Diamond Hands When Investing Through Stock Market Volatility

Investors have grown a bit anxious over the past quarter as both the stock and bond markets have unusually moved lower in tandem due in part from prolonged headwinds of supply side shocks, record high inflation, rising interest rates, elevated oil prices and the Russia/ Ukraine war debacle. Headlines affirming that the US Bond Market just suffered its worst quarter in decades and that the 30 year mortgage rates are doubling up near 5% is not an April Fools hoax.

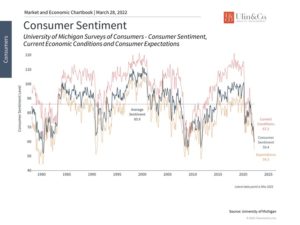

Too boot, U.S. consumer confidence numbers are at lows seen during the crises of the ‘70s. Indicators like the American Association of Individual Investors’ weekly sentiment survey, and the CNN Fear & Greed Index, show investors are at extreme levels of misery.

Jon here. Are you feeling a bit queasy now from all this information, like when watching a potential CAT 5 hurricane heading our way to Florida? Are you dusting off your hurricane shutters and contemplating cashing out of the market? If you are not currently contemplating a bigger mattress but are buying stocks, then perhaps you possess a disciplined, contrarian mindset to buy when others are fearful.

Is this déjà vu? There is always a sense that “this could be the big one” – a crash that makes it seem foolish to have ever been optimistic, even though the odds may be in your favor over the long run. This is why a major hurdle to achieving financial goals is not about modeling interest rates and inflation, or analyzing Fibonacci sequences, – it’s overcoming one’s own behavioral and cognitive biases while maintaining a calm, disciplined and diversified investment process with perhaps a bit of a diamond-hand mentality.

Diamond Hands

If you’ve got “diamond hands,” you’re mentally ready to hold on to a position or portfolio for the end goal, despite the potential risks, headwinds and losses along the way. If you’ve got “paper hands,” you exit a position, or fold early on because the heat of the situation might be too much to stomach.

None of the recent market volatility and relentless headline news has made any loss of appetite for retail investors the past few months to “fold” or cash out. In fact, the motto to “buy the dip” may be alive and well. Purchases of US equities and ETFs rebounded swiftly to year-to-date averages of about $1.3 billion a day by retail investors signaling that the average investor is feeling a bit upbeat about the financial markets.

On a silver lining, the world is reopening, the pandemic is diminishing, job numbers have improved and U.S. corporate profits jumped 25% in 2021 to record highs, as the global economy continues to rebound from the pandemic-led recession.

What are the Odds?

Casino games do not have good odds for players. There’s a reason for the phrase, “the house always wins.” Every casino game is designed to give the house a better edge. The odds of winning any of the most popular casino games in Vegas from roulette, slots, craps to blackjack average only about 50%. You can enjoy a casino and accept that it will cost you some money to be there. Likewise, you’ll spend money if you go to an amusement park.

Lottery odds are quite worse, though Americans spend about $72B on Lottery Tickets every year. More than a third of people believe winning the lottery is the only way they will ever retire comfortably. But the odds of winning either the Powerball or Mega Millions are roughly 1 in 292.2 million and 1 in 302.5 million, respectively.

Things That Are More Likely Than Winning the Lottery include; Car accident: 106 to one, Falling out of bed: 2 million to one, Lightning strike: 1.2 million to one, Dog attack: 118,776 to one, Shark attack: 3.75 million to one. Turns out swimming with the sharks is safer than petting a dog, driving your car, or sleeping in your bed.

Stock market odds look even better- over time. The key for long-term investors is that the stock market tends to rise over long periods of time even if it can swing wildly in the short run. How can this be if there are almost as many down days as up? The fact that markets are up slightly more than 50% of days provides compounding over time. Even when the market is volatile, returns tend to be positive over time.

Like many things, the power of compounding works slowly and positive returns over any individual day, month or year are never guaranteed. Market pullbacks and corrections may grab attention and headlines, but it is the slow building of wealth in the face of never-ending market fear that works in investors’ favor over the course of years and decades.

Consumer Impact

Markets have shown greater signs of stability since the Fed’s rate hike announcement two weeks ago. Not only was it widely expected, but many investors believe the Fed should tighten even further. This is because, despite risks surrounding the intensifying war in Ukraine, the economy is fundamentally strong. Unemployment has fallen to 3.8%, 90% of the jobs lost during the pandemic have been recovered, and the average consumer is financially stable.

Like many developed countries, consumer spending forms the backbone of the $24 trillion U.S. economy. When times are good and consumers are optimistic about their jobs and financial situations, they tend to spend more. This boosts sales for small businesses and large corporations alike, which in turn hire more workers, develop new products, make investments, and more. This then creates new jobs and boosts wages which increase consumer activity further. Thus, how consumers feel is an important economic indicator for investors to consider across business cycles.

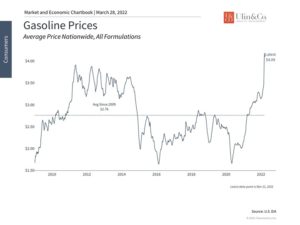

Of the daily purchases affected by inflation, skyrocketing gasoline prices may sting the most. The average price per gallon of regular unleaded is now above $4, and as high as $6 in certain parts of the country and for higher grades. (see below) These prices are highly visible and their sudden jump can stir emotional and psychological responses. For many, driving is unavoidable whether it’s to commute to work, buy groceries or take the kids to soccer practice.

When considering the Consumer Price Index – the most commonly cited measure of inflation – gasoline makes up 3.7% of consumer spending for all urban consumers and 5% for wage earners specifically. Having such a large part of one’s daily expenses double or even triple so suddenly has a significant impact on one’s wallet. Despite these challenges, there are a few factors to keep in mind.

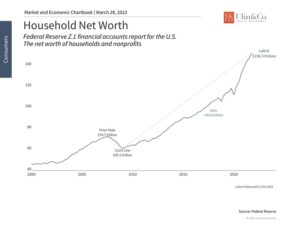

First, although consumers are feeling pessimistic, they are arguably in their strongest financial positions in years. The job market is robust with many more job openings than unemployed individuals, wages are rising, house prices are climbing, and household net worth has reached new all-time highs. (see below) Along with high savings rates during the pandemic lockdowns, the average consumer is in a position to absorb these high expenses.

Second, the initial shock of rising prices is the hardest to overcome. In the short run, there’s very little choice but to cut spending elsewhere. In the long run, consumers can adjust their behavior to offset these costs. Oil prices, which spiked as high as $128 per barrel in early March, have also come back down. While energy prices are still elevated, this suggests there could be stability in gasoline prices as well, especially as more production comes online. Of course, much of this depends on how the ongoing conflict between Russia and Ukraine plays out.

Third, perhaps the most important fact for investors to remember is that consumer sentiment is often a contrarian indicator for markets – i.e., it is often better to invest when consumers are nervous than when they are confident. (see below) Over the course of a business cycle, how consumers feel tends to rise and fall with economic conditions. In hindsight, the market is often the most attractive when consumers and investors are the most fearful.

While consumer sentiment is only a single indicator, it’s an important one. At the moment, the data suggest that everyday individuals and households will need prices to stabilize before they feel better about the world. This is another reason for long-term investors to focus on the future by staying diversified and focused. Below are three charts that provide perspective on the consumer situation.

1 Consumer sentiment has plummeted

How consumers feel about the world has deteriorated due to rising prices. According to the University of Michigan Survey of Consumers, households expect prices to rise 5.4% over the next year and 3% over the next 5 years. This is especially challenging given the more recent jump in energy prices.

2 Gas prices have skyrocketed, hurting consumer pocketbooks

Gasoline prices have risen significantly since the pandemic lockdowns of 2020 and, more recently, since Russia invaded Ukraine. For many, gasoline is an unavoidable expense. These higher prices directly impact consumer pocketbooks and, in the short run, may reduce spending elsewhere.

3 However, consumers are still financially strong

Despite rising prices, consumers have been in a strong position throughout the economic recovery. Household net worth has reached record levels driven by rising home prices, the stock market rebound, and more.

The bottom line? Historically, staying invested through stock market volatility when consumers are the most pessimistic has been rewarded. Investors should continue to stay focused on the long run as markets and energy prices stabilize.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.