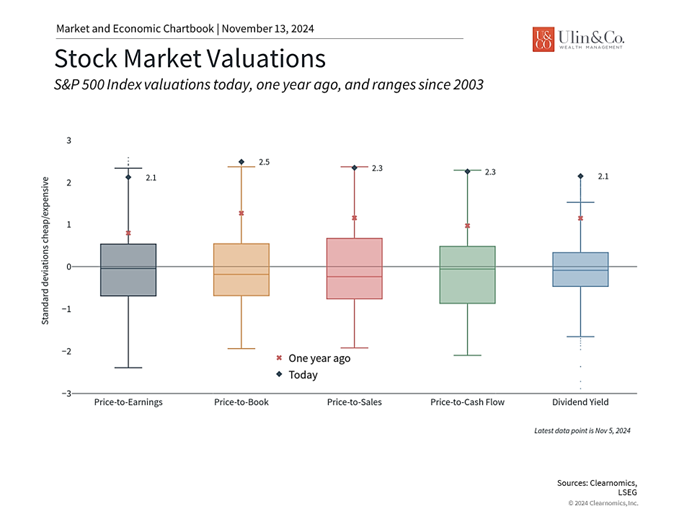

Valuations are above historical averages

Putting politics aside, chances are that the next administration will inherit strong economic tailwinds. While it’s clear that voters struggled with inflation over the past few years, rising prices were the result of both supply chain disruptions during the pandemic and the significant government stimulus that followed. These shocks to the system have faded as inflation has fallen back toward 2%, prompting the Fed to cut rates, which supports the economy.

At the same time, the bull market rally since late 2022 means that valuations across an array of asset classes are well above average, suggesting that many investments are no longer as attractive. The post-election rally in recent days has only pushed valuations higher. The price-to-earnings of the S&P 500, for instance, is nearing post-pandemic highs and is only a few points away from its historic dot-com bubble peak.

History shows that markets can move back and forth between extremes as investors overreact to positive and negative events. This occurred after the 2016 election as well for Trump’s first term in the White House. Markets rallied throughout 2017 before facing a market correction in early 2018, which ended the year negative for the first time in a decade. Markets then experienced a strong rally in 2019 until it was derailed by the pandemic in early 2020. While the past is no guarantee of the future, this goes to show that the market never moves up in a straight line, despite how positive the situation may seem at the time.

In uncertain situations, a north star that can guide investors is valuations. In the long run, there is nothing more correlated with returns than whether the market is cheap or expensive compared to measures such as corporate earnings. While valuations are not market timing tools – stocks can run well above fundamentals in the short run – they do tell us how to set expectations that reflect long-term trends.

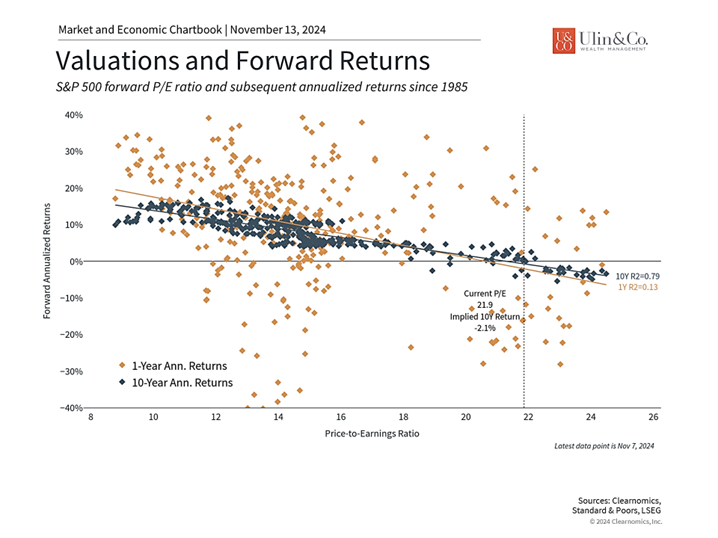

Higher valuations correspond to lower expected returns

Trump Trade

Today, market enthusiasm is the result of the “Trump trade,” which refers to investments that benefit from the expected policies of the next administration. This includes lower individual and corporate taxes, tariffs, light regulation, and deficit spending in areas such as infrastructure. This propelled markets for a time after the 2016 election due to optimism in financial markets, the strengthening of the U.S. dollar, and higher bond yields as investors anticipated pro-growth economic policies.

As the famous investor Benjamin Graham observed, “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” This is relevant today because many of the investments with stretched valuations, including tech stocks and cryptocurrencies, are especially prone to booms and busts. When things go well, it seems foolish in hindsight to focus on valuations and earnings. However, the reason to do so is exactly because it is difficult to predict the exact winners.

As the accompanying chart shows, elevated valuations have often corresponded to lower or even negative longer run returns. This occurs if those valuations take place later in the business cycle just before a correction. The hope is that this time is different, and the economy continues to grow steadily. But even in that scenario, markets that are rallying ahead of fundamentals could mean that returns are “pulled forward.”

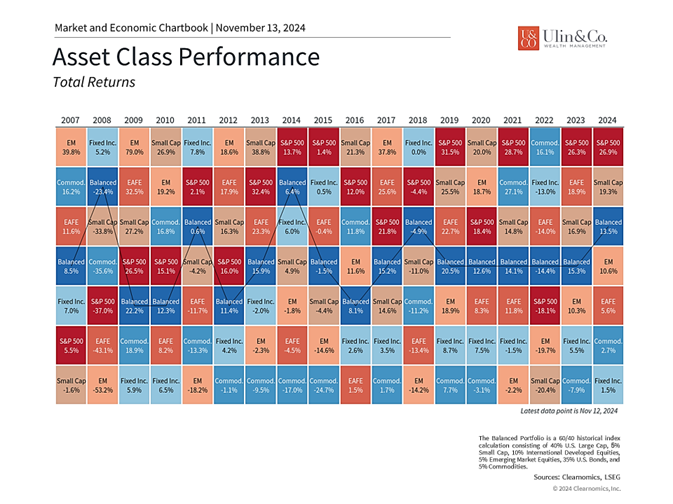

Many asset classes beyond U.S. stocks have performed well this year

High valuations don’t mean we should avoid the stock market. Instead, they suggest we should carefully construct and adjust portfolios in a risk-aware manner, using diversification as a key tool. The accompanying chart shows that while U.S. stocks have performed well this year, many other asset classes have generated positive returns too, with balanced portfolios hovering near 13% gross year to date.

International stocks, for instance, continue to have much more attractive valuations than U.S. stocks. And while bonds have not performed as well recently with rates rising again, they still provide income and diversification benefits, especially in periods of market volatility.

Perhaps most importantly, long-term fundamentals suggest that the trends are still moving in the right direction. Corporate earnings have shown steady growth in recent quarters and GDP figures have been surprisingly strong. The Federal Reserve also implemented its second rate cut of the cycle after the election, lowering the fed funds rate by 25 basis points to a target range of 4.5% to 4.75%.

In its official statement, the central bank acknowledged evolving labor market dynamics, noting that conditions have generally eased while unemployment, though higher, remains at historically low levels. It highlighted that while inflation has eased substantially and the economy remains strong overall, labor market conditions have moderated compared to pre-pandemic levels.

During the post-meeting press conference, Fed Chair Powell presented a balanced view of the economic landscape, emphasizing both progress and continued vigilance. Your portfolio should be viewed in the same manner, balancing progress and vigilance.

The bottom line? Presidential policies, including Trump’s, can sway markets in the short term, but long-term success depends on steady, disciplined strategies. As 2016-2020 illustrated, maintaining a well-diversified portfolio allows investors to capitalize on rallies while weathering uncertainty.

Worry less about Trump Trade winners and losers. Focus more on fundamentals, remain disciplined, and stay the course—markets thrive on trends, not temporary shifts.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.