The Oil Slick of Negative Prices & Rising Supply

The nationwide shutdown in response to the coronavirus has hit all corners of the economy, including the energy sector. The oil market made historic moves in April with the headline price of crude falling into negative territory for the first time. Meanwhile, demand has plummeted, supply has been rising, and storage capacity is reaching its limits.

The fact that Americans aren’t commuting, airlines have cut flights and businesses have temporarily shuttered means that there’s reduced need for crude oil. While this decline in demand is likely to be temporary, it creates significant challenges for the industry in addition to a supply and storage surplus.

Future Prices

The oil market is different from the stock and bond markets. Whereas a share of stock is a purely financial asset, holding an oil futures contract means you are buying 1000 barrels of oil to be delivered at a later date. As with other commodities, companies that need physical oil on a future date can use these contracts to lock in prices today and hedge price movements as well.

Of course, not all buyers of oil futures contracts need or want physical oil to be delivered. In normal times, financial investors who trade oil contracts simply sell their contracts and close out their positions before the expiration date. In doing so, they can make a financial gain (or loss) without dealing with the logistics of receiving, delivering or storing oil. There are even ETFs whose purpose is to do this for investors.

Alternatively, there may be situations where oil prices may be much higher at future contract dates (i.e. the oil futures curve slopes upward). In these cases, very sophisticated investors and companies could buy futures contracts at the lower price today, then later take delivery of the oil and store it (in a storage facility, on a tanker, etc.). They can simultaneously sell this oil via longer-dated futures contracts at the higher price and lock in a gain today, taking into account the cost of storage between the two delivery dates. Later, they deliver the oil they stored to the buyer of the longer-dated contract, fulfilling their obligation.

Unfortunately, all of these dynamics broke down this week due to multiple factors.

- First, demand has dried up due to the economic shutdown as described above.

- Second, supply has remained high due to disagreements between large producers, namely Saudi Arabia and Russia. These countries only reached a deal over the past two weeks and are now considering accelerating their production cuts of roughly 10 million barrels per day. These cuts are insufficient to fully stabilize oil prices, but they could help toward keeping the global industry on life support.

- Third, this supply and demand imbalance has resulted in a short-term glut of oil which has to be stored. Over time, storage capacity fills up and it becomes incrementally more difficult and costly to store each barrel of oil.

This is why the May WTI futures contract fell to negative levels as it approached expiration. A negative price means that the holder/seller of a contract pays the buyer to take the contract (and physical delivery) off of the seller’s hands. This occurred because 1) oil prices were very low to begin with and 2) there was a squeeze in the market whereby there are fewer buyers who can take physical delivery and either use or store the oil. Note that contracts beyond May are low but not in negative territory – the June contract closed at $20 on the same day. Over time, this price could come down to converge with spot prices as well, depending on the dynamics of the oil industry.

Thus, there are both short-term and long-term impacts of what has happened in oil markets in recent weeks. The fact that oil prices fell into negative territory is likely to be a short-term phenomenon due to the mechanics of how oil trades. However, the fact that oil prices are low, and the fact that there are significant supply and demand imbalances, could persist for some time. As with everything else at the moment, this depends critically on if, when and how the economy reopens in the coming months.

Jon here. How does this impact long-term investors? Probably not too much. For those who are properly diversified, the energy sector now only accounts for 2.7% of the S&P 500’s market capitalization.

This is because energy stocks have faced significant difficulty since oil prices began to plummet in 2014. Going forward, even large swings in energy prices and energy stocks will have a considerably smaller impact on overall index values.

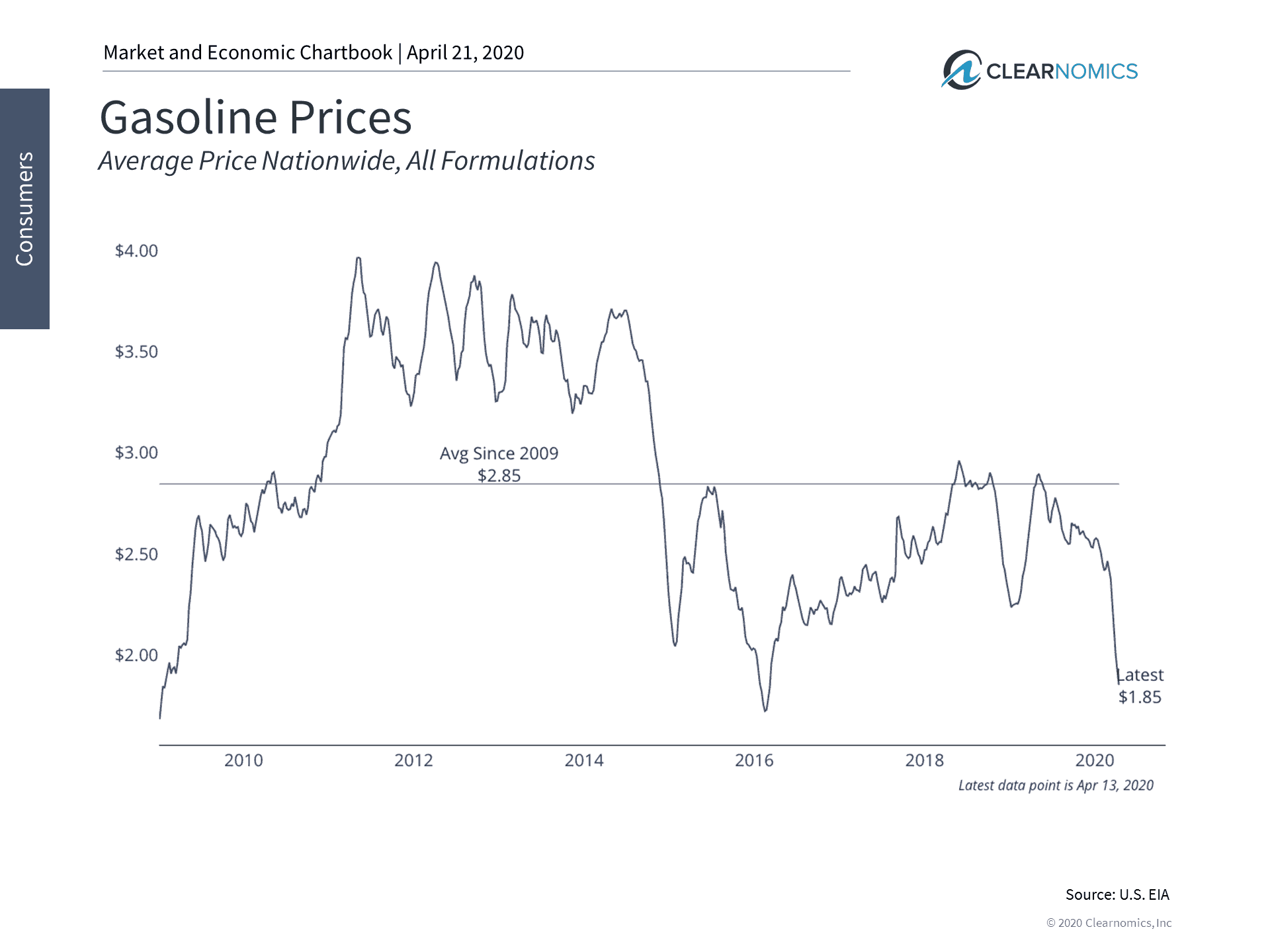

In general, cheaper energy prices are positive for U.S. consumers and the economy overall. Since lower energy prices reduce the cost of products and services both directly and indirectly, the emergence of the U.S. as a major energy player has been positive for consumers. For instance, as one of the charts below shows, gasoline prices were already well below average even before this crisis began. Additionally, the White House is reportedly planning to buy oil at these levels to potentially add 75 million barrels to the nation’s Strategic Petroleum Reserve.

Of course, the aggregate numbers mask the serious challenges faced by individuals and businesses who directly and indirectly work in the energy industry. These areas will likely face ongoing challenges similar to other industries shut down by the coronavirus.

While the negative price of oil has captured the attention of investors and headlines, the longer-lasting implications will depend on how quickly the economy gets back on track. Long-term, diversified investors should seek to stay disciplined and see through these temporary developments as the coronavirus crisis evolves.

Below are four charts that help to put recent oil moves in perspective.

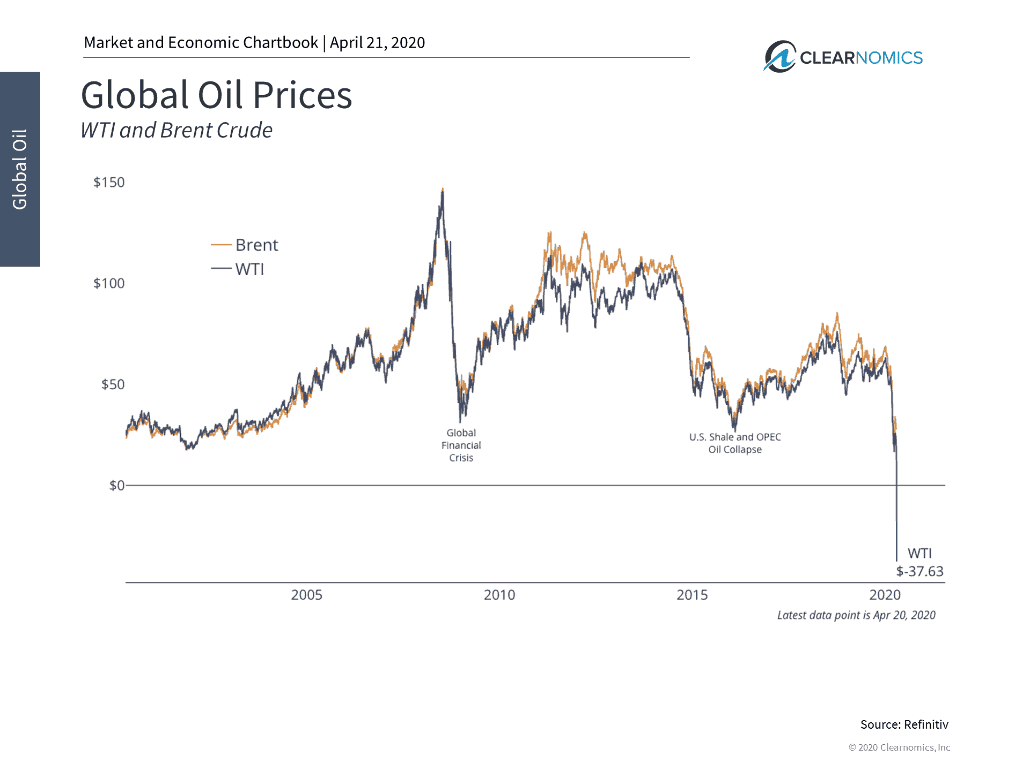

1. Oil prices have plummeted, even falling into negative territory due to technical factors

Oil prices have fallen due to the economic shutdowns that have resulted from the coronavirus pandemic. The drying-up of demand and a glut of supply have pushed both WTI and Brent below levels last seen during the 2014-2016 period. WTI prices even fell below zero due to a technical squeeze stemming from limited storage capacity.

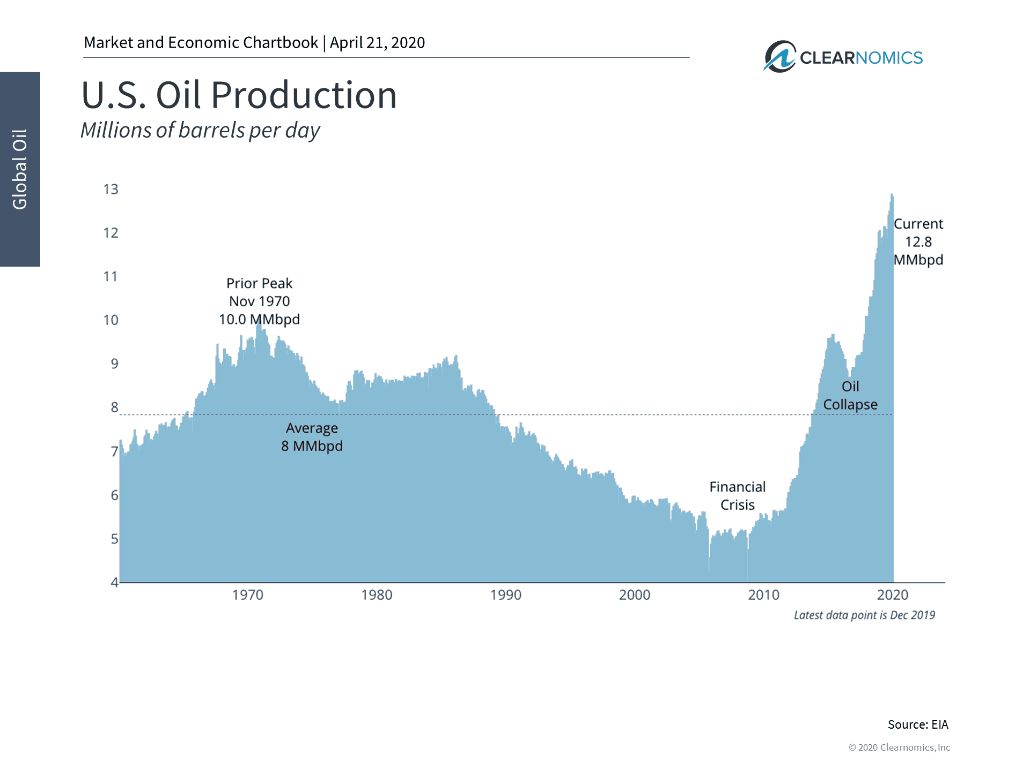

2. The U.S. is a leading global producer

The U.S. energy renaissance of the past decade has seen U.S. energy production climb steadily. The U.S. produced about 13 million barrels per day prior to the coronavirus crisis.

3. The energy sector’s earnings are tied to oil prices

It’s no surprise that the health of the energy sector depends heavily on oil prices. Oversupply and plummeting demand are expected to significantly reduce the sector’s earnings over the next year. Since the last oil price peak in 2014, the sector’s estimated earnings-per-share have declined by about 87%.

4. In general, lower energy prices are good for the U.S. economy and consumers

The bottom line? As an input into everything we buy and use, lower oil prices are generally positive for the U.S. economy as a whole. Gasoline prices, for instances, were already below average before the economic shutdowns hit. Cheaper energy prices effectively translate into more money in the pockets of all Americans – good news for when the economy eventually reopens.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.

“West Texas intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light crude oil because of its relatively low density, and sweet because of its low sulfur content.”