The 4% Rule for Retirement Income Revisited

Retiring on your own terms and not outliving your savings takes a great amount of time, energy and planning to figure out, especially with many people experiencing a retirement lasting much longer than their working years well into their 80’s and 90’s.

The post-pandemic world combined with technology continues to affect our mental and physical health, and has changed how we work, live, shop, travel, socialize and retire. Many individuals we talk to that are in – or nearing – retirement are greatly concerned about market volatility, Fed policy, lingering inflation, high interest rates, rising health care costs, snowballing government debt and the potential for higher taxes and lower social benefits. Some of our clients are taking care of their aging parents and adult kids at the same time.

These factors are motivating many people to start rethinking retirement income and goal planning altogether from money to lifestyle goals.

Living for 20 or 30 years without a paycheck while caring for your loved ones should include a long-term strategy to build up required assets during your working years, to then “flip the switch” over to a pension-like “income for life” plan that is repeatable and keeps up with inflation over time.

Jon here. We also remind our clients to control what they can control that includes our own behavior by staying disciplined. Thus, while there are never any guarantees, having a sound financial plan that can adjust to changing conditions, accompanied by proper financial guidance, is the best way to help minimize retirement risks.

Work and Retirement

Planning for retirement is taking on new and different dimensions as retirees seek to define meaningful and fulfilling roles for themselves in a new life phase. Work and retirement and intertwined that may help many to maintain a certain quality of life along with social and emotional benefits.

Today’s retirees are more active and significantly different than past generations. They are very busy with life, family hobbies and travel, with many continuing to work well past their 60’s into new careers or creating their own small businesses. In many cases hobbies become part time work.

Some individuals work through their golden years more so than just to supplement their retirement income. There may be important nonfinancial motives to work or turn a hobby into a job – such as mental and physical health, social contact and connections, as well as contributing back to society.

Health and Wealth

The two most significant drivers to quality of life are your health and wealth. I always remind our clients the maxim that “your health affects your wealth, and your wealth affects your health.” I’m a big proponent of exercise and healthy eating/living which can help to improve your standard of living while lowering your healthcare/medical expenses. While I can do only so much to motivate our clients regarding health habits and come from a family of physicians, we can do a bit more to motivate clients with our proverbial wheelhouse of financial health and wellness expertise.

While our planning approach for clients involves key areas to maintain financial independence including tax minimization, long term care strategies, portfolio management and legacy planning, creating lifetime retirement income from savings is the focus for many of our clients. This goes beyond traditional planning discussions to simply determine your ”lump-sum” retirement savings number.

The 4% Rule Starting Point

When it comes to markets and the economy, we can’t control the timing of events – including day-to-day market swings and whether investors begin retirement in a bull or bear market. What we can control, however, is our own course of action through planning. Thus, while there are never any guarantees, history shows that having a sound financial plan that can adjust to changing conditions, accompanied by proper financial guidance, is the best way to minimize retirement risks. Consider the following factors for retirees to help maintain their savings and their quality of life in today’s post pandemic world while considering the 4% rule for portfolio lifetime income.

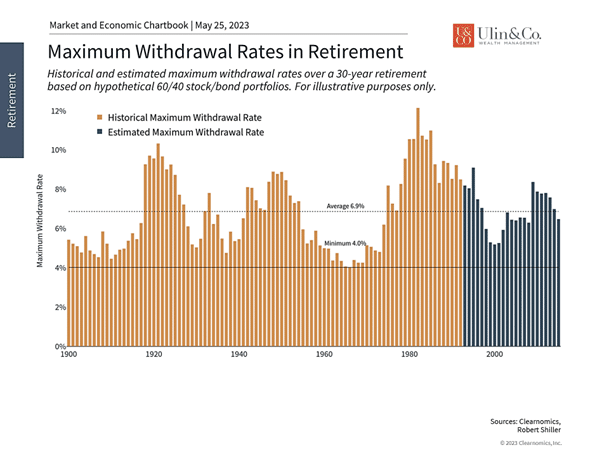

Maximum Withdrawal Rates (historical)

Two of the most important concepts when it comes to retirement and investment planning are “the 4% rule” and “sequence of returns risk.” In simple terms, the 4% rule attempts to answer the question “how much can I withdraw from my portfolio each year over the course of my retirement?” This concept was coined by William Bengen who observed that, historically, a 4% annual withdrawal rate from a portfolio was “safe” in that retirees were unlikely to exhaust their savings over a 30-year retirement horizon, accounting for inflation.

How does the 4% rule hold up today? The accompanying chart (above) illustrates the hypothetical “safe” withdrawal rates based on 60/40 stock/bond portfolios and inflation rates across historical 30-year periods as well as estimates for more recent years. These illustrative calculations show that only once in the 1960s did the maximum withdrawal rate fall as low as 4%. On average and with the benefit of hindsight, retirees would have been able to withdraw 6.9% each year without running out of funds. Of course, the safe withdrawal rate can vary dramatically from year to year, a fact that should not be surprising given how much market returns can change across a cycle. In general, this pattern is positive for retirees since it suggests that there is a historical basis for steady withdrawal rates of 4% or above.

However, there are several points to keep in mind. First, this depends heavily on sticking to an investment plan throughout the full period. Investors who would have overreacted to short-term market pullbacks would have failed to rebound alongside the market, negatively impacting their withdrawal rates later in retirement. This is why investing is as much about our own behavior as it is about market and economic events. Second, this analysis is oversimplified since it does not account for differences in portfolio construction and risk tolerance across individuals that are a critical part of real-life financial planning. After all, a 60/40 portfolio may be quite aggressive for many retirees, especially later in life.

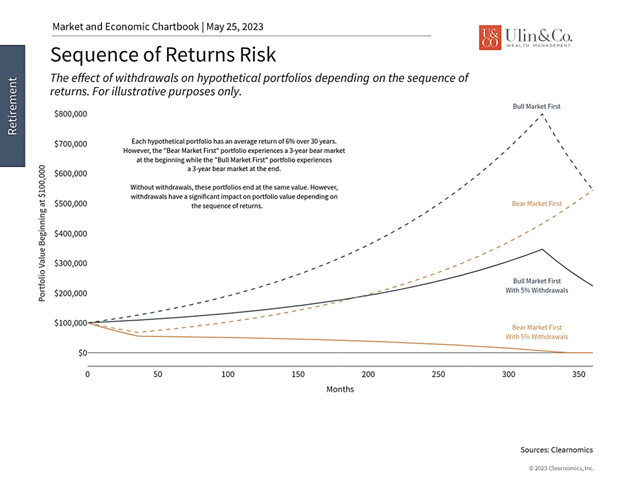

The sequence of returns can dramatically impact the value of a retirement portfolio

Finally, and most importantly, simple rules of thumb should be used with caution since they may not account for the sequence of returns, or the idea that the timing of bear and bull markets can dramatically impact the value of a portfolio when withdrawals are being made.

Specifically, when the market is down early in retirement, withdrawing funds amounts to “selling low.” Investors are then less able to take advantage of future bull markets and the wonders of compound interest over the remaining years. Conversely, withdrawing when the market is up (“selling high”) allows the portfolio to maintain a higher value and compound faster, which then provides a cushion when the inevitable recession and bear market hits. Unfortunately, investors don’t get to choose whether they begin with a bull or bear market – they need to adjust accordingly to the hand they are dealt.

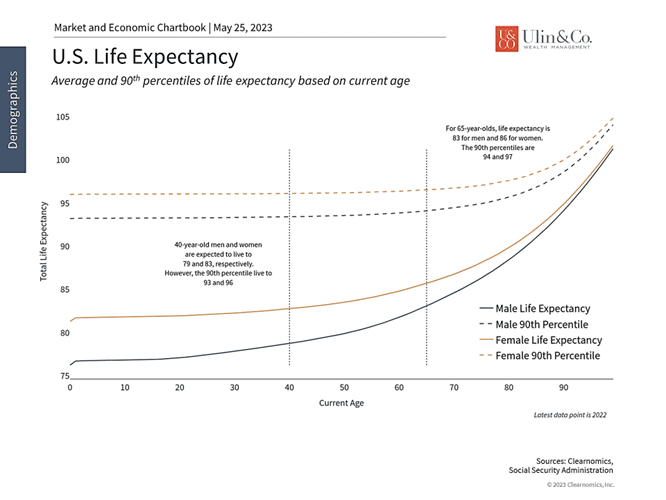

Life Expectancy is Rising

What simple rules of thumb also don’t account for are increasing life expectancies. For instance, according to the Social Security Administration, 40-year-old men and women today have a life expectancy of 79 and 83, respectively, as shown in the accompanying chart. However, the 90th percentile could live well into their 90s. Similarly, men and women who are 65 years old today could live to 83 and 86, on average, while the 90th percentile could live to 94 and 97, respectively. The difference of a decade or longer, i.e. a retirement of 20 years vs 30 years, or 30 years vs 40 years, can have dramatic implications for investment portfolios and financial plans.

The prospect of living longer than expected is often referred to as “longevity risk.” This risk is asymmetric in that running out of funds is far worse for most households than leaving money behind to loved ones, charities, and more. This means that life expectancy is an important input to any financial plan. Ultimately, managing longevity risk is another reason why all individuals can benefit from professional financial advice.

The bottom line? While the 4% rule can act as a basic guide for retirees, it unfortunately isn’t enough. Investors should rethink retirement income for the long run. Continue to stick to long-term investment and financial plans as they navigate this challenging market and economic environment.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.