Strongest Stock Market Start in Decades

Neither snow, rain, Trump, China, inflation, interest rates, GDP or gloom of night stays the aging Bull from the swift rebound of expected and unexpected corrections and hurdles. Ten plus years into this record setting bull-run would be a great time to tune-down the chicken-little news reports and review your own investment process and strategy.

Last week, the S&P 500 hit new record highs, fully recovering from last year’s market pullback. This market rebound took four months which, coincidentally, is exactly the historical average for bounce-backs after market corrections. This occurred despite the fact that the market decline nearly reached bear market levels.

Keep Your Brain in the Game

This is a vivid reminder that a large part of investing is behavioral. As the saying goes, “the best laid plans of mice and men often go awry.” Even with the best statistics, Monte Carlo simulations, and financial plans that modern finance theory affords us, the weakest link in achieving our financial goals is often ourselves. Those investors who were patient, who didn’t dwell on short-term performance, and who ignored the noise of financial media, were in a better position to stay invested and achieve long-term goals.

This is also why, despite the fact that markets and investors may be calm today, there’s no better time to reflect on the events of the past several months. The best way to combat and change human nature is often through education and experience. While it’s no guarantee of success, it’s much easier to consider how we’ll react during the next bout of market volatility today than in the middle of the storm.

Know Your Fundamentals

Why has the market rebounded so strongly this year? As last week’s positive GDP surprise showed, economic growth is still healthy even if it is decelerating somewhat. The recession that many investors feared was imminent – or that was already occurring – hasn’t yet appeared.

Additionally, the possibility that the Fed will make a mistake by over-tightening interest rates hasn’t played out either. In fact, the Fed has done the exact opposite by reversing course on rate hikes and its balance sheet. Of course, it’s ironic that this could lay the groundwork for the opposite error – that of the Fed keeping monetary policy too loose. Only time will tell.

Finally, other geopolitical risks such as the U.S.-China trade talks have ebbed as signs of progress appear. This is not universally the case, e.g. with Brexit, but just enough to lift market sentiment.

This is certainly not to say that it’s smooth sailing from here. To be sure, there will be more market volatility ahead. Just as trees don’t grow to the sky, the market can’t rise in a straight line forever.

However, this is a clear reminder that markets are inherently volatile. The best way to manage this volatility isn’t to swerve in and out of markets – it’s to maintain a portfolio that can handle the bumps and, more importantly, to develop a steady hand.

Below are three charts that illustrate these points.

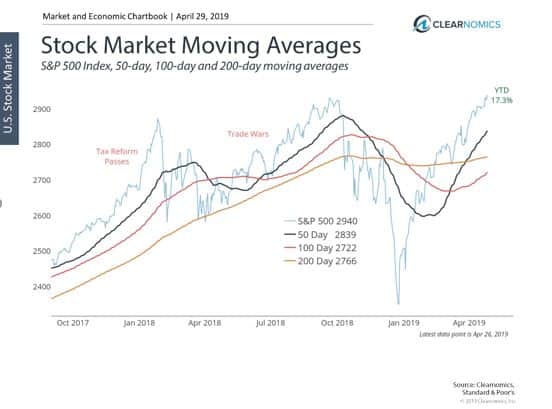

1. The stock market has fully recovered from recent volatility

S&P 500 Moving Averages

The S&P 500 has fully recovered from last year’s market volatility. While there are many factors which propelled the market forward, the most important was the fact that the economy is still healthy. This is yet another reason for long-term investors to focus on the economic fundamentals.

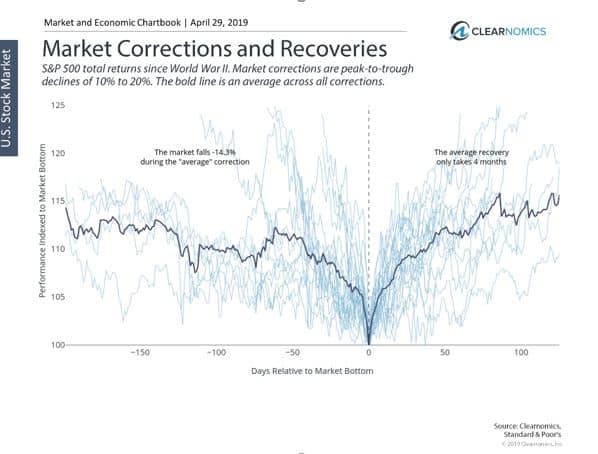

2. History reminds us that market corrections and pullbacks are normal

Market Corrections and Recoveries

With the benefit of hindsight, the recent market rebound was similar to historical periods of market volatility. The fact that the recovery took about four months is exactly in line with the historical average.

While the exact timing may be a coincidence, the broader story is that market corrections and recoveries are normal. Investors should not be surprised by market pullbacks – they can occur at any time and without warning – nor should they be surprised when markets recover.

For many investors, the challenge is not over-reacting at exactly the wrong moment. As the chart above shows, not only do pullbacks occur swiftly, recoveries can do so as well.

The market recovery has been due in no small part to a healthy economy. Recent data confirm this, including last week’s GDP report which showed a positive surprise. While economic growth in the U.S. and globally may be decelerating, we are not yet seeing signs of the recession many had feared during Q4 of last year.

The bottom line for investors? Market volatility is not only normal – it should be expected. An important part of investing is learning to stay disciplined in the fact of market uncertainty.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.